Connecticut Direct Deposit Form for Unemployment

Description

How to fill out Direct Deposit Form For Unemployment?

Selecting the appropriate legal document template can be challenging.

Undoubtedly, there is a selection of templates accessible online, but how can you identify the legal form you require.

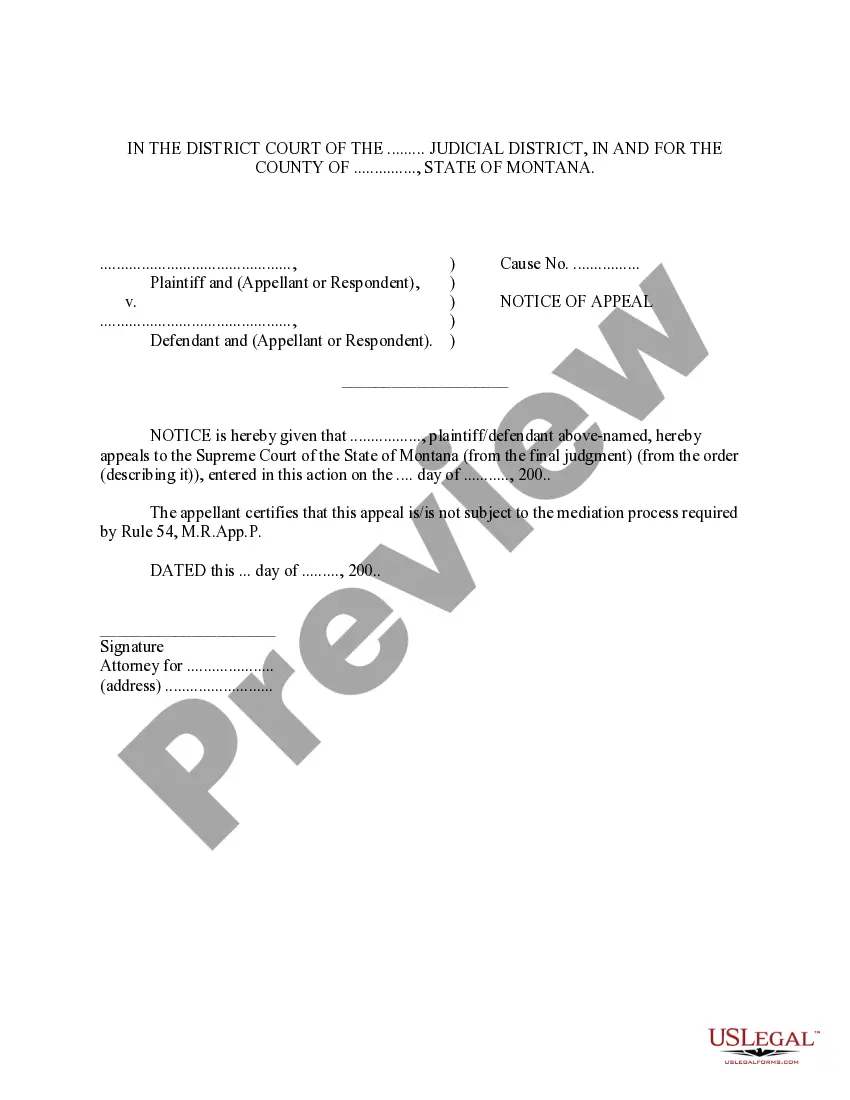

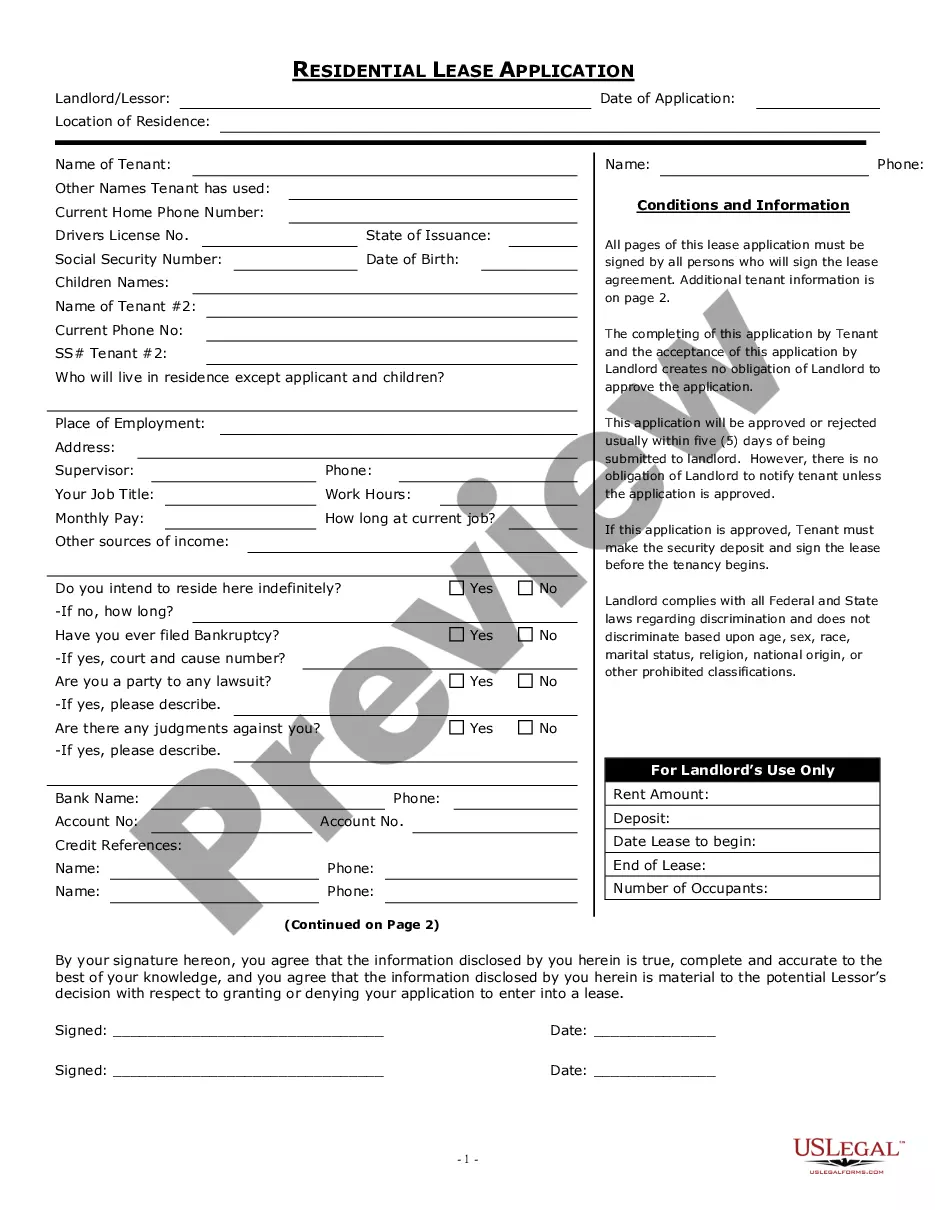

Visit the US Legal Forms website. This service provides an extensive range of templates, including the Connecticut Direct Deposit Form for Unemployment, suitable for both professional and personal needs.

If you are a new user of US Legal Forms, here are simple steps to follow: Firstly, ensure you have chosen the correct form for your area or region. You can preview the form using the Preview button and review the form description to confirm it is the right one for you.

- All forms are vetted by experts.

- They comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Connecticut Direct Deposit Form for Unemployment.

- Use your account to look through the legal forms you have previously purchased.

- Navigate to the My documents tab in your account and download another version of the form you require.

Form popularity

FAQ

To sign up for Direct Deposit, you must enroll online. You CANNOT sign up for Direct Deposit by phone. Using the Department of Labor's secure website you must click on the SELECT/MODIFY PAYMENT METHOD option from the Unemployment Insurance Welcome Screen.

You may file a weekly claim from Sunday through Friday for the previous calendar week (Sunday through Saturday). If you miss filing a claim for a week, you will not be able to file the following week. This may result in a delay or loss of benefits.

You will receive a Debit Card in the mail within 7 to 10 days after your continued claim(s) has been released for payment.

To do so, sign in to your account and selecting the Update Direct Deposit option from the dashboard. If you requested direct deposit when you filed your new claim online, you do not need to sign up again unless you need to change your bank account information.

CONNECTICUT, USA Q: When does unemployment deposit money in CT? DOL: For a claim processed over the weekend (most people file Sundays which is the earliest day you can file for that week) and the $ will be in a person's bank account by Tuesday.

If we can do direct deposit you will have the funds within two business days of claim approval, said DOL spokeswoman Nancy Steffens.

CONTACT KEY BANK ON-LINE AT FOR THE FOLLOWING: check Debit Card balances. make Debit Card account inquiries. review a free electronic statement for a Debit Card account.

CONTACT KEY BANK ON-LINE AT FOR THE FOLLOWING: check Debit Card balances. make Debit Card account inquiries. review a free electronic statement for a Debit Card account.