Connecticut Checklist - Leasing vs. Purchasing Equipment

Description

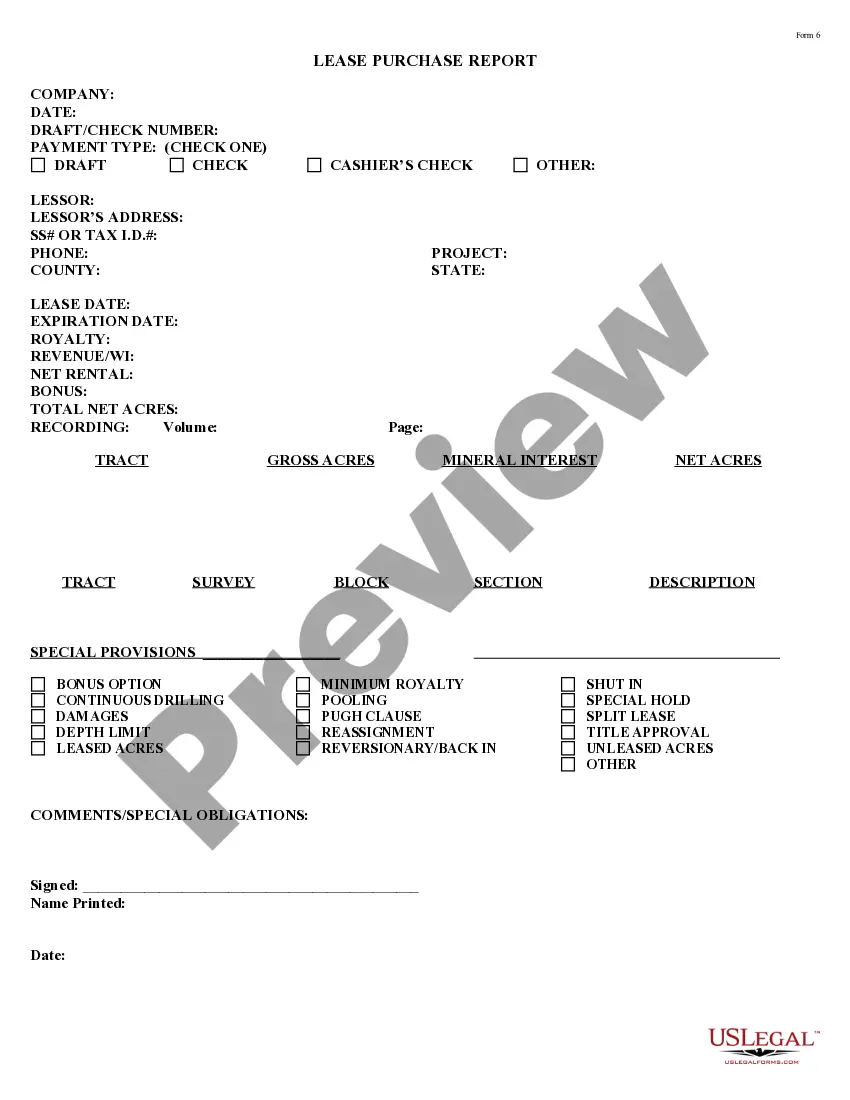

Every lease decision is unique so it's important to study the lease agreement carefully. When deciding to obtain equipment, you need to determine whether it is better to lease or purchase the equipment. You might use this checklist to compare the costs for each option.

How to fill out Checklist - Leasing Vs. Purchasing Equipment?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a variety of legal paperwork templates that you can download or print.

By utilizing the website, you can obtain thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Connecticut Checklist - Leasing vs. Purchasing Equipment in a matter of seconds.

If you already have a subscription, Log In and download the Connecticut Checklist - Leasing vs. Purchasing Equipment from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded templates in the My documents section of your account.

Every template you add to your account has no expiration date and belongs to you forever. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Connecticut Checklist - Leasing vs. Purchasing Equipment through US Legal Forms, possibly the most extensive library of legal documentation templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your city/state. Click the Review button to review the content of the form. View the form summary to make sure you have chosen the right one.

- If the form does not meet your requirements, use the Search feature at the top of the page to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your preferred pricing plan and provide your information to register for an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Make modifications. Fill, edit, print, and sign the downloaded Connecticut Checklist - Leasing vs. Purchasing Equipment.

Form popularity

FAQ

To set up an equipment lease in QuickBooks, start by creating a new account for the leased equipment. You can input the necessary lease details, including the payment schedule and asset information. Utilizing the Connecticut Checklist - Leasing vs. Purchasing Equipment can streamline this process, helping you maintain accurate financial records.

A good equipment lease rate can vary depending on several factors, including the equipment type, lease term, and market conditions. Typically, lease rates range from a few percent to several percent of the equipment value. To find the best rate, it is advisable to compare quotes using the Connecticut Checklist - Leasing vs. Purchasing Equipment, ensuring you secure a fair deal.

To set up an equipment lease, first determine the type of equipment you need for your operations. Next, review various leasing companies and evaluate their terms and rates. Engaging with legal support can also clarify lease conditions, allowing you to refer to the Connecticut Checklist - Leasing vs. Purchasing Equipment for comprehensive insight.

Setting up an equipment lease starts with identifying your needs and budget. You should then research various leasing options available and compare terms from different providers. The Connecticut Checklist - Leasing vs. Purchasing Equipment serves as a helpful guide to ensure you make informed decisions throughout the leasing process.

Recording a lease on equipment involves documenting the lease agreement in your accounting records. The equipment lease should reflect as a liability on your balance sheet, while the leased equipment is recorded as an asset. It is important to follow the guidelines of the Connecticut Checklist - Leasing vs. Purchasing Equipment to ensure compliance and proper financial reporting.

Leasing may be considered better than buying for taxes, depending on your business's financial landscape and goals. Lease payments can often be fully deducted as business expenses, helping to reduce taxable income. However, purchasing equipment allows for depreciation deductions over time, which can also provide tax benefits. With this Connecticut Checklist - Leasing vs. Purchasing Equipment, you can take a closer look at each option to find the best fit for your tax strategy.

The primary difference between buying and leasing equipment lies in ownership and financial commitment. When you buy equipment, you own it outright and can use it as needed, whereas leasing provides you access to equipment without ownership. This Connecticut Checklist - Leasing vs. Purchasing Equipment helps you understand these distinctions, allowing you to decide which option best suits your operational needs and financial circumstances.

Whether it is better to lease or buy equipment for tax purposes depends on your specific financial situation and long-term plans. Leasing often provides immediate tax benefits since monthly payments can be fully deductible. However, buying equipment can lead to depreciation benefits and ownership of an asset. This Connecticut Checklist - Leasing vs. Purchasing Equipment can help you analyze these options and determine which aligns best with your tax strategy.

Leasing equipment can offer several tax advantages that may benefit your business in the long run. Lease payments are often considered deductible business expenses, which can lead to a lower taxable income. Furthermore, using this Connecticut Checklist - Leasing vs. Purchasing Equipment, you can identify if there are any specific state tax credits or deductions available for equipment leases. This can provide additional financial relief and flexibility.

The credit score required to lease equipment usually varies by lender, but a score of 650 or higher is often favorable. Having a solid credit score helps secure better terms, including lower payments and interest rates. By referring to the Connecticut Checklist - Leasing vs. Purchasing Equipment, you can gain insights on how to strengthen your financial position for leasing equipment.