Connecticut Employment Separation Agreement

Description

How to fill out Employment Separation Agreement?

You can devote hours on-line searching for the authorized papers template that meets the federal and state requirements you require. US Legal Forms supplies thousands of authorized kinds which are examined by specialists. You can actually download or print out the Connecticut Employment Separation Agreement from our services.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Down load switch. After that, it is possible to full, edit, print out, or indication the Connecticut Employment Separation Agreement. Every authorized papers template you acquire is your own for a long time. To acquire another backup associated with a bought develop, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site the very first time, stick to the easy guidelines below:

- First, ensure that you have selected the proper papers template for that county/area that you pick. Read the develop description to make sure you have chosen the correct develop. If accessible, make use of the Preview switch to check with the papers template too.

- If you want to find another edition of your develop, make use of the Research discipline to obtain the template that meets your requirements and requirements.

- When you have discovered the template you would like, click Buy now to carry on.

- Pick the costs strategy you would like, type your references, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal accounts to cover the authorized develop.

- Pick the structure of your papers and download it to the device.

- Make alterations to the papers if needed. You can full, edit and indication and print out Connecticut Employment Separation Agreement.

Down load and print out thousands of papers layouts making use of the US Legal Forms site, which provides the greatest assortment of authorized kinds. Use skilled and express-particular layouts to handle your small business or individual needs.

Form popularity

FAQ

Employment separation occurs when the employment contract or at-will agreement between an employee and his or her company comes to an end. Some terminations will be forced by an employer, including getting fired or laid off. Other separations, like retirement or resignation, will be voluntary.

Do I have a legal right to severance payments? Most Connecticut employees do not have a legal right to severance payments. For those who do, it is usually the product either of individually-negotiated employment contracts or union contracts (also known as collective bargaining agreements).

Reporting Severance Pay When you make your claim to the CTDOL, you must report your severance pay. The reason is that severance pay is still considered income. Although collecting income doesn't disqualify you from Connecticut unemployment benefits, it may change your eligibility.

However, there are a few non job-related reasons for quitting under which a person may be approved for benefits. These include quitting to care for a spouse, child, or parent with an illness or disability, and quitting to escape domestic violence.

A separated employee is one who leaves an employment situation for any reason, whether voluntary or involuntary. A terminated employee is involuntarily let go, usually because of poor performance or lack of work.

If you sign a release of claims in return for severance pay, you may collect unemployment benefits for the same period of time as your severance payments.

Connecticut labor laws do not require employers to provide employees with severance pay. If an employer chooses to provide severance benefits, it must comply with the terms of its established policy or employment contract.

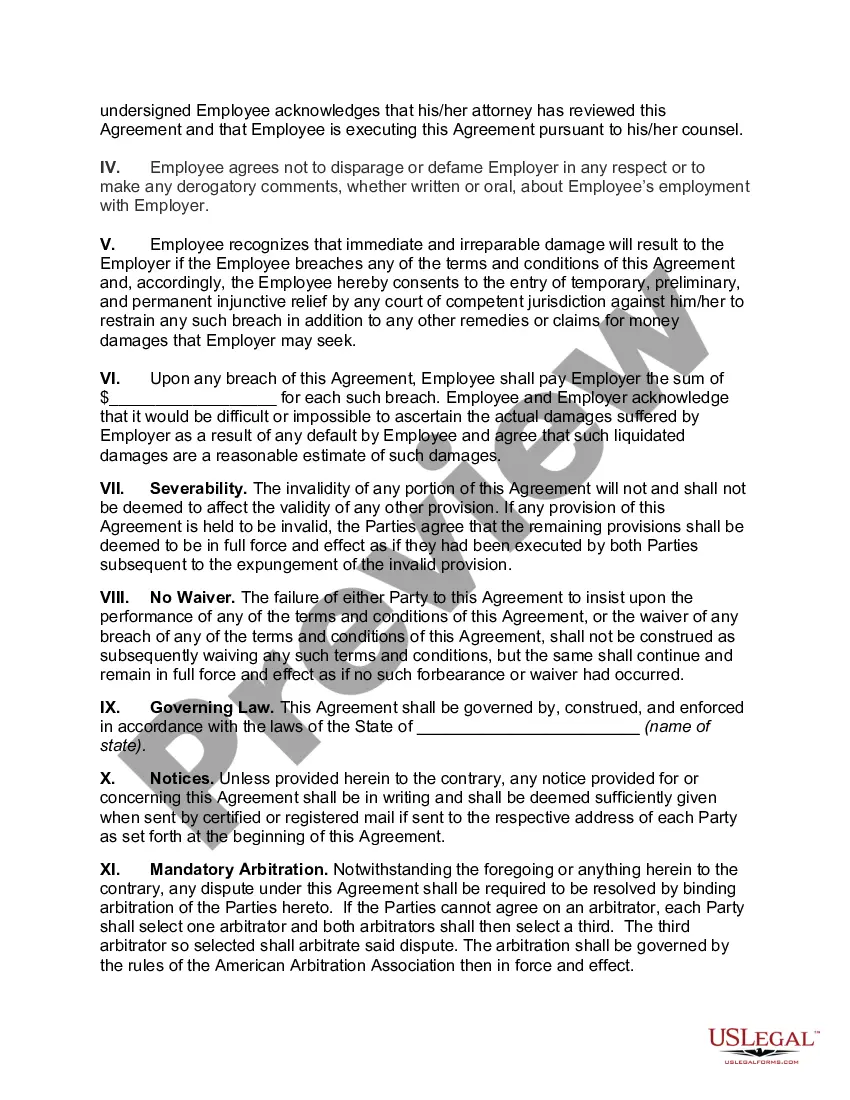

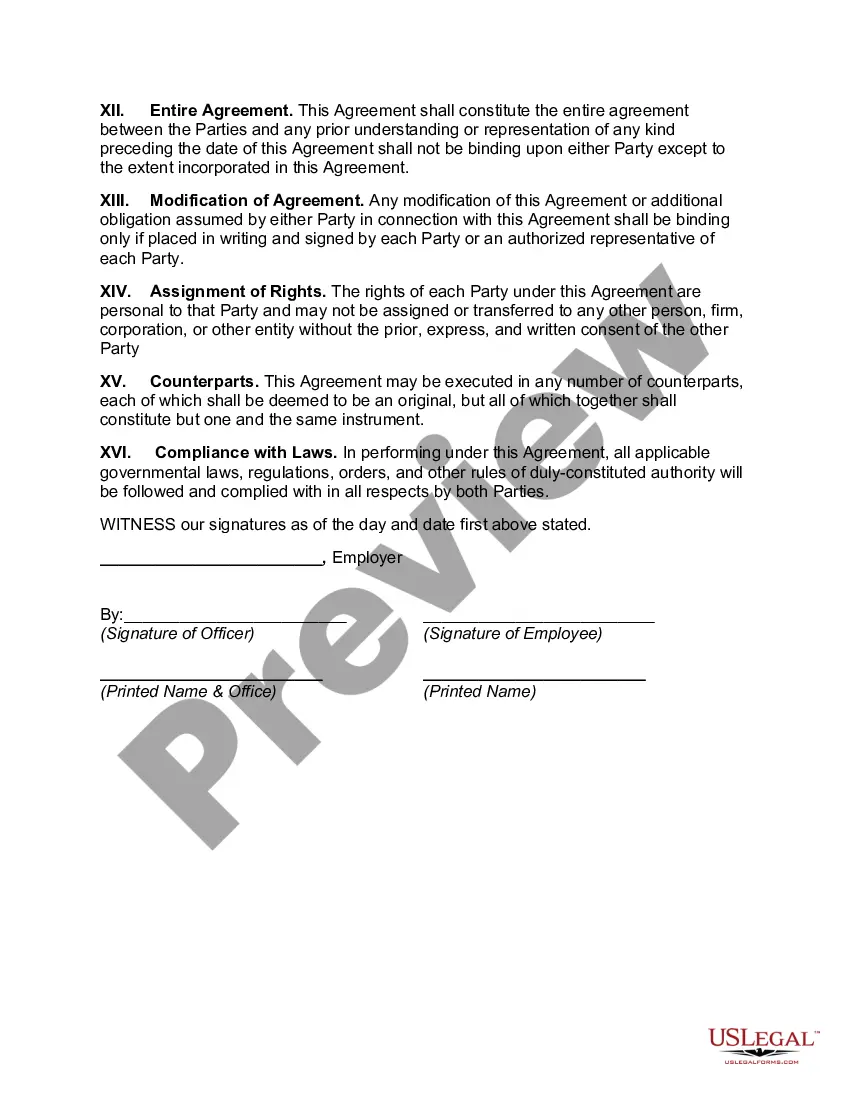

A separation agreement (also commonly referred to as a severance agreement) between an employer and a departing employee specifying terms of the employee's separation from employment, including a release of legal claims against the employer in exchange for a benefit.

Generally, a person cannot receive EI benefits at the same time they are receiving termination pay from their employer. However, they can receive EI benefits once their severance period the number of months their severance pay is worth is over.

Amount and Duration of Unemployment Benefits in ConnecticutThe DOL determines your weekly benefit amount by averaging your wages from the two highest quarters in your base period and dividing that number by 26, up to a maximum of $698 (as of 2021).