This is a form to track progress on a delinquent customer account and to record collection efforts.

Connecticut Delinquent Account Collection History

Description

How to fill out Delinquent Account Collection History?

Are you in a situation where you will require documents for potential business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of template options, including the Connecticut Delinquent Account Collection History, designed to comply with state and federal regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you want, complete the necessary information to create your account, and process the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Delinquent Account Collection History template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

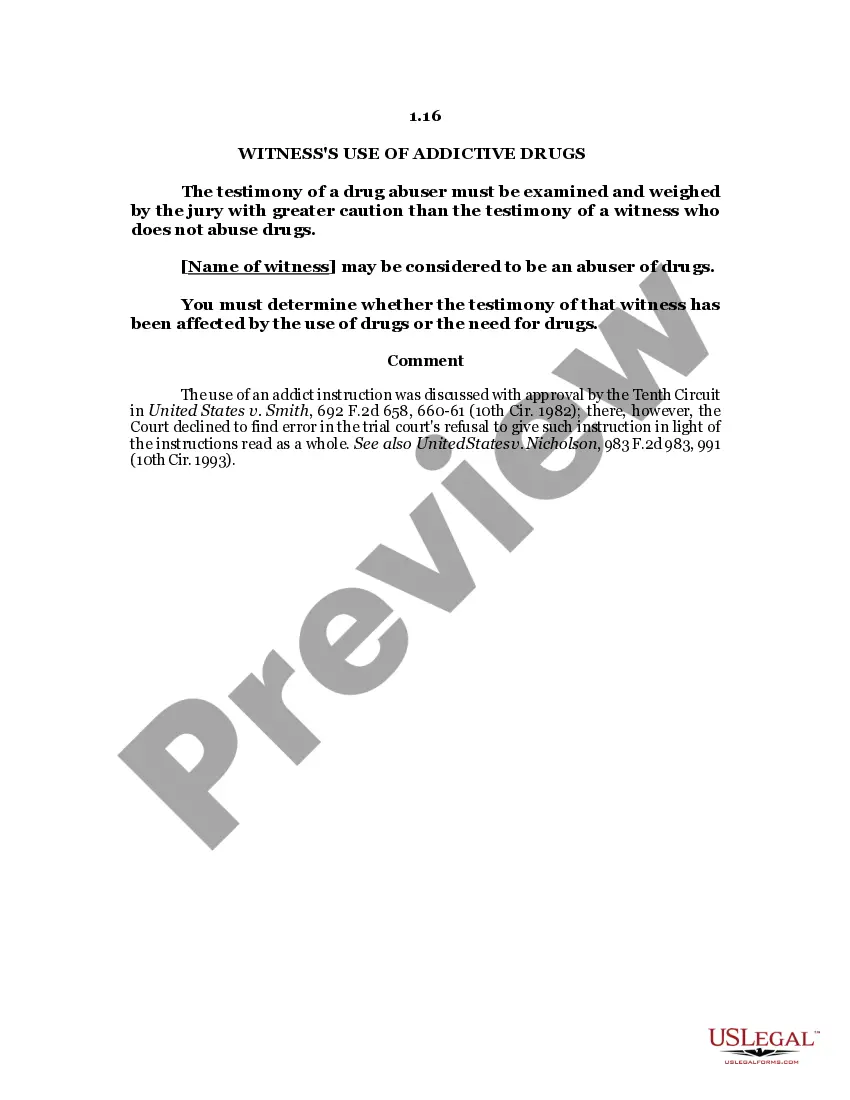

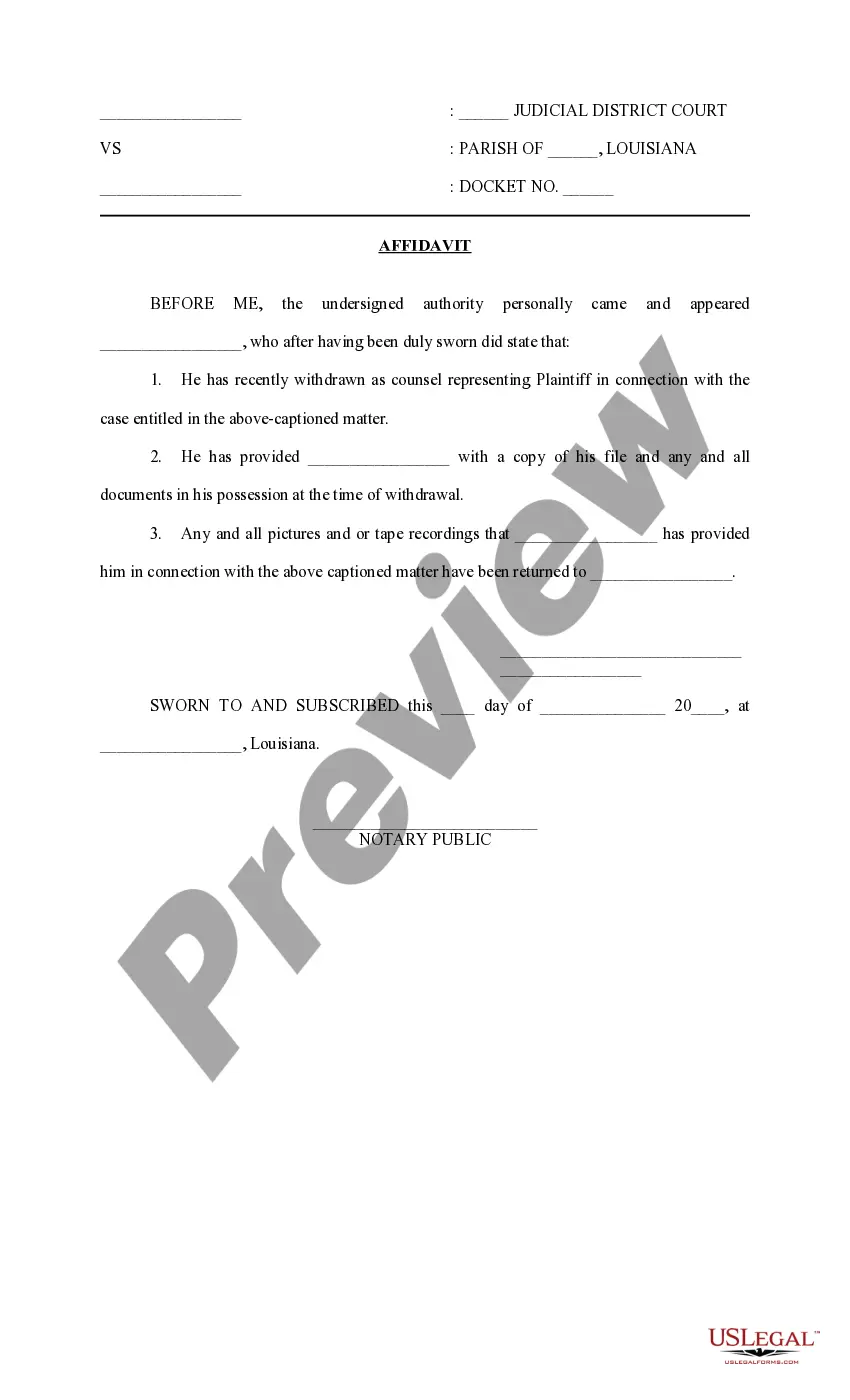

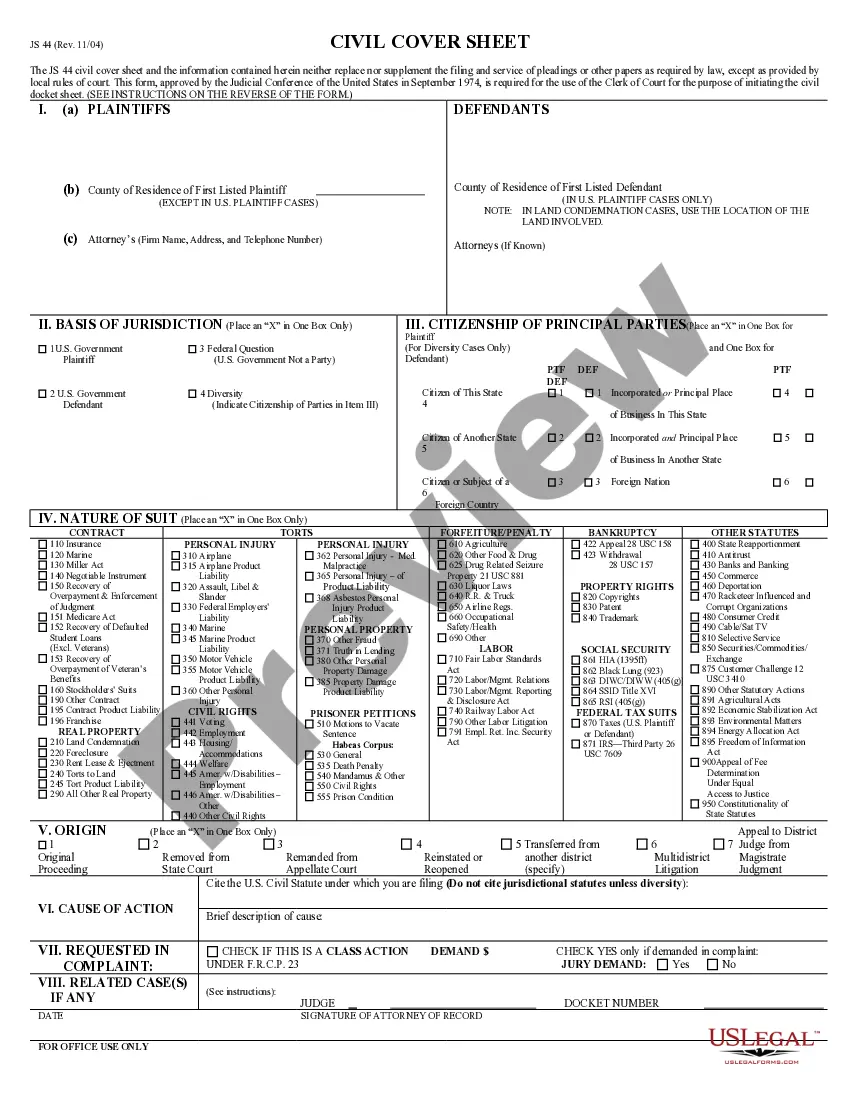

- Use the Review button to examine the form.

- Read the description to verify that you have selected the right form.

- If the form is not what you are seeking, utilize the Lookup area to locate the form that fits your needs.

Form popularity

FAQ

In Connecticut, a lien can remain on a property for 15 years. After this period, if it is not renewed, the lien may be removed. If you're reviewing your Connecticut Delinquent Account Collection History, it's essential to understand how long liens persist. Resources like USLegalForms are beneficial for understanding how to navigate these situations effectively.

In Connecticut, the statute of limitations for unpaid car taxes is three years. This means that after this period, the state may not take legal action to collect these taxes. Knowing this timeframe helps you understand your Connecticut Delinquent Account Collection History and can guide you in making informed decisions about resolving any outstanding balances. For specific guidance, consider checking USLegalForms for relevant resources.

To look up liens in Connecticut, you can visit the Connecticut Secretary of State's website. They provide access to public records that include liens filed against property. You can search by the name of the property owner, which will help you find any Connecticut Delinquent Account Collection History associated with that name. Utilizing online services like USLegalForms can simplify this process, allowing you to efficiently gather necessary information.

In Kansas, property taxes can remain unpaid for several years before the county initiates a foreclosure process. Typically, after three years of unpaid taxes, the county can take action to recover the debt. For those interested in understanding the ramifications of delinquent tax accounts, reviewing Connecticut delinquent account collection history can provide useful insights.

Yes, you can look up IRS tax liens through the IRS website or other public records services. This information is made available to keep transparency around tax debts. Furthermore, understanding your state’s Connecticut delinquent account collection history can facilitate better management of liens and possible resolutions.

To pull a tax delinquent list, start by checking your state or local government's official website for tax records. This will typically display current delinquent accounts. Using services like US Legal Forms can help automate the process, offering you tools that effectively manage Connecticut delinquent account collection history.

To pull a tax delinquent list, you can start by visiting your local tax collector's website. Many counties or municipalities provide public access to this information online. Additionally, using tools from platforms like US Legal Forms can streamline this process, ensuring you pull accurate and comprehensive data regarding Connecticut delinquent account collection history.

You might owe state taxes in Connecticut for various reasons, from income gaps to underpayment of withholding taxes. State tax obligations can accumulate quickly, especially if you're not aware of or have misunderstood Connecticut delinquent account collection history. Keeping records and consulting with tax professionals can help you clarify and manage your tax responsibilities effectively. Using services like uslegalforms can also guide you through tax-related inquiries.

In Connecticut, when property taxes remain unpaid, the municipality may issue a tax lien against the property. This lien signifies that there's a debt owed, which can be sold to investors at a public auction. Understanding the Connecticut delinquent account collection history is crucial for potential investors, as it outlines the processes and risks involved. Consulting resources like uslegalforms can simplify your understanding of tax lien procedures.

Yes, Connecticut is a tax lien state. This means that if property taxes are unpaid, the state can place a lien on the property. By exploring the state's policies in Connecticut delinquent account collection history, you can gain insights into how tax liens work and what they mean for you. Engaging with professionals or reliable legal platforms can provide valuable assistance.