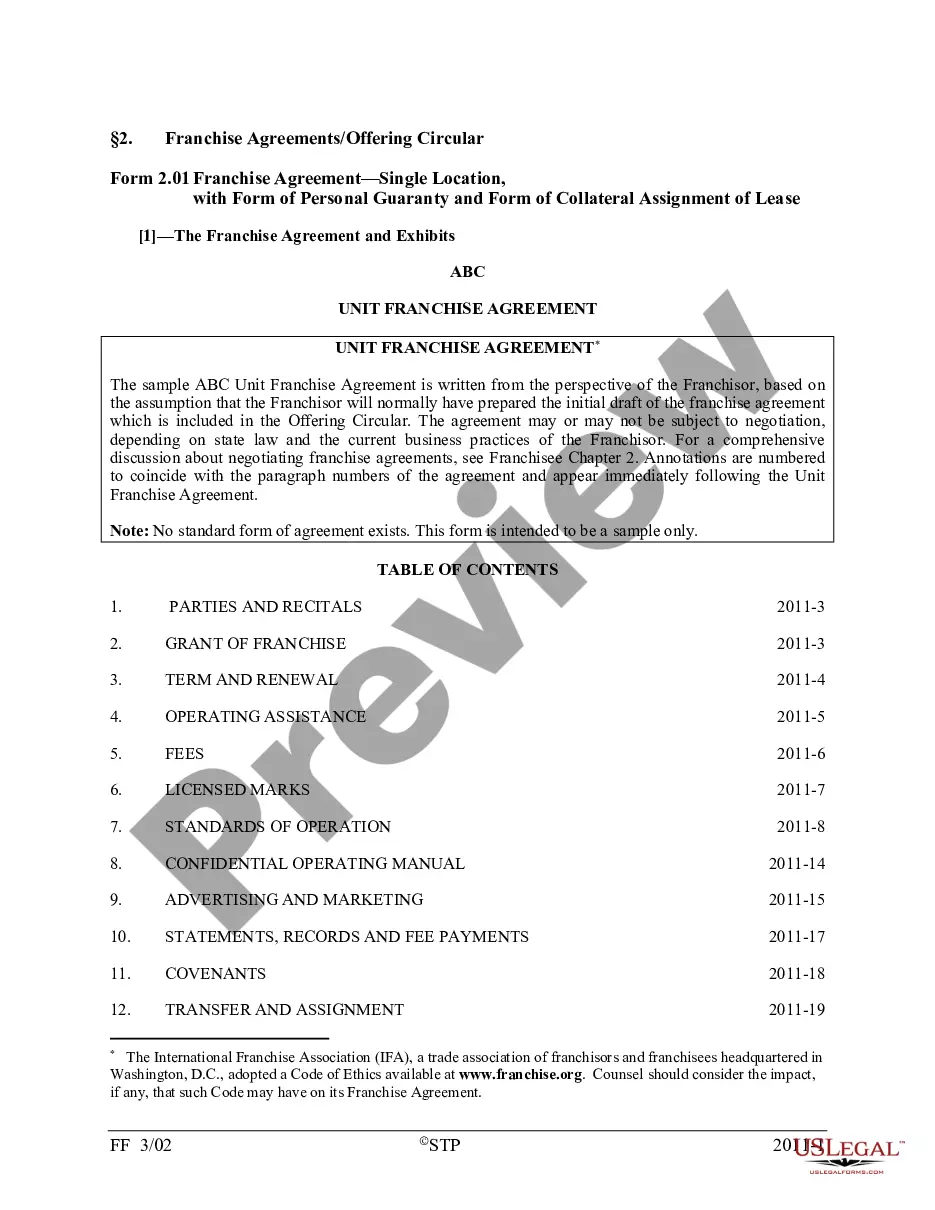

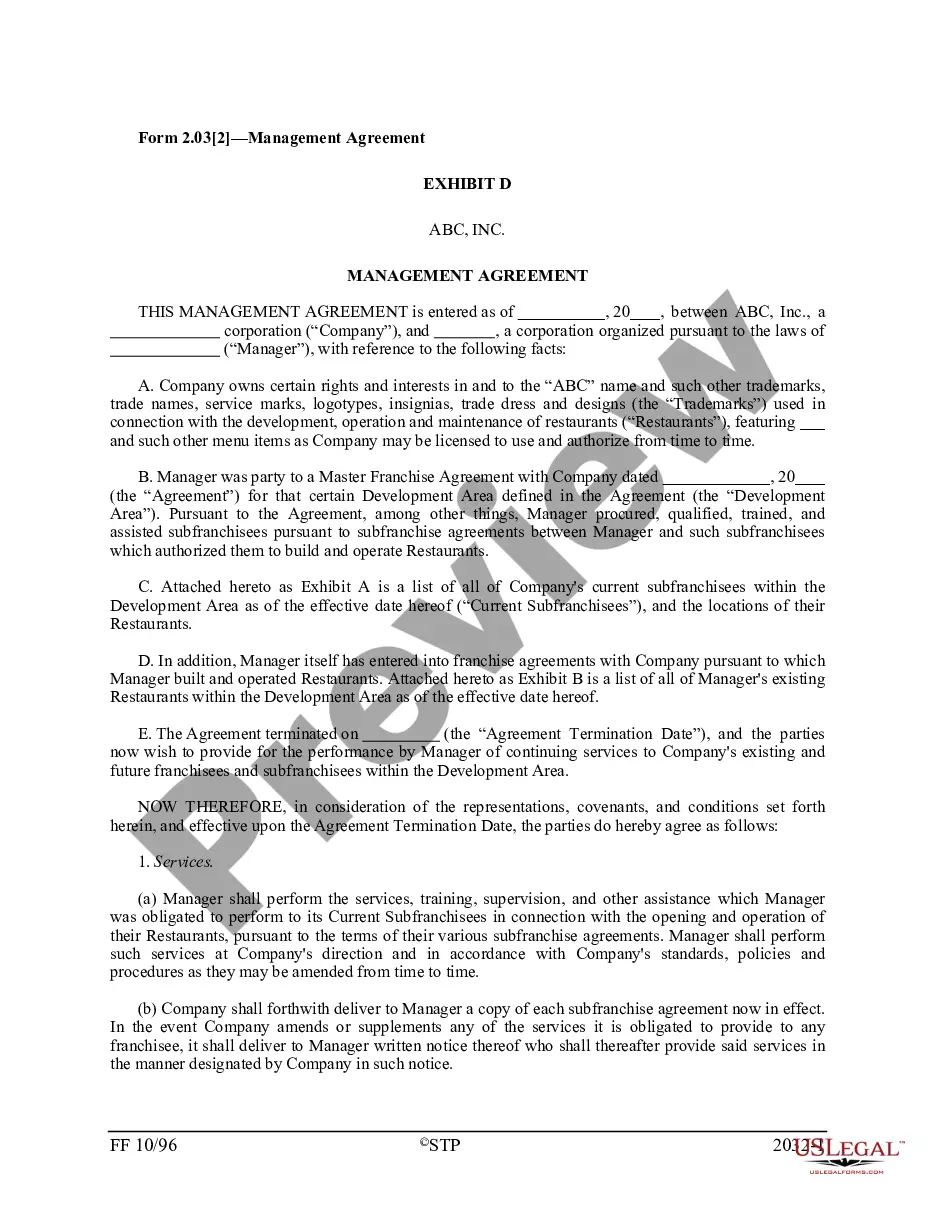

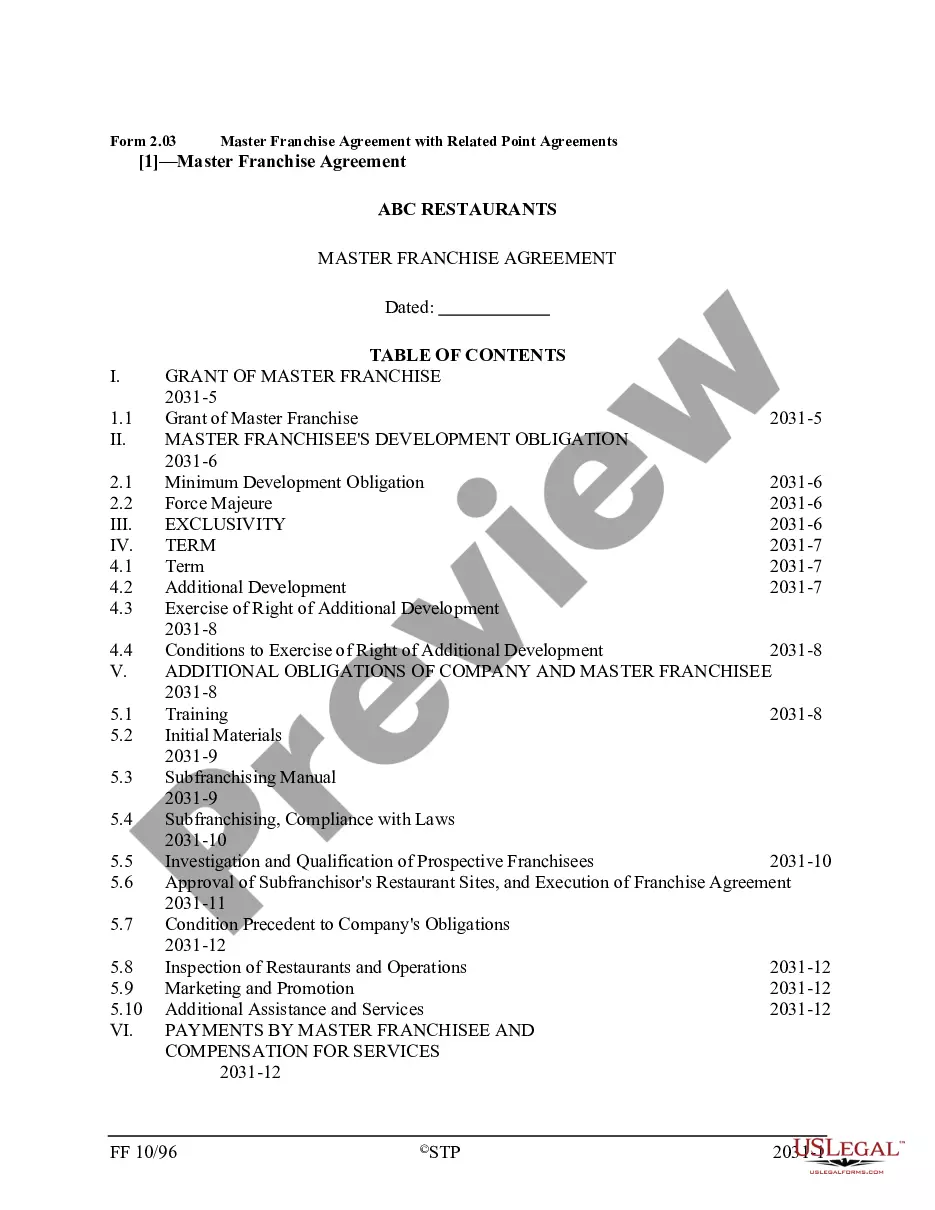

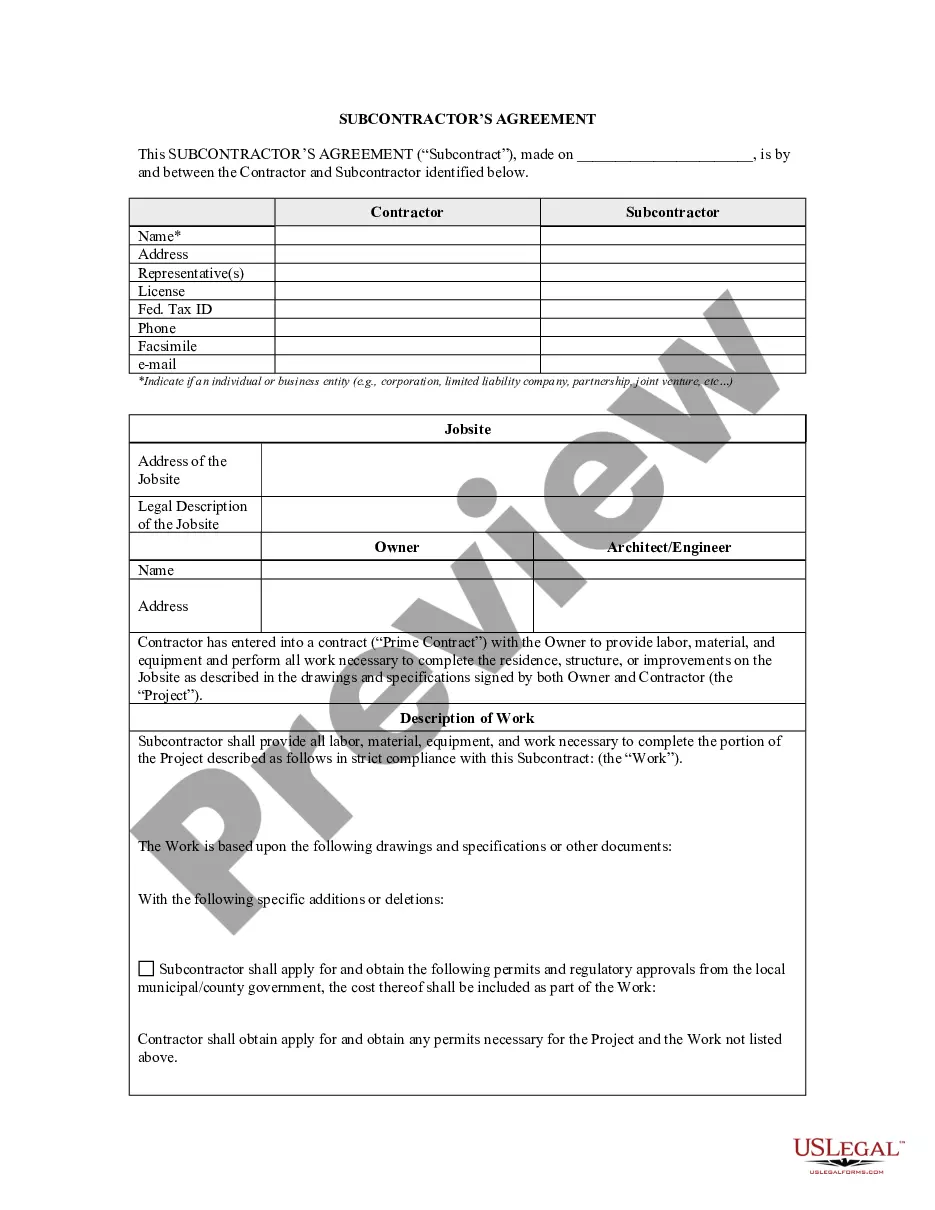

District of Columbia Sample Franchise Agreement

Description

How to fill out Sample Franchise Agreement?

US Legal Forms - one of many greatest libraries of legitimate forms in the United States - delivers a wide array of legitimate papers layouts you can obtain or produce. Utilizing the website, you will get thousands of forms for company and specific uses, sorted by groups, states, or keywords.You will discover the most up-to-date variations of forms just like the District of Columbia Sample Franchise Agreement within minutes.

If you currently have a monthly subscription, log in and obtain District of Columbia Sample Franchise Agreement from the US Legal Forms library. The Down load option will appear on each and every form you look at. You have accessibility to all formerly acquired forms in the My Forms tab of the accounts.

In order to use US Legal Forms the first time, listed below are simple recommendations to help you started:

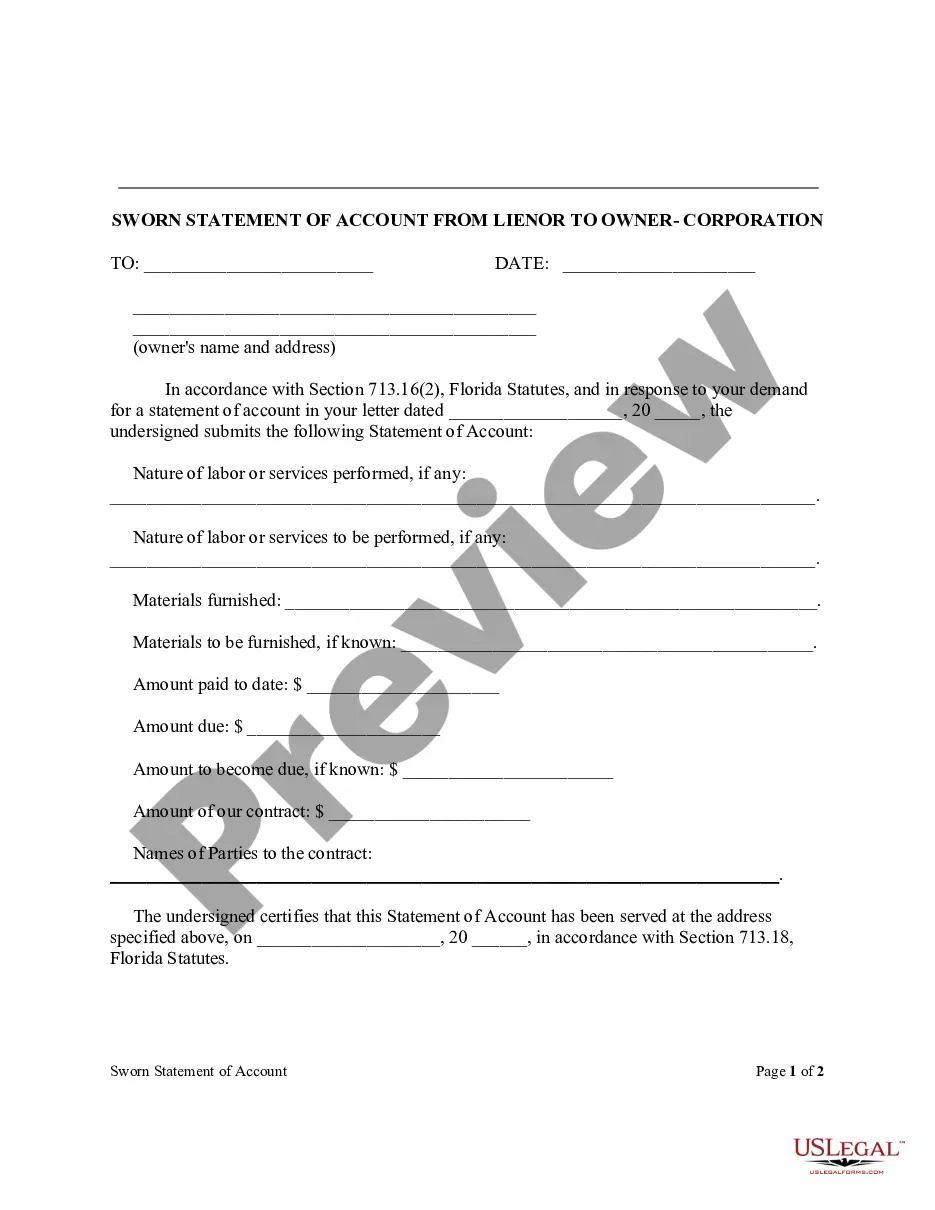

- Make sure you have picked out the best form to your town/area. Click on the Review option to examine the form`s content. Look at the form description to ensure that you have selected the appropriate form.

- If the form doesn`t fit your needs, utilize the Research industry on top of the monitor to get the the one that does.

- Should you be satisfied with the shape, affirm your selection by visiting the Get now option. Then, select the pricing program you like and offer your references to sign up to have an accounts.

- Method the purchase. Utilize your bank card or PayPal accounts to complete the purchase.

- Select the structure and obtain the shape on your own system.

- Make alterations. Fill out, revise and produce and indicator the acquired District of Columbia Sample Franchise Agreement.

Every format you put into your bank account does not have an expiration particular date and it is your own property for a long time. So, if you would like obtain or produce yet another backup, just go to the My Forms section and click about the form you will need.

Get access to the District of Columbia Sample Franchise Agreement with US Legal Forms, probably the most considerable library of legitimate papers layouts. Use thousands of professional and status-particular layouts that meet your company or specific demands and needs.

Form popularity

FAQ

MyTax.DC.gov Offers the ability to file online the D 30/Schedules to registered taxpayers provided you are not filing a Combined Report or short year return.

Who must file Form D-30? Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Nonresidents may request a refund of erroneously withheld DC tax withheld or mistakenly made DC estimated payments by filing Form D-40B, Nonresident Request for Refund. Non-resident DC returns cannot be electronically filed, they must be printed and mailed.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 from District sources, must file a D-30 (whether or not it has net income).

MyTax.DC.gov is now live with 24/7 access. Visit the District's new online tax portal to view and pay your taxes. For many tax types, you can even file.

DC participates in the Modernized e-File program for Corporation (D-20 family), Unincorporated Business Franchise (D-30 family with an EIN only) tax returns and Partnership Return of Income (D-65).

DC Corporate Franchise Tax Overview A minimum tax of $250 applies for businesses with DC gross receipts of $1 million or less, and $1,000 for receipts exceeding the $1 million mark.

Generally, every corporation or financial institution must file a Form D-20 (including small businesses, professional corporations, and S corporations) if it is carrying on or engaging in any trade, business, or commercial activity in the District of Columbia (DC) or receiving income from DC sources.