Connecticut Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

If you require thorough, acquire, or generate official document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Leverage the site's user-friendly search to locate the documents you need.

A range of templates for commercial and personal applications are organized by categories and states, or keywords.

Step 4. Once you have identified the form you want, click the Get now button. Select your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Connecticut Covenant Not to Sue by Widow of Deceased Shareholder with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Get button to find the Connecticut Covenant Not to Sue by Widow of Deceased Shareholder.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you’re using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for your correct city/state.

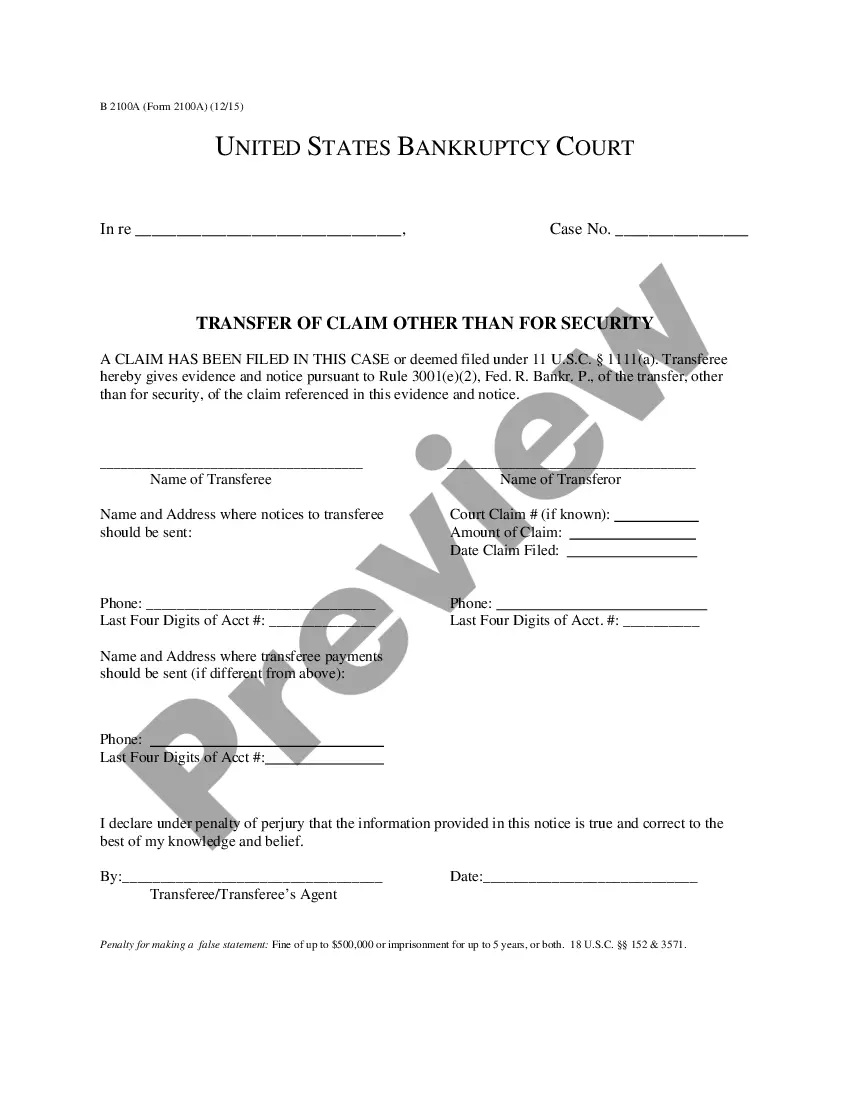

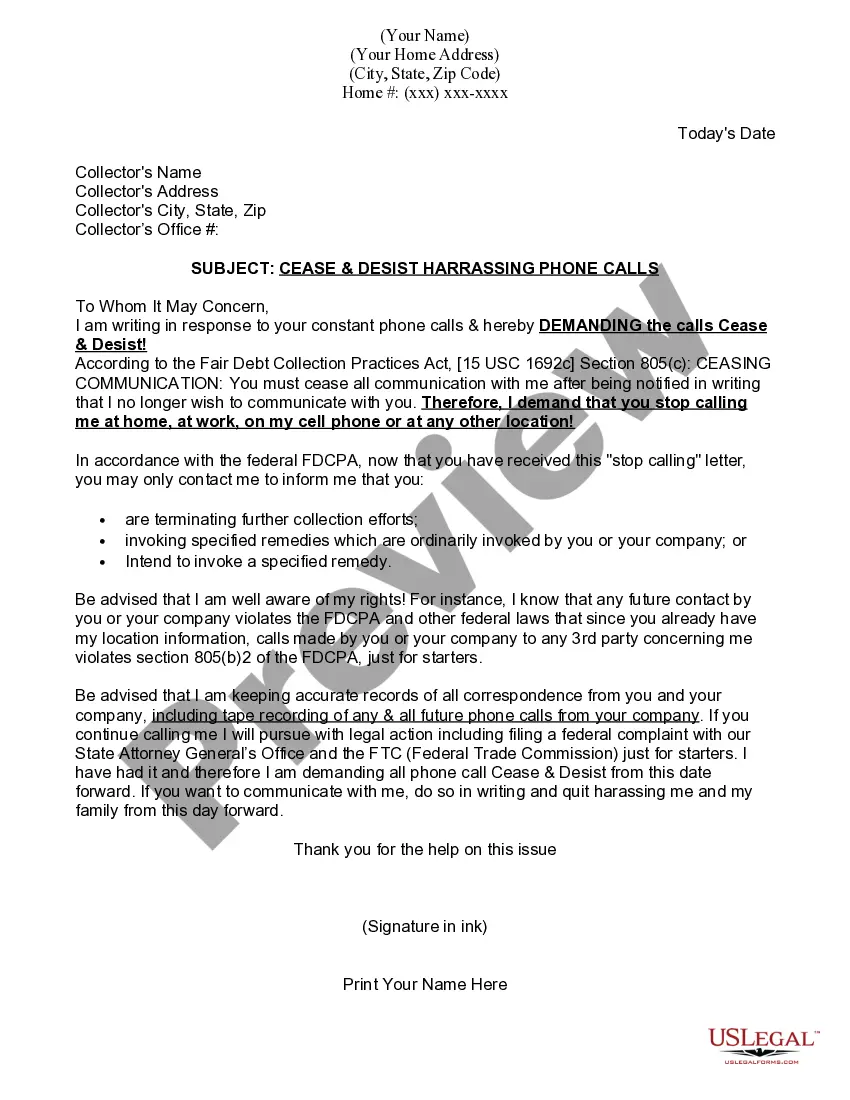

- Step 2. Use the Preview feature to review the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Statute 52-584 in Connecticut deals with limitation periods for bringing lawsuits. Specifically, it outlines the time frame within which a widow must file claims related to her husband's estate. Understanding this statute is essential because it directly affects the widow's ability to seek recourse if disputes arise after the death of a spouse.

Section 52-575 of the Connecticut General Statutes pertains to the Connecticut Covenant Not to Sue by Widow of Deceased Stockholder. This law allows a widow to waive certain rights to file lawsuits against the deceased husband's estate under specific circumstances. Essentially, it provides a legal mechanism for resolving disputes without litigation, ensuring that the widow can inherit her rightful share without unnecessary complications.

In Connecticut, the right of survivorship typically takes precedence over a will. This means that assets held in joint tenancy are transferred directly to the surviving owner upon death, regardless of what a will states. Consequently, understanding these legal nuances is essential for any widow navigating estate matters. The Connecticut Covenant Not to Sue by Widow of Deceased Stockholder can play a significant role in clarifying intentions and avoiding conflicts stemming from these complex situations.