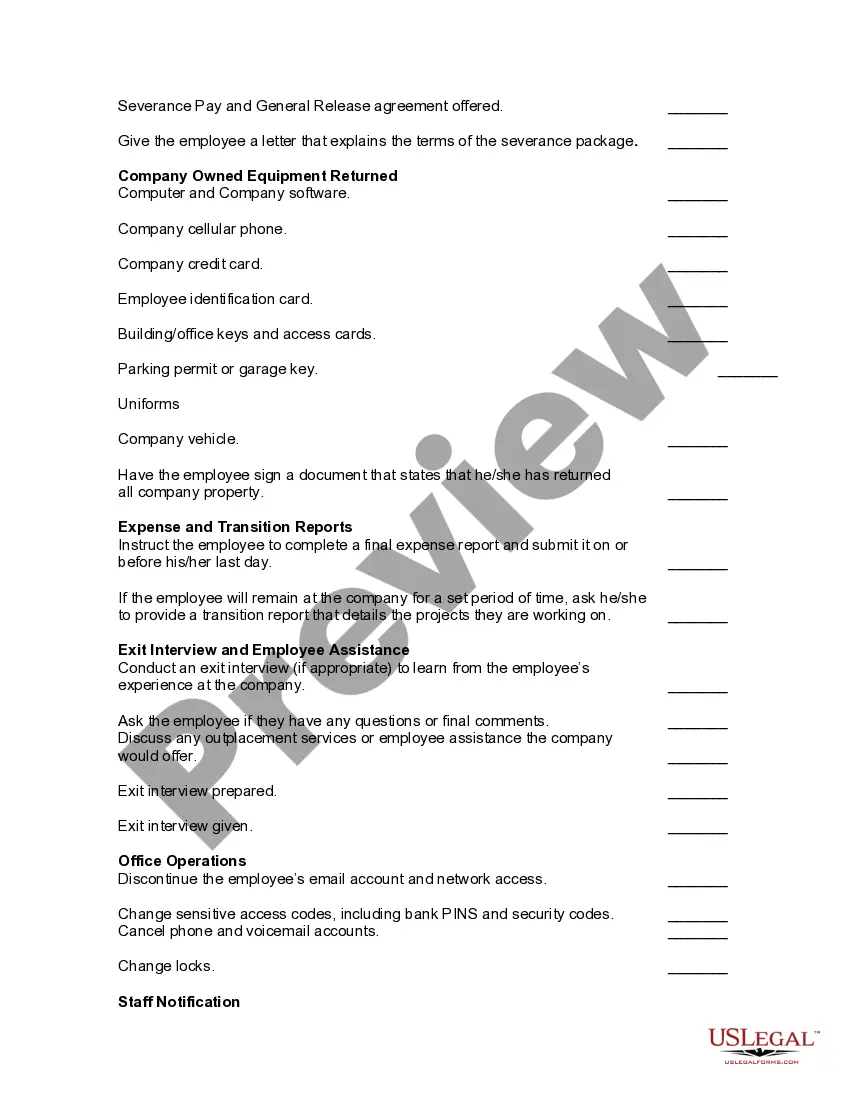

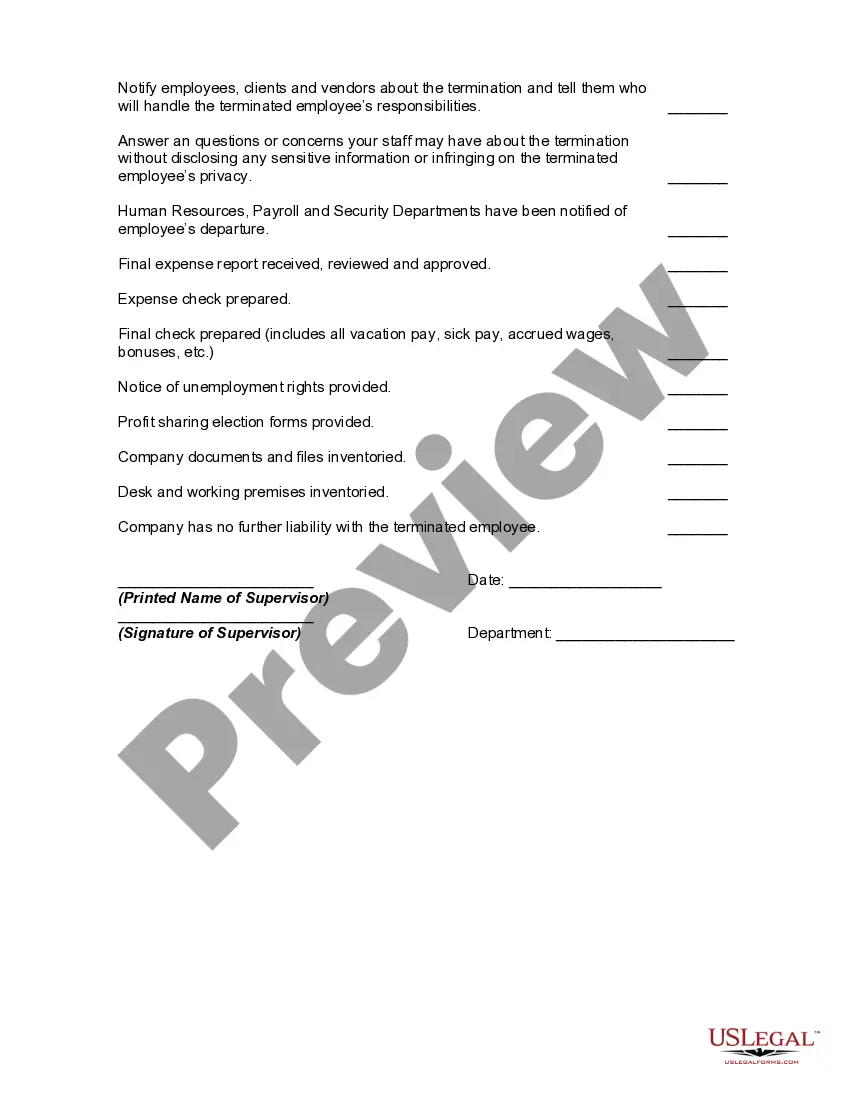

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

District of Columbia Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

You can devote numerous hours online searching for the legal document template that meets the state and federal criteria you desire.

US Legal Forms offers thousands of legal templates that are vetted by professionals.

You have the option to acquire or create the District of Columbia Worksheet - Termination of Employment through their service.

Review the form description to ensure you have chosen the correct template. If available, use the Review button to check the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Acquire button.

- Following that, you can complete, modify, create, or sign the District of Columbia Worksheet - Termination of Employment.

- Each legal document template you obtain belongs to you permanently.

- To get another copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure that you have selected the correct document template for your county/city of preference.

Form popularity

FAQ

Employees may be terminated for various reasons, including performance issues, misconduct, or organizational restructuring. It's essential to document these reasons thoroughly and follow company policy. A District of Columbia Worksheet - Termination of Employment can help you clarify valid reasons for termination while ensuring legal compliance.

Purpose: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

Individual Income Tax: Mail payment with payment voucher to the Office of Tax and Revenue, PO Box 96169, Washington, DC 20090-6169. Individual Income Estimated Tax and Extension of Time to File: Mail payment with payment voucher to the Office of Tax and Revenue, PO Box 96018, Washington, DC 20090-6018.

District of Columbia (DC) employers must withhold DC income taxes on wage payments made to DC residents who work in DC. An employee is a DC resident for income tax purposes if certain criteria are met. Nonresidents who work in DC are not subject to withholding.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee's paycheck. The Internal Revenue Service (IRS) Form W-4 is used to calculate and claim withholding allowances.

You should claim 0 allowances on your 2019 IRS W4 tax form if someone else claims you as a dependent on their tax return. (For example you're a college student and your parents claim you). This ensures the maximum amount of taxes are withheld from each paycheck. You'll most likely get a refund back at tax time.

If you are not a resident of DC you must file a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.

Acronym. Definition. D-4. Direct Injection 4 Stroke Gasoline Engine (Toyota) Copyright 1988-2018 AcronymFinder.com, All rights reserved.

Every new employee who resides in DC and is required to have DC income taxes withheld, must fill out Form D-4 and file it with his/her employer.