Colorado Leasehold Interest Workform

Description

How to fill out Leasehold Interest Workform?

Are you currently in a situation where you need documents for potentially organizational or personal purposes nearly every day.

There are numerous legal document templates accessible online, yet finding ones you can trust is not simple.

US Legal Forms offers a vast selection of form templates, such as the Colorado Leasehold Interest Workform, that are crafted to comply with state and federal requirements.

Select the pricing plan you desire, provide the required information to create your account, and purchase your order using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Afterward, you can download the Colorado Leasehold Interest Workform template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/region.

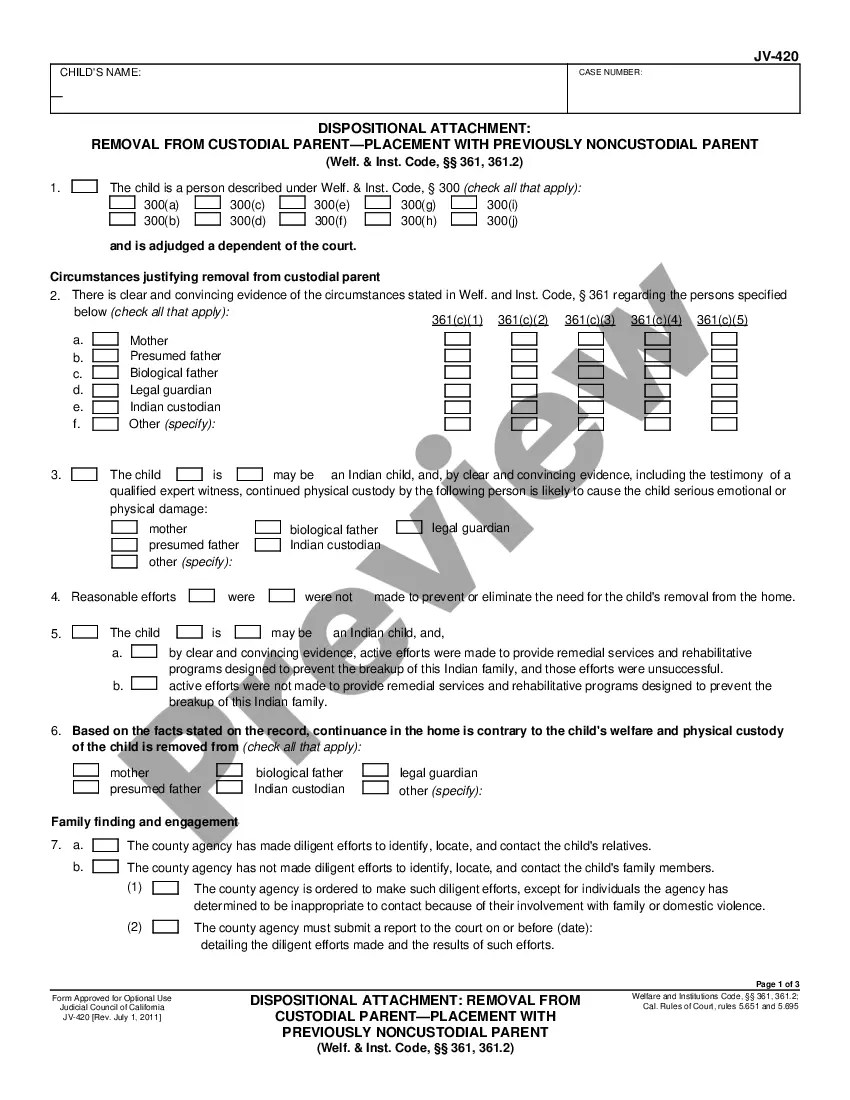

- Utilize the Review button to inspect the form.

- Check the summary to confirm that you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to locate the form that suits your needs and requirements.

- Once you find the correct form, click Acquire now.

Form popularity

FAQ

Yes, a leasehold interest is considered a possessory interest in real estate. This means you have the right to occupy and use the property based on the terms of the lease. Understanding its implications is crucial, particularly when completing your Colorado Leasehold Interest Workform.

Form 1099-G is issued by government entities such as state and local governments in the United States. This form reports various types of income, including unemployment compensation and state tax refunds. If you engage in transactions related to a Colorado Leasehold Interest Workform, you might receive this form from relevant authorities.

To avoid capital gains tax on real estate in Colorado, you can consider utilizing 1031 exchanges or primary residence exclusions. Additionally, engaging with a legal or financial expert can help you navigate the specific requirements related to your Colorado Leasehold Interest Workform and other investments.

To retrieve your Colorado 1099-G, you should access the Colorado Department of Revenue's online services. If necessary, you may also request a physical copy through the mail. Ensuring you have this form will facilitate the accurate disclosure of income related to your Colorado Leasehold Interest Workform.

If you do not receive your 1099-G form, it's advisable to contact the Colorado Department of Revenue immediately. They can assist you in obtaining a duplicate or help verify your income reporting. Missing this form can complicate the reporting of incomes tied to your Colorado Leasehold Interest Workform.

To obtain your 1099-G form in Colorado, visit the state’s Department of Revenue website. Follow the instructions provided to request your form either online or by mail. It’s important to keep this document on hand, especially if it relates to your Colorado Leasehold Interest Workform.

You can easily access your 1099-G form through the Colorado Department of Revenue's website. Once there, navigate to the section for tax forms and select the 1099-G. If you receive payments related to a Colorado Leasehold Interest Workform, this document is crucial for accurately reporting your income.

To mail Colorado tax forms, use the specific address provided on the form for submission. It’s crucial to ensure that you send your forms to the correct location to avoid delays. By utilizing the Colorado Leasehold Interest Workform, you gain insights into not only your tax obligations but also the best practices for submissions.

2 form with Colorado withholding indicates that your employer has deducted state taxes from your earnings. This ensures that your tax responsibility is managed throughout the year. Utilizing the Colorado Leasehold Interest Workform can assist in understanding how these withholdings affect your overall tax situation.

The possessory interest tax applies to individuals or entities that hold a right to occupy or use property owned by someone else. This tax is particularly relevant for leaseholders. Using the Colorado Leasehold Interest Workform can help you navigate this tax obligation clearly and effectively.