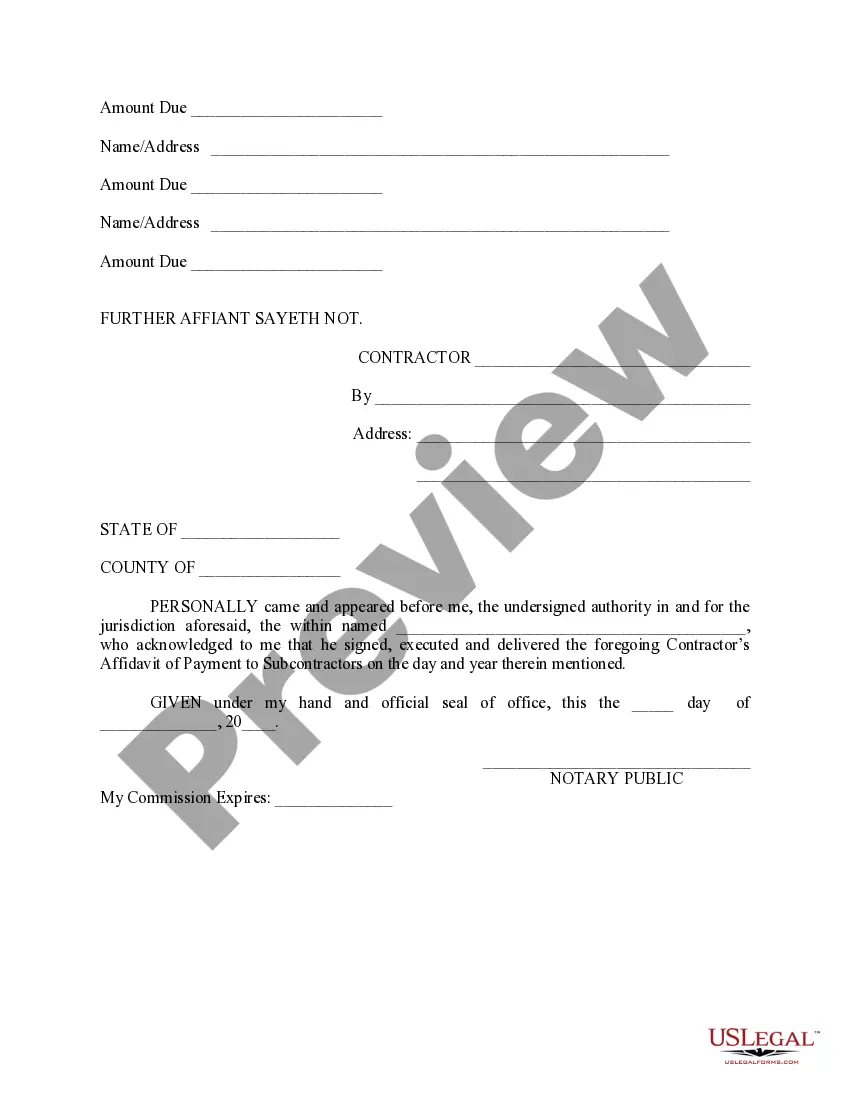

District of Columbia Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

If you aim to be thorough, obtain, or create authentic document templates, utilize US Legal Forms, the largest repository of legal documents available online.

Make use of the website's user-friendly and efficient search feature to locate the papers you require.

Various templates for business and personal purposes are categorized by groups and states, or by keywords.

Step 3. If you're unsatisfied with the form, use the Search bar at the top of the screen to find alternative versions in the legal form style.

Step 4. After locating the form you want, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

- Use US Legal Forms to discover the District of Columbia Contractor's Affidavit of Payment to Subs with only a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click on the Download button to obtain the District of Columbia Contractor's Affidavit of Payment to Subs.

- You can also access documents you've previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Don’t forget to read the summary.

Form popularity

FAQ

How do I write a subcontractor agreement?Negotiate and finalise all terms and conditions of the agreement.Draft the agreement in writing and send it to the subcontractor for review.Review the agreement, sign and execute.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

A subcontracting agreement is an agreement between a main contractor and a person or company (a subcontractor) delegating part of the main contractor's work or obligations.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

In order to get paid, subcontractors need to issue invoices to the contractors they work for. Every invoice you issue needs to include some basic information, including: An invoice number: a unique code that follows a sequential order.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

200dA 'Payment Notice' is the document the contractor (the employer) serves the subcontractor (the employee) providing details of what's payable and why. This is known as the 'Notified Sum' and this is what will be paid on the 'Final Date for Payment' (see below).

How do I write a subcontractor agreement?Negotiate and finalise all terms and conditions of the agreement.Draft the agreement in writing and send it to the subcontractor for review.Review the agreement, sign and execute.

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.