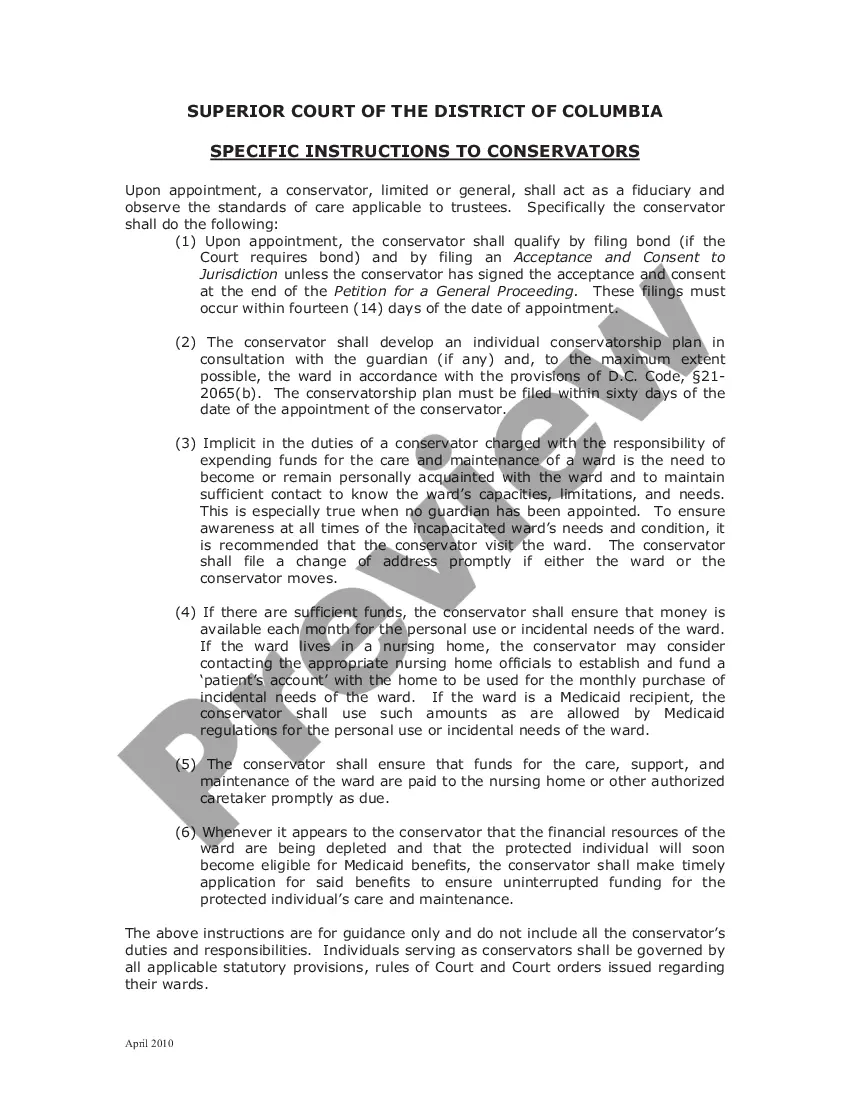

This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

District of Columbia Bond of Conservator

Description

How to fill out District Of Columbia Bond Of Conservator?

The larger quantity of documents you need to produce - the more anxious you become.

You can find countless templates for the District of Columbia Bond of Conservator online, yet you might not know which ones to trust.

Eliminate the frustration of locating samples by utilizing US Legal Forms.

Click Buy Now to initiate the registration process and select a pricing option that suits your needs. Input the required details to create your account and complete the payment for your order using PayPal or a credit card. Choose a suitable document type and receive your copy. Access every document you download in the My documents section. Simply navigate there to create a new copy of the District of Columbia Bond of Conservator. Even with well-prepared templates, it is still important to consider consulting your local attorney to double-check the completed document to ensure your submission is accurately filled out. Achieve more for less with US Legal Forms!

- Obtain professionally crafted papers tailored to fulfill state regulations.

- If you already possess a US Legal Forms subscription, Log In to your account, and you will discover the Download button on the District of Columbia Bond of Conservator’s page.

- If you have not used our site previously, complete the registration procedure following these steps.

- Verify that the District of Columbia Bond of Conservator is applicable in your state.

- Confirm your selection by reading the description or by using the Preview feature if available for the selected file.

Form popularity

FAQ

Obtaining a conservatorship can be straightforward but requires following specific legal steps. You must demonstrate the need for a conservator and submit the required documents, such as the District of Columbia Bond of Conservator, to the court. While the process may seem complex, using platforms like uslegalforms can help simplify the paperwork, making it easier for you to navigate through the requirements.

A conservator has control over the personal and financial affairs of their ward. This includes managing assets, paying bills, and making healthcare decisions, among other responsibilities. The role of a conservator is crucial, and having a District of Columbia Bond of Conservator ensures that the conservator acts responsibly and ethically, thus protecting the interests of the ward.

Yes, a conservator can add themselves to a bank account, provided they have the necessary legal authority. This process typically requires the conservator to present appropriate documentation, including the District of Columbia Bond of Conservator. By doing this, the conservator secures access to manage funds on behalf of the ward, ensuring financial decisions are made in the ward's best interest.

A conservator serves to protect the welfare and assets of individuals who are unable to care for themselves. This role encompasses making informed financial decisions and ensuring that the person's rights are upheld. By taking on these responsibilities, a conservator helps foster a supportive environment for the individual, allowing them to focus on their well-being. Accompanying their role with a District of Columbia Bond of Conservator reinforces their duty of care.

The primary purpose of conservatorship is to protect individuals who cannot manage their own affairs due to incapacity. This legal arrangement ensures that their financial and personal needs are addressed responsibly. Ultimately, conservatorship helps maintain stability and security for those who may feel vulnerable. Obtaining a District of Columbia Bond of Conservator helps further reinforce this protective framework.

The main responsibilities of a conservator include overseeing the financial affairs of the individual, reporting to the court regularly, and making decisions that align with the individual's best interests. A conservator must also manage any health care decisions, ensuring that the individual's needs are met effectively. This role requires a person with integrity and commitment, as they act in place of someone unable to handle their own matters. The District of Columbia Bond of Conservator adds an additional layer of accountability.

A conservator can help manage financial and personal affairs when someone is unable to do so. This support can lead to improved decision-making and stability for the individual in need. However, there are also drawbacks; for instance, conservators have significant control over finances, which can lead to potential misuse or conflict. Balancing these factors is crucial when considering the need for a District of Columbia Bond of Conservator.

DC Code 21 2058 outlines the requirements for a District of Columbia Bond of Conservator. This code mandates that conservators must provide a bond to ensure protection for the assets of the person under their care. This legal requirement helps instill trust and reliability between the conservator and the court. By requiring a bond, the code safeguards the interests of the individual who may not be able to manage their own financial affairs.

Yes, executor fees must be reported to the IRS as they are considered income. When you receive payments for your duties as an executor, it is crucial to report these earnings properly. Understanding the implications of the District of Columbia Bond of Conservator can also help you manage your tax responsibilities effectively.

Conservatorship accounts are typically considered taxable entities. Any income generated within the account, such as interest or dividends, may be subject to federal and state income taxes. You may want to consult with a tax adviser to understand better how the District of Columbia Bond of Conservator impacts your obligations.