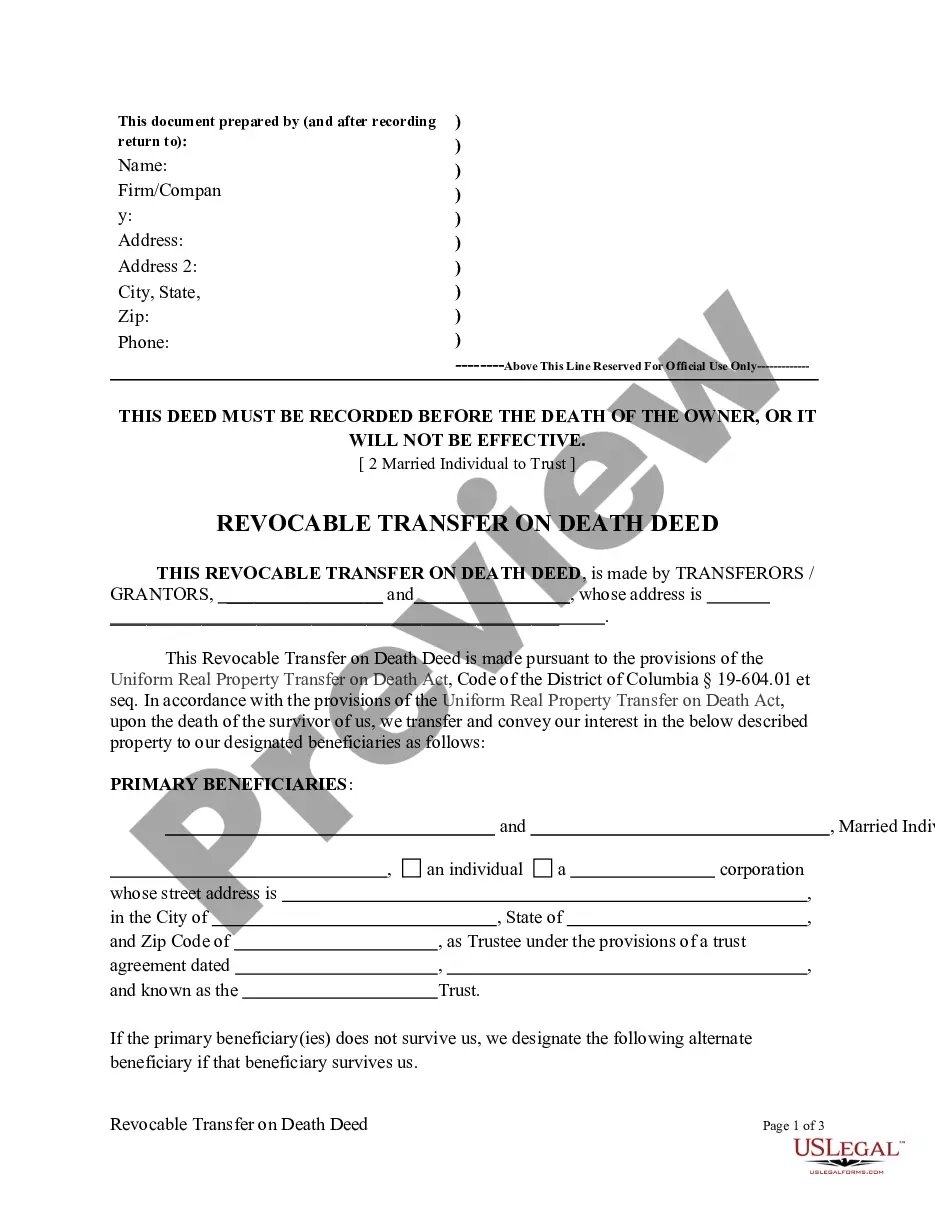

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To A Trust?

Utilize US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Trust.

Our court-approved documents are crafted and frequently revised by experienced attorneys.

Ours is the most comprehensive Forms collection online, providing affordable and precise templates for clients, attorneys, and small to medium-sized businesses.

Choose Buy Now if it is the document you desire. Establish your account and make payment through PayPal or by card|credit card. Retrieve the document to your device and feel free to use it multiple times. Utilize the Search box if you wish to locate another document template. US Legal Forms offers a vast selection of legal and tax documents and bundles for business and personal requirements, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Trust. More than three million users have already successfully utilized our platform. Select your subscription package and access high-quality forms within a few clicks.

- The paperwork is categorized based on state requirements, and many can be viewed before downloading.

- To access samples, users must have a subscription and sign in to their profile.

- Click Download next to any form you require and find it in My documents.

- For users lacking a subscription, follow these steps to quickly find and download the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Trust.

- Ensure you acquire the correct document in relation to the state it is intended for.

- Examine the document by reading its description and utilizing the Preview option.

Form popularity

FAQ

You cannot transfer a deed to someone who has already passed away. If an individual dies, their property is subject to the legal process of probate. However, utilizing the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust can help ensure that property transfers to the designated beneficiary immediately upon death, simplifying future transactions.

Several states across the U.S. recognize the transfer on death deed, including Maryland, Texas, and Illinois, among others. Each state may have specific rules regulating this deed, so understanding local laws is essential. In the District of Columbia, the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust is an excellent option to streamline the transfer process.

Choosing between a trust and a transfer on death deed depends on your specific needs. A trust offers comprehensive management and protection of assets, whereas the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust provides a straightforward process for property transfer. For those with uncomplicated assets, a TOD may suffice, but a trust can better handle complex situations and provide ongoing support.

While the transfer on death deed has benefits, it also carries disadvantages. One major concern is that it does not provide protection from creditors, meaning your property could still be claimed if debts exist. Furthermore, the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust cannot handle complex family situations or conditions that might arise after a property owner's death.

To avoid probate in the District of Columbia, one effective method is using a transfer on death deed. This deed allows you to designate beneficiaries for your property, bypassing the probate process. Additionally, establishing a trust, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust, can further help streamline the transfer of assets.

Yes, the District of Columbia allows the use of a transfer on death deed (TOD). This legal tool enables property owners to transfer ownership to designated beneficiaries outside of probate. Specifically, with the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust, spouses can effectively ensure their property passes seamlessly to their chosen beneficiaries upon their death.

One downside of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust is its inability to protect the property from creditors after the owner’s death. This situation can complicate matters for the beneficiaries, especially if the estate has outstanding debts. Additionally, a TOD deed might not reflect your wishes if circumstances change after the deed is established.

The decision between a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust and a trust largely depends on your specific needs and circumstances. A TOD deed is easier to execute and provides straightforward benefits for passing property. On the other hand, a trust offers more comprehensive estate planning options and can manage a broader range of assets.

While it is not mandatory to hire a lawyer for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust, consulting one is highly advisable. A lawyer can help ensure that the deed is executed correctly and meets all legal requirements. Working with a legal professional may also provide peace of mind during the process.

While a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Trust offers benefits, it also comes with some disadvantages. One major concern is that the property is not accessible for creditors after death, which can lead to complications. Additionally, if there are multiple beneficiaries, disagreements may arise over the property's future.