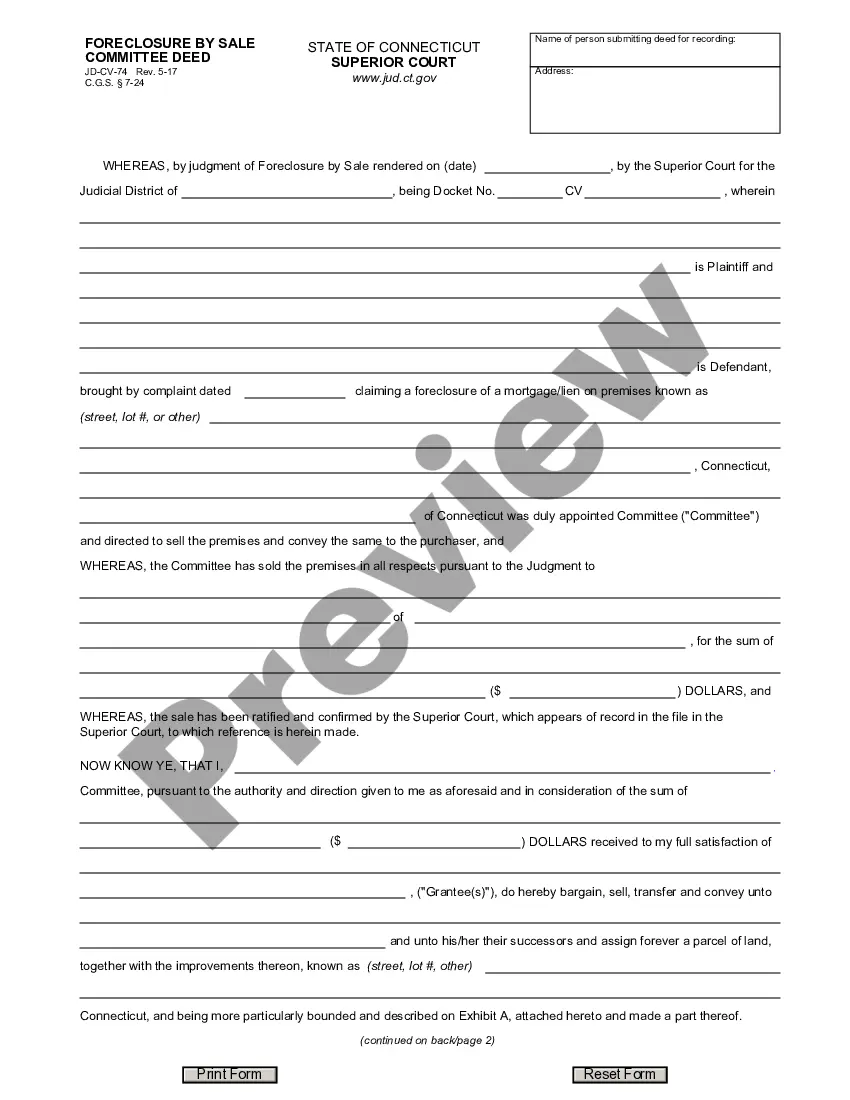

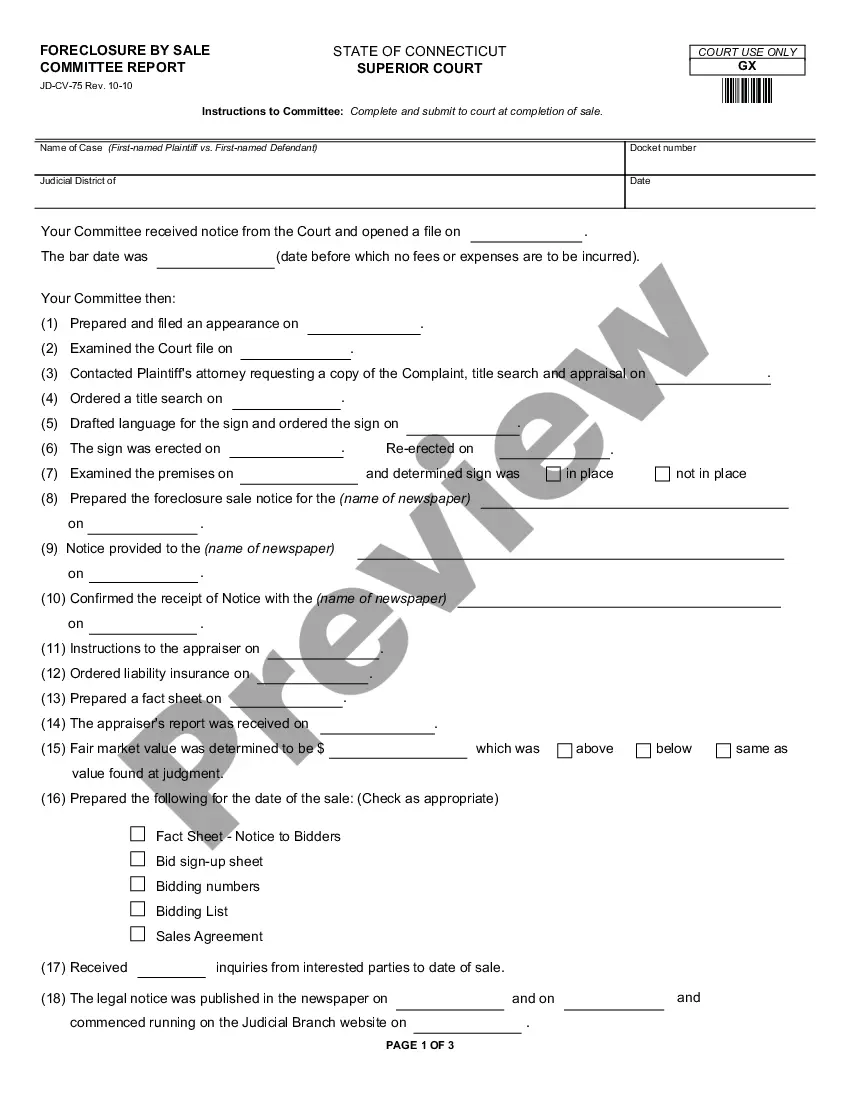

Connecticut Foreclosure / Motion For Approval of Committee Sale, Approval of Committee Deed, Acceptance of Committee Report, Allowance of Fees and Expenses, Allowance of Appraiser's Fees

Description

How to fill out Connecticut Foreclosure / Motion For Approval Of Committee Sale, Approval Of Committee Deed, Acceptance Of Committee Report, Allowance Of Fees And Expenses, Allowance Of Appraiser's Fees?

Drafting legal documents can be a significant hassle unless you have accessible fillable templates. With the US Legal Forms online repository of formal documentation, you can trust the forms you find, as all adhere to federal and state laws and are validated by our experts.

Acquiring your Connecticut Foreclosure / Motion For Approval of Committee Sale, Approval of Committee Deed, Acceptance of Committee Report, Allowance of Fees and Expenses, Allowance of Appraiser's Fees from our service is incredibly straightforward. Previously authorized users with a valid subscription just need to Log In and click the Download button once they locate the correct template. Furthermore, if they wish, users can retrieve the same document from the My documents section of their profile. Nonetheless, even if you are a newcomer to our service, registering with a valid subscription will only take a few moments. Here's a quick guide for you.

Haven’t you enrolled with US Legal Forms yet? Subscribe to our service now to access any official document quickly and conveniently anytime you require, and keep your paperwork organized!

- Document compliance verification. You should carefully review the content of the form you desire and ensure it meets your requirements and aligns with your state law stipulations. Previewing your document and examining its general description will assist you with that.

- Alternative search (optional). If you come across any discrepancies, explore the library through the Search tab above until you identify a suitable template, and click Buy Now when you find the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, Log In and choose your desired subscription plan. Make a payment to proceed (PayPal and credit card options are provided).

- Template download and further usage. Select the file format for your Connecticut Foreclosure / Motion For Approval of Committee Sale, Approval of Committee Deed, Acceptance of Committee Report, Allowance of Fees and Expenses, Allowance of Appraiser's Fees and click Download to save it on your device. Print it to complete your documents manually, or utilize a multi-featured online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

The Right of Redemption in Connecticut. When the court enters a judgment of strict foreclosure, the judge sets a Law Day date for you. Your Law Day could be as soon as 21 days after the judgment. Most of the time, though, it's around 45-90 days after the judgment.

In Connecticut, all foreclosures take place through the court system. Typically, it takes about 2 or 3 months to foreclose on a property in Connecticut. However, that time frame can be extended by the court.

In Connecticut, mortgage and other foreclosures fall into one of two categories; either Strict Foreclosure (no equity-debt greater than value of property) or Foreclosure by Sale (enough equity to justify auction considering costs of sale- debt less than value of property).

Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a couple of exceptions. (12 C.F.R. § 1024.41). This 120-day period provides most homeowners with ample opportunity to submit a loss mitigation application to the servicer.

A deed in lieu of foreclosure is the result of the lender and the borrower agreeing that the borrower will give the lender a deed to the property, which secures the loan. The deed in lieu of foreclosure would obviate the need for a foreclosure.

Contact a HUD-Approved Housing Counselor Assist in identifying solutions to your financial issues. Review your budget. Negotiate with your mortgage company to address issues, including federal and CHFA programs. Assist in preparing for the Judicial Foreclosure Mediation Program.