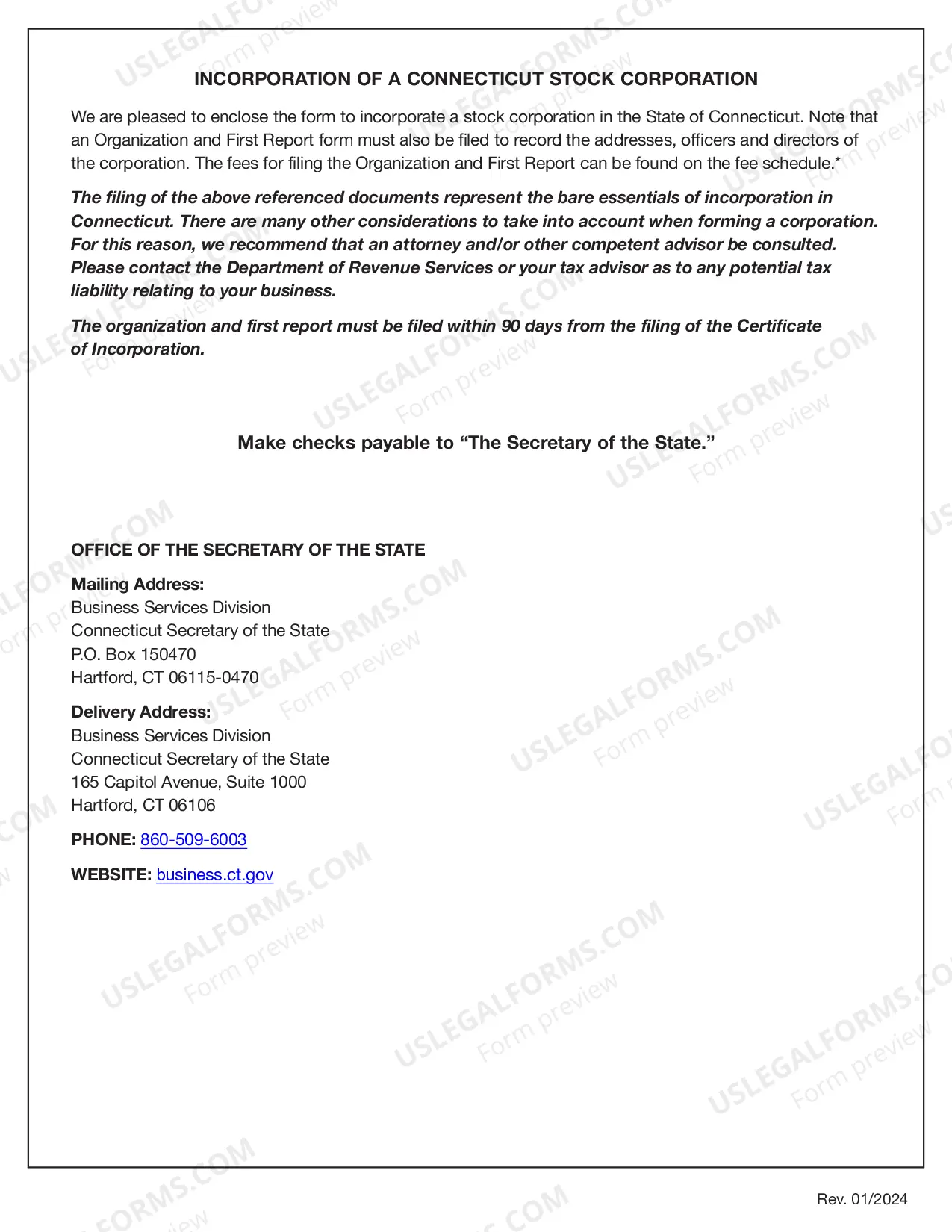

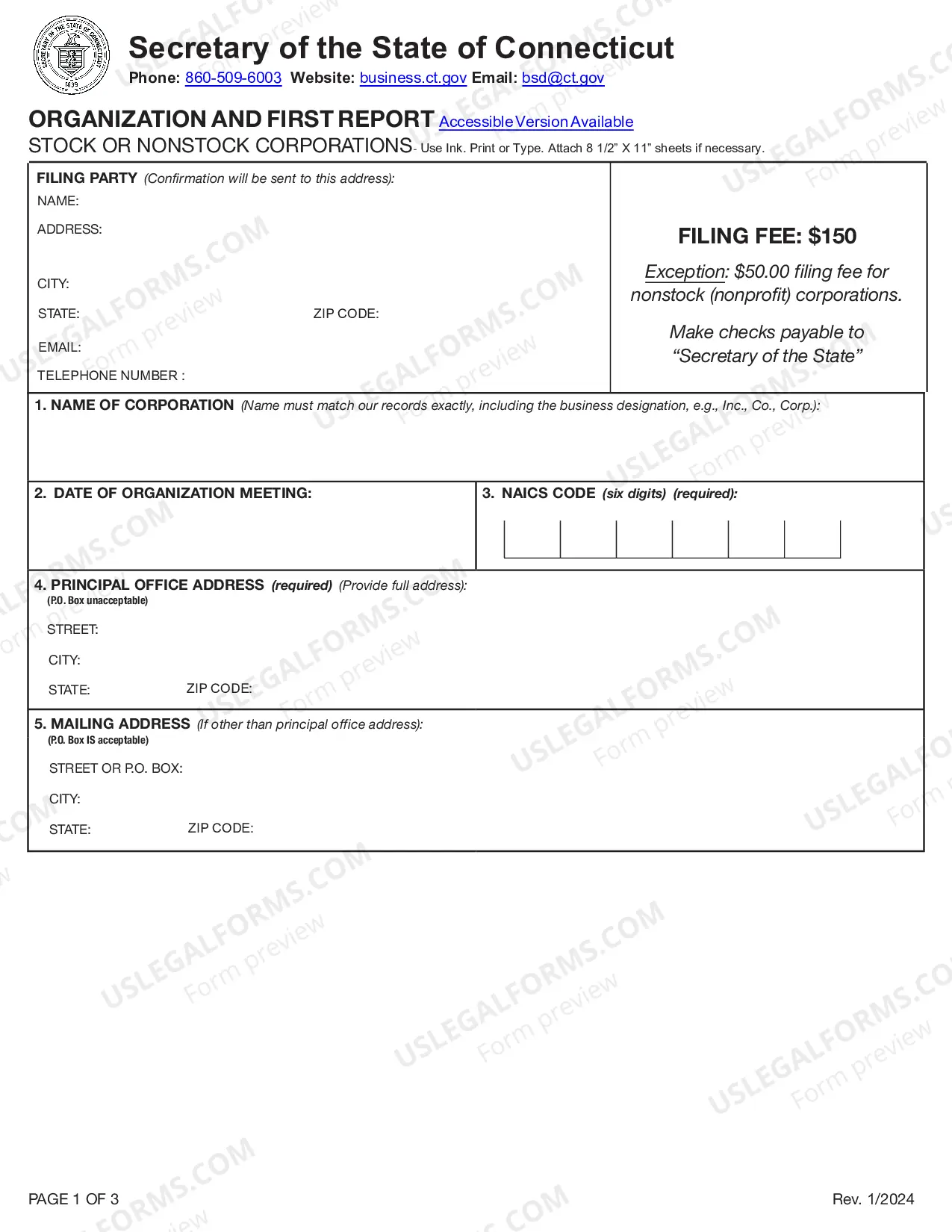

Certificate of Incorporation for a Connecticut Professional Corporation.

Ct Articles Of Incorporation

Description Certificate Of Incorporation Connecticut

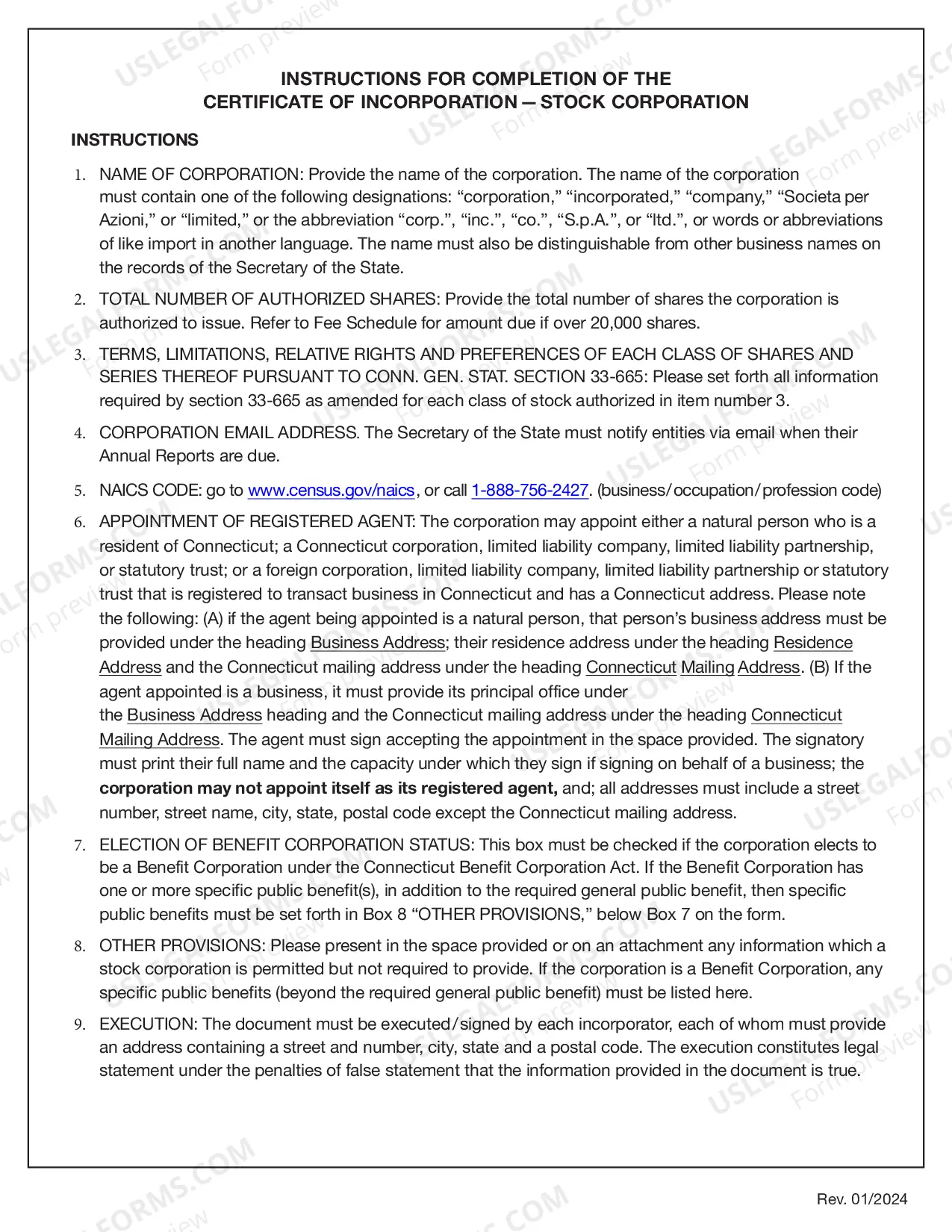

How to fill out Connecticut Certificate Of Incorporation For Professional Corporation?

The greater number of papers you should create - the more worried you become. You can find a huge number of Connecticut Certificate of Incorporation for Professional Corporation blanks on the web, nevertheless, you don't know which of them to have confidence in. Get rid of the headache and make detecting exemplars easier with US Legal Forms. Get professionally drafted documents that are composed to satisfy state requirements.

If you have a US Legal Forms subscription, log in to the account, and you'll find the Download key on the Connecticut Certificate of Incorporation for Professional Corporation’s page.

If you’ve never used our platform earlier, complete the registration procedure using these steps:

- Ensure the Connecticut Certificate of Incorporation for Professional Corporation is valid in your state.

- Double-check your decision by reading through the description or by using the Preview function if they’re provided for the chosen file.

- Click Buy Now to start the sign up procedure and choose a costs plan that suits your expectations.

- Provide the asked for details to make your profile and pay for the order with your PayPal or bank card.

- Choose a handy file type and obtain your copy.

Find each template you get in the My Forms menu. Simply go there to fill in fresh version of the Connecticut Certificate of Incorporation for Professional Corporation. Even when using properly drafted forms, it’s nevertheless vital that you think about asking the local lawyer to twice-check filled in form to be sure that your record is accurately completed. Do much more for less with US Legal Forms!