District of Columbia Credit support agreement

Description

How to fill out Credit Support Agreement?

You may devote hours on the web searching for the legal document template that meets the state and federal needs you will need. US Legal Forms provides 1000s of legal types which can be evaluated by specialists. You can actually obtain or produce the District of Columbia Credit support agreement from my support.

If you have a US Legal Forms account, you may log in and click on the Download button. Following that, you may complete, edit, produce, or indicator the District of Columbia Credit support agreement. Each and every legal document template you get is your own property permanently. To have another backup of the bought kind, check out the My Forms tab and click on the corresponding button.

If you use the US Legal Forms web site initially, adhere to the straightforward instructions beneath:

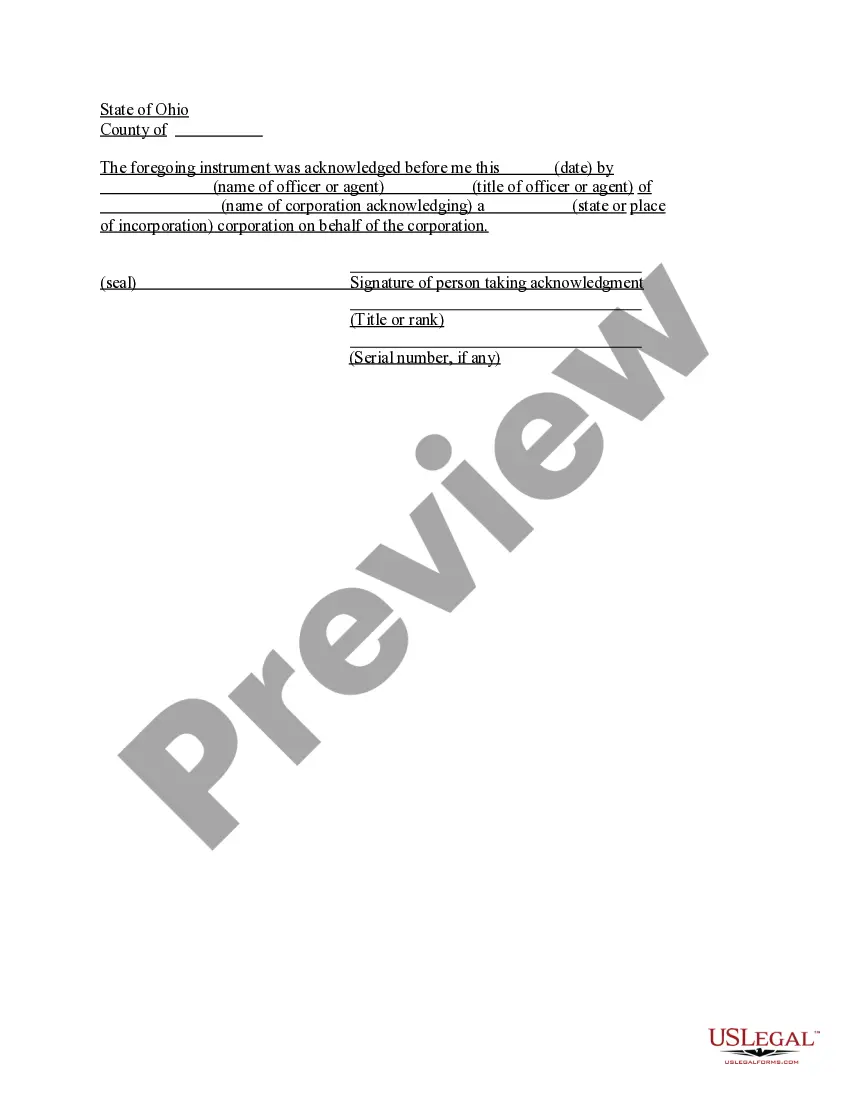

- Initial, make sure that you have selected the proper document template to the area/metropolis of your choice. Read the kind information to make sure you have picked the right kind. If offered, utilize the Review button to appear from the document template as well.

- In order to locate another model of the kind, utilize the Search area to discover the template that suits you and needs.

- After you have found the template you want, click Purchase now to move forward.

- Choose the pricing plan you want, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your bank card or PayPal account to cover the legal kind.

- Choose the structure of the document and obtain it to your product.

- Make adjustments to your document if required. You may complete, edit and indicator and produce District of Columbia Credit support agreement.

Download and produce 1000s of document layouts while using US Legal Forms website, that provides the biggest assortment of legal types. Use skilled and condition-certain layouts to handle your small business or individual requirements.

Form popularity

FAQ

Prohibited Acts Under the DC Consumer Protection Procedures Act. The CPPA enumerates specific ?unlawful trade practices? that are violations of the statute. Most of the unlawful trade practices identified relate to fraud or misrepresentation.

Definitions of stand for. verb. express indirectly by an image, form, or model; be a symbol. synonyms: emblematize, represent, symbolise, symbolize, typify.

The CPPA also provides for a private right of action: a consumer who is harmed by an unlawful trade practice may sue for treble damages (or $1500 per violation, if greater), punitive damages, and attorney's fees, as well as an injunction against the unlawful trade practice.

Protection of Consumers: The primary objective is to protect consumers from hazardous goods, deficient services, and unfair trade practices. Promoting Consumer Rights: The Act emphasizes six consumer rights, including the right to safety, information, choice, representation, redressal, and consumer education.

The CSP provides funds for deposit with a participating lender (a participating bank, credit union or community development financial institution) to provide the necessary collateral to cover the borrower's collateral shortfall.

Statute of Limitations The Statute of limitations in the District of Columbia for open accounts and writings, such as contracts and promissory notes, is three (3) years from the date of breach. Generally, a renewed promise that can be proved to pay an old debt renews the limitations period.

To promote fair business practices, To protect consumers from unfair, unreasonable and/or improper trade practices. To protect consumers from misleading, deceptive, unfair or fraudulent conduct and/or actions, and. To provide for systems of dispute resolution and enforcement.

This Act applies to every contract for goods or services entered into between a consumer and a merchant in the course of his business.