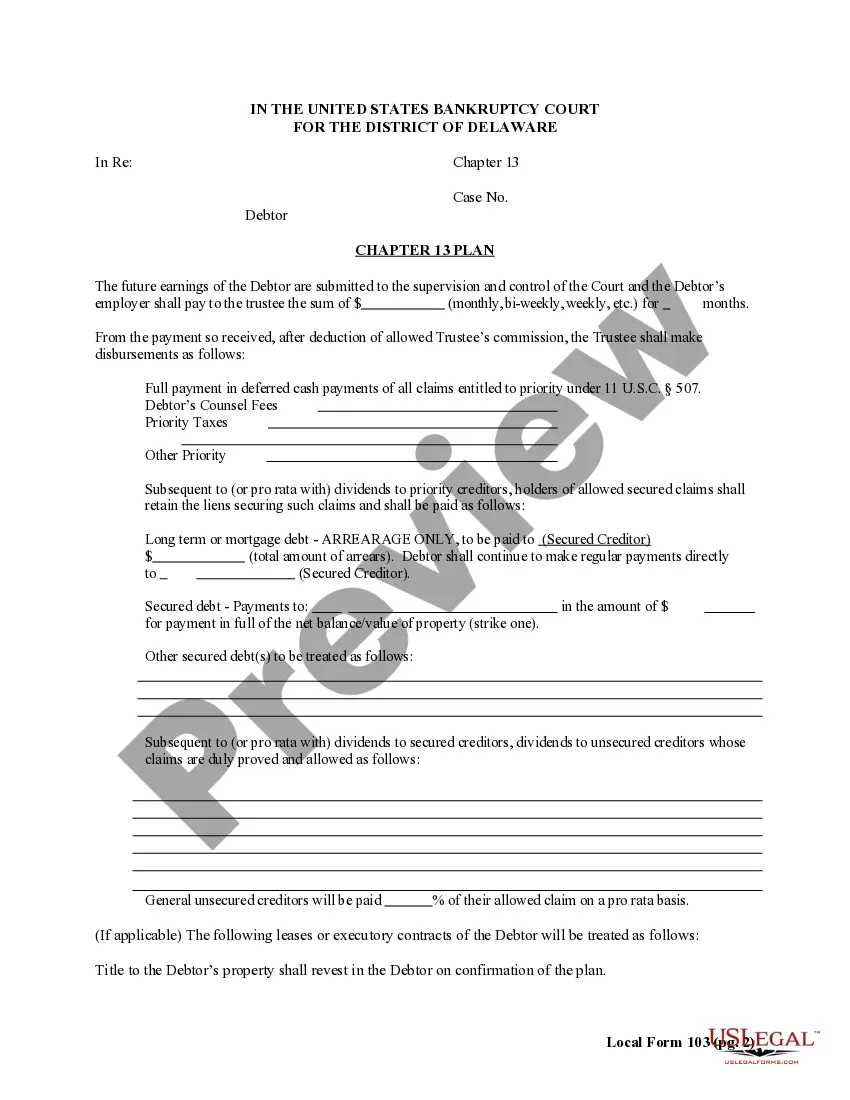

The chapter 13 plan analysis contains information concerning the total debt provided for under the plan and the administrative expenses. The form also requires the signature of the debtor's attorney, the debtor, and the debtor's spouse.

Delaware Chapter 13 Plan Analysis

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Chapter 13 Plan Analysis?

The larger amount of documents you should create - the more anxious you become.

You can discover myriad Delaware Chapter 13 Plan Analysis templates online, but you are uncertain which to trust.

Eliminate the stress and simplify the process of locating samples using US Legal Forms.

Proceed by clicking Buy Now to initiate the registration process and choose a pricing plan that meets your needs. Input the required information to create your account and pay for your order using PayPal or credit card. Select a preferred document type and download your sample. Locate every template you've downloaded in the My documents section. Simply navigate there to prepare a new copy of the Delaware Chapter 13 Plan Analysis. Even when utilizing professionally drafted forms, it is still essential to consider consulting your local attorney to verify that your filled-out document is accurate. Achieve more for less with US Legal Forms!

- Obtain accurately formulated documents that comply with state regulations.

- If you are already a subscriber to US Legal Forms, Log In to your account, and you'll find the Download option on the Delaware Chapter 13 Plan Analysis’s webpage.

- If you haven't utilized our service before, complete the registration process following these instructions.

- Verify if the Delaware Chapter 13 Plan Analysis is applicable in your jurisdiction.

- Re-confirm your choice by reviewing the description or using the Preview mode if available for the selected document.

Form popularity

FAQ

If your Chapter 13 plan is not confirmed, it could lead to dismissal of your bankruptcy case. This means you may need to start over or find alternative debt relief options. Consulting a service for Delaware Chapter 13 Plan Analysis can provide insights and strategies to enhance your plan and increase the likelihood of confirmation.

Filling out Chapter 13 forms requires careful attention to detail and understanding of your financial situation. You will need to provide information about your debts, income, expenses, and proposed repayment plan. Utilizing tools available through uslegalforms for Delaware Chapter 13 Plan Analysis can simplify this process, ensuring accuracy and compliance.

To respond effectively to an objection regarding confirmation, start by reviewing the details of the objection carefully. You may need to provide additional evidence or adjustments to your plan to address their concerns. Consider a knowledgeable partner for Delaware Chapter 13 Plan Analysis to help you respond accurately and effectively.

Responding to an objection to the confirmation of a Chapter 13 plan involves preparing a formal response and possibly attending a court hearing. You should clearly address the specific concerns raised by the objecting party. Utilizing expert resources in Delaware Chapter 13 Plan Analysis can help you formulate a compelling response that increases the chances of plan confirmation.

To get your Chapter 13 plan dismissed, you typically need to file a motion with the court. This process might involve presenting your reasons and any necessary supporting documentation. Engaging in a thorough Delaware Chapter 13 Plan Analysis can clarify your options and ensure you understand the implications of dismissal.

When a trustee objects to the confirmation of a Delaware Chapter 13 plan, it indicates that they believe the plan does not meet legal requirements. You will likely have to attend a hearing where you can present your reasons for confirmation. Addressing the trustee's concerns is crucial, so consider seeking expert assistance in Delaware Chapter 13 Plan Analysis to navigate this situation effectively.

The average monthly payment for Chapter 13 varies depending on your income, debts, and plan specifics. Typically, payments range from a few hundred to several thousand dollars each month. It's essential to assess your financial situation to determine the appropriate payment within the parameters of your plan. A thorough Delaware Chapter 13 Plan Analysis can assist you in anticipating and planning your monthly obligations.

A 100% payment plan for Chapter 13 means that you will repay all creditors at 100% of what you owe over the plan's duration. This type of plan can arise when your income or assets leave no room for compromise. It helps you avoid losing property through bankruptcy. Utilizing a Delaware Chapter 13 Plan Analysis can provide insights into whether this path is right for you.

A 100% Chapter 13 plan is a specific repayment plan where you commit to paying back all your unsecured debts in full. This option is often available for those who have significant disposable income or assets. It allows you to keep your property while satisfying your obligations. Engaging in a Delaware Chapter 13 Plan Analysis can clarify if this option fits your financial situation.

An order confirming a Chapter 13 plan signifies that the court has approved your repayment plan as compliant with the law. This approval allows you to proceed with making scheduled payments to your creditors as outlined in the plan. Successfully navigating this phase is critical, and a comprehensive Delaware Chapter 13 Plan Analysis can assist in ensuring that your plan meets court standards.