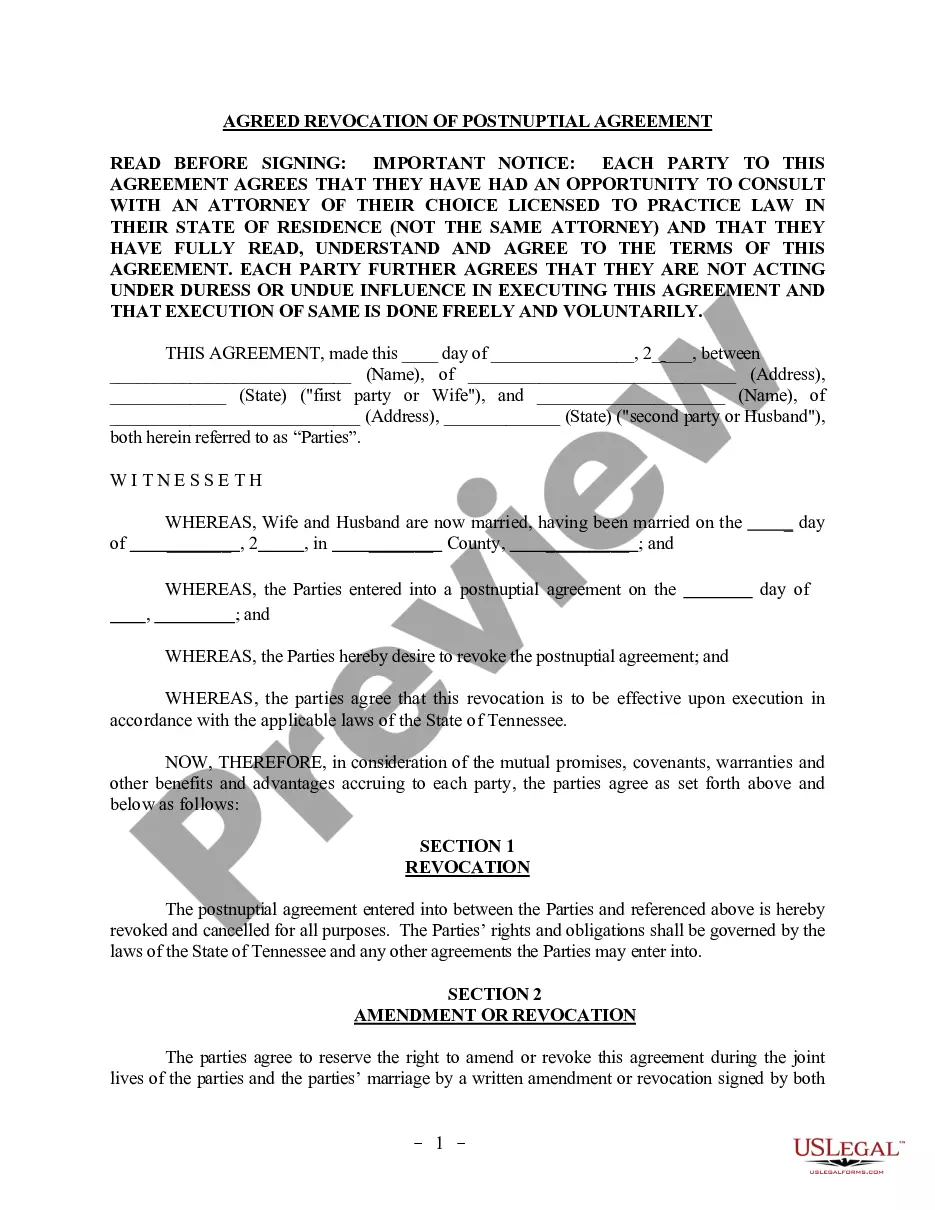

Delaware Property and Casualty Retaliatory Statement is a document that is required for any insurance company that wishes to write property and casualty insurance in the state of Delaware. It is a statement of the company's intention to obey all laws and regulations regarding the issuance and sale of insurance in Delaware. The statement also includes an affirmation that the company will not retaliate against any consumer for filing a complaint with the state's insurance department. There are two types of Delaware Property and Casualty Retaliatory Statement: the General Statement and the Non-Resident Statement. The General Statement is used by all insurance companies that wish to write property and casualty insurance in Delaware, while the Non-Resident Statement is used by companies that are licensed in other states but wish to write insurance in Delaware. Both documents must be filed with the Delaware Department of Insurance.

Delaware Property and Casualty Retaliatory Statement

Description

How to fill out Delaware Property And Casualty Retaliatory Statement?

If you are seeking a method to effectively prepare the Delaware Property and Casualty Retaliatory Statement without hiring an attorney, then you are in the perfect location.

US Legal Forms has established itself as the most comprehensive and reliable repository of official templates for every individual and business situation. Each document available on our online platform is designed in accordance with federal and state regulations, ensuring that your paperwork is accurate.

Another wonderful aspect of US Legal Forms is that you will never misplace the documents you have purchased - you can access any of your downloaded forms in the My documents section of your profile whenever you require it.

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its textual description or utilizing the Preview mode.

- Enter the form title in the Search tab at the top of the page and choose your state from the dropdown to find an alternate template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are assured that the paperwork meets all requirements.

- Log in to your account and select Download. Register for the service and opt for a subscription plan if you do not already have one.

- Use your credit card or the PayPal option to acquire your US Legal Forms subscription. The template will be available for download immediately.

- Decide in which format you wish to receive your Delaware Property and Casualty Retaliatory Statement and download it by clicking the corresponding button.

- Upload your template to an online editor to complete and sign it promptly or print it out to prepare your physical copy manually.

Form popularity

FAQ

A premium tax is prevalent in numerous states, with rates varying significantly. States such as Illinois, Massachusetts, and Washington impose this tax on insurance companies. Understanding the nuances of the Delaware Property and Casualty Retaliatory Statement can provide insights into how premium taxes affect your insurance costs in these states.

To avoid repaying your premium tax credit, ensure that your income stays within the qualifying range set by the IRS. Additionally, update your information with the marketplace if your circumstances change. Understanding the Delaware Property and Casualty Retaliatory Statement can also help you navigate the costs associated with your insurance effectively.

The highest income to qualify for Medicaid in Delaware varies based on household size and specific program guidelines. Generally, the income limits are adjusted annually, so it's essential to stay updated on any changes. Understanding how the Delaware Property and Casualty Retaliatory Statement interacts with Medicaid can help in determining your eligibility. For personalized clarification, visiting the Delaware Medicaid website or contacting their office is recommended.

The contact number for Delaware State insurance inquiries is available on the Delaware Department of Insurance website. Calling them directly can connect you with knowledgeable representatives who can assist with your specific questions. Knowing about the Delaware Property and Casualty Retaliatory Statement can add value to your conversation, ensuring you clarify pertinent details. For immediate assistance, don't hesitate to reach out.

Delaware state insurance typically refers to the various insurance programs administered by the Delaware Department of Insurance. These programs oversee several types of insurance, including property and casualty insurance. Being informed about the Delaware Property and Casualty Retaliatory Statement can empower you to make better insurance choices. Always check with official resources or knowledgeable platforms like USLegalForms for accurate information.

To contact Delaware Medicaid, you can call their customer service number or visit their official website for assistance. They provide support for questions regarding eligibility and benefits. Having information about the Delaware Property and Casualty Retaliatory Statement can also be beneficial when discussing your coverage options. Engaging with Medicaid representatives ensures you receive the care you need.

The surplus line tax in Delaware is a tax imposed on insurance policies obtained from non-admitted insurers. Currently, the tax rate is 2% of the gross premiums. This tax is crucial for supporting the Delaware Department of Insurance and ensuring regulatory compliance. Understanding the implications of the Delaware Property and Casualty Retaliatory Statement can help policyholders navigate these expenses effectively.

To obtain your insurance license in Delaware, you need to complete pre-licensing education requirements. After finishing your coursework, you must pass the state exam. It's vital to submit a licensing application along with your fees to the Delaware Department of Insurance. Utilizing a resource like USLegalForms can help streamline the process by providing necessary forms and guidance.

Trinidad Navarro currently serves as the Insurance Commissioner for Delaware. His position involves upholding the integrity of the state's insurance laws and managing issues related to the Delaware Property and Casualty Retaliatory Statement. Engaging with his office can provide clarity on insurance-related inquiries you may have.

A retaliatory tax serves to equalize tax burdens between states and prevent larger companies from exploiting lower tax states. Essentially, it levels the playing field for all insurance providers. Familiarity with the concept of the retaliatory tax can enhance your understanding of the Delaware Property and Casualty Retaliatory Statement.