District of Columbia Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

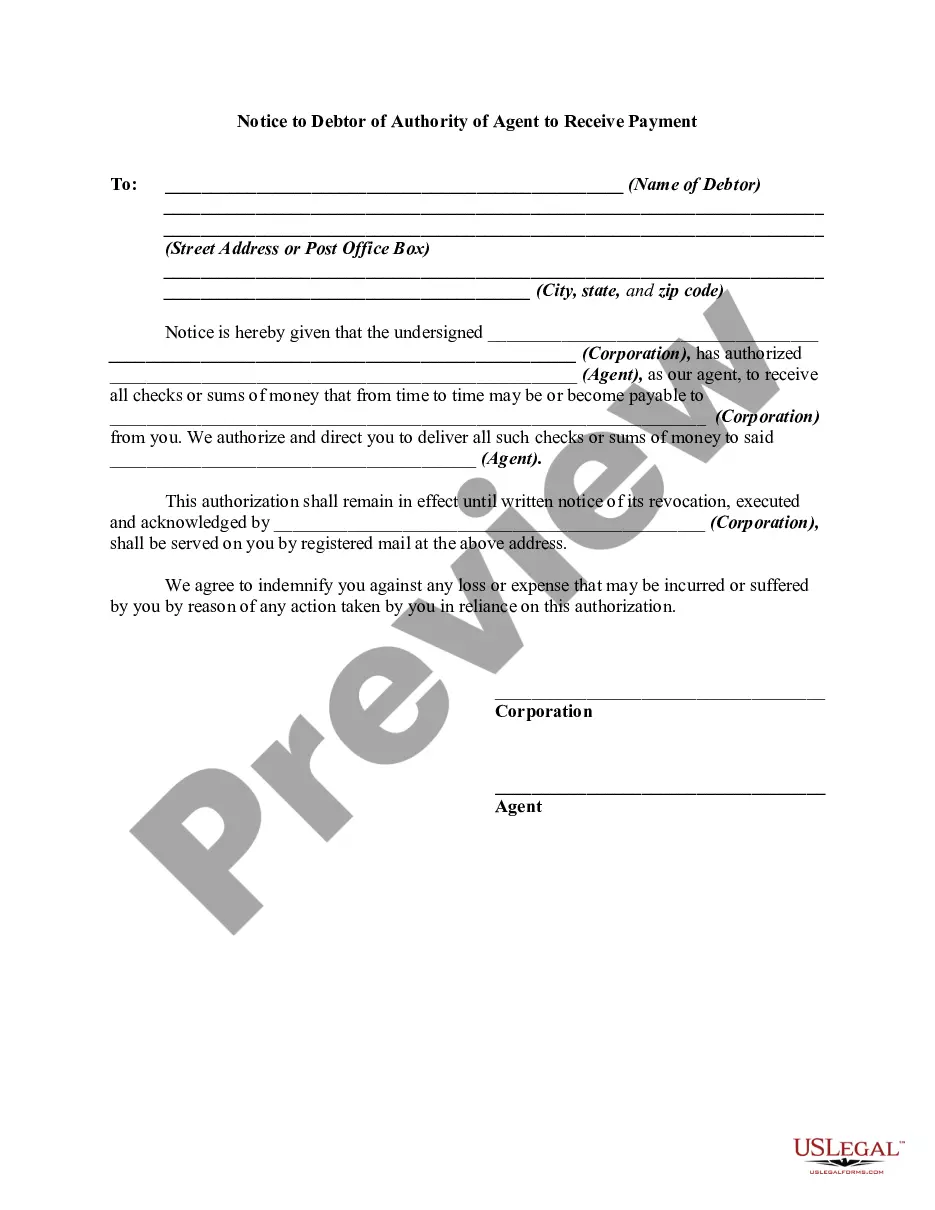

How to fill out Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

US Legal Forms - among the biggest libraries of authorized forms in the United States - gives a variety of authorized record layouts you may download or produce. Using the web site, you can get a large number of forms for company and person reasons, sorted by classes, states, or keywords and phrases.You can find the most up-to-date types of forms like the District of Columbia Self-Employed Independent Contractor Employment Agreement - commission for new business within minutes.

If you already possess a monthly subscription, log in and download District of Columbia Self-Employed Independent Contractor Employment Agreement - commission for new business from the US Legal Forms library. The Down load button will show up on each and every type you perspective. You have accessibility to all earlier saved forms within the My Forms tab of your own accounts.

If you would like use US Legal Forms the very first time, allow me to share easy recommendations to help you get started out:

- Ensure you have selected the right type for the area/area. Go through the Review button to check the form`s articles. Browse the type outline to actually have selected the appropriate type.

- In the event the type doesn`t suit your needs, use the Research industry near the top of the screen to find the the one that does.

- When you are satisfied with the shape, confirm your selection by clicking the Buy now button. Then, opt for the pricing plan you like and offer your credentials to sign up for an accounts.

- Approach the purchase. Use your bank card or PayPal accounts to finish the purchase.

- Find the file format and download the shape on your own system.

- Make changes. Complete, edit and produce and indication the saved District of Columbia Self-Employed Independent Contractor Employment Agreement - commission for new business.

Every single web template you included with your account does not have an expiration day and it is the one you have for a long time. So, if you would like download or produce another copy, just check out the My Forms section and click around the type you want.

Obtain access to the District of Columbia Self-Employed Independent Contractor Employment Agreement - commission for new business with US Legal Forms, one of the most extensive library of authorized record layouts. Use a large number of skilled and condition-particular layouts that meet your small business or person requirements and needs.

Form popularity

FAQ

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.