If you have to complete, acquire, or produce legitimate file templates, use US Legal Forms, the biggest selection of legitimate types, that can be found on the Internet. Take advantage of the site`s easy and hassle-free research to obtain the files you need. Various templates for company and individual functions are categorized by categories and states, or keywords and phrases. Use US Legal Forms to obtain the Connecticut Application and Loan Agreement for a Business Loan with Warranties by Borrower with a number of click throughs.

When you are already a US Legal Forms client, log in to your accounts and click the Obtain key to obtain the Connecticut Application and Loan Agreement for a Business Loan with Warranties by Borrower. You can also accessibility types you formerly delivered electronically inside the My Forms tab of the accounts.

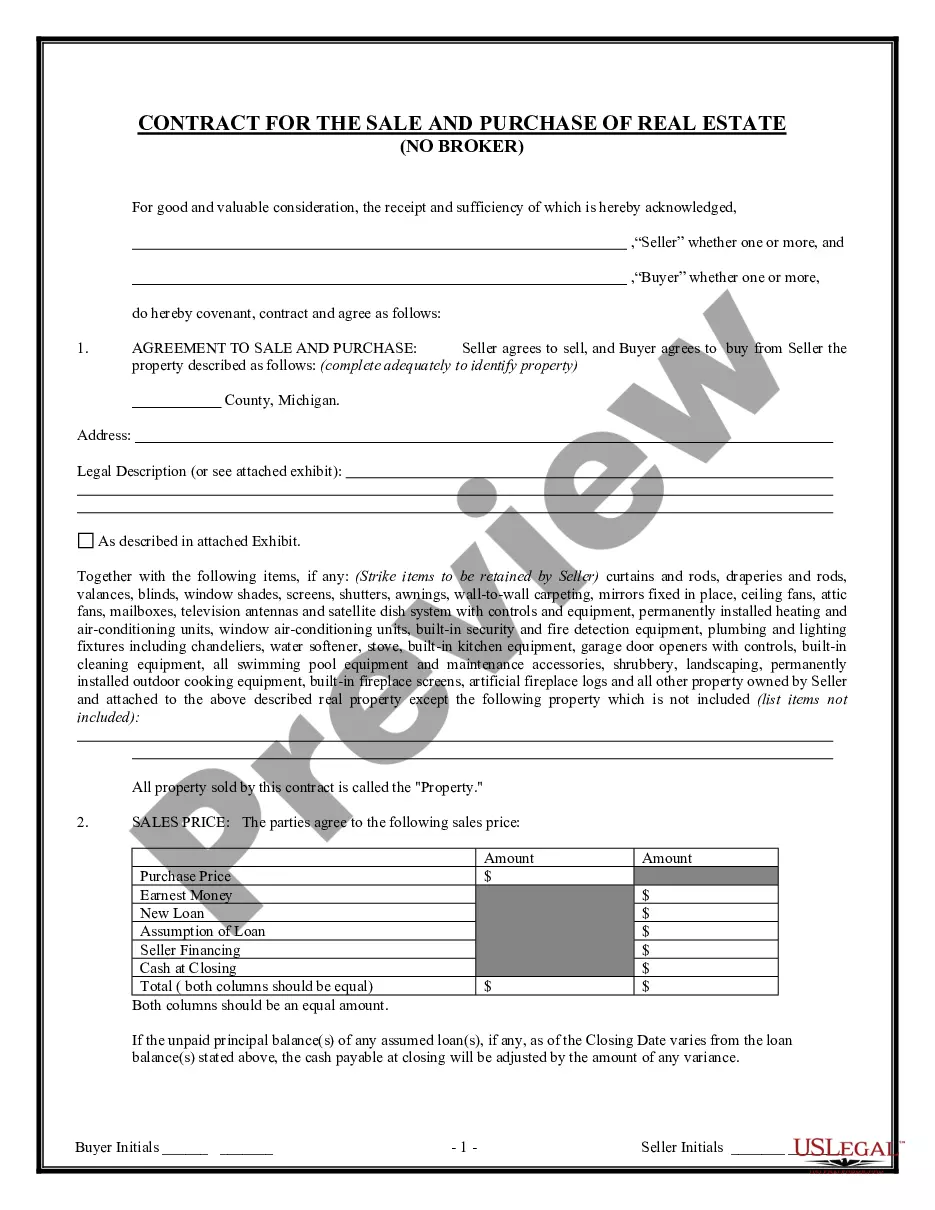

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form to the correct metropolis/land.

- Step 2. Use the Review solution to look through the form`s content material. Do not forget about to learn the outline.

- Step 3. When you are not satisfied with the type, utilize the Research industry on top of the display to get other variations of the legitimate type design.

- Step 4. Once you have located the form you need, go through the Acquire now key. Select the prices prepare you choose and include your references to register for the accounts.

- Step 5. Approach the deal. You should use your bank card or PayPal accounts to accomplish the deal.

- Step 6. Find the structure of the legitimate type and acquire it on your own product.

- Step 7. Total, change and produce or sign the Connecticut Application and Loan Agreement for a Business Loan with Warranties by Borrower.

Each and every legitimate file design you buy is yours for a long time. You may have acces to each and every type you delivered electronically with your acccount. Click on the My Forms area and select a type to produce or acquire once more.

Compete and acquire, and produce the Connecticut Application and Loan Agreement for a Business Loan with Warranties by Borrower with US Legal Forms. There are many specialist and status-distinct types you can utilize for the company or individual demands.