Connecticut Registration of Foreign Corporation

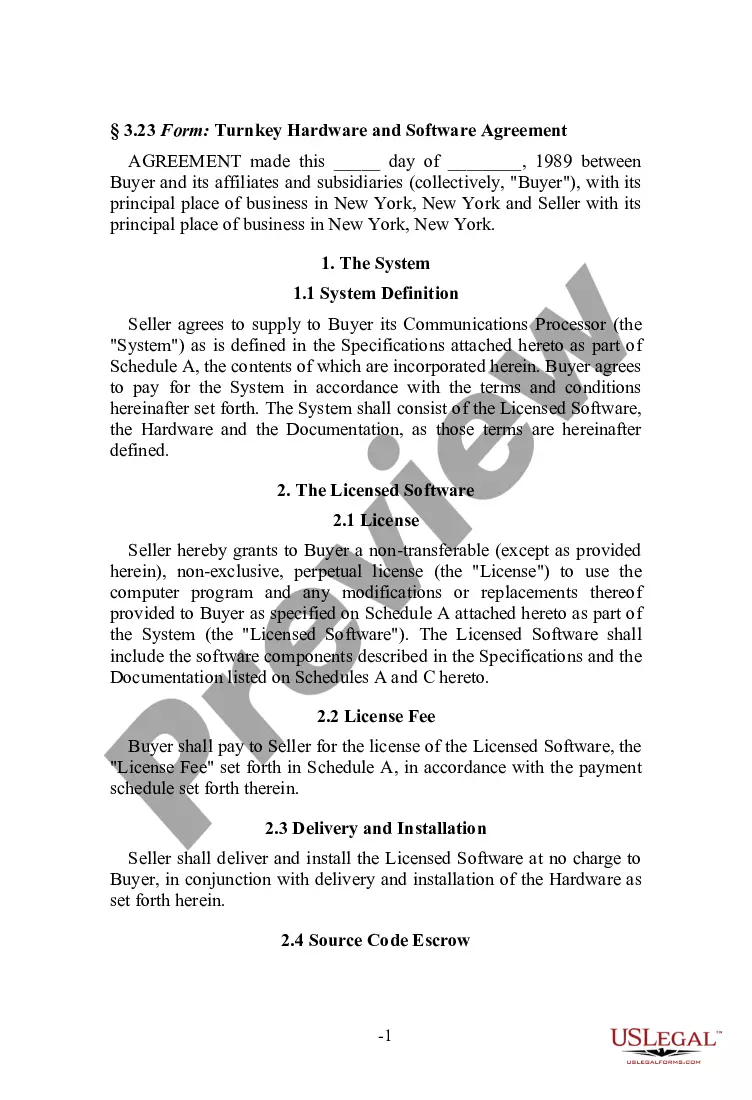

Description

How to fill out Connecticut Registration Of Foreign Corporation?

The larger quantity of documents you ought to compile - the more anxious you feel.

You can find countless Connecticut Registration of Foreign Corporation templates online, yet, you are unsure which ones to trust.

Eliminate the inconvenience and make searching for samples significantly simpler by using US Legal Forms. Obtain precisely formulated documents that are designed to fulfill state standards.

Provide the necessary information to establish your account and pay for the order using your PayPal or credit card. Choose a suitable document format and download your sample. Access each document you acquire in the My documents section. Simply navigate there to create a new version of the Connecticut Registration of Foreign Corporation. Even when possessing expertly crafted templates, it’s still important to consider consulting your local attorney to verify that your document is completed correctly. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, Log In to your account, and you will see the Download option on the Connecticut Registration of Foreign Corporation’s page.

- If this is your first time using our service, follow these instructions to complete the registration process.

- Ensure that the Connecticut Registration of Foreign Corporation is applicable in your resident state.

- Verify your selection by reviewing the description or by utilizing the Preview option if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

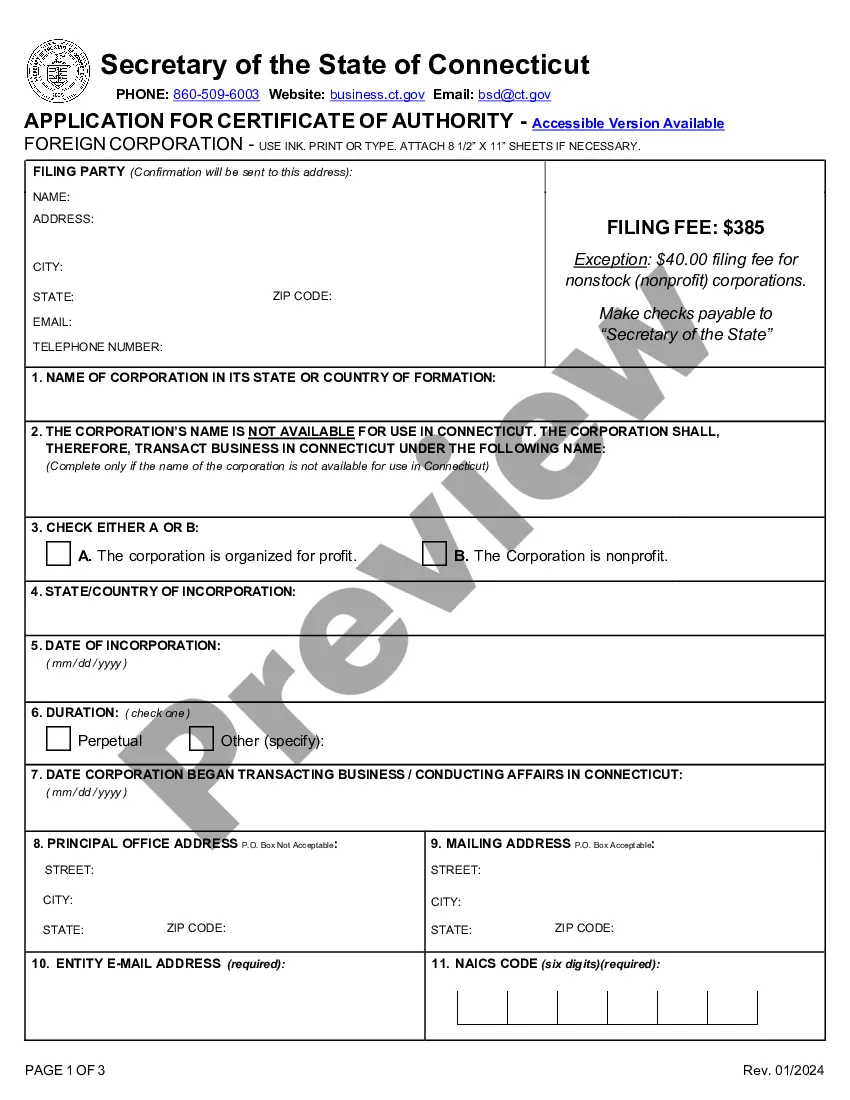

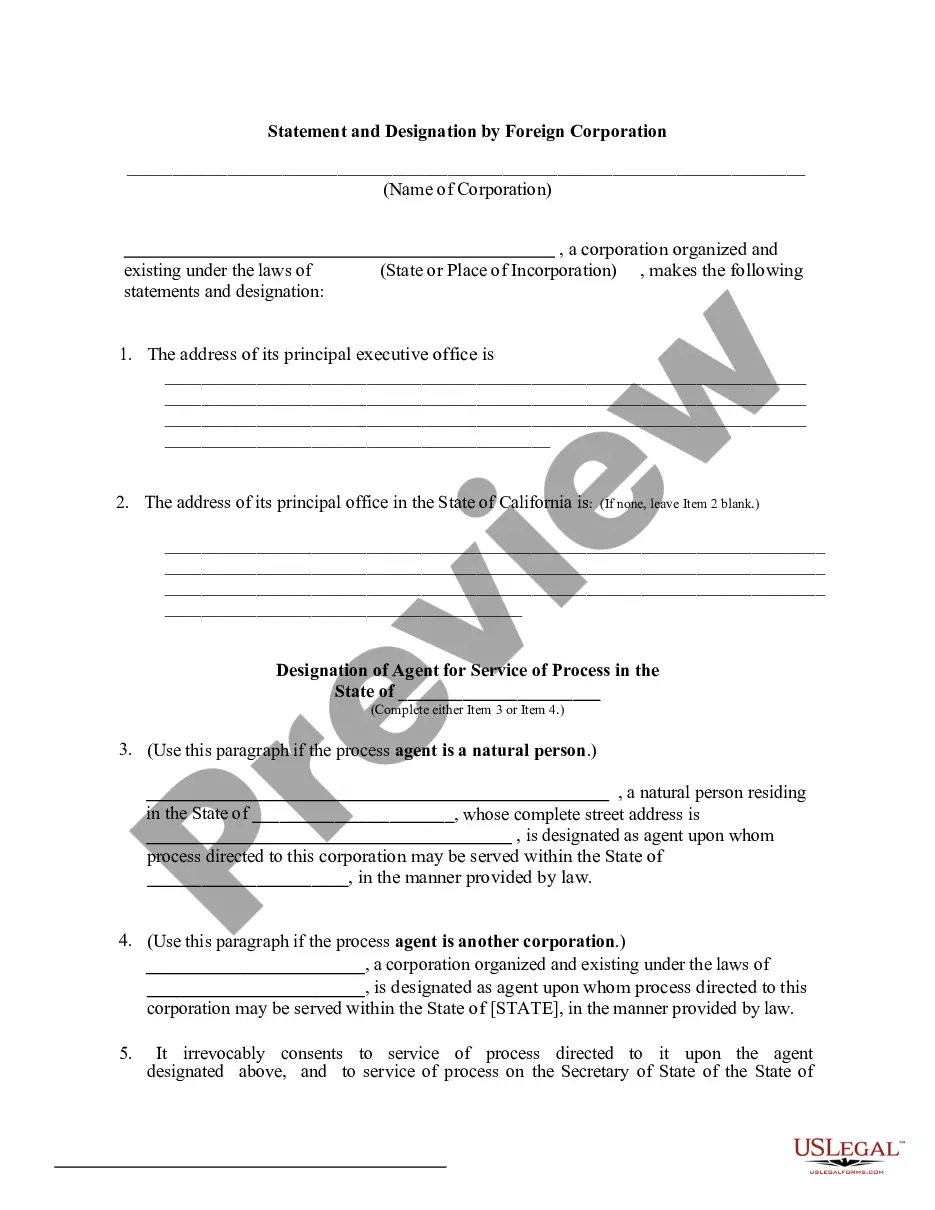

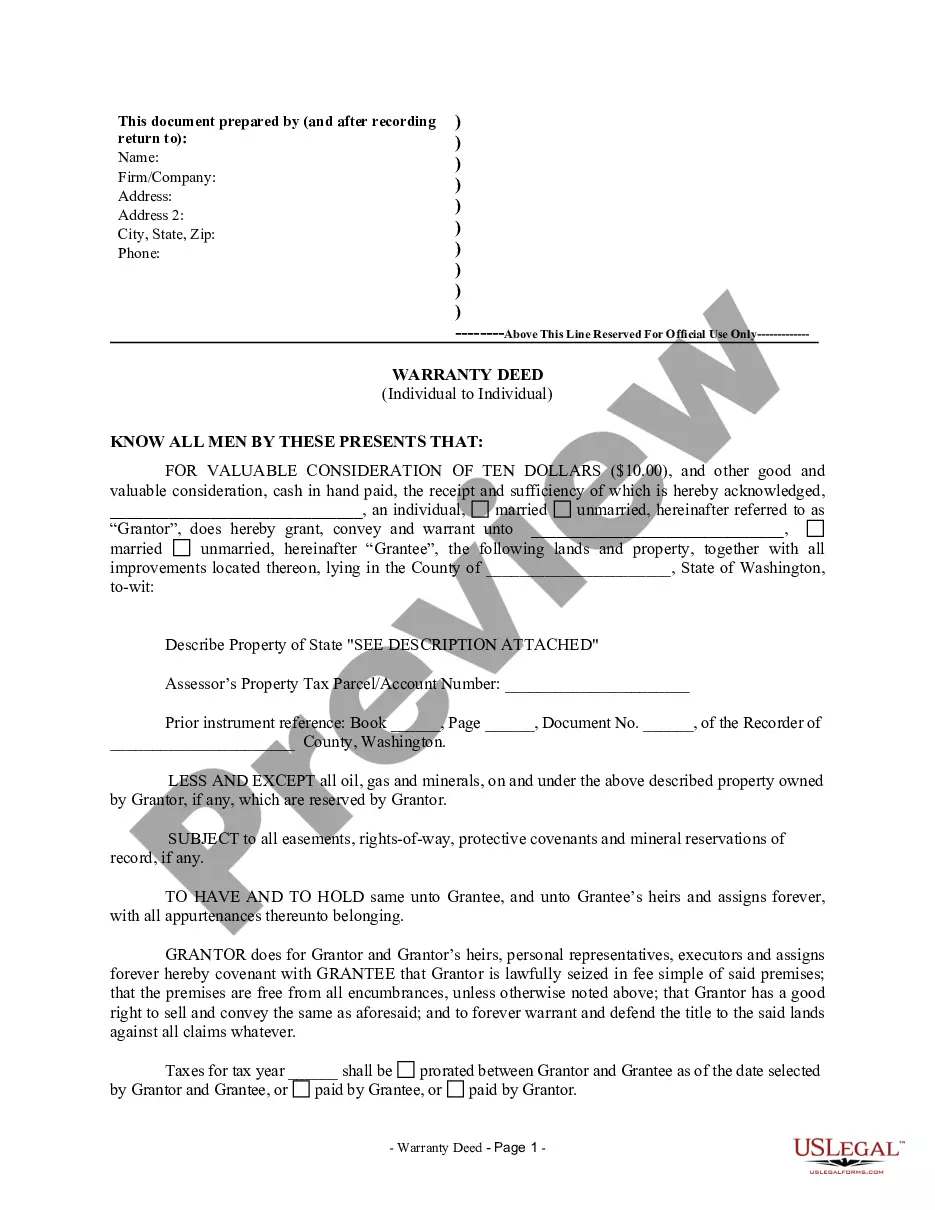

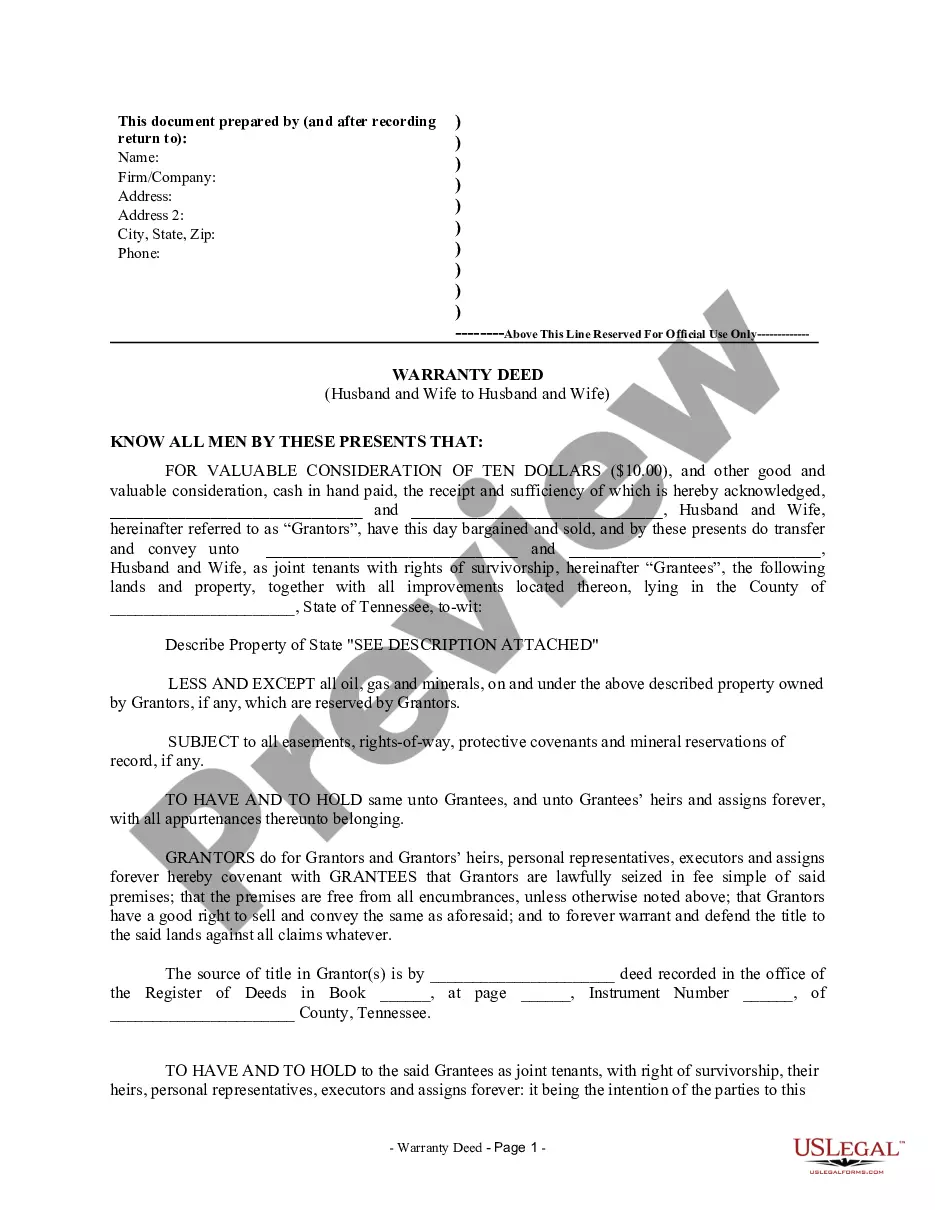

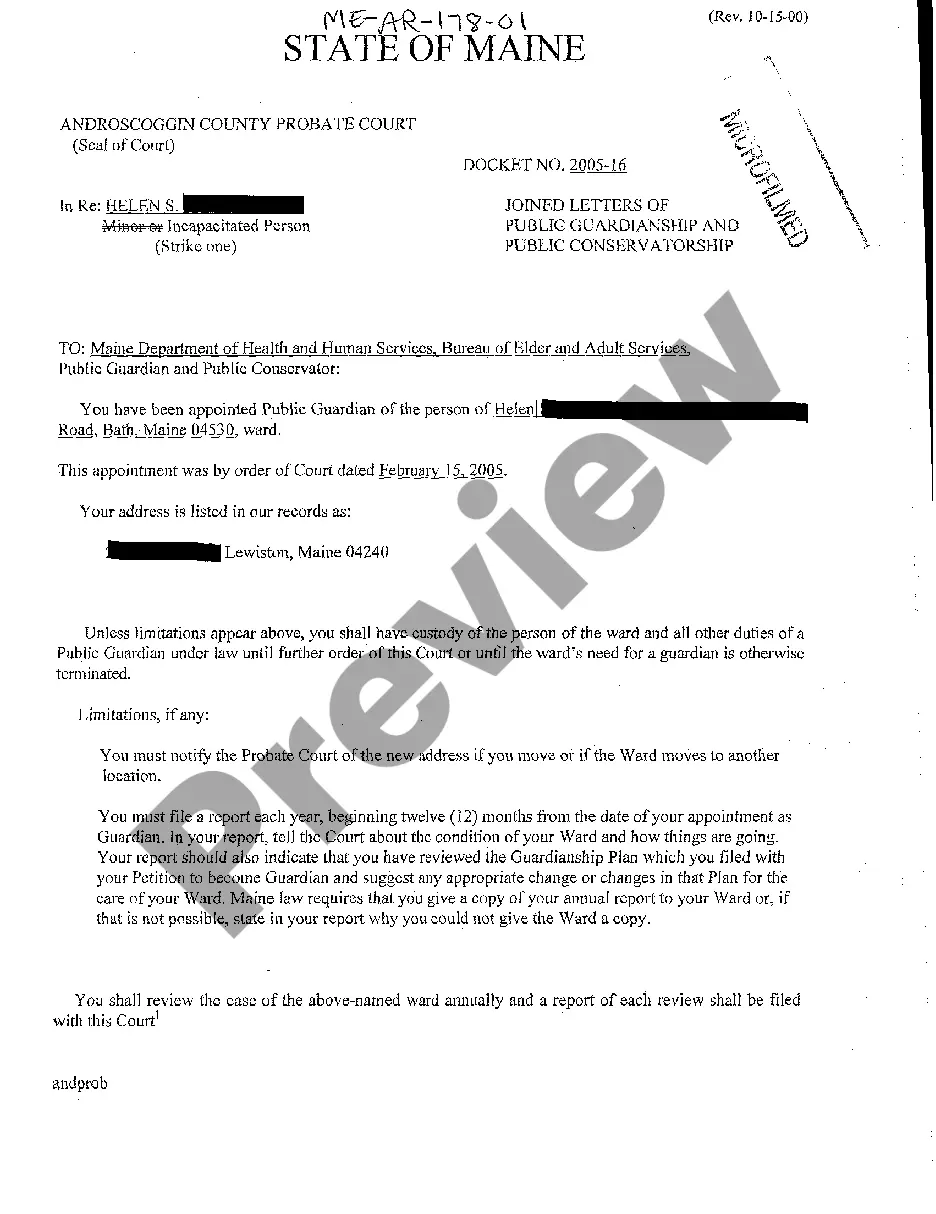

To register a foreign corporation in Connecticut, you need to submit an application for a Certificate of Authority to the Connecticut Secretary of State. This application should include essential details about your corporation, such as its name, state of incorporation, and the registered agent’s information. Completing the Connecticut Registration of Foreign Corporation correctly is crucial for compliance and smooth business operations. Consider using US Legal Forms, which provides resources to assist with the registration process, making it easier for you to navigate the requirements.

Before a foreign corporation can conduct business in Texas, it must file an application for a Certificate of Authority with the secretary of state. This document is essential for legal recognition and allows the corporation to operate within Texas. If you're considering the Connecticut Registration of Foreign Corporation process, you might want to explore similar requirements depending on the states you plan to do business in. US Legal Forms can help guide you through the application process, ensuring you meet all state requirements smoothly.

Dissolving a corporation in Connecticut requires you to file a Certificate of Dissolution with the Secretary of the State. Make sure to address any outstanding debts and obligations as part of the dissolution process. This step ensures the proper closure of your business activities. For guidance throughout this process and for help with Connecticut Registration of Foreign Corporation, consider the resources provided by US Legal Forms.

To register a foreign business in the US, you need to apply for a Certificate of Authority in the state where you plan to operate. This typically involves submitting the necessary formation documents, paying the required fees, and designating a registered agent. Through proper registration, you can successfully initiate the process of Connecticut Registration of Foreign Corporation. For a streamlined experience, explore the services offered by US Legal Forms.

To withdraw a foreign corporation from New York, you must file a Certificate of Withdrawal with the Department of State. This process effectively removes your foreign corporation from New York's records. It is important to ensure that all your taxes and obligations are met prior to filing. For assistance with the Connecticut Registration of Foreign Corporation, consider using the US Legal Forms platform.

To register as a small business, you need to choose a business structure and file the appropriate documentation with the Connecticut Secretary of State. You must also apply for any required licenses and permits pertinent to your business type. Utilizing a resource like USLegalForms can streamline the process and ensure compliance with regulations, including the Connecticut Registration of Foreign Corporation.

The minimum tax for a corporation in Connecticut is $250 annually. This tax applies regardless of whether the corporation made a profit or not. Understanding this tax is crucial as you consider the financial aspects of your business, particularly when going through the Connecticut Registration of Foreign Corporation.

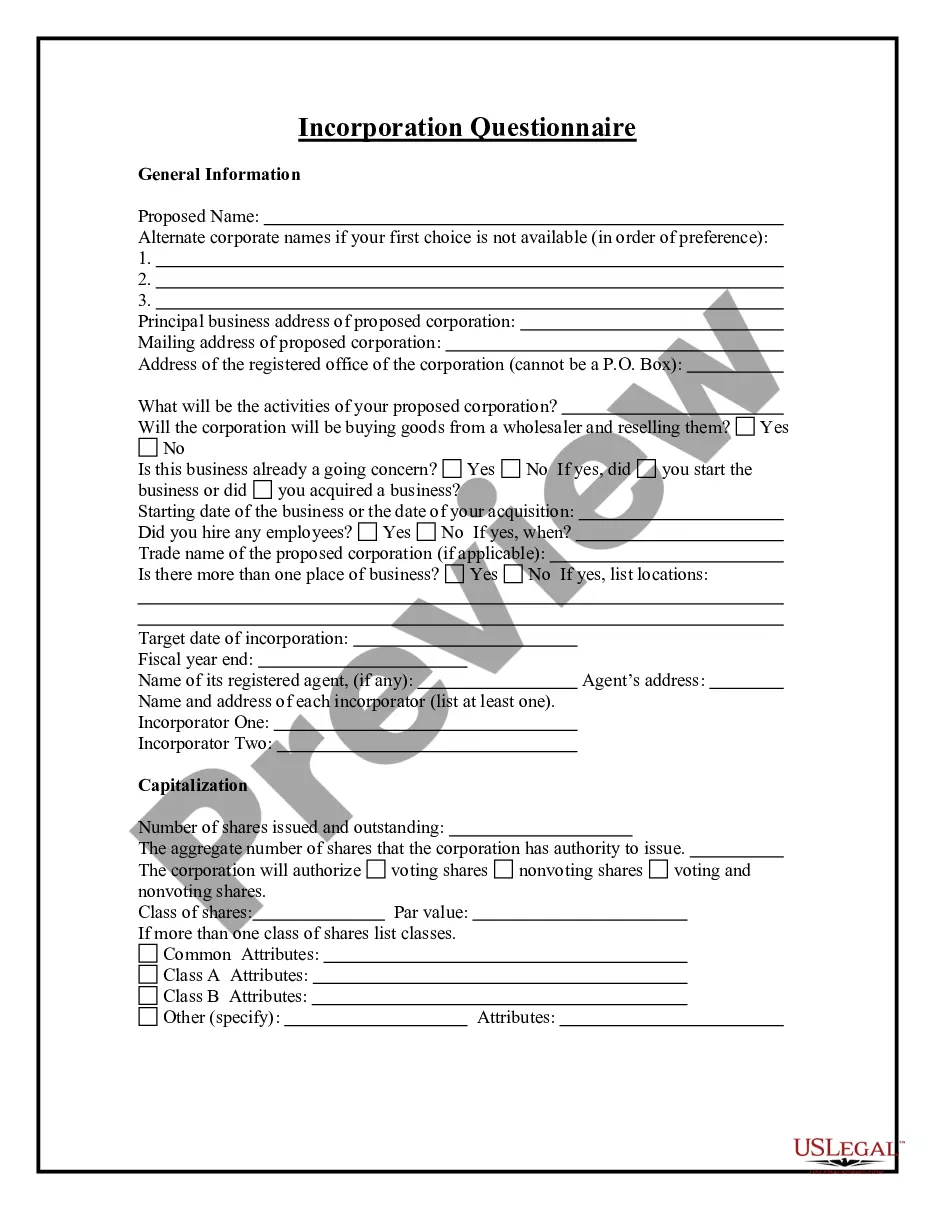

To register a corporation in Connecticut, you must first submit your Articles of Incorporation along with the necessary fees to the Secretary of State. Ensure you meet all naming requirements and designate a registered agent. Following the correct procedures will facilitate your success as you navigate the Connecticut Registration of Foreign Corporation process.

Setting up a corporation in Connecticut starts with choosing a unique name and filing Articles of Incorporation with the Secretary of State. Additionally, you need to create bylaws and appoint a registered agent. This foundational process is crucial to a successful business operation, especially when considering aspects like the Connecticut Registration of Foreign Corporation.

Registering a foreign corporation in Connecticut requires you to fill out an application for a Certificate of Authority. You must also provide a copy of your existing certificate of incorporation from your home state. Ensuring compliance with the Connecticut Registration of Foreign Corporation process can be simplified by leveraging resources available at USLegalForms.