Connecticut Investment Management Agreement for Separate Account Clients

Description

How to fill out Investment Management Agreement For Separate Account Clients?

If you wish to finalize, acquire, or produce authentic document templates, utilize US Legal Forms, the widest selection of authentic forms, available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you require.

Numerous templates for both business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

Step 6. Choose the format of the legal form and download it to your device.

- Utilize US Legal Forms to secure the Connecticut Investment Management Agreement for Separate Account Clients in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and hit the Download button to fetch the Connecticut Investment Management Agreement for Separate Account Clients.

- You can also access forms you previously stored in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

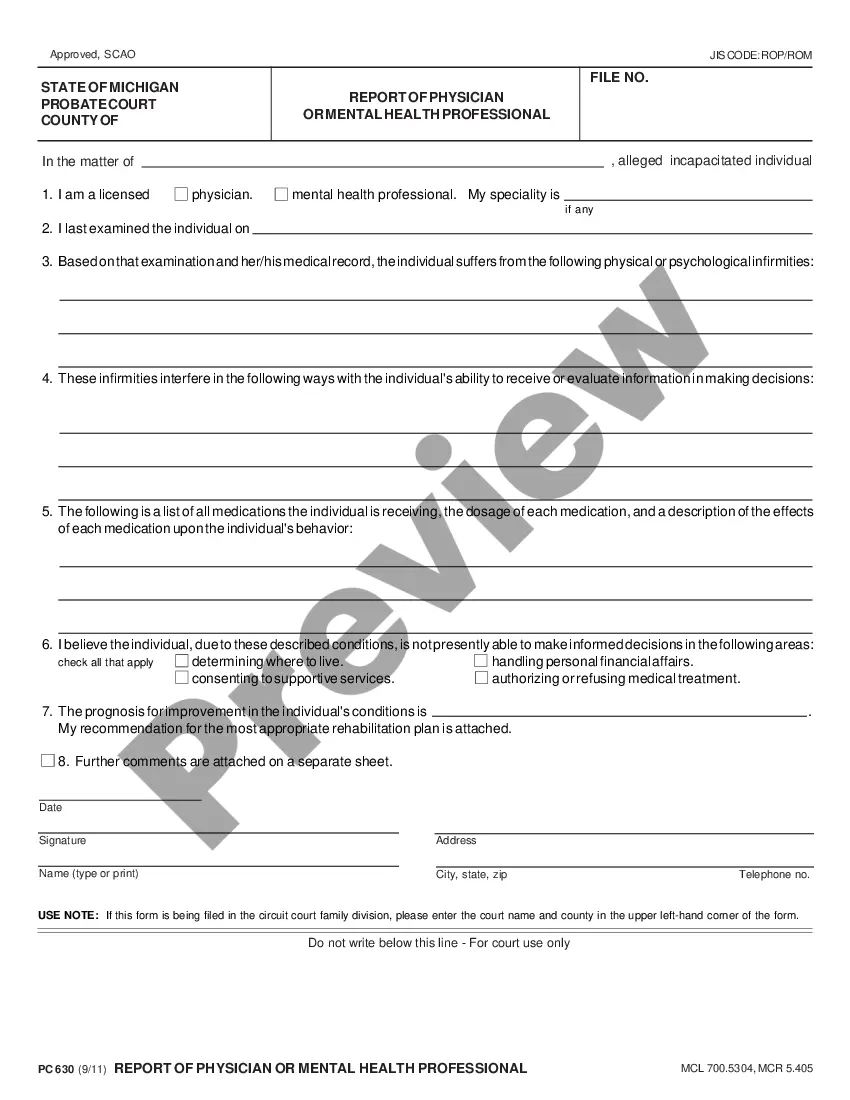

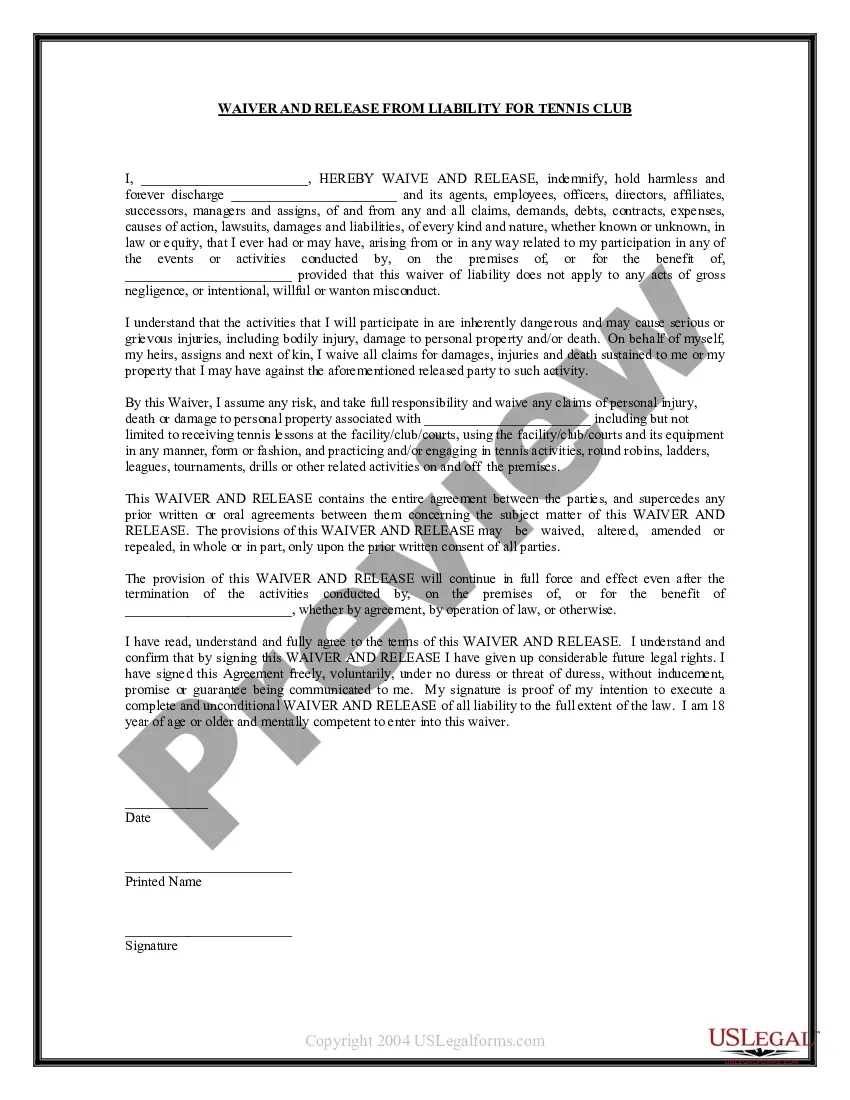

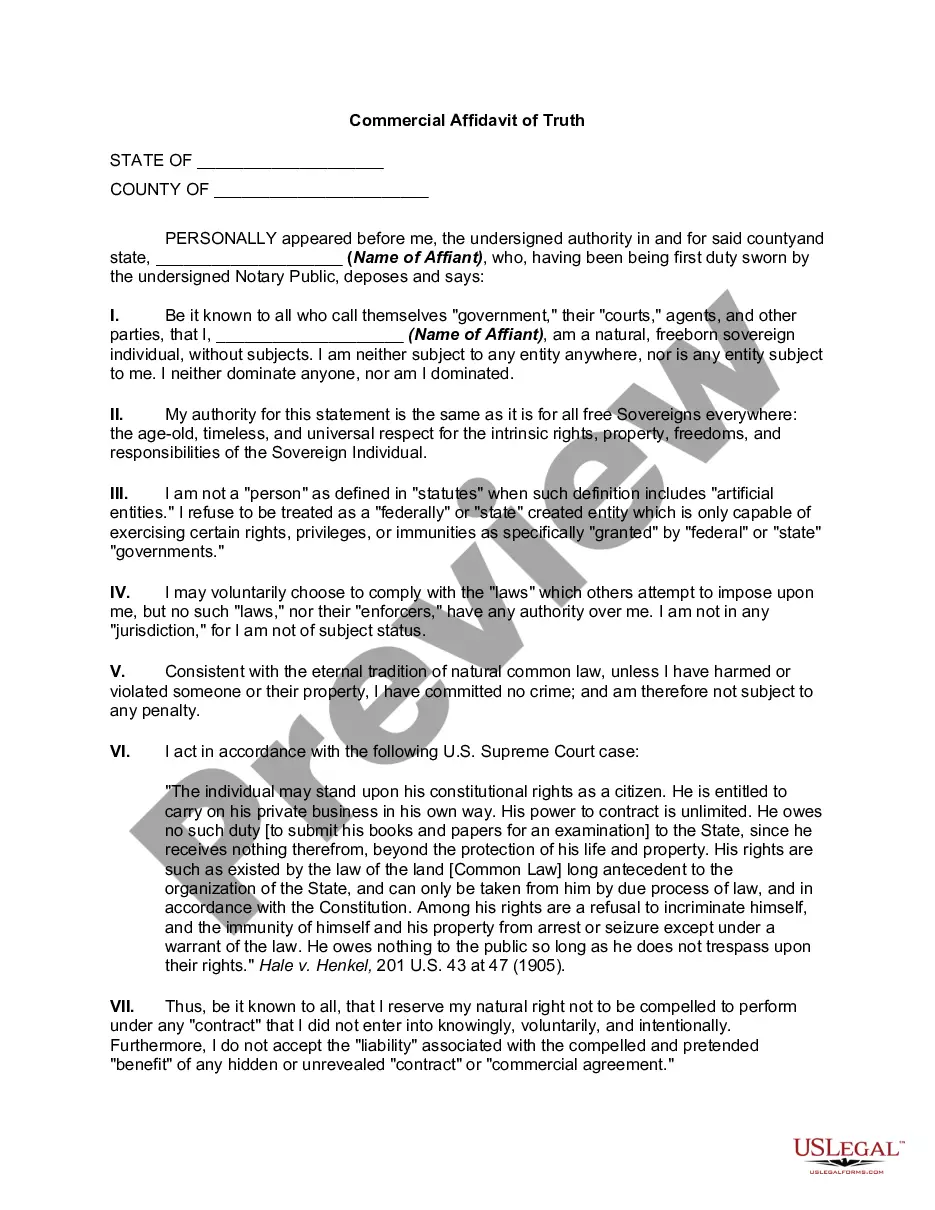

- Step 2. Use the Review option to examine the form's content. Do not forget to read the details.

- Step 3. If you are not satisfied with the form, employ the Search area at the top of the screen to locate alternative versions of the legal form format.

- Step 4. Once you have found the form you desire, click the Purchase now button. Choose the pricing plan you prefer and add your details to register for an account.

Form popularity

FAQ

Investment management services include asset allocation, financial statement analysis, stock selection, monitoring of existing investments, and portfolio strategy and implementation.

An Investment Management Account (IMA) is a flexible fund management arrangement that allows you to diversify your portfolio by gaining access to a wide range of financial instruments that span various asset types.

Portfolio Managers build and maintain investment portfolios, while investment advisors sell a specific product. 1 Investment advisors play an important role in the financial markets, but are not in a position to support the needs of a client's long-range financial objectives. That's the job of the Portfolio Manager.

Exclusively tailored services. First Command's Investment Management Accounts (IMA) are asset allocation portfolios designed for high net worth clients. Each portfolio is tailored to the client's individual risk tolerance and investment objective.

Key Takeaways. Investment managers are people or organizations who handle all activities related to financial planning, investing, and managing a portfolio for individuals or organizations. Clients of investment managers can be either individual or institutional investors.

Investment Guidelines means the general criteria, parameters and policies relating to Investments as established by the Board of Directors, as the same may be modified from time-to-time.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

I would say that a manager is likely to have people reporting to them and budget responsibilites, whereas an advisor is more likely to just convey advice, guidance and information to help an organisation to remain compliant.

A managed account (or separately managed account) is a portfolio of individual securities, such as stocks or bonds, that is managed on your behalf by a professional asset management firm. Unlike with a mutual fund or exchange-traded fund, you directly own the individual securities.