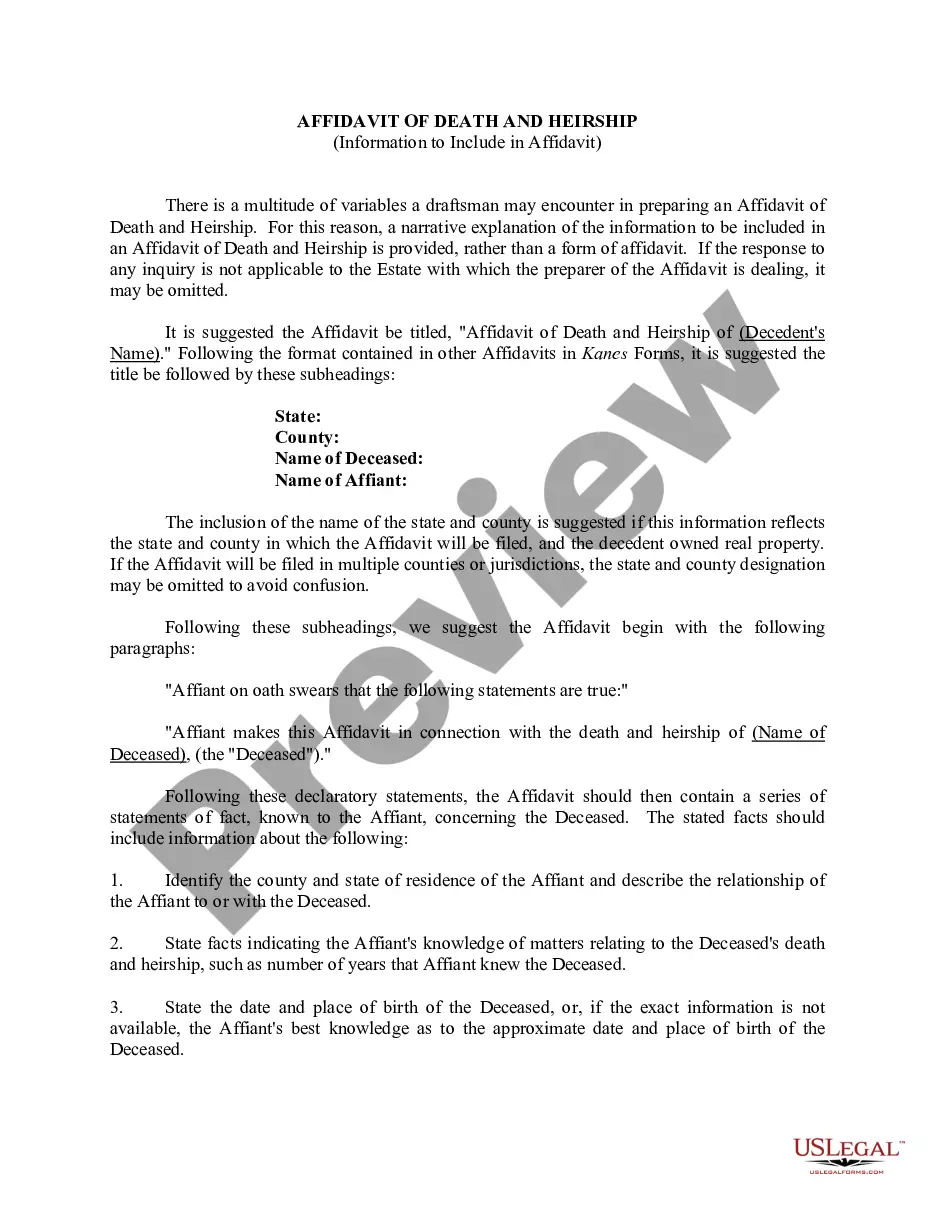

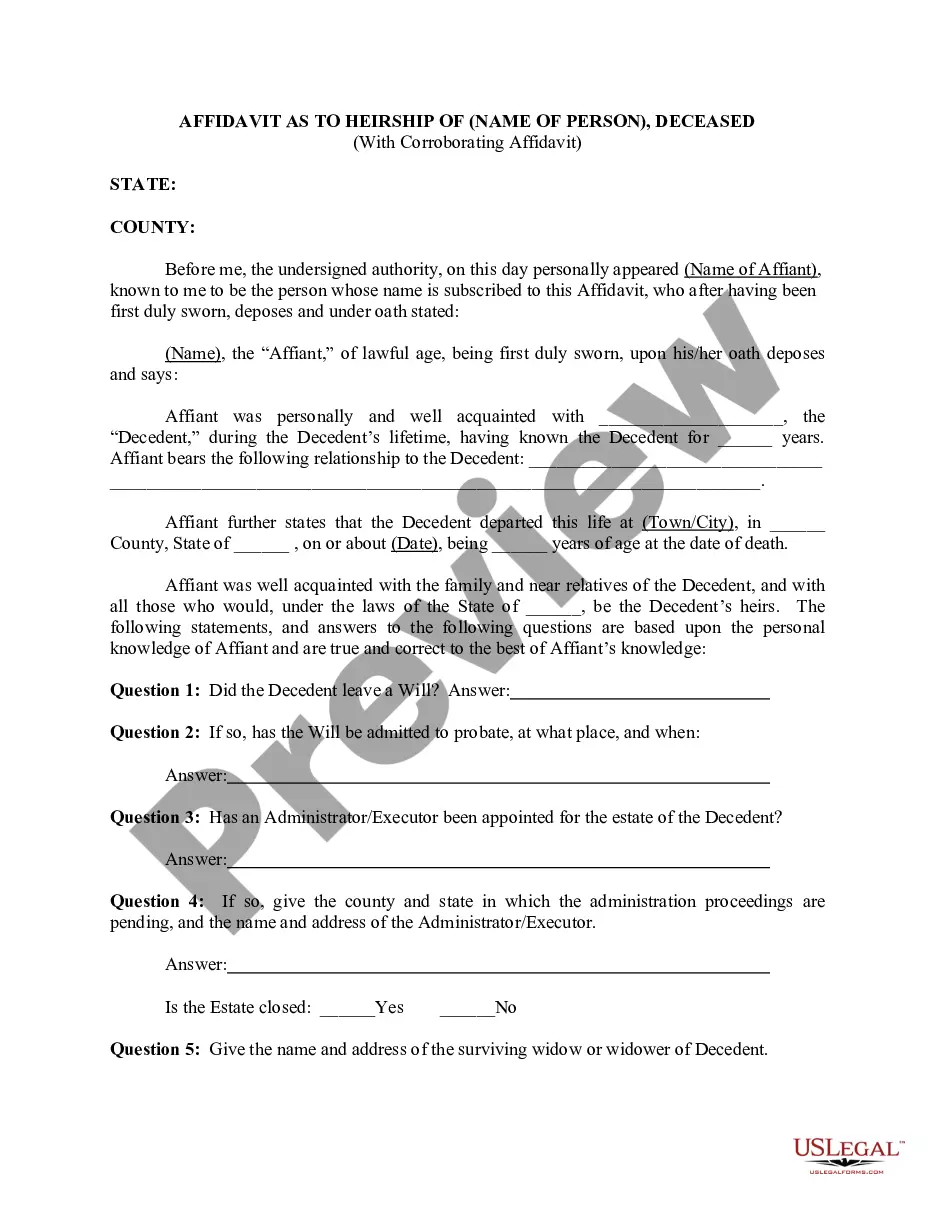

Connecticut Affidavit of Death and Heirship (Information to Include in Affadavit)

Description

How to fill out Affidavit Of Death And Heirship (Information To Include In Affadavit)?

It is possible to commit several hours on the Internet searching for the lawful document format that fits the federal and state demands you will need. US Legal Forms supplies 1000s of lawful types which are evaluated by specialists. You can actually down load or produce the Connecticut Affidavit of Death and Heirship (Information to Include in Affadavit) from our assistance.

If you currently have a US Legal Forms accounts, you may log in and then click the Download switch. After that, you may full, change, produce, or indicator the Connecticut Affidavit of Death and Heirship (Information to Include in Affadavit). Each lawful document format you purchase is your own property forever. To have yet another duplicate of any obtained develop, proceed to the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms internet site for the first time, keep to the basic directions listed below:

- Initial, ensure that you have selected the best document format for that area/town of your choice. Look at the develop explanation to make sure you have selected the right develop. If available, utilize the Preview switch to search throughout the document format also.

- If you want to get yet another edition of your develop, utilize the Research industry to discover the format that meets your needs and demands.

- Upon having discovered the format you desire, click on Acquire now to move forward.

- Choose the rates strategy you desire, key in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You can use your Visa or Mastercard or PayPal accounts to purchase the lawful develop.

- Choose the structure of your document and down load it to the gadget.

- Make adjustments to the document if necessary. It is possible to full, change and indicator and produce Connecticut Affidavit of Death and Heirship (Information to Include in Affadavit).

Download and produce 1000s of document themes using the US Legal Forms website, that offers the biggest assortment of lawful types. Use specialist and condition-particular themes to deal with your business or personal requirements.

Form popularity

FAQ

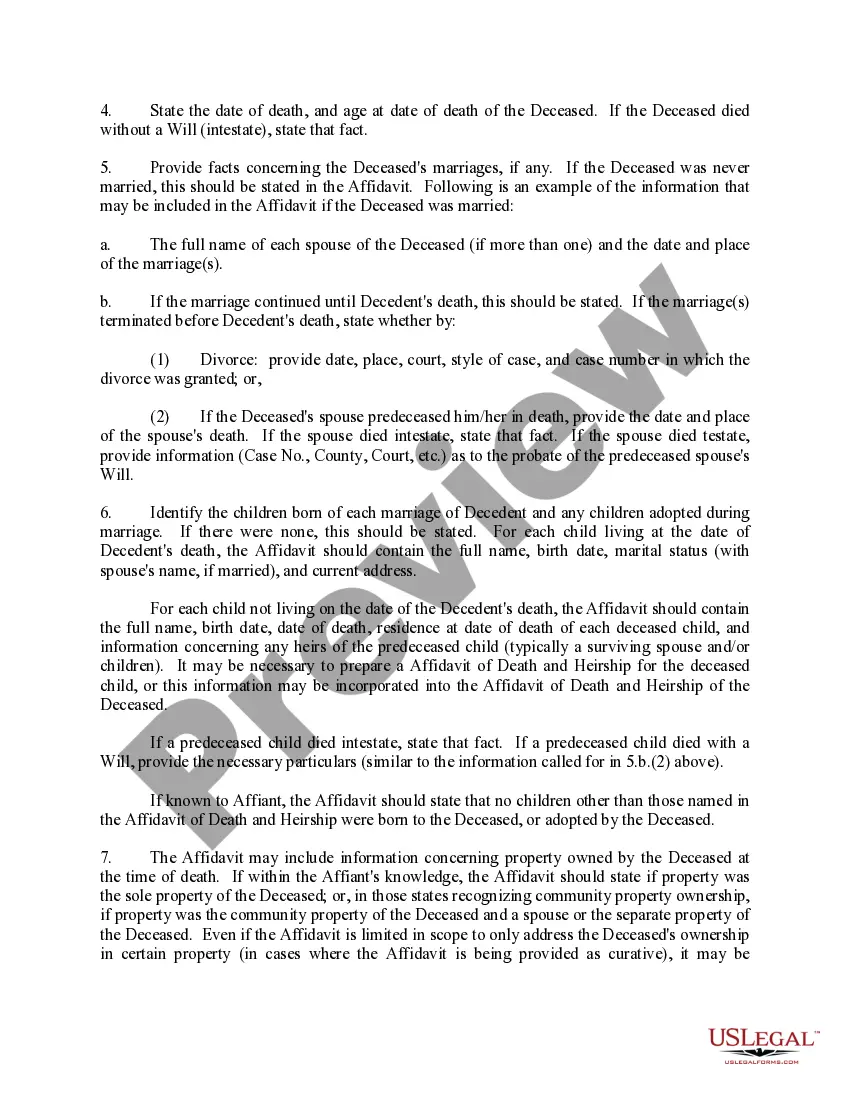

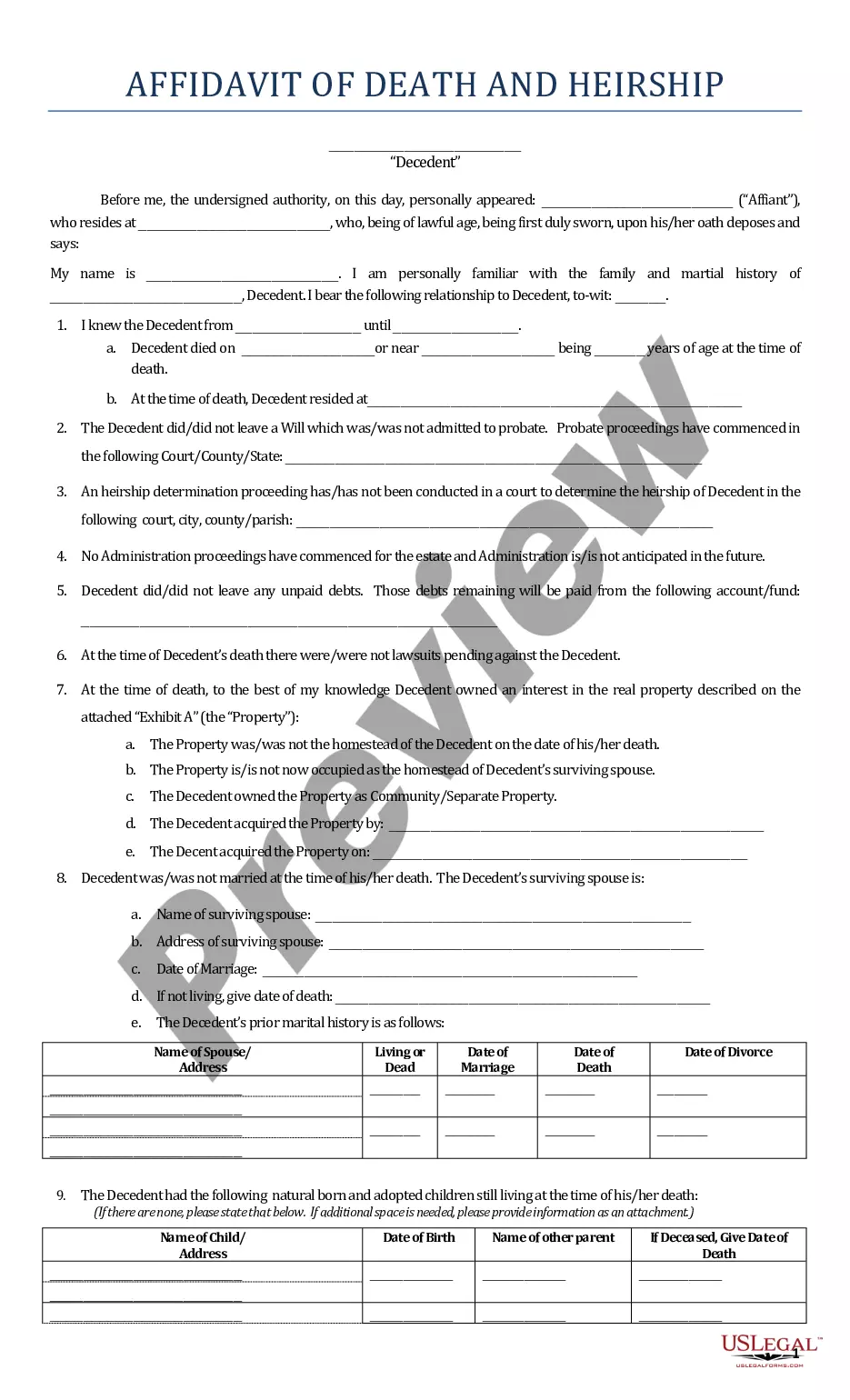

A Connecticut small estate affidavit allows assets from estates worth less than a set amount of money to pass to the heirs or successors of the decedent without having to go through the traditional probate process.

Avoiding Probate In Connecticut If assets are jointly owned, they are not subject to probate. If assets pass by beneficiary designation, they are not subject to probate. Finally, if assets are in a Revocable Trust, they are not subject to probate.

Probate can be a lengthy process in Connecticut. It generally takes a minimum of six to twelve months, but it can extend beyond that, often lasting a year or more. Complex estates or disputes among beneficiaries can further lengthen the process.

Full "probate" is ONLY required by law if the person who dies, with or without a will, (1) owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR (2) owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person.

List of Probate Assets Real property which is titled only in the name of the person who passed away (the person who passed away is called the decedent). Personal property owned by the decedent. ... Bank accounts if those accounts are solely in the name of the decedent. ... Interests in certain types of businesses.

If the decedent's solely-owned assets include no real property and are valued at less than $40,000 ? which meets Connecticut's ?small estates limit? ? then the assets and property of the estate can be settled without full probate, under a much shorter and easier process.

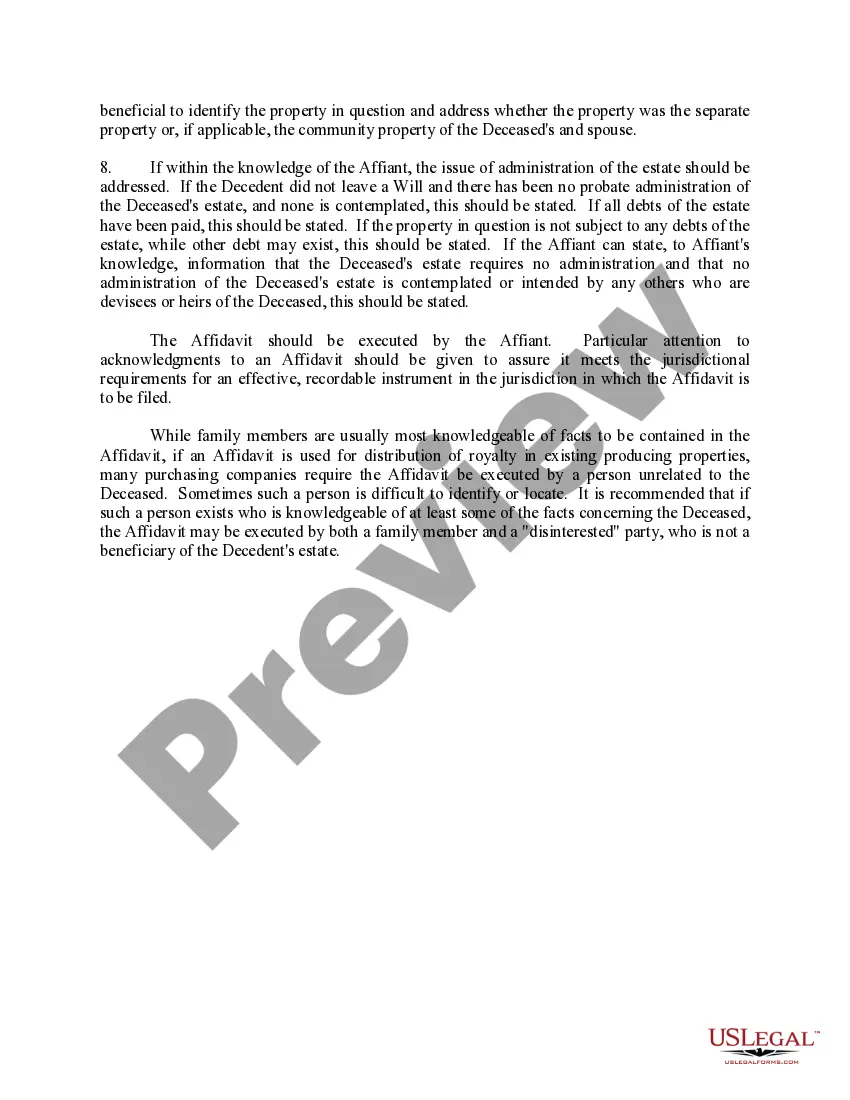

To use the small estate procedure, the surviving spouse, next of kin or other person files what is called an ?Affidavit in Lieu of Probate of Will/Administration,? form PC-212, listing the decedent's solely owned assets, funeral expenses, expenses associated with settling the estate, taxes and the decedent's debts.

To use the small estate procedure, the surviving spouse, next of kin or other person files what is called an ?Affidavit in Lieu of Probate of Will/Administration,? form PC-212, listing the decedent's solely owned assets, funeral expenses, expenses associated with settling the estate, taxes and the decedent's debts.

If the decedent's solely-owned assets include no real property and are valued at less than $40,000 ? which meets Connecticut's ?small estates limit? ? then the assets and property of the estate can be settled without full probate, under a much shorter and easier process.

1) A petitioner filing a PC-212, Affidavit in Lieu of Probate of Will/Administration, may use this form to request an order of distribution if (a) assets exceed expenses and claims or (b) a person who paid expenses or claims waives reimbursement for payment of the expense or claim.