In this guaranty, two corporations guarantee the debt of an affiliate corporation.

District of Columbia Cross Corporate Guaranty Agreement

Description

How to fill out Cross Corporate Guaranty Agreement?

Locating the appropriate authorized document template can be quite challenging.

Naturally, there are numerous templates accessible online, but how can you discover the appropriate form you need.

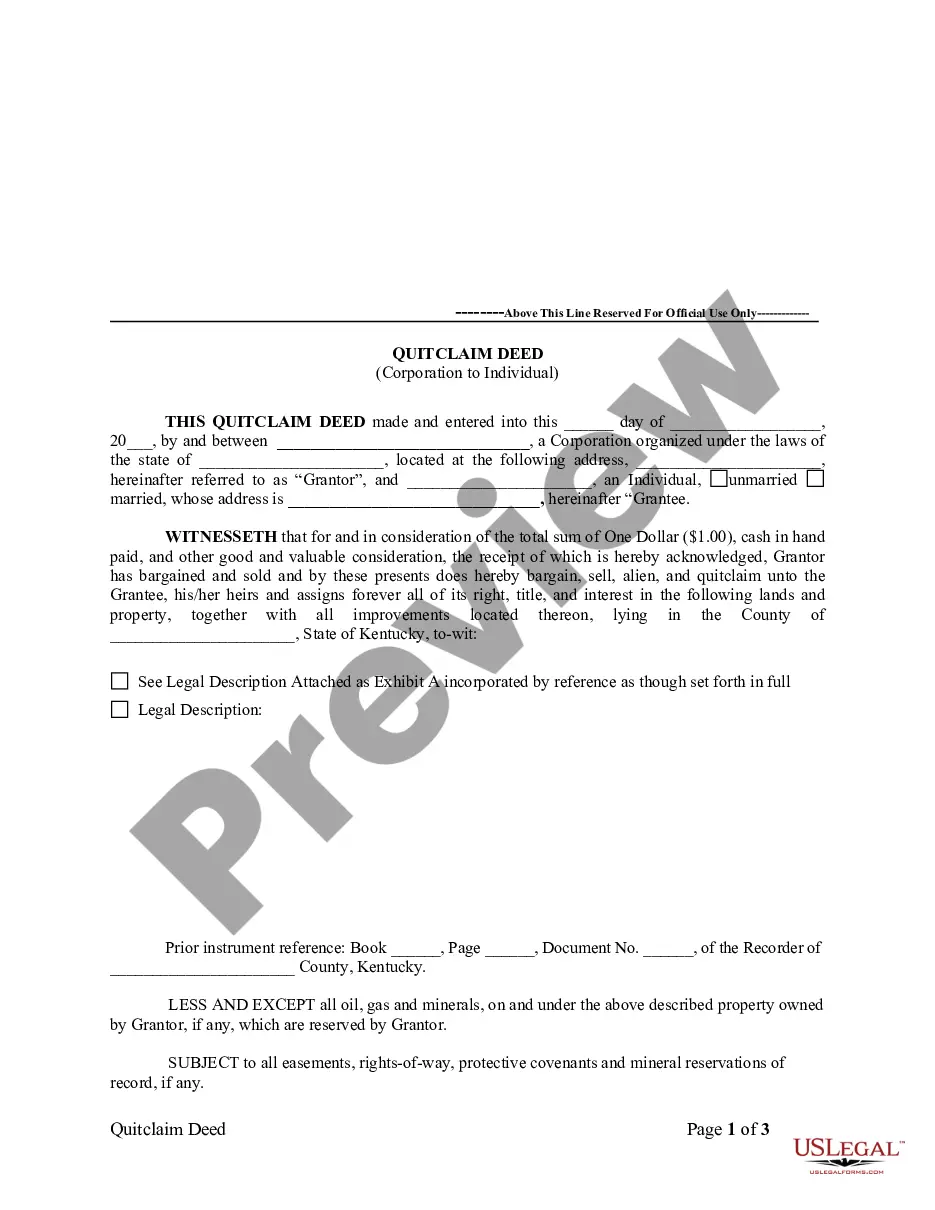

Utilize the US Legal Forms website. The platform offers a vast selection of templates, including the District of Columbia Cross Corporate Guaranty Agreement, which can fulfill both business and personal requirements.

US Legal Forms boasts the largest library of legal forms where you can find various document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to locate the District of Columbia Cross Corporate Guaranty Agreement.

- Use your account to browse through the legal forms you've purchased before.

- Navigate to the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps you should follow.

- First, ensure you have selected the correct form for your city/state.

- You can preview the form using the Review option and read the description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to locate the right form.

- Once you are confident that the form is appropriate, click the Purchase now button to acquire the form.

- Select the payment plan you prefer and provide the required information.

- Create your account and pay for the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, edit, print, and sign the downloaded District of Columbia Cross Corporate Guaranty Agreement.

Form popularity

FAQ

The guaranty clause's primary purpose is to establish the obligations of the guarantor in a District of Columbia Cross Corporate Guaranty Agreement. This clause clarifies the extent of the guarantor's responsibility, providing peace of mind to lenders. It also outlines the terms under which the guarantor will cover any default, ensuring transparency and accountability.

Being a guarantor carries certain risks, especially in a District of Columbia Cross Corporate Guaranty Agreement. If the primary borrower defaults, the guarantor must fulfill the debt, which may strain personal finances. Additionally, it can impact the guarantor's credit score if the borrower fails to make payments, potentially leading to financial complications.

A guaranty agreement allows a party, known as the guarantor, to accept responsibility for another individual's or entity's debts or obligations. In the realm of the District of Columbia Cross Corporate Guaranty Agreement, this document provides a legal framework to reassure lenders or creditors that payments will be met. Understanding this type of agreement can significantly impact your business relationships and financial dealings.

A guaranty agreement, specifically in the context of the District of Columbia Cross Corporate Guaranty Agreement, serves as a commitment by one party to cover the obligations of another. This document ensures that if the original party fails to meet their responsibilities, the guarantor steps in to fulfill those needs. It is essential for businesses looking to secure financing or establish credibility in their transactions.

In a contract of guaranty, the parties involved consist of the guarantor, the principal debtor, and the creditor. This is often formalized in agreements such as the District of Columbia Cross Corporate Guaranty Agreement. It is important to understand that each party has distinct roles and legal obligations, which can affect the dynamics of any financial transaction. Clarity in these relationships supports effective management of guarantees.

The parties to a contract of guarantee generally include the guarantor, the creditor, and the principal debtor responsible for the obligation. In the case of a District of Columbia Cross Corporate Guaranty Agreement, these roles may involve multiple corporate entities. Each party has specific responsibilities and rights that outline their relationships regarding the guaranteed obligations. This structure is vital for clarity and enforcement.

In a personal guarantee, the parties typically include the individual guaranteeing a debt and the lender or creditor. The individual takes on personal liability for the debt of a business or another person. In the context of a District of Columbia Cross Corporate Guaranty Agreement, it may also include companies that the individual is associated with. Understanding the implications of personal guarantees can help individuals make informed decisions about their financial commitments.

A guaranty agreement is signed by the guarantor and may also require the principal debtor’s signature. For a District of Columbia Cross Corporate Guaranty Agreement, proper signatures from authorized representatives of each involved entity are crucial. This ensures that all parties legally acknowledge their obligations and liabilities under the agreement. It's important to have these signatures in place to enforce the terms of the guarantee effectively.

The parties involved in a guarantee contract typically include the guarantor and the creditor, as well as the principal debtor. In a District of Columbia Cross Corporate Guaranty Agreement, the guarantor often represents a different entity that supports the principal debtor's obligations. Understanding these roles is essential, as they define the relationship and responsibilities outlined within the contract. This clarity can help prevent disputes down the line.

When writing a guarantee agreement, start by clearly identifying the parties involved. Specify the obligations being guaranteed and outline the terms of the guarantee. In the case of a District of Columbia Cross Corporate Guaranty Agreement, it is crucial to include details specific to any corporate guarantees involved, as well as any relevant legal compliance. You may also consider using platforms like uslegalforms to ensure precise wording and completeness.