District of Columbia Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005

Description

How to fill out Declaration Under Penalty Of Perjury On Behalf Of A Corporation Or Partnership - Form 2 - Pre And Post 2005?

Are you within a position in which you need to have files for either business or individual reasons virtually every day time? There are a variety of legal file web templates available on the net, but getting ones you can rely on is not straightforward. US Legal Forms delivers thousands of develop web templates, like the District of Columbia Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005, which are created in order to meet federal and state demands.

If you are already familiar with US Legal Forms site and get a merchant account, basically log in. After that, you are able to obtain the District of Columbia Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 format.

If you do not offer an accounts and would like to begin to use US Legal Forms, follow these steps:

- Get the develop you require and ensure it is for your appropriate city/county.

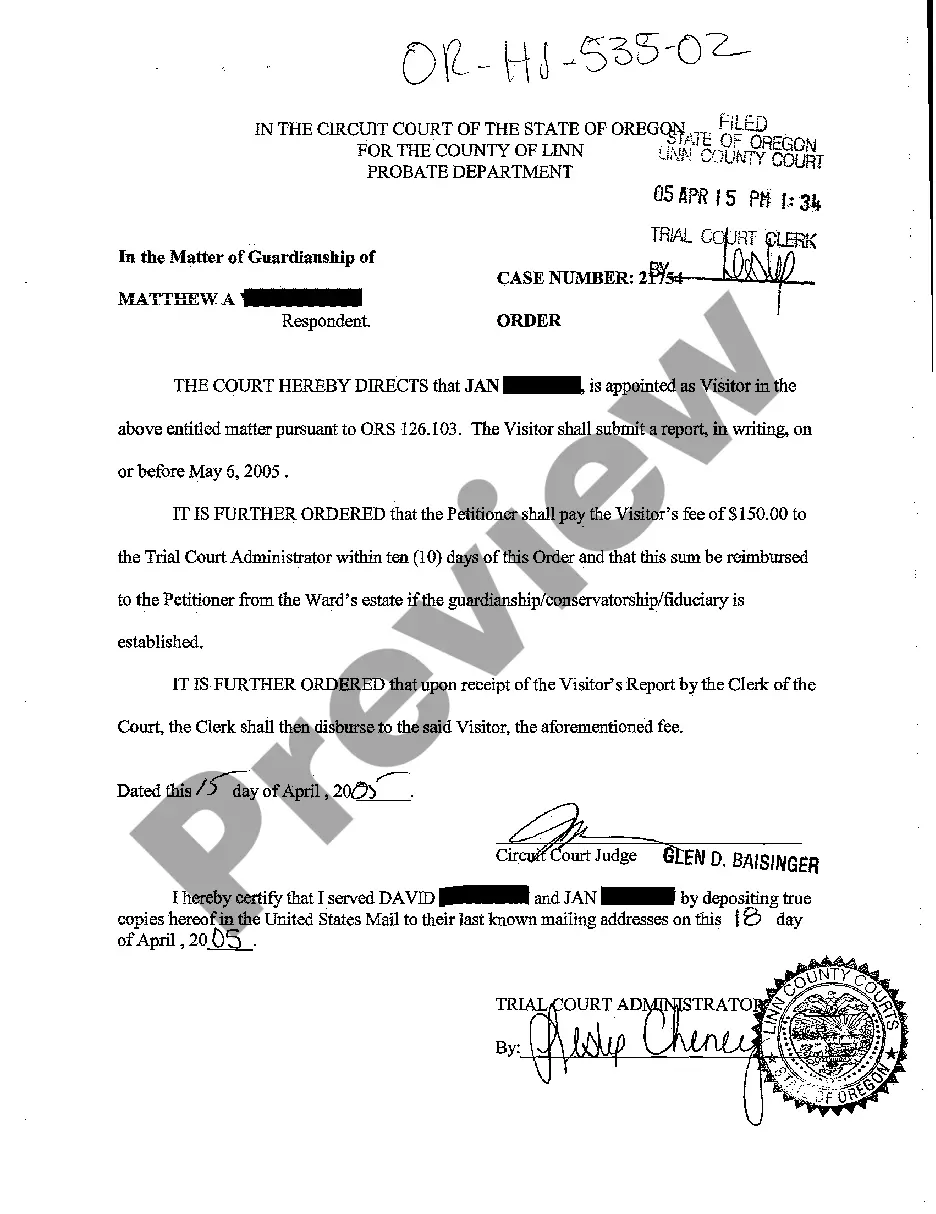

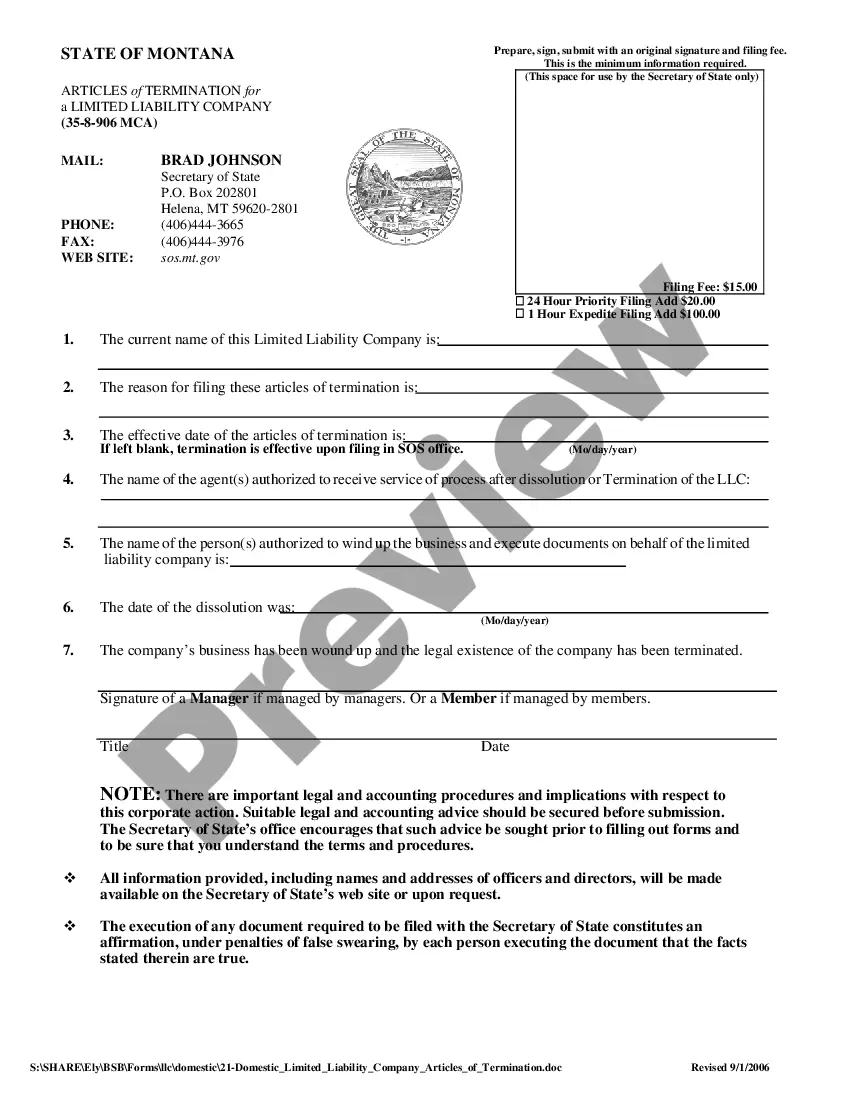

- Make use of the Preview option to check the shape.

- Look at the description to actually have selected the proper develop.

- In case the develop is not what you`re seeking, take advantage of the Look for industry to find the develop that meets your requirements and demands.

- If you discover the appropriate develop, just click Purchase now.

- Pick the pricing program you desire, fill in the necessary information and facts to create your bank account, and pay money for an order using your PayPal or charge card.

- Pick a practical file formatting and obtain your copy.

Locate each of the file web templates you possess purchased in the My Forms menu. You can get a more copy of District of Columbia Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005 anytime, if possible. Just go through the needed develop to obtain or produce the file format.

Use US Legal Forms, the most considerable selection of legal kinds, to save time as well as avoid errors. The support delivers appropriately made legal file web templates which can be used for an array of reasons. Create a merchant account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

Primary tabs. Declaration under penalty of perjury is a statement of facts or testimony accompanied by the declaration that the person making the statement will be found guilty of perjury if the facts declared in the statement are shown to be untrue.

The elements of perjury are (1) that the declarant took an oath to testify truthfully, (2) that he willfully made a false statement contrary to that oath (3) that the declarant believed the statement to be untrue, and (4) that the statement related to a material fact. It is easy to prove that a declarant took an oath.

If executed within the United States, its territories, possessions, or commonwealths: "I declare (or certify, verify, or state) under penalty of perjury that the foregoing is true and correct. Executed on (date). (Signature)".

Let's say that Robert is testifying about his wife's infidelity. Robert purposefully lies, saying that his wife had multiple affairs, when he knows for certain that she has not had any affairs during their marriage. This purposeful and intentional lie would constitute perjury.

If executed within the United States, its territories, possessions, or commonwealths: "I declare (or certify, verify, or state) under penalty of perjury that the foregoing is true and correct. Executed on (date). (Signature)".

Primary tabs. A declaration is an official statement, or proclamation, such as an affidavit. If the person making the declaration (called the declarant) lies in it, the declarant may be guilty of perjury. [Last updated in September of 2022 by the Wex Definitions Team]

You may only write about facts or occurrences that you have personal knowledge of or that you personally witnessed. Explain how you know each fact. If you have documents that support your argument, you may attach them to this declaration. Using a separate paragraph and separate exhibit letter for each document.

The elements of perjury are (1) that the declarant took an oath to testify truthfully, (2) that he willfully made a false statement contrary to that oath (3) that the declarant believed the statement to be untrue, and (4) that the statement related to a material fact. It is easy to prove that a declarant took an oath.

Your ?declaration? is your story to the judge. You will probably not be given the time to say much to the judge when you go to court. You must therefore write everything you want to say to the judge here in your declaration.

A "penalty of perjury" statement includes not just the warning about penalty of perjury, the person signing avows that the statements are true to the best of their knowledge.