District of Columbia Computer Software Lease with License Agreement

Description

How to fill out Computer Software Lease With License Agreement?

Are you presently facing a circumstance where you frequently require documents for either business or personal purposes? There are numerous legal form templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, such as the District of Columbia Software Lease with License Agreement, which are designed to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Afterwards, you can download the District of Columbia Software Lease with License Agreement template.

Access all the form templates you have purchased in the My documents section. You can obtain another copy of the District of Columbia Software Lease with License Agreement at any time, if necessary. Simply click on the required form to download or print the template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and minimize mistakes. The platform offers expertly crafted legal form templates suitable for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the form you require and confirm it is applicable to the correct city/state.

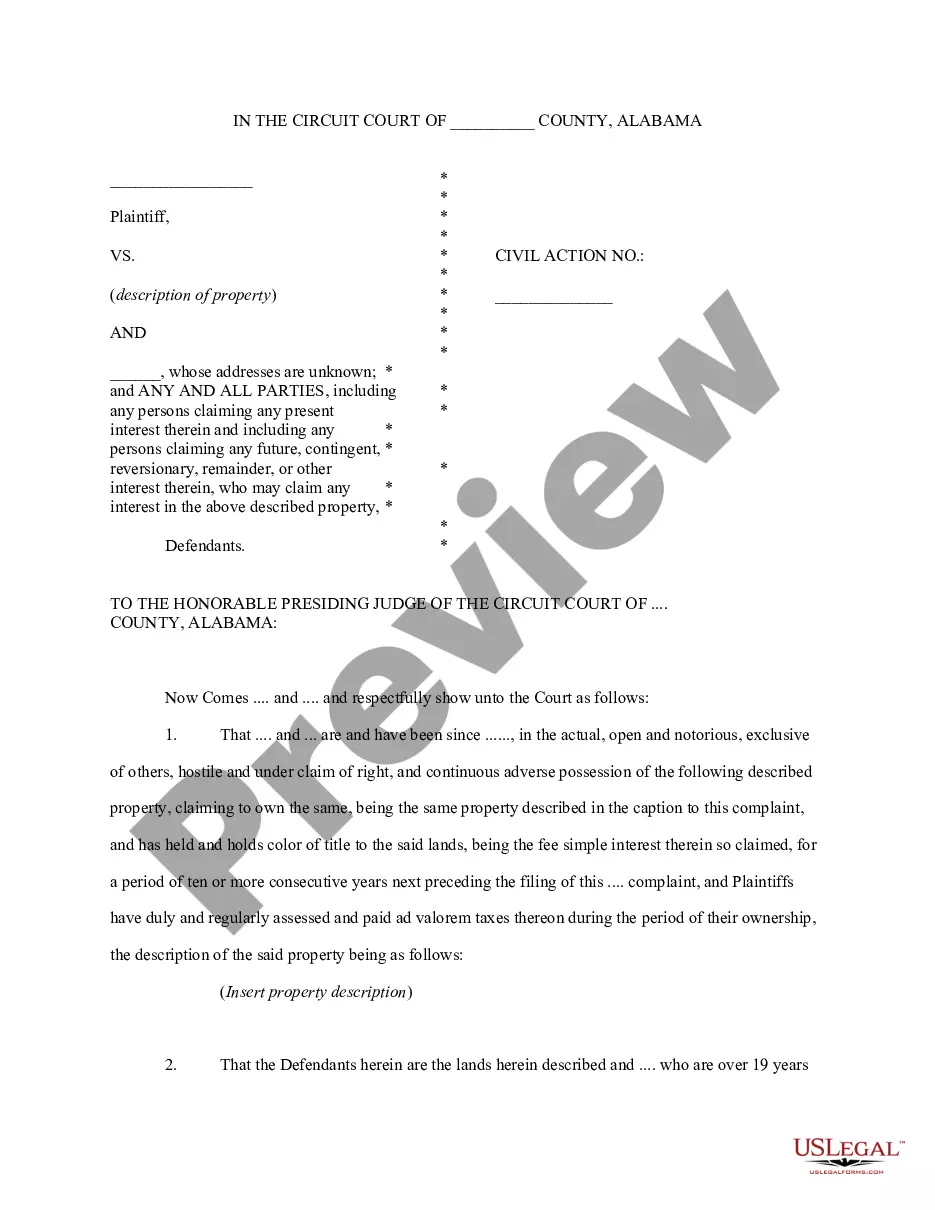

- Use the Review button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find a form that meets your needs.

- Once you locate the appropriate form, click Get now.

- Choose the pricing plan you wish, enter the necessary information to create your account, and proceed to pay for the order with your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

Form popularity

FAQ

You can contact the DC Department of Motor Vehicles (DMV) through their official website or customer service line. Whether you have questions about vehicle registration or other services, they are equipped to assist you. For software-related needs, such as agreements tied to the District of Columbia Computer Software Lease with License Agreement, you can also find pertinent information on their site.

To contact the DC Mayor's Office, you can visit their website for contact details or call directly. They offer various resources and support for residents and businesses, including those needing advice on matters like the District of Columbia Computer Software Lease with License Agreement. Engaging with the Mayor’s Office can provide additional support for your queries.

You can contact the Department of Licensing and Consumer Protection (DLCP) in DC through their official website or by phone. They provide assistance for various inquiries, including licensing issues related to the District of Columbia Computer Software Lease with License Agreement. Don’t hesitate to reach out for more specific guidance.

Verifying a business license in the District of Columbia is easy through the DCRA’s online database. You only need to enter the business name or license number. This verification helps you confirm the legitimacy of businesses, especially when engaging in agreements like a District of Columbia Computer Software Lease with License Agreement.

To obtain a DC business license, visit the DCRA’s website and complete the application process. You will need to provide information about your business, including any agreements, such as the District of Columbia Computer Software Lease with License Agreement. Ensure that you meet all necessary requirements to avoid delays.

If you encounter issues with a contractor in DC, you can file a complaint with the DCRA. Provide details about your concerns, and if applicable, include any documents related to your District of Columbia Computer Software Lease with License Agreement. This information helps the authorities take appropriate action.

Renewing your DC Business License (BBL) is straightforward. You can visit the Department of Consumer and Regulatory Affairs (DCRA) website to access the necessary forms. Make sure to gather all required supporting documents including your District of Columbia Computer Software Lease with License Agreement if applicable. This step ensures a smooth renewal process.

The DC D 30 tax form is the individual income tax return for residents of Washington, DC. This form is required for individuals who report income exceeding a specific threshold, including income from businesses. Completing this form accurately is crucial to avoid penalties and comply with local tax laws. If you earn income through contracts like the District of Columbia Computer Software Lease with License Agreement, ensure you accurately file your DC D 30.

Any business entity in the District of Columbia that has gross receipts of $1 million or more must file the FR 500 form. This includes corporations and unincorporated businesses alike. Filing FR 500 is essential for tax compliance and helps ensure accurate financial reporting. If your business engages in transactions such as a District of Columbia Computer Software Lease with License Agreement, securing your tax filings is essential.

Yes, your business may be required to withhold DC income tax from any employees who are DC residents. This is a mandatory requirement for businesses that employ individuals in the area. Ensuring compliance with these tax obligations is critical, especially when dealing with employee agreements or payroll contracts. When entering into agreements like the District of Columbia Computer Software Lease with License Agreement, consider these withholding requirements.