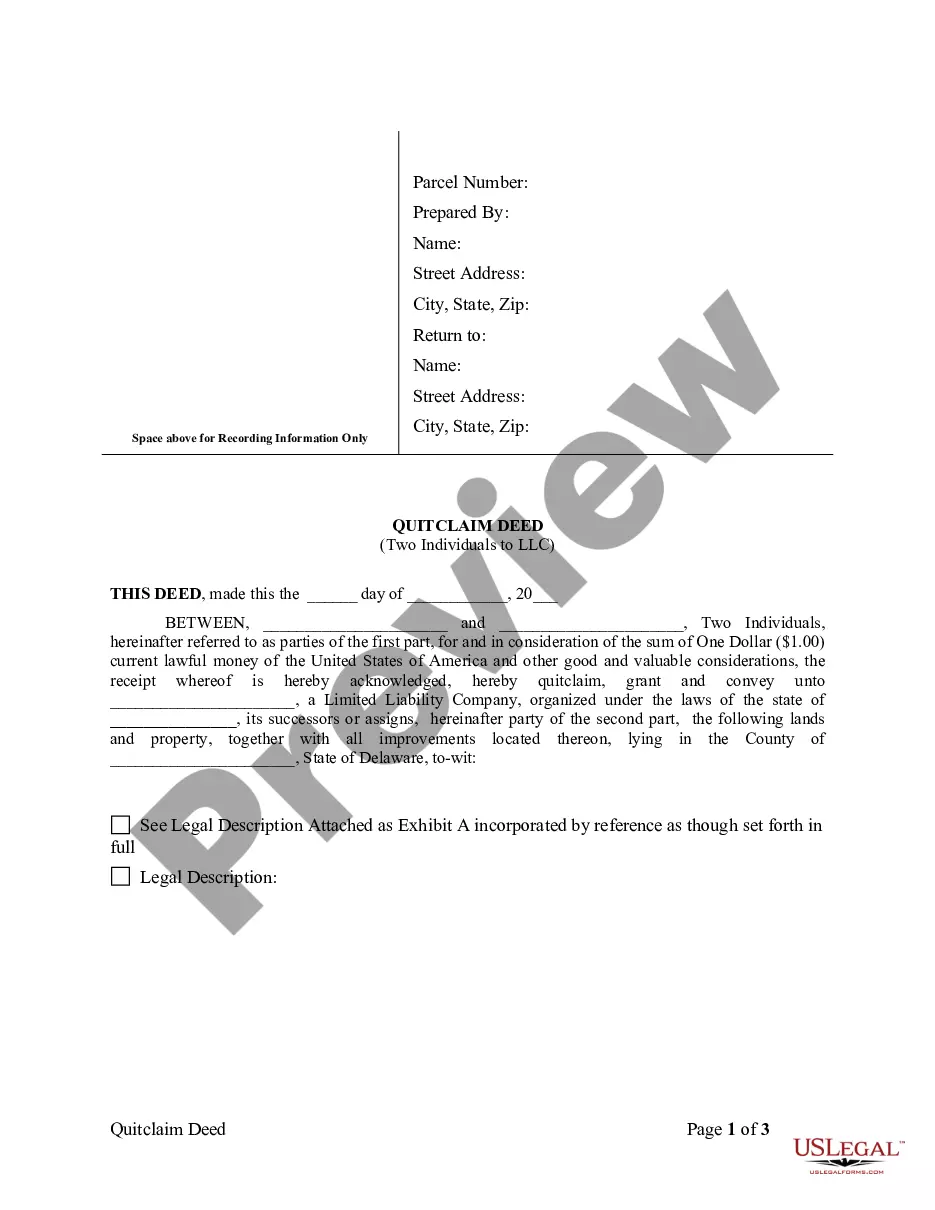

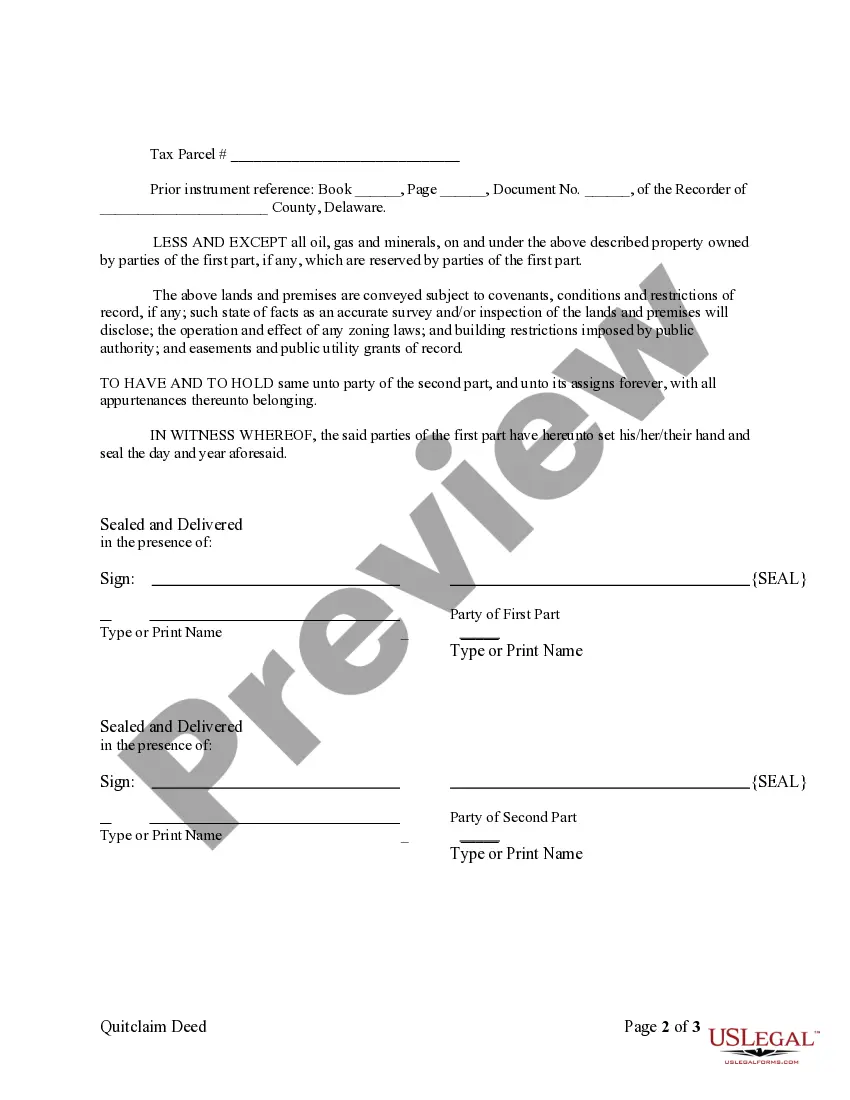

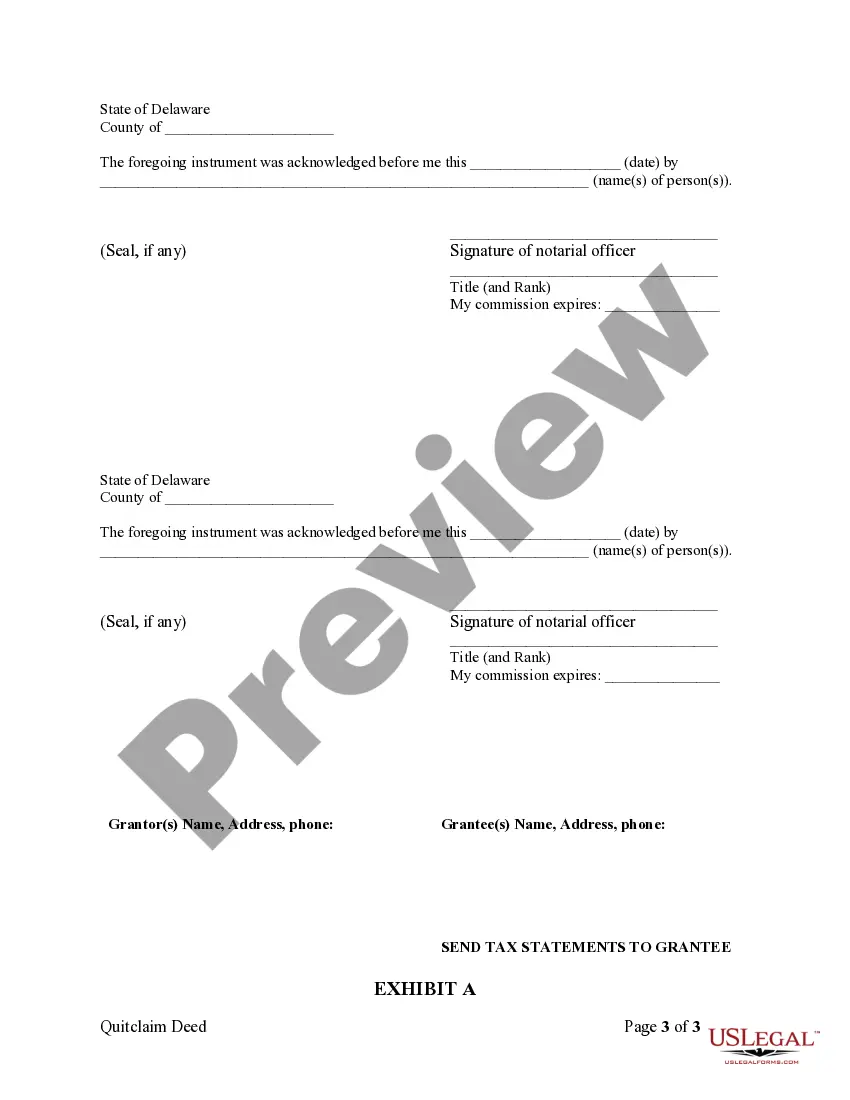

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

Delaware Quitclaim Deed by Two Individuals to LLC

Description

How to fill out Delaware Quitclaim Deed By Two Individuals To LLC?

The larger quantity of documents you need to produce - the more anxious you become.

You can discover countless Delaware Quitclaim Deed templates by Two Individuals to LLC available online, yet you remain unsure which ones to depend upon.

Eliminate the trouble in making the search for samples simpler by utilizing US Legal Forms.

Click on Buy Now to initiate the registration process and select a pricing plan that meets your requirements. Provide the requested information to set up your account and complete your purchase using PayPal or credit card. Choose a convenient document format and download your copy. Access each file you receive in the My documents section. Simply navigate there to prepare a new version of your Delaware Quitclaim Deed by Two Individuals to LLC. Even with correctly prepared templates, it remains crucial to consider consulting a local attorney to verify that your document is accurately filled out. Achieve more for less with US Legal Forms!

- Obtain expertly crafted documents that comply with state regulations.

- If you already hold a subscription with US Legal Forms, Log In to your account, and you will find the Download button on the Delaware Quitclaim Deed by Two Individuals to LLC’s page.

- If you haven't used our website before, complete the registration process by following these steps.

- Check whether the Delaware Quitclaim Deed by Two Individuals to LLC is recognized in your state.

- Re-evaluate your choice by reviewing the description or by using the Preview feature if available for the selected document.

Form popularity

FAQ

Buying property under an LLC using a Delaware Quitclaim Deed by Two Individuals to LLC comes with both benefits and challenges. On the positive side, LLCs provide liability protection, tax advantages, and ease of ownership transfer. However, there are potential downsides such as costs related to formation and operation, and possible limitations with traditional financing options. It's essential to weigh these factors carefully before proceeding.

Many individuals choose to use a Delaware Quitclaim Deed by Two Individuals to LLC to shield personal assets from liabilities related to their property. By placing a home in an LLC, owners protect their personal finances in case of legal issues involving the property. Additionally, LLCs offer potential tax benefits and simplify the transfer of ownership, making them appealing for investment properties and family estates.

One notable disadvantage of putting property into an LLC is the associated costs. This includes legal fees and potential ongoing maintenance fees. Additionally, transferring a property via a Delaware Quitclaim Deed by Two Individuals to LLC may complicate traditional financing options, so it's essential to weigh these factors carefully.

Transferring a deed to an LLC is a straightforward process. You will usually need to complete a Delaware Quitclaim Deed by Two Individuals to LLC, which serves as the official document for the transfer. Using platforms like US Legal Forms can guide you through the required steps and ensure that everything is filed correctly.

Yes, an LLC can gift property to an individual, however, it’s subject to specific regulations. This type of transfer usually requires documentation like a Delaware Quitclaim Deed by Two Individuals to LLC to ensure the process is legal and clear. Consulting with a legal expert can help clarify the guidelines for such gifts.

Selling your house to your own LLC may lead to tax complications, including potential capital gains tax. While the concept might seem appealing, it’s essential to consult a tax professional. A Delaware Quitclaim Deed by Two Individuals to LLC could facilitate the transfer, but professional advice is vital to navigate potential tax implications.

Yes, you can transfer a deed without a lawyer, though it can be risky. You can complete a Delaware Quitclaim Deed by Two Individuals to LLC on your own; however, understanding local laws is crucial. To ensure accuracy and compliance, many find that using a service like US Legal Forms can help simplify the process.

Many individuals choose to place their property in an LLC for several reasons. Firstly, an LLC can provide liability protection, meaning personal assets are safeguarded from claims related to property disputes. Additionally, it may simplify property management and enable easier transfer through a Delaware Quitclaim Deed by Two Individuals to LLC.

Yes, you can quit claim your property to your LLC by using a Delaware Quitclaim Deed by Two Individuals to LLC. This legal instrument allows you to transfer ownership while maintaining protection and benefits associated with an LLC structure. Consider using resources like US Legal Forms to navigate the required paperwork efficiently.

The best way to add someone to a deed involves using a legitimate form like the Delaware Quitclaim Deed by Two Individuals to LLC. This method minimizes complications and ensures a smooth transfer of ownership. Additionally, it’s advisable to consult professionals or online services such as US Legal Forms for accurate guidance and documentation.