A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

District of Columbia Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

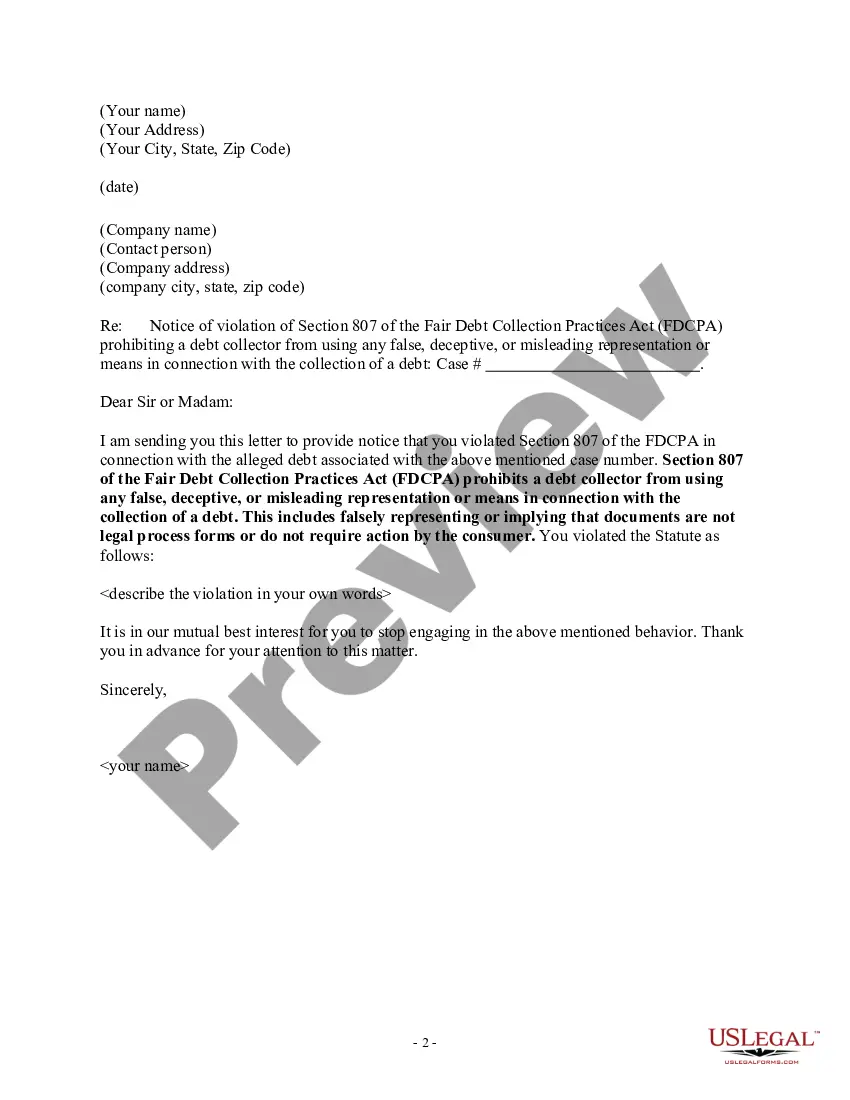

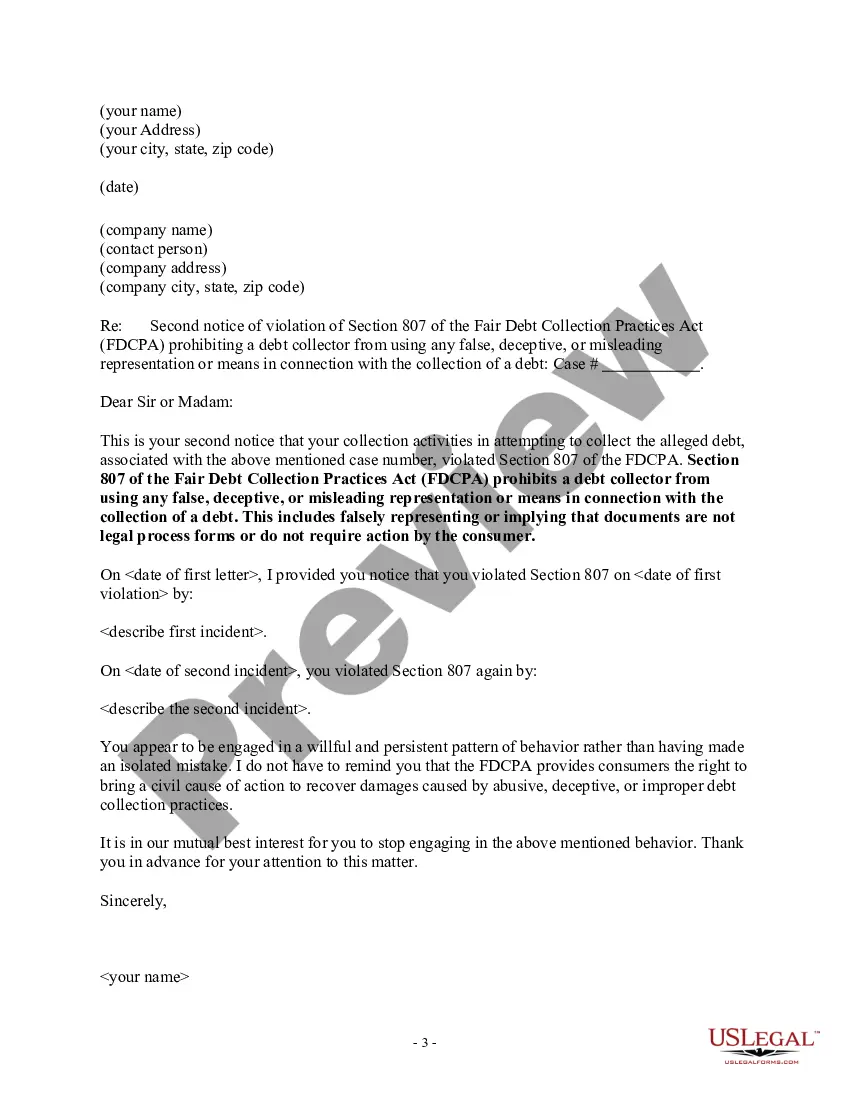

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

It is feasible to invest hours online trying to discover the legal document format that conforms to the state and federal criteria you require.

US Legal Forms offers a vast selection of legal documents which are assessed by experts.

You can effortlessly download or print the District of Columbia Notice to Debt Collector - Misrepresenting Documents are Not Legal Process or Do Not Require Action from my service.

If available, use the Review option to examine the document format as well.

- If you already possess a US Legal Forms account, you can Log In and choose the Download option.

- After that, you can complete, modify, print, or sign the District of Columbia Notice to Debt Collector - Misrepresenting Documents are Not Legal Process or Do Not Require Action.

- Each legal document format you acquire is yours permanently.

- To obtain another copy of any purchased form, head to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document format for the county/city of your choice.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Statute of Limitations The Statute of limitations in the District of Columbia for open accounts and writings, such as contracts and promissory notes, is three (3) years from the date of breach. Generally, a renewed promise that can be proved to pay an old debt renews the limitations period.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The FDCPA broadly defines a debt collector as "any person who uses any instrumentality of interstate commerce or the mails in any business the principal purpose of which is the collection of any debts, or who regularly collects or attempts to collect, directly or indirectly, debts owed or due or asserted to be owed or

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

The FDCPA prohibits debt collectors from engaging in harassment or abuse, making false or misleading representations, and engaging in unfair practices.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

5 Things Debt Collectors Are Forbidden to DoPretend to Work for a Government Agency. The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement.Threaten to Have You Arrested.Publicly Shame You.Try to Collect Debt You Don't Owe.Harass You.