District of Columbia Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock

Description

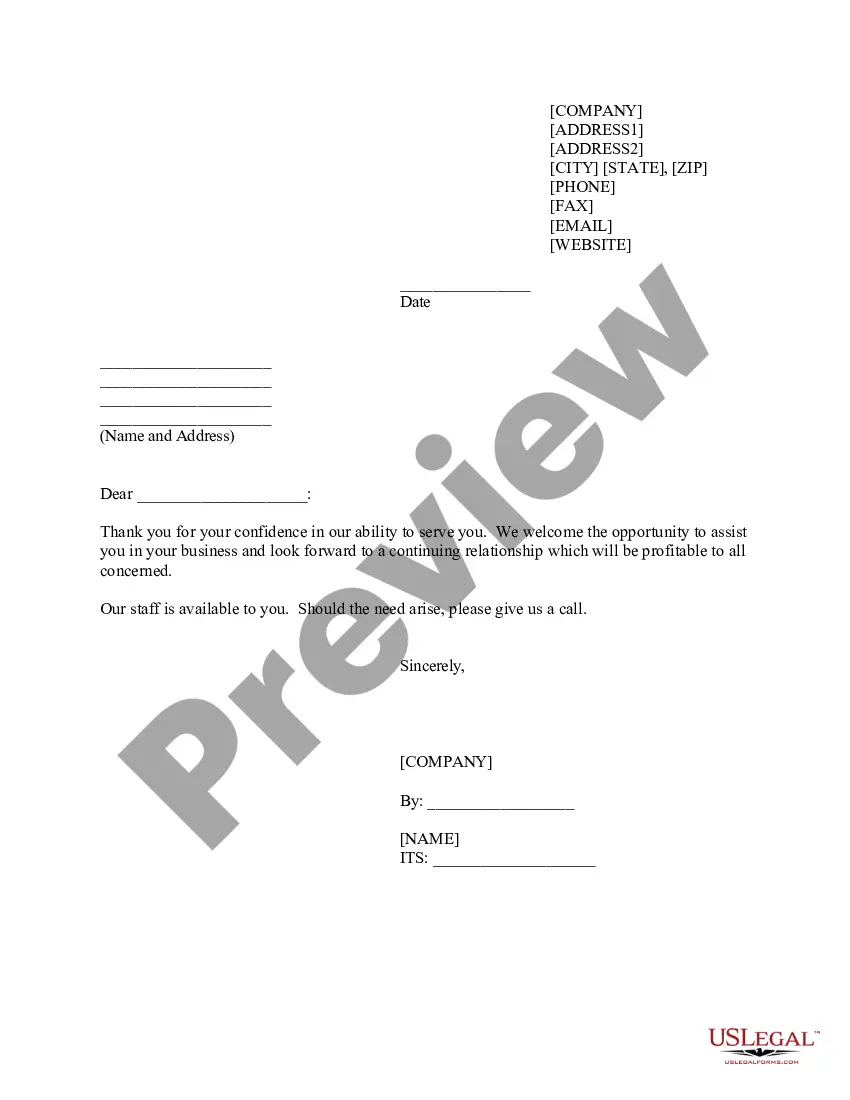

How to fill out Subscription Agreement - 6% Series G Convertible Preferred Stock - Between ObjectSoft Corp. And Investors Regarding Issuance And Sale Of Preferred Stock?

If you have to complete, obtain, or print legal file themes, use US Legal Forms, the most important variety of legal types, that can be found on the Internet. Take advantage of the site`s simple and easy hassle-free lookup to obtain the files you will need. Different themes for business and person functions are categorized by types and says, or key phrases. Use US Legal Forms to obtain the District of Columbia Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock in just a couple of click throughs.

In case you are already a US Legal Forms client, log in in your accounts and click on the Down load key to obtain the District of Columbia Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock. You can even accessibility types you formerly saved in the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for that proper area/region.

- Step 2. Take advantage of the Preview method to look over the form`s information. Don`t neglect to see the explanation.

- Step 3. In case you are unsatisfied with the type, take advantage of the Look for area near the top of the display to get other versions of the legal type design.

- Step 4. Upon having found the form you will need, select the Buy now key. Pick the costs plan you like and include your credentials to sign up on an accounts.

- Step 5. Method the transaction. You should use your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Choose the format of the legal type and obtain it on your system.

- Step 7. Full, revise and print or signal the District of Columbia Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock.

Each legal file design you buy is yours permanently. You might have acces to every type you saved inside your acccount. Select the My Forms segment and decide on a type to print or obtain once more.

Compete and obtain, and print the District of Columbia Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock with US Legal Forms. There are thousands of professional and state-particular types you can use for your personal business or person requirements.

Form popularity

FAQ

Convertible preferred stocks are preferred shares that include an option for the holder to convert them into a fixed number of common shares after a predetermined date.

Some disadvantages of convertible preferred stocks are that they are riskier and become less profitable when transformed into common stock. In addition, an issuer's control of the company diminishes upon the transformation to common stock since they have voting rights.

Risk and Returns There is a slightly higher risk that a company may default on preferred stocks, especially if the company has poor credit. Also, the price of preferred stock may drop when interest rates rise. On the other hand, the price may rise when interest rates fall.

Convertible preferred stock offers the investor the benefits of both preferred stock and common stock. Investors get the stability, liquidation priority, and higher dividends of preferred stock, but they also have the option to convert their shares into common stock later if they believe that the price will go up.

The conversion price is calculated by dividing the par value of the preferred stock by the conversion ratio. For example, if the par value of the preferred stock is $50 and the conversion ratio is 5, the conversion price would be $10.

The main disadvantage of owning preference shares is that the investors in these vehicles don't enjoy the same voting rights as common shareholders. 1 This means that the company is not beholden to preferred shareholders the way it is to traditional equity shareholders.

Some disadvantages of convertible preferred stocks are that they are riskier and become less profitable when transformed into common stock. In addition, an issuer's control of the company diminishes upon the transformation to common stock since they have voting rights.

The terms "redeemable shares" and "convertible shares" refer to different types of preferred stock. If a preferred stock is redeemable, it means that the issuing company can exchange those shares for cash, while convertible shares can be exchanged by the shareholder for common stock.