Connecticut Acknowledgment for Limited Liability Partnership

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Acknowledgment For Limited Liability Partnership?

The larger amount of documentation you need to complete - the more anxious you become.

You can discover numerous Connecticut Acknowledgment for Limited Liability Partnership samples online, but you’re unsure which ones to rely on.

Reduce the hassle and make searching for templates much easier with US Legal Forms. Obtain precisely drafted documents that comply with state regulations.

Provide the required information to set up your account and complete your payment through PayPal or card. Select your desired document type and obtain your copy. Access each template you've downloaded in the My documents section. Simply go there to fill out a new copy of your Connecticut Acknowledgment for Limited Liability Partnership. Even when utilizing professionally created forms, it remains important to consider consulting a local attorney to verify that your completed form is accurate. Achieve more for less with US Legal Forms!

- If you already have a subscription to US Legal Forms, Log In to your account, and you'll find the Download option on the Connecticut Acknowledgment for Limited Liability Partnership’s page.

- If you've never utilized our service before, follow these steps to register.

- Ensure that the Connecticut Acknowledgment for Limited Liability Partnership is applicable in your state.

- Confirm your selection by reviewing the description or using the Preview feature if available for the document you selected.

- Click on Buy Now to begin the registration process and choose a pricing plan that meets your needs.

Form popularity

FAQ

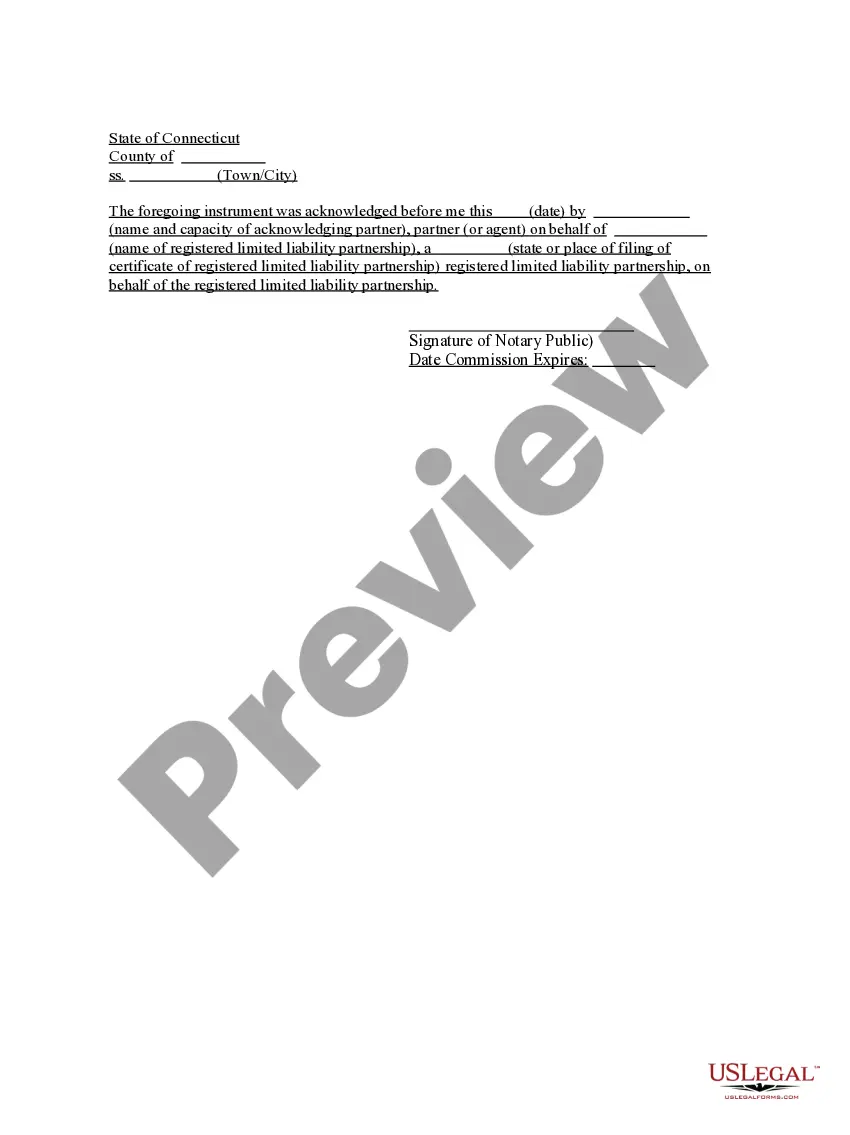

The partnership act establishes fundamental rules that govern the operations and relationships within partnerships. This act defines partnership liability, outlining how partners share profits and losses, manage daily operations, and make decisions. By reinforcing the principles of the Connecticut Acknowledgment for Limited Liability Partnership, the act safeguards partners from personal liability in most cases. It creates a structured environment, allowing partnerships to thrive while ensuring compliance with legal standards.

The Connecticut Uniform Partnership Act outlines the laws governing partnerships within the state. It dictates how partnerships are formed, managed, and dissolved, offering essential guidelines for business relationships. Incorporating the Connecticut Acknowledgment for Limited Liability Partnership ensures that your partnership adheres to state regulations, thus providing legal security for all involved parties. Understanding this act is crucial for anyone looking to successfully navigate partnership dynamics in Connecticut.

The Uniform Partnership Act offers a standardized legal framework for partnerships across various states, including Connecticut. Its purpose is to provide clear rules regarding partnership formation, governance, and dissolution. By aligning with the Connecticut Acknowledgment for Limited Liability Partnership, partners benefit from protections that facilitate smoother operations and dispute resolutions. This act helps create a reliable structure that stakeholders can rely on for fair treatment.

The CT partnership Plan allows business partners in Connecticut to establish a business framework for their limited liability partnership (LLP). This plan provides guidelines for how the partnership operates, including management, profit distribution, and responsibilities of each partner. By focusing on the Connecticut Acknowledgment for Limited Liability Partnership, business partners ensure proper legal recognition, protecting their interests and assets. The plan promotes transparency and legal compliance, vital for the success of any partnership.

To file an LLC in Connecticut, you need to submit a Certificate of Organization to the Secretary of State. Incorporating a Connecticut Acknowledgment for Limited Liability Partnership can enhance the legitimacy of your LLC's formation. Once filed, ensure ongoing compliance by keeping your LLC records updated.

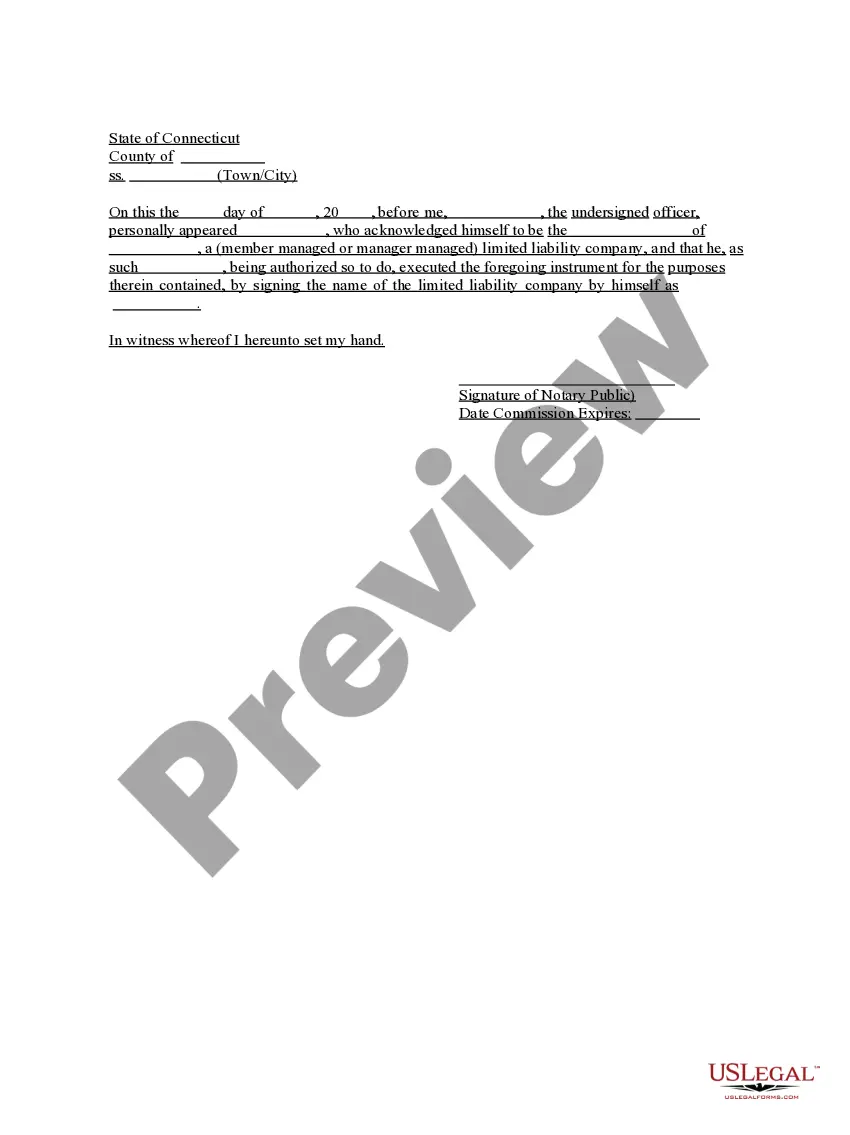

In Connecticut, certain documents, including a Connecticut Acknowledgment for Limited Liability Partnership, often require a notary seal for authenticity. This validates the signatures and can provide extra protection in legal matters. Always check the specific requirements for your documents to ensure everything is in order.

In Connecticut, you can add someone to your LLC by updating your operating agreement and, if necessary, submitting a Connecticut Acknowledgment for Limited Liability Partnership. This helps solidify the new partner’s legal status. Don’t forget to inform the Secretary of State of any changes to ensure compliance.

Adding a partner to an LLC can be straightforward if you have a clear operating agreement. Consider using a Connecticut Acknowledgment for Limited Liability Partnership to document this change professionally. While the process may seem simple, clear communication and documentation are key to a smooth transition.

Adding a partner to your existing business involves revising your business structure. You may need to file a Connecticut Acknowledgment for Limited Liability Partnership to ensure legal compliance, as this document formalizes the partnership. Be clear on roles, responsibilities, and profit-sharing agreements to avoid future disputes.

To add someone to your LLC, you'll typically need to amend your operating agreement to reflect the new member’s involvement. This process often involves drafting a Connecticut Acknowledgment for Limited Liability Partnership that shows the member’s acceptance. Make sure to notify the Secretary of State about this change to keep your records up to date.