Connecticut Employee Evaluation Form for Sole Trader

Description

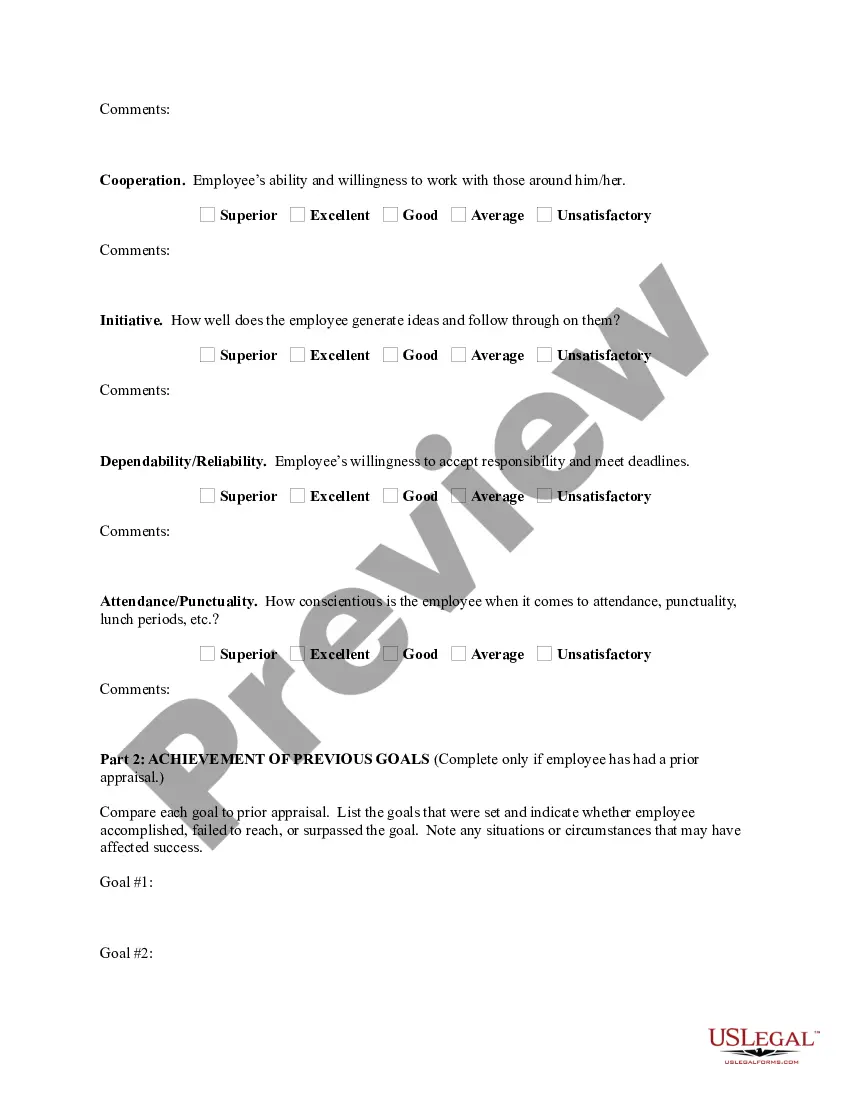

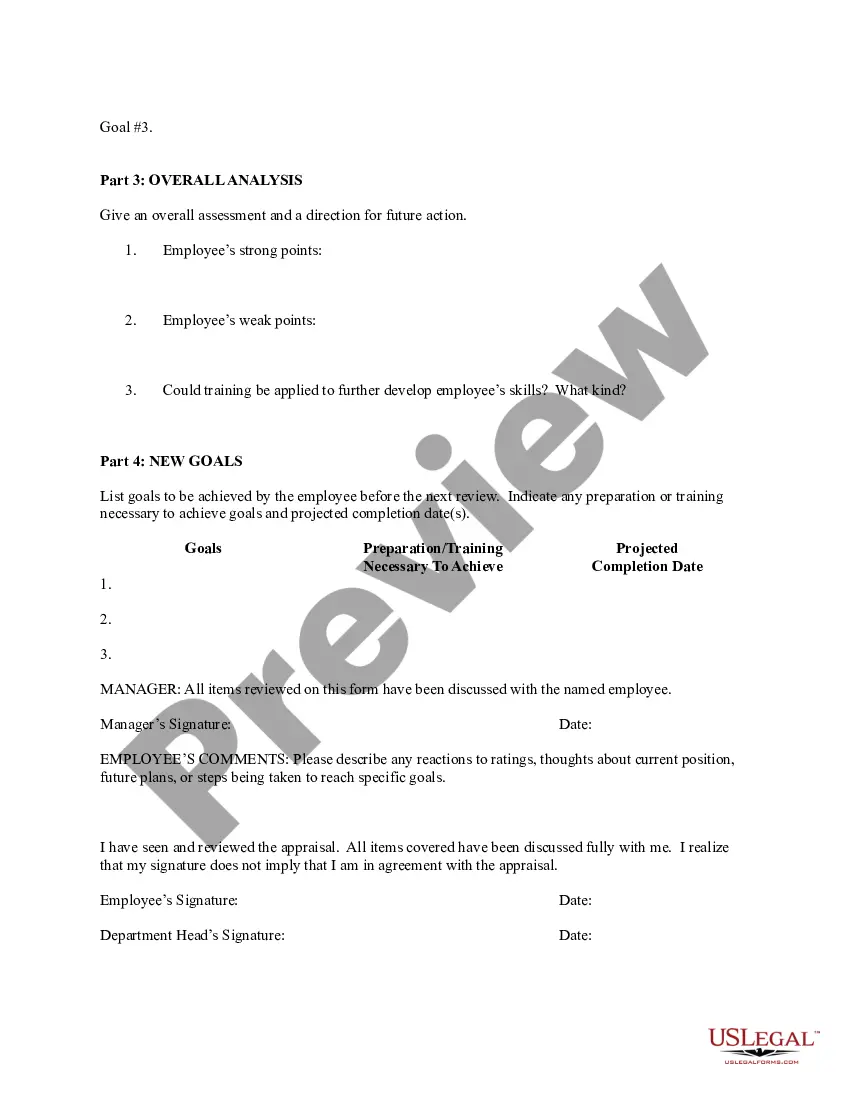

How to fill out Employee Evaluation Form For Sole Trader?

You can spend numerous hours online attempting to locate the legal document template that meets both state and federal requirements you have.

US Legal Forms offers a multitude of legal templates that are reviewed by experts.

You can effortlessly download or print the Connecticut Employee Evaluation Form for Sole Proprietor from the service.

Firstly, ensure that you have selected the correct document template for the area/city that you choose. Review the form details to confirm you have selected the right one. If available, utilize the Preview button to examine the document template as well. In order to obtain another version of the form, use the Search field to locate the template that fulfills your requirements and desires. Once you have identified the template you want, click on Purchase now to proceed. Select the pricing plan that you prefer, enter your information, and create an account on US Legal Forms. Complete the transaction. You can utilize your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make edits to the document if necessary. You can fill out, modify, sign, and print the Connecticut Employee Evaluation Form for Sole Proprietor. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can fill out, edit, print, or sign the Connecticut Employee Evaluation Form for Sole Proprietor.

- Every legal document template you obtain is your property indefinitely.

- To get another copy of a purchased form, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, adhere to the simple instructions provided below.

Form popularity

FAQ

Business owners and their partners are not typically considered employees of their business. To count yourself as an employee, you must receive some type of regular wage. Whether this is an option depends on your business structure.

It all comes down to your business structure. You're a sole trader when you're self-employed and the sole owner of your business. If you're self-employed, but are in a business partnership or run a limited company, you're not a sole trader.

' All sole proprietors are, by definition, self-employed. But not all self-employed persons are sole proprietors.

If you are self-employed, you always have to complete a Self Assessment tax return (unless your trading income is exempt under the trading allowance). It does not matter whether you make a profit or loss from your self-employment, or indeed whether you actually begin to trade as self-employed once you have registered.

The good news is that you can employ people and remain a sole trader. There's no need to set up a limited company if you don't want to. While sole traders operate the business on their own, that doesn't mean they have to work alone.

You can be both employed and self-employed at the same time, for example if you work for an employer during the day and run your own business in the evenings. You can check whether you're self-employed: online. by phone.

Yes, Self-Employed Business Owners Can Employ Others It simply means you're the sole owner of the business. As you grow, you can hire independent contractors and even bring on full-fledged employees.

So, can independent contractors hire employees? Yes! As a self-employed person, you are your own businessand businesses are allowed to hire employees.

Sole trader vs. self-employed. To summarise, the main difference between sole trader and self employed is that 'sole trader' describes your business structure; 'self-employed' means that you are not employed by somebody else or that you pay tax through PAYE.

To summarise, the main difference between sole trader and self employed is that 'sole trader' describes your business structure; 'self-employed' means that you are not employed by somebody else or that you pay tax through PAYE.