Colorado Pipeline Service Contract - Self-Employed

Description

How to fill out Pipeline Service Contract - Self-Employed?

If you aim to accumulate, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to find the documents you require.

A range of templates for business and personal purposes are categorized by type and region, or keywords.

Step 4. Once you have found the desired form, click on the Acquire now button. Choose the payment plan you prefer and input your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the Colorado Pipeline Service Contract - Self-Employed in just a few clicks.

- If you are already a US Legal Forms client, sign into your account and click the Download button to retrieve the Colorado Pipeline Service Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for the appropriate state/country.

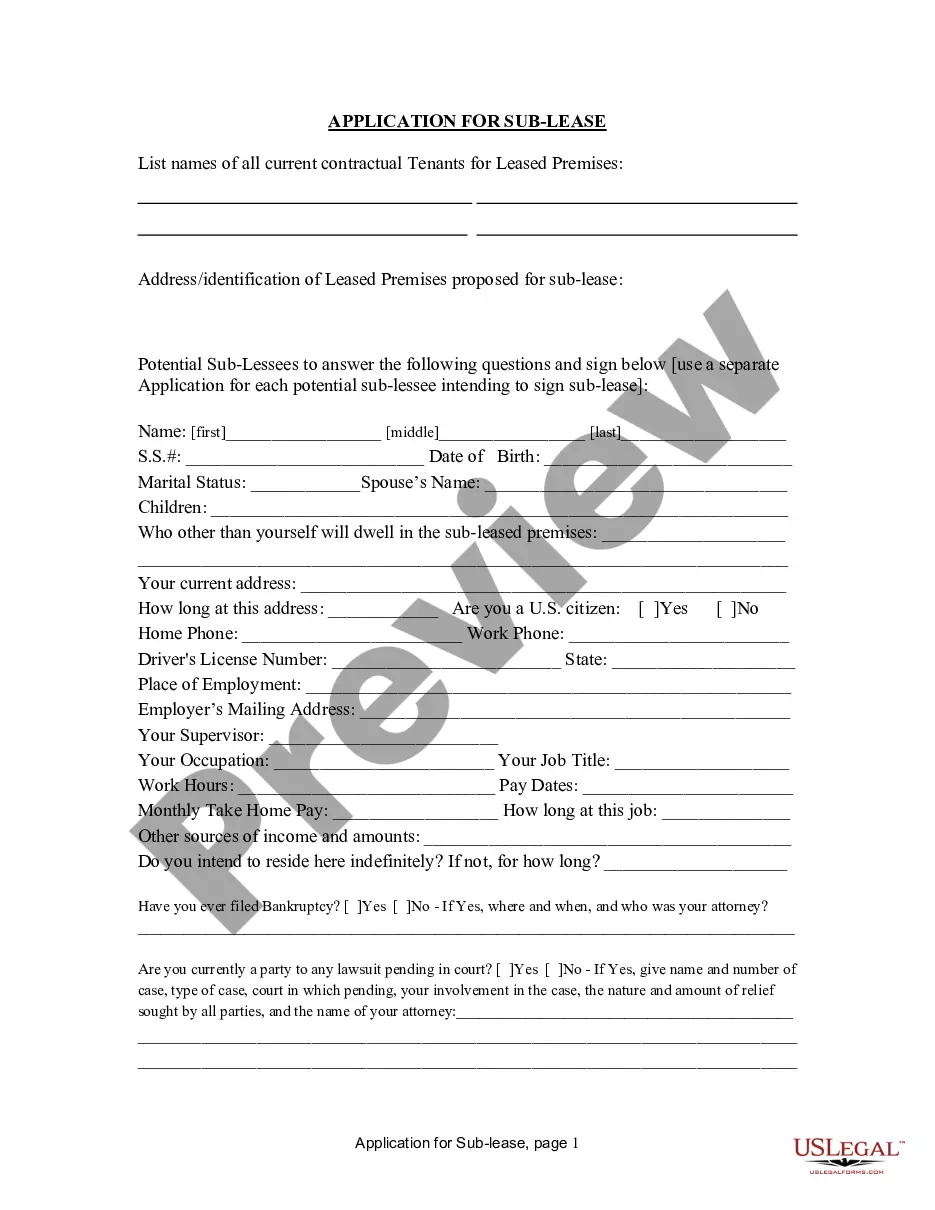

- Step 2. Use the Review feature to check the content of the form. Remember to read the details.

- Step 3. If you are unhappy with the form, utilize the Search field at the top of the screen to find alternative forms in the legal document format.

Form popularity

FAQ

In Colorado, independent contractors must comply with state regulations, including licensing and tax obligations. You must maintain accurate records of your income and expenses for tax reporting purposes. Engaging in a Colorado Pipeline Service Contract - Self-Employed often requires understanding these essentials to ensure compliance and smooth operation in your freelance work.

While it is possible to receive a 1099 form without a formal contract, it is not recommended. A contract clarifies the relationship between you and your client, detailing expectations and responsibilities. For those involved in a Colorado Pipeline Service Contract - Self-Employed, having a written agreement is crucial for successful and structured freelancing.

To perform services as an independent contractor in the U.S., you typically need to obtain the necessary licenses or permits depending on your state and the nature of your work. For Colorado, this may involve registering your business and obtaining specific local licenses. Exploring the Colorado Pipeline Service Contract - Self-Employed can guide you through these requirements and ensure your compliance with local regulations.

Yes, you can freelance without a contract; however, it is not advisable. Operating without a contract can expose you to risks related to payment and scope of work. For self-employed individuals working under a Colorado Pipeline Service Contract - Self-Employed, a contract serves as your protection and outlines the terms of engagement between you and your clients.

Without a contract, you may face misunderstandings regarding project scope, payment schedules, and deliverables. This could lead to conflicts or non-payment for your services. When working under a Colorado Pipeline Service Contract - Self-Employed, having a formal agreement can prevent such issues and provide you with legal recourse if problems arise.

While a contract is not legally required for all self-employed work, having one is highly recommended. A contract can clarify expectations, payment terms, and project details. For those engaging in the Colorado Pipeline Service Contract - Self-Employed, a well-drafted contract helps ensure protection for both the contractor and client.

Self-employed individuals own their business, setting their rates and working conditions. In contrast, contracted workers typically work for a client under specific terms outlined in a contract. Understanding this distinction is crucial for those entering the workforce as self-employed professionals under a Colorado Pipeline Service Contract - Self-Employed arrangement.

In the United States, an independent contractor must earn at least $600 from a client in a calendar year to receive a 1099 form. This requirement ensures proper reporting for tax purposes. If you are self-employed in Colorado and receive a payment of $600 or more for your services, you should expect to receive a 1099, as it aligns with the Colorado Pipeline Service Contract - Self-Employed regulations.

To declare independent contractor income, you need to report earnings on your tax return using the appropriate forms such as Schedule C. It's essential to keep accurate records of your income and expenses throughout the year. By effectively managing your finances in a Colorado Pipeline Service Contract - Self-Employed, you can simplify this process and ensure compliance.

Both terms have their significance, but they can be used interchangeably in many contexts. Saying 'self-employed' emphasizes your business status, while 'independent contractor' highlights your method of work. When discussing a Colorado Pipeline Service Contract - Self-Employed, either term effectively describes your role.