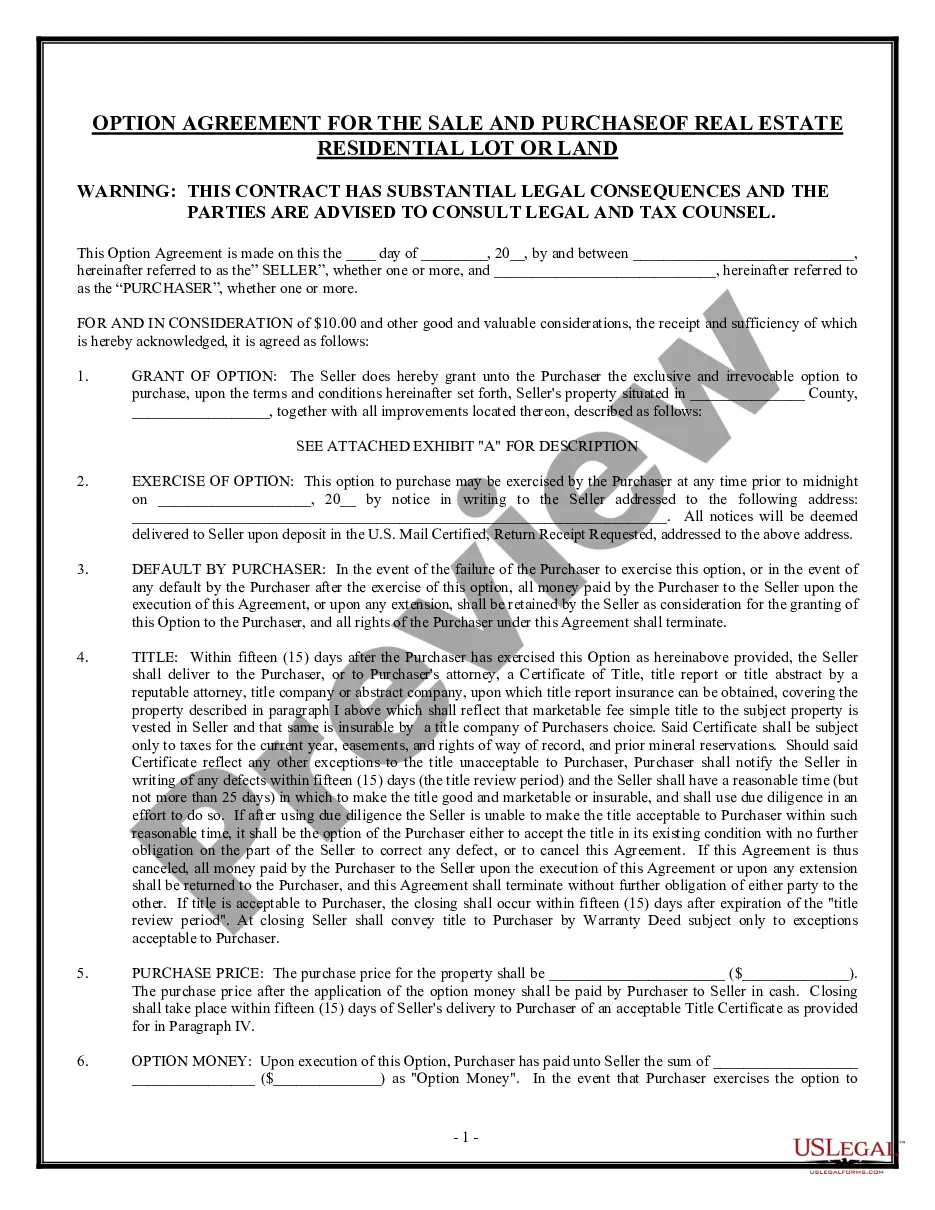

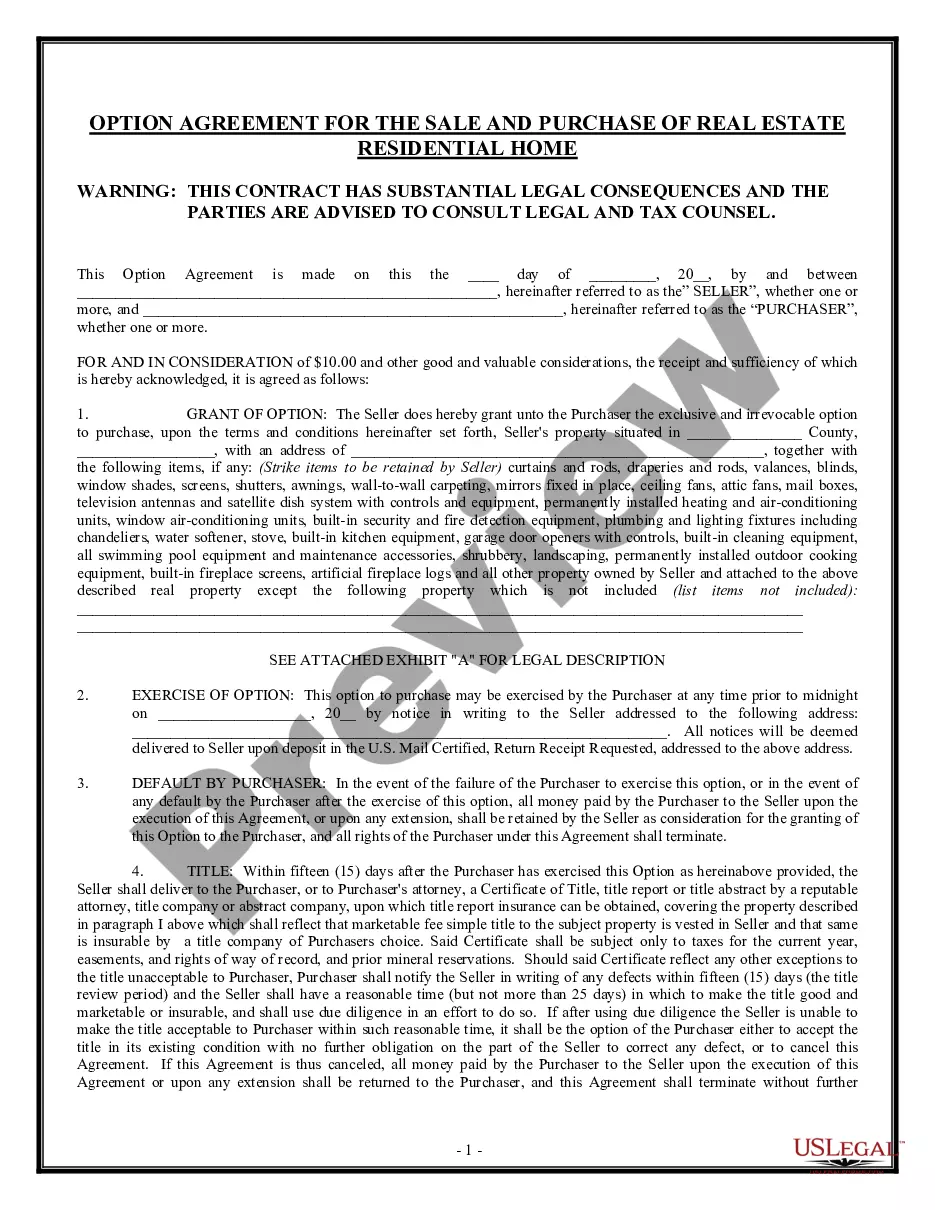

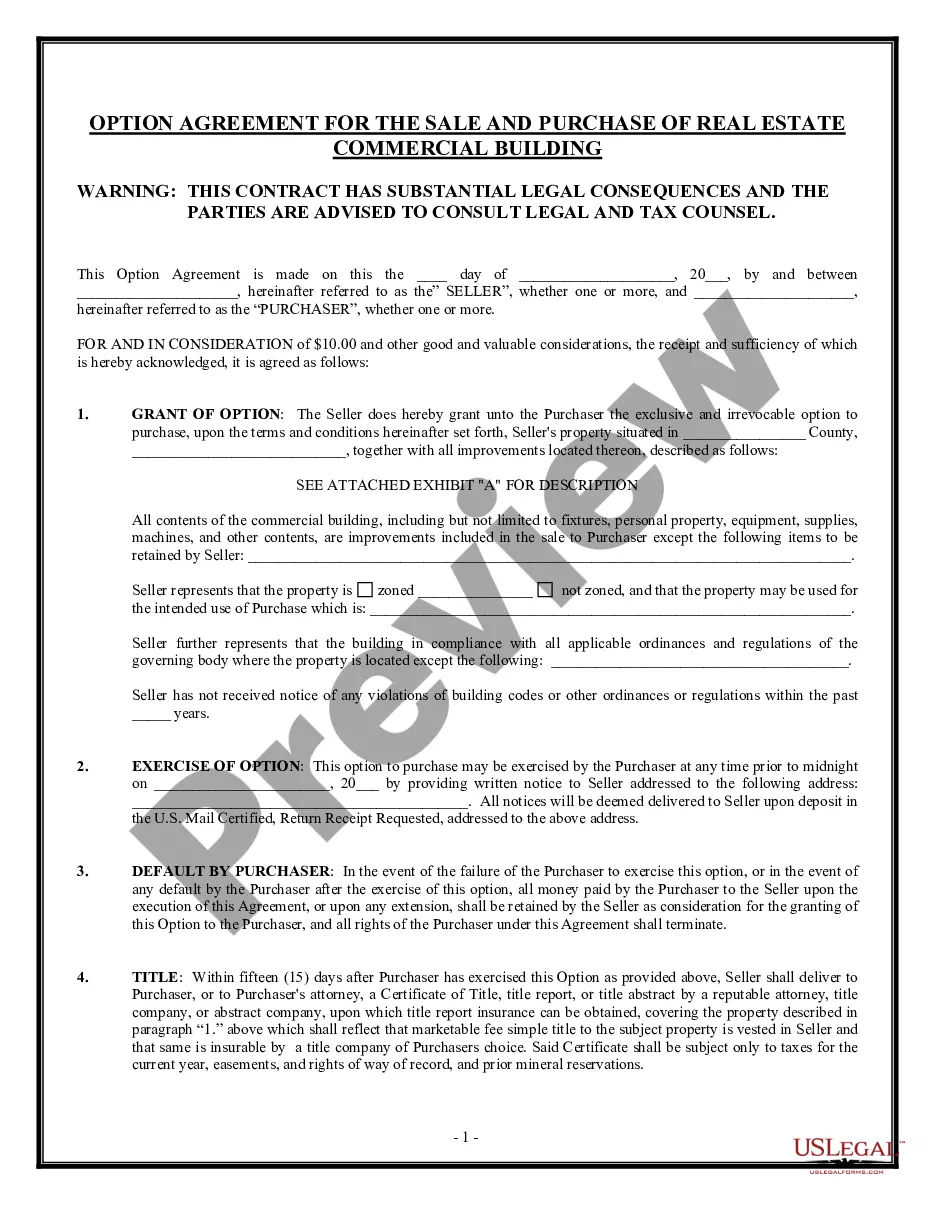

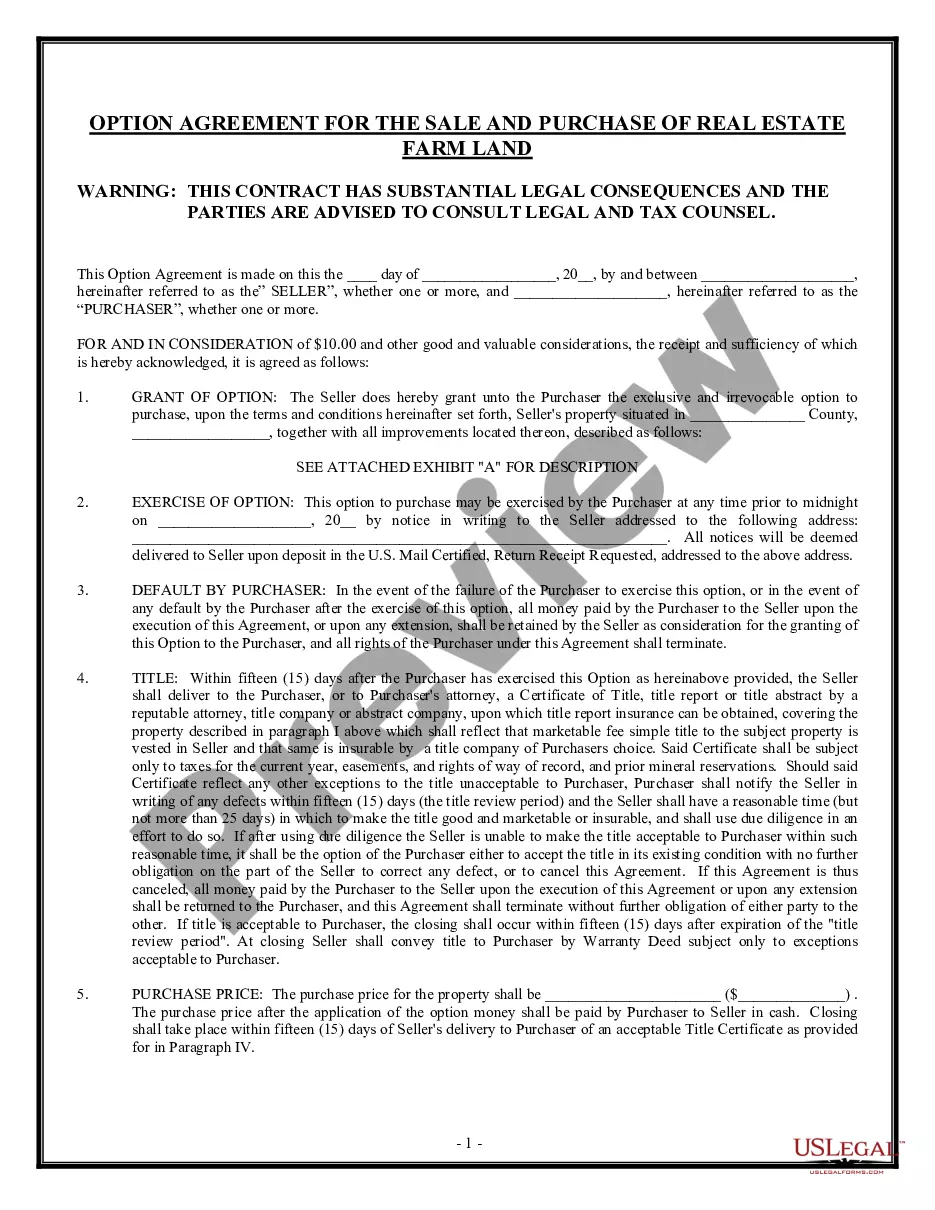

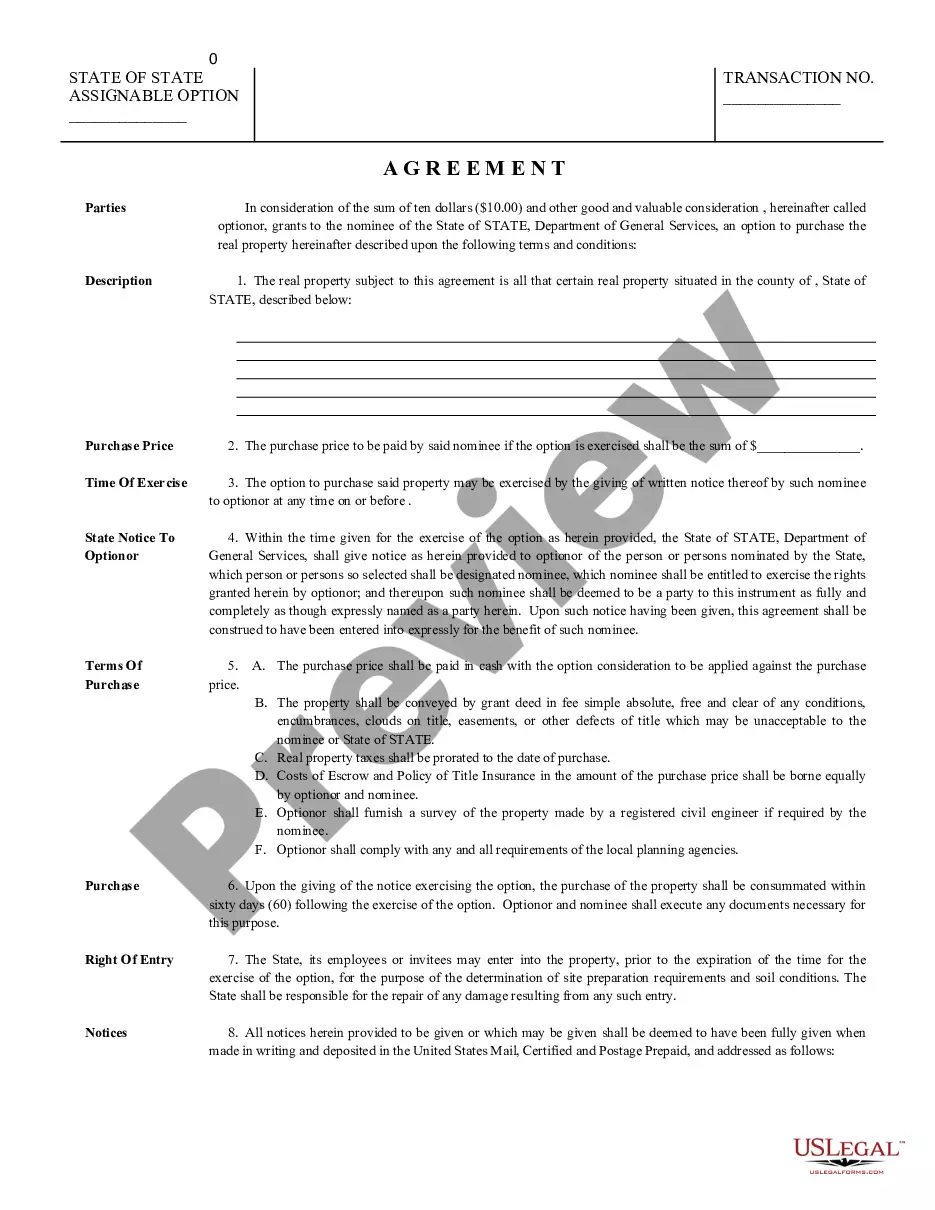

District of Columbia Option For the Sale and Purchase of Real Estate - Residential Lot or Land

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Lot Or Land?

Selecting the optimal sanctioned document format could present a challenge. Clearly, there exists a multitude of templates obtainable online, but how might you locate the sanctioned document you require.

Utilize the US Legal Forms website. The service provides thousands of templates, including the District of Columbia Option For the Sale and Purchase of Real Estate - Residential Lot or Land, which can be utilized for business and personal needs. All the forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to download the District of Columbia Option For the Sale and Purchase of Real Estate - Residential Lot or Land. Use your account to review the legal forms you have purchased previously. Navigate to the My documents tab of your account and obtain another copy of the document you desire.

Complete, modify, print, and sign the acquired District of Columbia Option For the Sale and Purchase of Real Estate - Residential Lot or Land. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download professionally crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct document for your city/region. You can view the form using the Preview button and read the form description to confirm this is appropriate for you.

- If the document does not fulfill your requirements, utilize the Search field to find the correct document.

- Once you are confident that the form is suitable, click the Get now button to download the form.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Select the file format and download the legal document format to your device.

Form popularity

FAQ

Capital Gains and losses in the District of Columbia are treated the same as they are under federal law. All realized capital gains are taxed, a deduction of up to $3,000 for net capital losses is allowed, and taxpayers can carry over unused capital losses to subsequent years.

District law states that tenants in buildings up for sale must be offered the first opportunity to buy the building (DC Law 3-86, the Rental Housing Conversion and Sale Act of 1980,under which falls the Tenant Opportunity to Purchase Act (TOPA))/ The District encourages tenants to exercise this rightit stabilizes

A $200 Tax Sale fee will be added to each property at the time of the sale. Purchasers are also required to complete Form FR-500, Combined Business Tax Registration Application, prior to registering. The form is available at OTR's portal, MyTax.DC.gov.

Washington, D.C. Property Taxes The tax rate on residential property in D.C. is just $0.85 per $100 in assessed value. However, that rate may overstate the amount paid by many homeowners.

Class 3, vacant property, is taxed at $5.00 per $100 of assessed value and Class 4, blighted property, is taxed at $10.00 per $100 of assessed value. The DC Code allows for exceptions that may allow a vacant property to receive the lower Class 1 or Class 2 tax rate, provided that certain conditions are met.

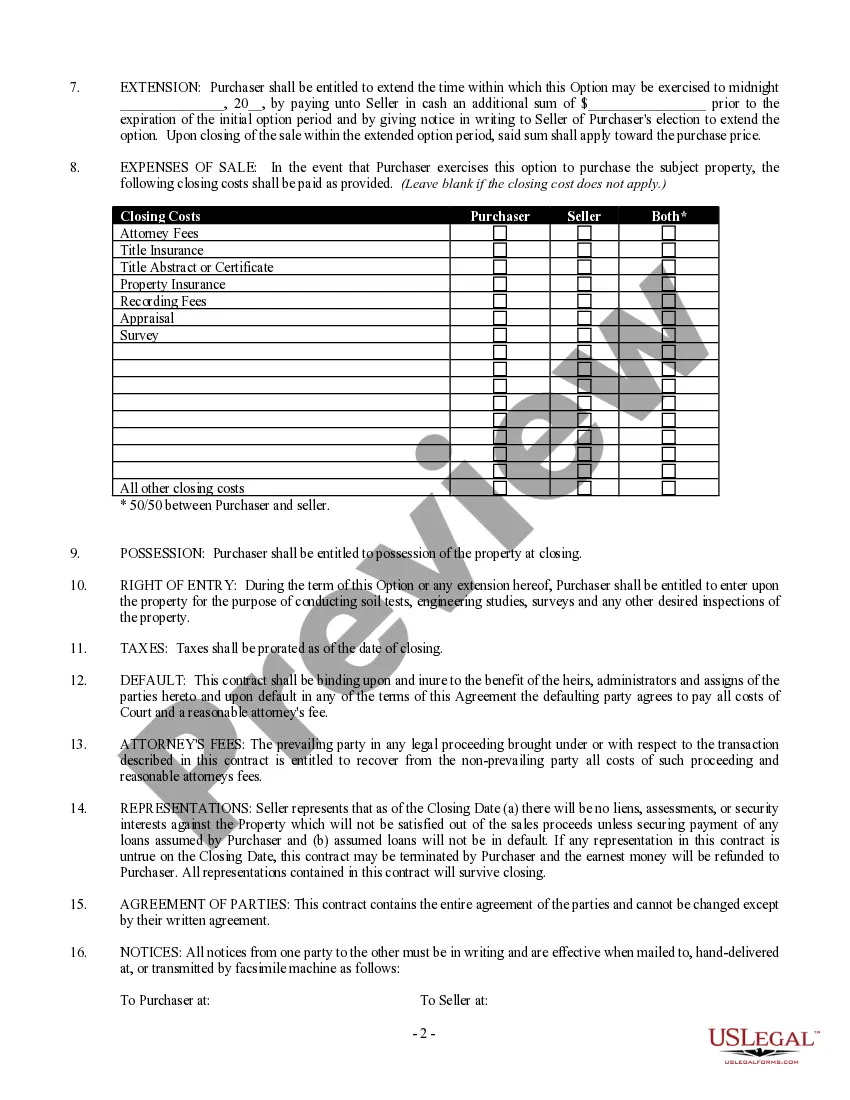

For transfers of property valued over $400,000 and up to $2 million, deed transfer (1.45%) and recordation (1.45%) taxes in Washington will continue to total 2.9% of the purchase price or fair market value of the property. Transfer and recordation taxes are customarily split equally between the buyer and seller.

In addition to the DC Deed Tax, DC also imposes a Real Property Transfer Tax (DC Transfer Tax) at the time a deed or certain leases are submitted for recordation. The rate is 1.45% of the consideration for, or fair market value of, the property. Thus, the current total combined rate is 2.9%.

There are four classes of real property in the District of Columbia. Class 1 is residential real property including multifamily. Class 2 is commercial and industrial real property including hotels and motels. Class 3 is vacant real property.

Classification refers to how a property is used. Classifications such as homestead, rural vacant land, commercial, and agricultural describe a property's primary use and impact the amount of property tax paid.