District of Columbia Farmers Market Application and Rules and Regulations

Description

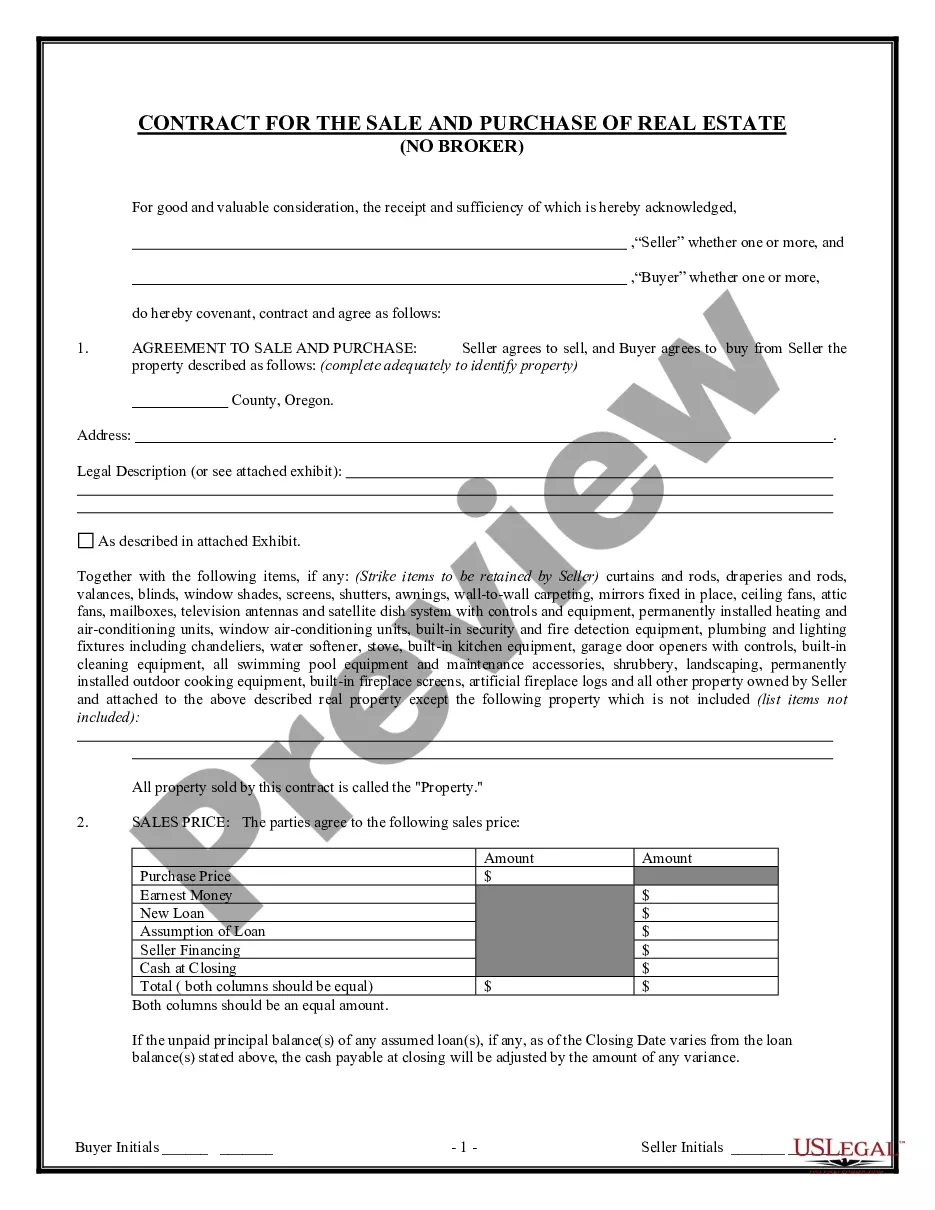

How to fill out Farmers Market Application And Rules And Regulations?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a variety of legal template formats for you to download or print.

Utilizing the website, you can access thousands of forms for business and personal uses, categorized by type, state, or keywords. You can find the latest versions of forms such as the District of Columbia Farmers Market Application and Rules and Regulations in just moments.

If you have an account, Log In and download the District of Columbia Farmers Market Application and Rules and Regulations from the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Choose the format and download the form onto your device.

Make changes. Fill out, modify, and print and sign the saved District of Columbia Farmers Market Application and Rules and Regulations. Every template you add to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Ensure you have selected the appropriate form for your locality/region. Click the Review button to examine the form's content.

- Read the form description to verify that you have chosen the right form.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred pricing option and provide your credentials to register for an account.

- Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the purchase.

Form popularity

FAQ

Yes, if you earn income from selling at a farmers market, you must report that income on your tax return. The District of Columbia Farmers Market Application and Rules and Regulations will provide guidelines on how to properly manage and report your earnings. It's advisable to keep thorough records of your sales and expenses to make tax filing easier.

Selling at a farmers market without a business license is generally not allowed and could lead to penalties. It's essential to review the District of Columbia Farmers Market Application and Rules and Regulations to ensure you meet all legal requirements. Obtaining the necessary permits can help you avoid issues and ensure compliance with local laws.

While an LLC is not mandatory for selling at a farmers market, it can offer significant legal protection. The District of Columbia Farmers Market Application and Rules and Regulations may require other forms of identification or permits, depending on your business type. An LLC can help legitimize your operations, build trust with customers, and simplify tax processes.

A local farmers market typically features vendors selling products that are produced within a specific geographic area, often promoting local agriculture. The District of Columbia Farmers Market Application and Rules and Regulations emphasize the importance of local sourcing to support community farms and businesses. These markets often create opportunities for consumers to connect directly with local growers and artisans.

Creating your own farmers market involves several steps, including selecting a location, securing vendor agreements, and promoting the market. You will also need to comply with the District of Columbia Farmers Market Application and Rules and Regulations to ensure everything is set up correctly. Being familiar with local laws and engaging the community can also enhance your market's success.

You do not necessarily need an LLC to sell at a farmers market; however, forming one can provide personal liability protection. The District of Columbia Farmers Market Application and Rules and Regulations may require different documentation, so it's wise to check those requirements. Creating an LLC can also lend credibility to your business, making it more attractive to customers.

For a market stall in the District of Columbia, you typically need general liability insurance. This coverage protects you against claims of bodily injury or property damage related to your stall. As outlined in the District of Columbia Farmers Market Application and Rules and Regulations, you may also want to consider additional coverage, such as product liability insurance, depending on what you sell. Engaging with a knowledgeable insurance broker can guide you through the process.

Having insurance for a farmers market is highly recommended, even if not always required. Insurance safeguards you against potential liabilities that can arise from injuries or damages during market operations. Check the District of Columbia Farmers Market Application and Rules and Regulations to determine specific insurance needs for vendors in your area. This proactive step can protect your finances and peace of mind.

Yes, many farmers markets in the District of Columbia require vendors to have insurance. This requirement helps protect not only your business but also the market and its customers. When applying through the District of Columbia Farmers Market Application and Rules and Regulations, you will find detailed information about the insurance policies needed for vendors. It's best to prepare accordingly to ensure compliance.

You do not need to form an LLC to sell at a farmers market in the District of Columbia. However, establishing an LLC can provide you with personal liability protection and may enhance your business credibility. Be sure to check the District of Columbia Farmers Market Application and Rules and Regulations for any specific legal requirements that may apply to your situation. Always consider your unique business circumstances when deciding on the best structure.