Connecticut Air Filtration Contractor Agreement - Self-Employed

Description

How to fill out Air Filtration Contractor Agreement - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or create. By using the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of documents such as the Connecticut Air Filtration Contractor Agreement - Self-Employed in just a few minutes.

If you already have an account, Log In and download the Connecticut Air Filtration Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded documents from the My documents tab of your account.

To use US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the right document for your city/region. Click the Preview button to review the document's contents. Check the document summary to confirm you have selected the correct document. If the document does not suit your needs, utilize the Search field at the top of the screen to find one that does.

Access the Connecticut Air Filtration Contractor Agreement - Self-Employed with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Once satisfied with the document, confirm your selection by clicking the Buy now button.

- Then, select the pricing plan you want and provide your details to register for the account.

- Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

- Choose the format and download the document to your device.

- Edit. Fill out, modify and print, and sign the downloaded Connecticut Air Filtration Contractor Agreement - Self-Employed.

- Every template you added to your account has no expiration date and is yours forever. Therefore, if you need to download or print another copy, simply navigate to the My documents section and click on the document you need.

Form popularity

FAQ

Legal requirements for independent contractors vary by state but generally include registering your business and obtaining necessary licenses. When entering into a Connecticut Air Filtration Contractor Agreement - Self-Employed, contractors must ensure compliance with local laws and taxation regulations. Understanding these requirements helps protect your rights and maintains a professional reputation. Consider using uslegalforms to access templates and guidance that simplify the compliance process.

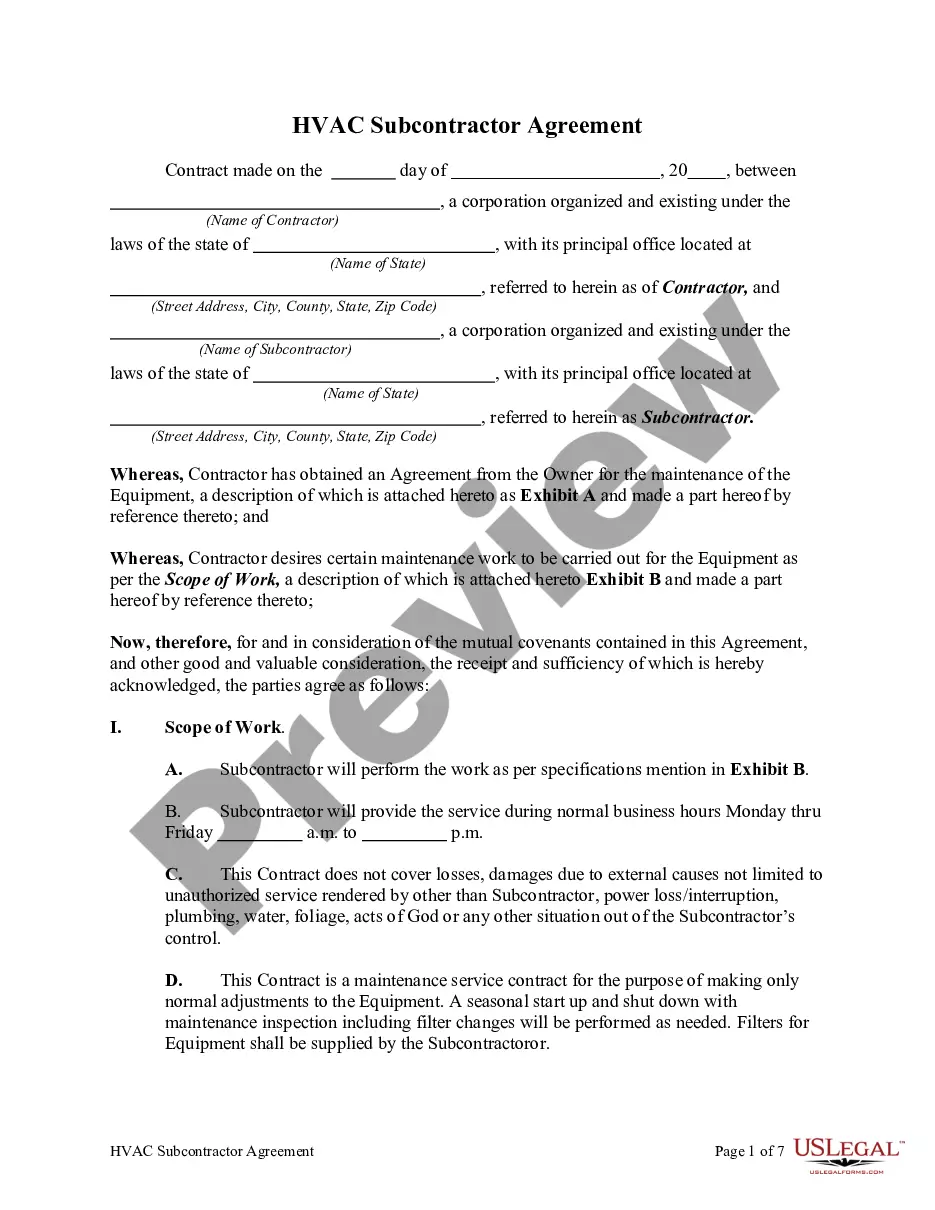

A basic independent contractor agreement outlines the relationship between a business and a self-employed individual. This document details the scope of work, payment terms, and expectations. When engaging a Connecticut Air Filtration Contractor Agreement - Self-Employed, it is crucial for both parties to understand their responsibilities to avoid disputes. Using a clearly defined agreement can enhance collaboration and provide legal protection.

To create an independent contractor agreement, start by outlining the scope of work, payment terms, and project timeline. Include details specific to air filtration services to ensure clarity and protect both parties. It's beneficial to use professional templates available online, such as those from US Legal Forms. A well-drafted Connecticut Air Filtration Contractor Agreement - Self-Employed sets clear expectations, fostering a positive working relationship.

Yes, Connecticut requires most contractors to hold a license, including those working as independent contractors in air filtration. Having a valid license helps ensure compliance with state regulations and builds trust with clients. You can obtain the necessary license through the Connecticut Department of Consumer Protection. If you're considering a Connecticut Air Filtration Contractor Agreement - Self-Employed, make sure you're licensed to avoid potential legal issues.

Protect Yourself When Hiring a ContractorGet Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.Consider Hiring Specialized Pros for Additional Guidance.Go With Your Gut.

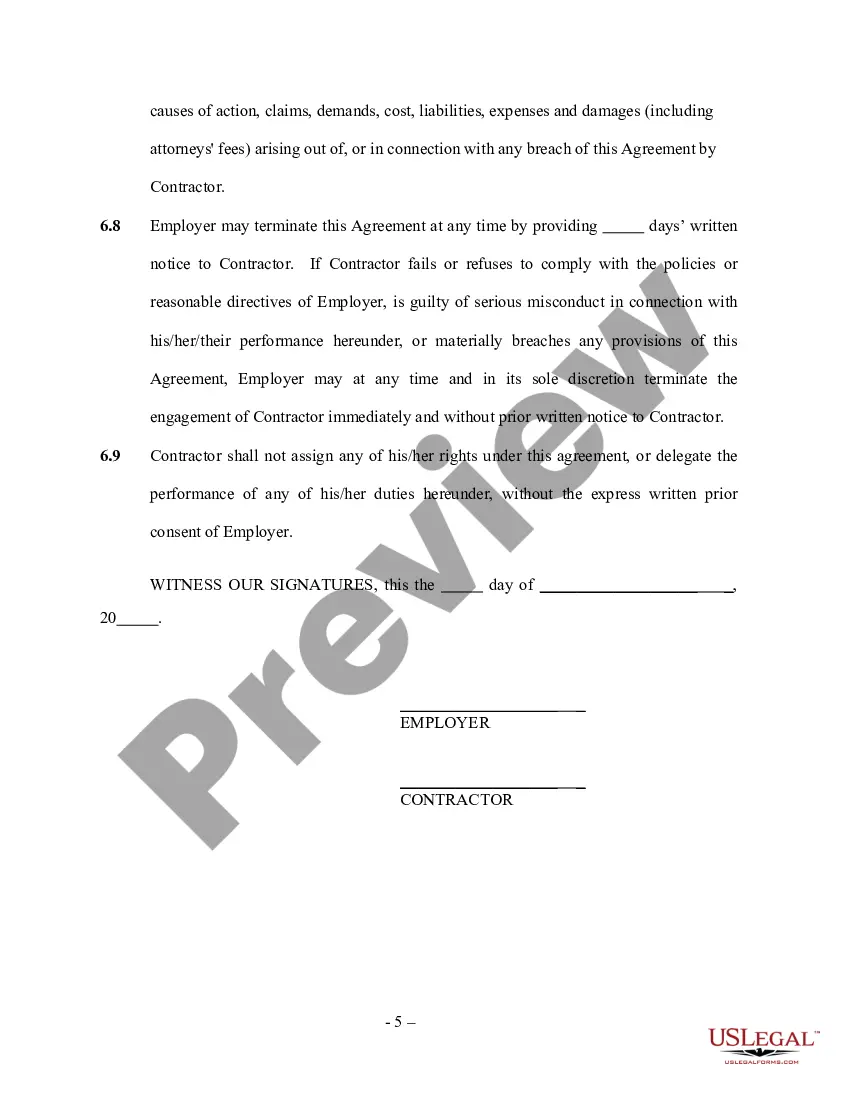

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

A contractor's labor is not subject to sales or use tax if performed in conjunction with new construction (with some exceptions), owner-occupied residential property (with some exceptions. Overall, from a sales tax compliance perspective, Connecticut is a fairly easy state in which to comply.

Connecticut's sales tax is assessed on goods and services, including labor.

(1) Repair or maintenance services to tangible personal property shall be taxable if the repairs to the tangible personal property are made in Connecticut.