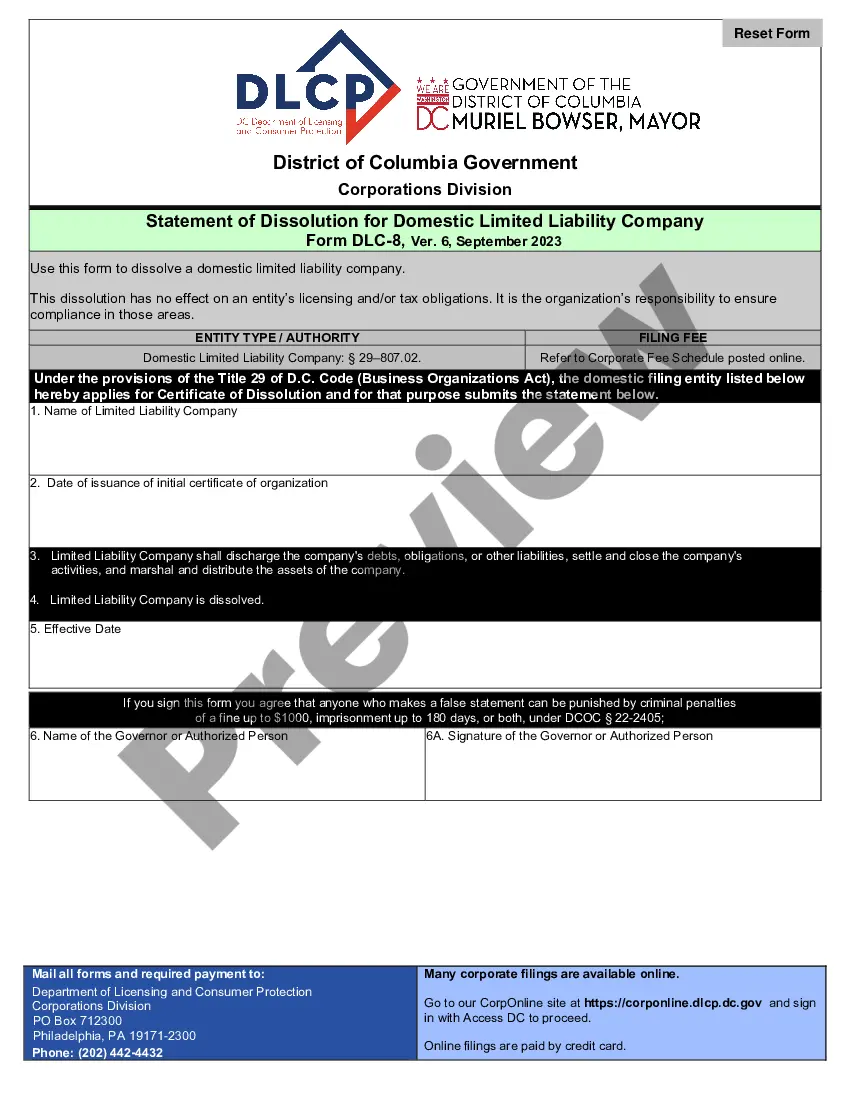

The District of Columbia Settlement Statement (also known as the HUD-1 or HUD-1A) is a form prepared by a lender or closing agent that itemizes all fees and costs associated with a real estate transaction. It is used to provide a comprehensive breakdown of a borrower's closing costs and to document the transfer of title of the property. The form is typically prepared at the end of the closing process and is required by the District of Columbia when closing a real estate transaction. There are two versions of the form: the HUD-1 for real estate transactions with a loan, and the HUD-1A for real estate transactions without a loan. Both forms include information such as the borrower's name, loan information, settlement costs, and escrow account information. The HUD-1 and HUD-1A can be found on the U.S. Department of Housing and Urban Development (HUD) website.

District of Columbia Settlement Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Settlement Statement?

US Legal Forms is the most straightforward and economical way to find appropriate legal templates.

It’s the largest online collection of business and personal legal documents created and validated by attorneys.

Here, you can discover printable and fillable templates that adhere to national and local laws - just like your District of Columbia Settlement Statement.

Review the form description or preview the document to ensure you’ve located the one that meets your requirements, or find another one using the search bar above.

Click Buy now when you’re confident of its adherence to all the specifications, and select the subscription package you prefer the most.

- Acquiring your template involves just a few easy steps.

- Users who already have an account with an active subscription only need to Log In to the web service and download the form onto their device.

- After that, they can access it in their profile under the My documents section.

- And here’s how you can secure a well-prepared District of Columbia Settlement Statement if you are using US Legal Forms for the first time.

Form popularity

FAQ

The amount of tax due is determined by dividing the assessed value of the property by $100, and then multiplying that amount by the applicable tax rate for the property, as stated in the below chart. For example, your residential property is under the Class 1 tax rate, which is $0.85.

Deed Recordation DC Code Citation: Title 42, Chapter 11. 1.45% of consideration or fair market value on the entire amount, if transfer is $400,000 or greater.

Who Pays Transfer Taxes in Washington, D.C.: the Buyer or the Seller? In Washington, D.C., the tax is split between the buyer and the seller. The seller pays the recordation tax, and the buyer pays the transfer tax.

What is the DC First-Time Homebuyer Recordation Tax Reduction? The DC first-time homebuyer recordation tax is generally reduced to 0.725% from the customary 1.1% or 1.4%.

1.1 % of consideration or fair market value for residential property transfers less than $400,000 and 1.45% of consideration or fair market value on the entire amount, if transfer is greater than $400,000.