Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

If you require extensive, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal use are categorized by types and categories, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to locate the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to find the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

- You can also access forms you previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

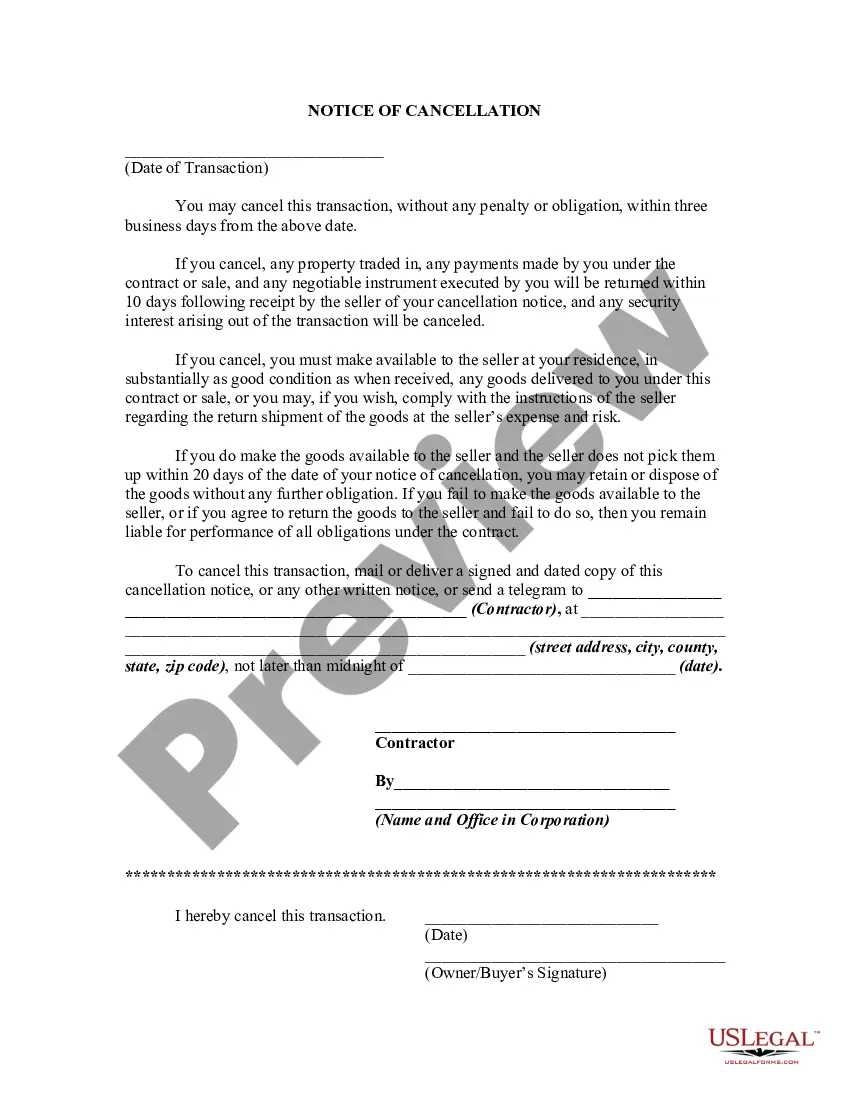

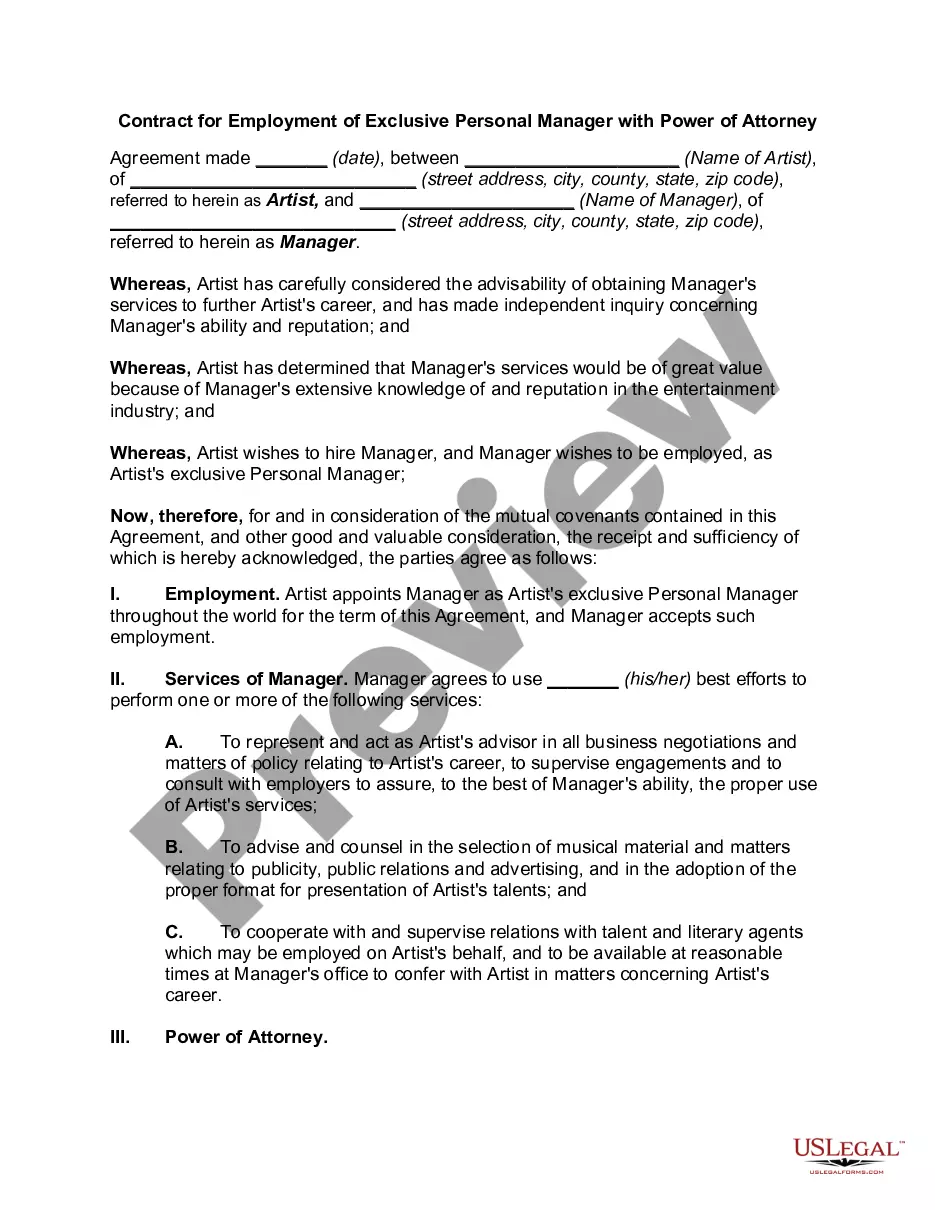

- Step 2. Use the Review option to examine the form’s contents. Be sure to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

A contemporaneous written acknowledgment of a charitable gift must include specific details: the donor's name, the amount of the gift, the date it was received, and a statement of whether any goods or services were provided in exchange. This ensures compliance with the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift guidelines. Utilizing platforms like uslegalforms can help you generate these acknowledgments easily and efficiently.

Acknowledging the receipt of a donation involves issuing a written letter or receipt to the donor. This should include the donor's name, the amount of the donation, and the date it was received. By doing so, you not only express gratitude but also meet the requirements of Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift, ensuring both parties have the necessary documentation for tax purposes.

To acknowledge a gift from a donor-advised fund, the receiving organization should provide a written statement that clearly identifies the contribution. Make sure to include the donor's name, the amount, and the date of the gift. This is essential for maintaining compliance with the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift regulations and helps the donor with their tax reporting.

Yes, obtaining a donation receipt from Goodwill is worthwhile. This receipt serves as proof of your contribution, which can be beneficial for tax deductions. In Connecticut, a donation receipt that includes the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift can help you substantiate your claims when filing taxes.

Generating a donation receipt can be done easily through the nonprofit’s accounting system or by using templates available online. Many organizations will automatically send you a receipt after your donation. For Connecticut-based charities, ensure that the receipt includes the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift to comply with tax regulations.

You can show proof of a charitable donation by presenting a receipt or acknowledgment letter from the nonprofit. This documentation should clearly state the amount donated and the date of the contribution. In Connecticut, utilizing the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift will provide you with the necessary proof for your records.

When making a Qualified Charitable Distribution (QCD), you need to provide documentation that includes the name of the charity, the donation amount, and the date of the transfer. Charitable organizations should issue a Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift. This will help you meet IRS requirements and support your tax reporting.

To obtain a receipt for your charitable donation, contact the organization to which you donated. Most nonprofits provide receipts automatically after receiving a contribution. In Connecticut, make sure to request the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift for proper documentation.

A gift acknowledgement letter is a formal document provided by a charitable organization confirming receipt of a donation. This letter outlines the details of the gift, which may include the amount and date of the contribution. For donors in Connecticut, this acknowledgment serves as an important record for tax purposes under the Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Yes, having a receipt for a charitable donation is important. It serves as proof of your contribution, which can be essential for tax purposes. The Connecticut Acknowledgment by Charitable or Educational Institution of Receipt of Gift ensures you have the necessary documentation to claim deductions on your tax return.