Connecticut The FACTA Red Flags Rule: A Primer

Description

How to fill out The FACTA Red Flags Rule: A Primer?

Are you in the situation the place you need to have files for either company or personal purposes virtually every day? There are a variety of authorized record themes accessible on the Internet, but discovering versions you can trust is not effortless. US Legal Forms gives a huge number of kind themes, just like the Connecticut The FACTA Red Flags Rule: A Primer, that are published to satisfy federal and state needs.

When you are presently acquainted with US Legal Forms web site and also have a merchant account, just log in. Afterward, you are able to down load the Connecticut The FACTA Red Flags Rule: A Primer format.

If you do not offer an accounts and want to start using US Legal Forms, abide by these steps:

- Find the kind you require and ensure it is for your right metropolis/region.

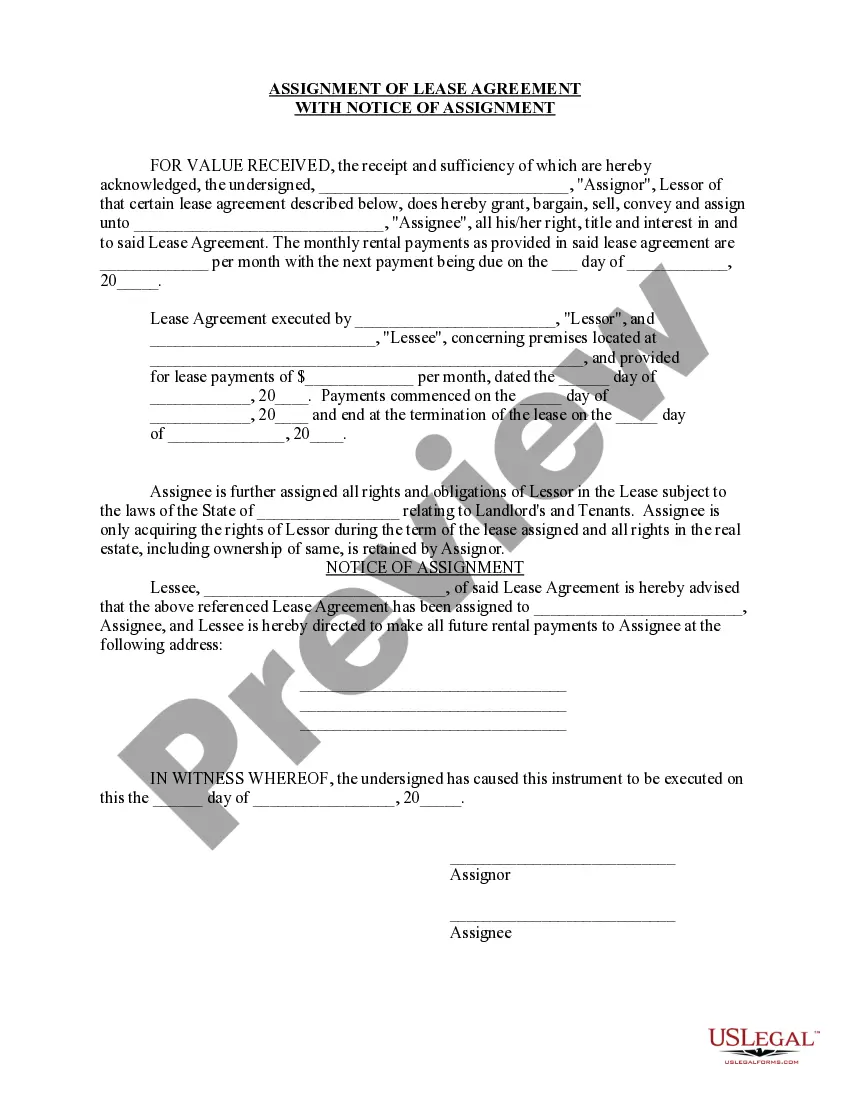

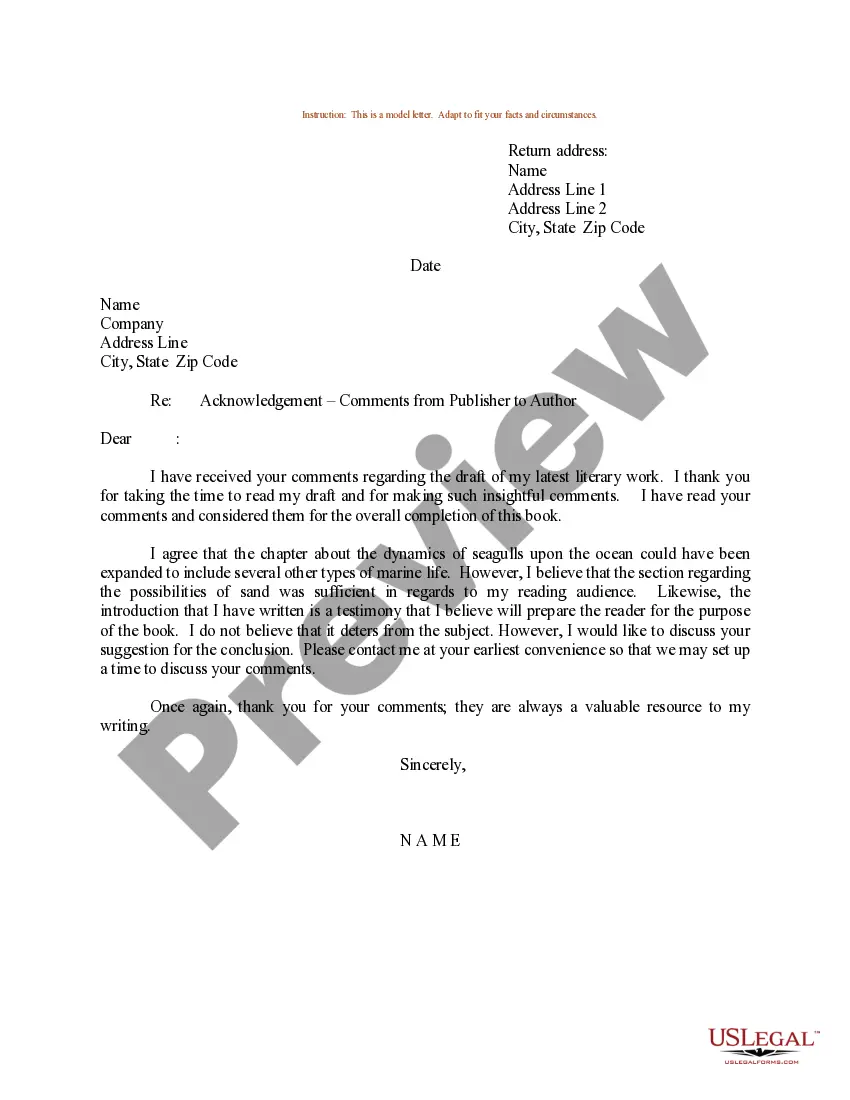

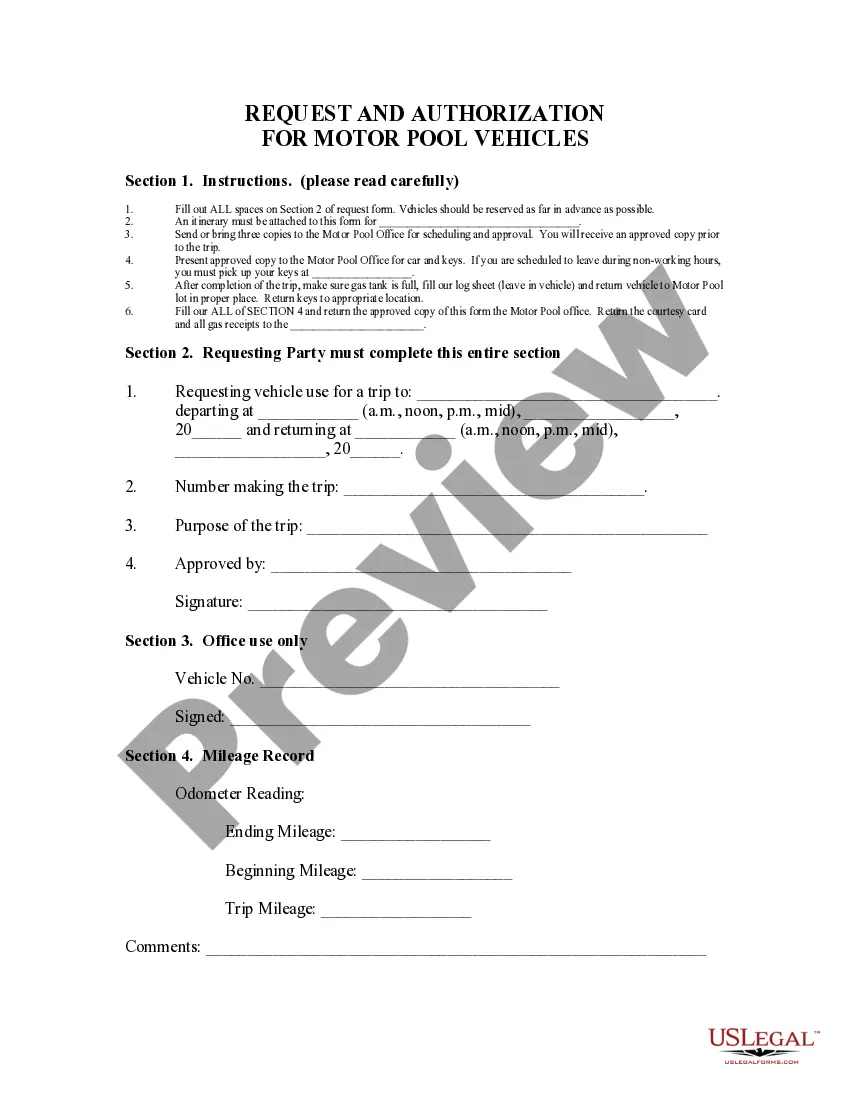

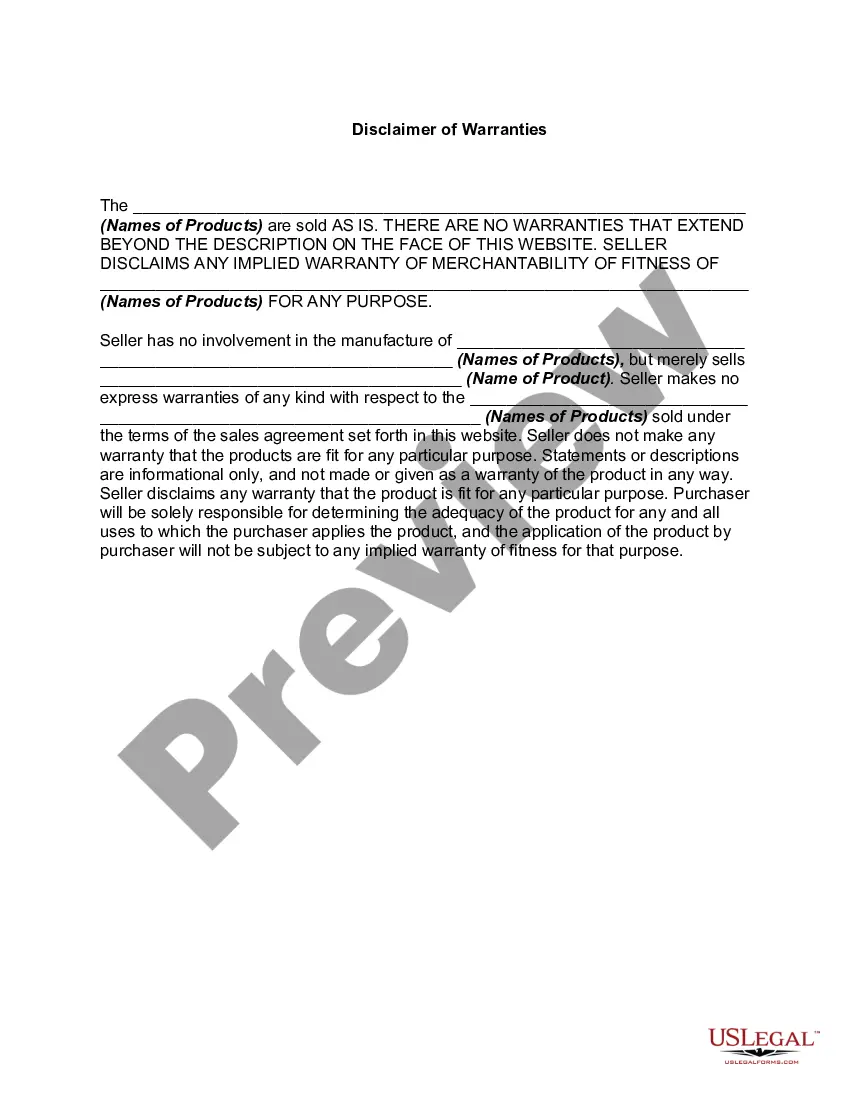

- Make use of the Preview switch to review the form.

- See the description to actually have chosen the appropriate kind.

- If the kind is not what you are looking for, make use of the Research discipline to find the kind that suits you and needs.

- Once you obtain the right kind, simply click Acquire now.

- Choose the rates plan you would like, fill out the desired info to make your money, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a handy document format and down load your backup.

Discover all the record themes you have purchased in the My Forms food selection. You can aquire a additional backup of Connecticut The FACTA Red Flags Rule: A Primer any time, if needed. Just click the needed kind to down load or printing the record format.

Use US Legal Forms, one of the most substantial collection of authorized kinds, in order to save time as well as prevent blunders. The service gives appropriately made authorized record themes that can be used for a range of purposes. Create a merchant account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

Under the Red Flags Rules, financial institutions and creditors must develop a written program that identifies and detects the relevant warning signs ? or ?red flags? ? of identity theft. Red Flag Rules - Texas Department of Savings and Mortgage Lending texas.gov ? mortgage-origination ? red-... texas.gov ? mortgage-origination ? red-...

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to ?red flags??patterns, practices or specific activities?that could indicate identity theft.

The Red Flags Rule requires organizations to implement a written identity theft prevention program to help them identify any of the relevant ?red flags? that indicate identity theft in daily operations. The Rule also offers steps to help prevent the crime and to mitigate its damage. What Is the FTC Red Flags Rule and Who Must Comply? I.S. Partners ? blog ? what-is-the-ftc-... I.S. Partners ? blog ? what-is-the-ftc-...

The Red Flags Rule requires that each "financial institution" or "creditor"?which includes most securities firms?implement a written program to detect, prevent and mitigate identity theft in connection with the opening or maintenance of "covered accounts." These include consumer accounts that permit multiple payments ... Red Flags Rule - Wikipedia Wikipedia ? wiki ? Red_Flags_Rule Wikipedia ? wiki ? Red_Flags_Rule

The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers. FACTA Red Flags Rule Regulatory Compliance - Experian Experian ? business ? solutions ? red... Experian ? business ? solutions ? red...

A red flag is a pattern, practice, or activity that indicates a possibility of identity theft. These flags produce a three digit score (0-999) that calculates the customer's fraud risk through the credit report. A higher score indicates a lower risk of identity fraud.