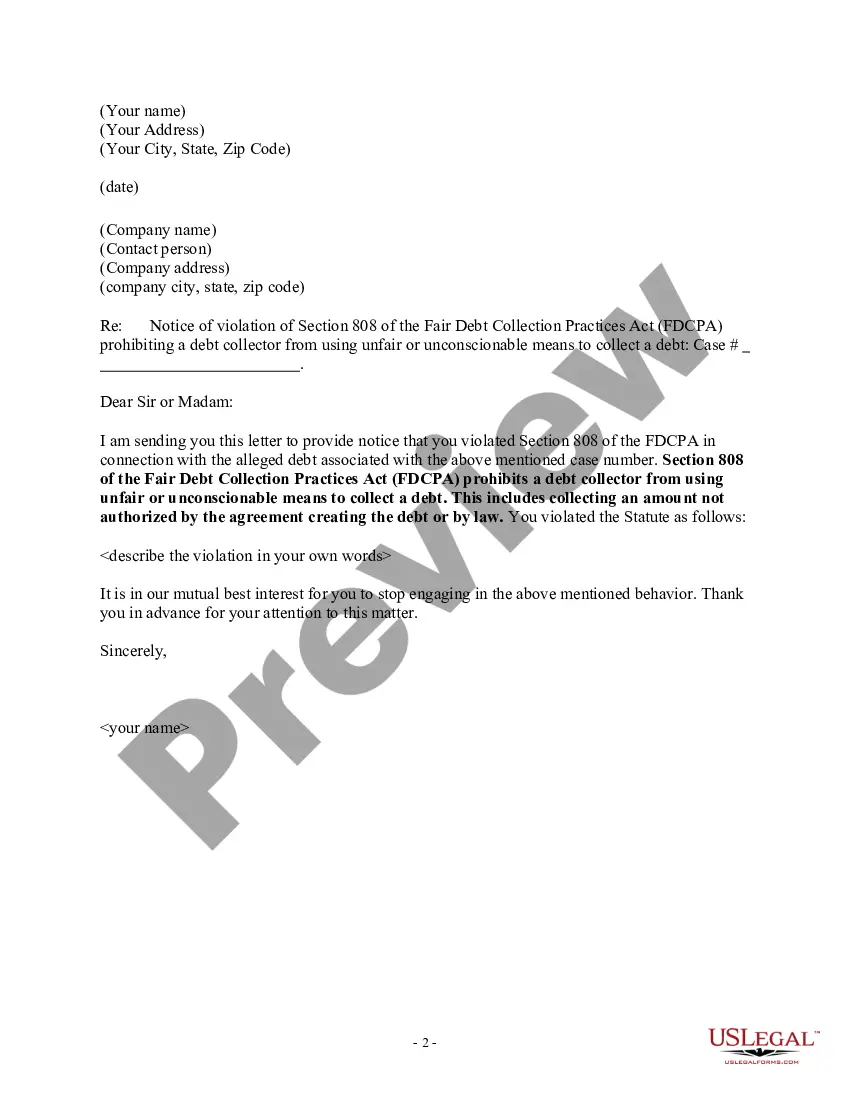

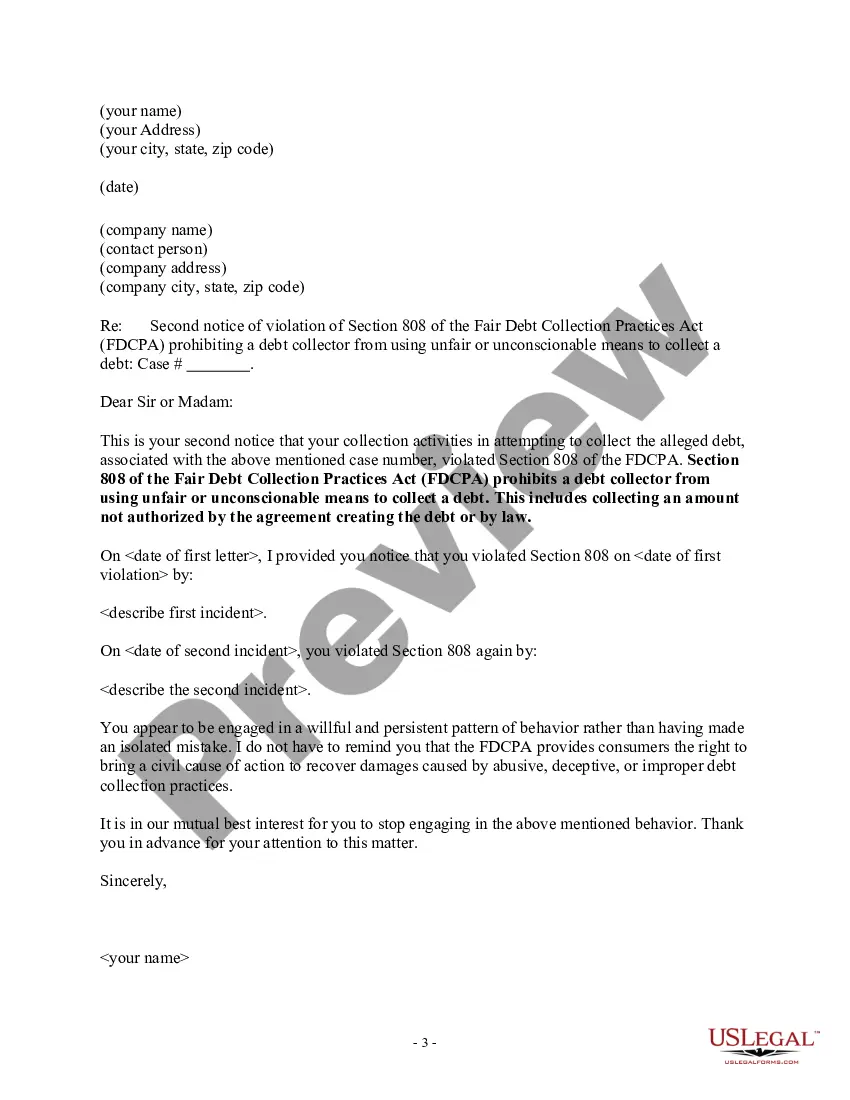

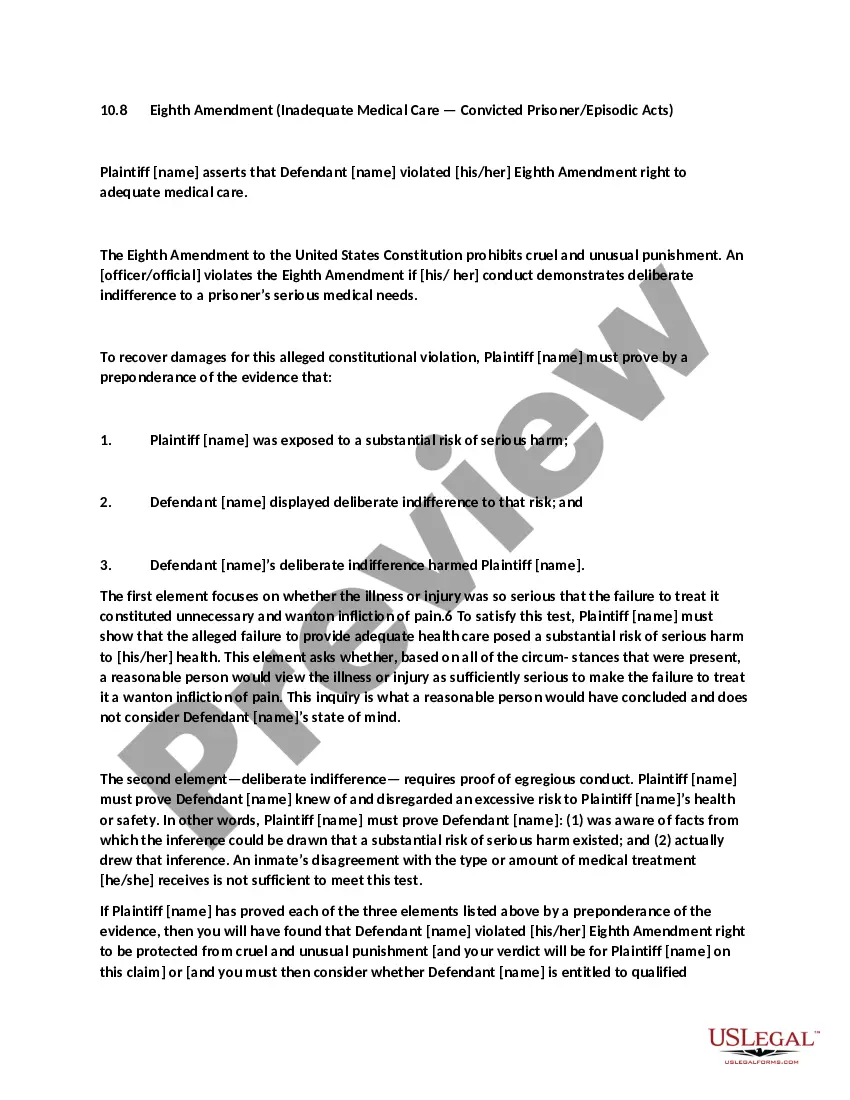

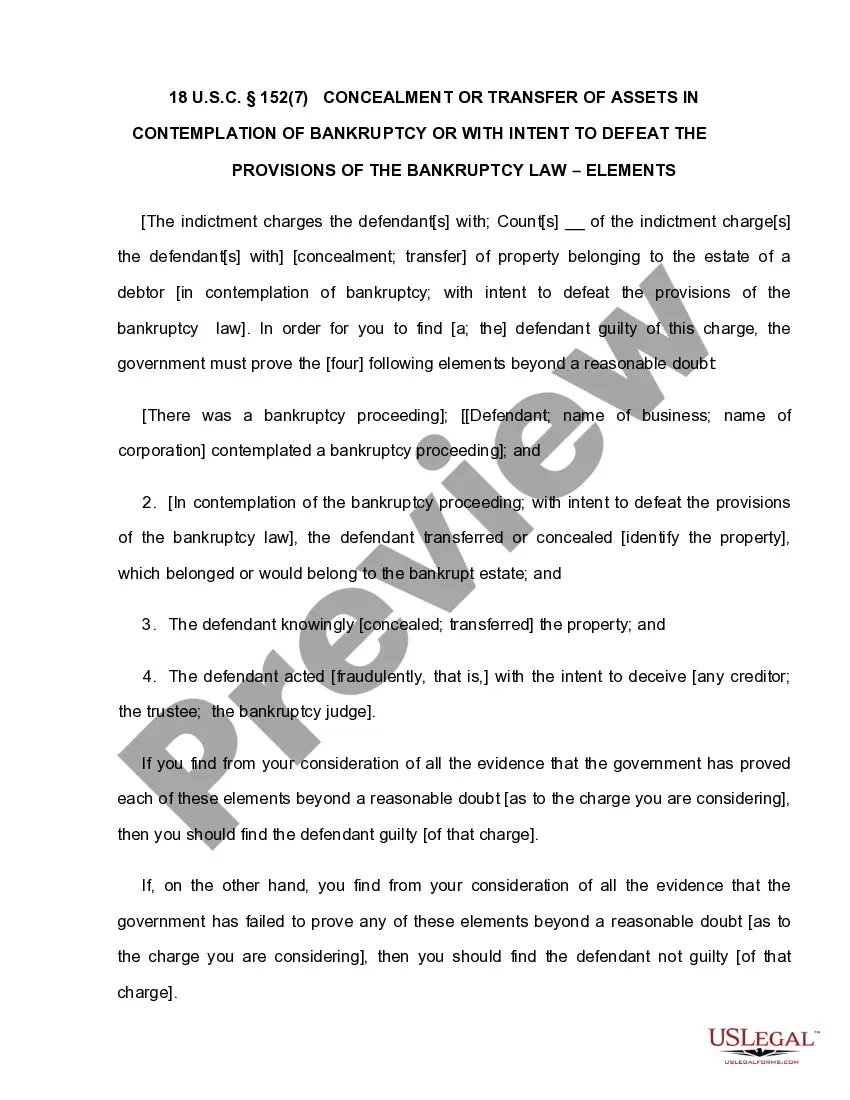

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Colorado Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

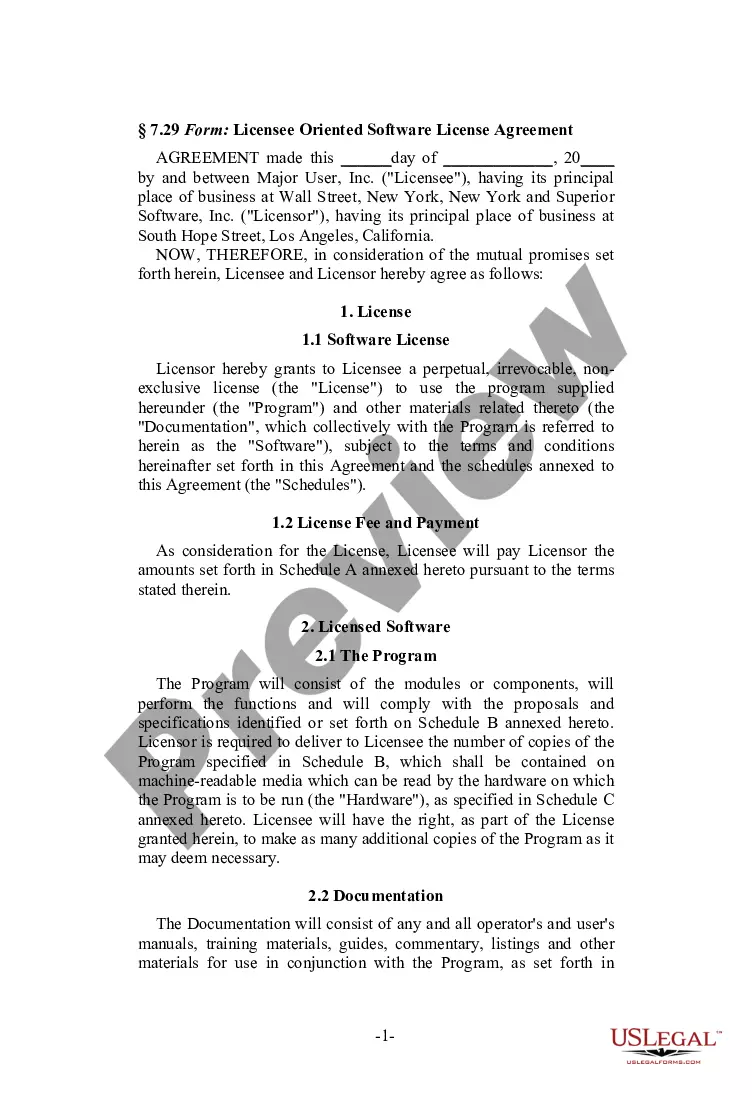

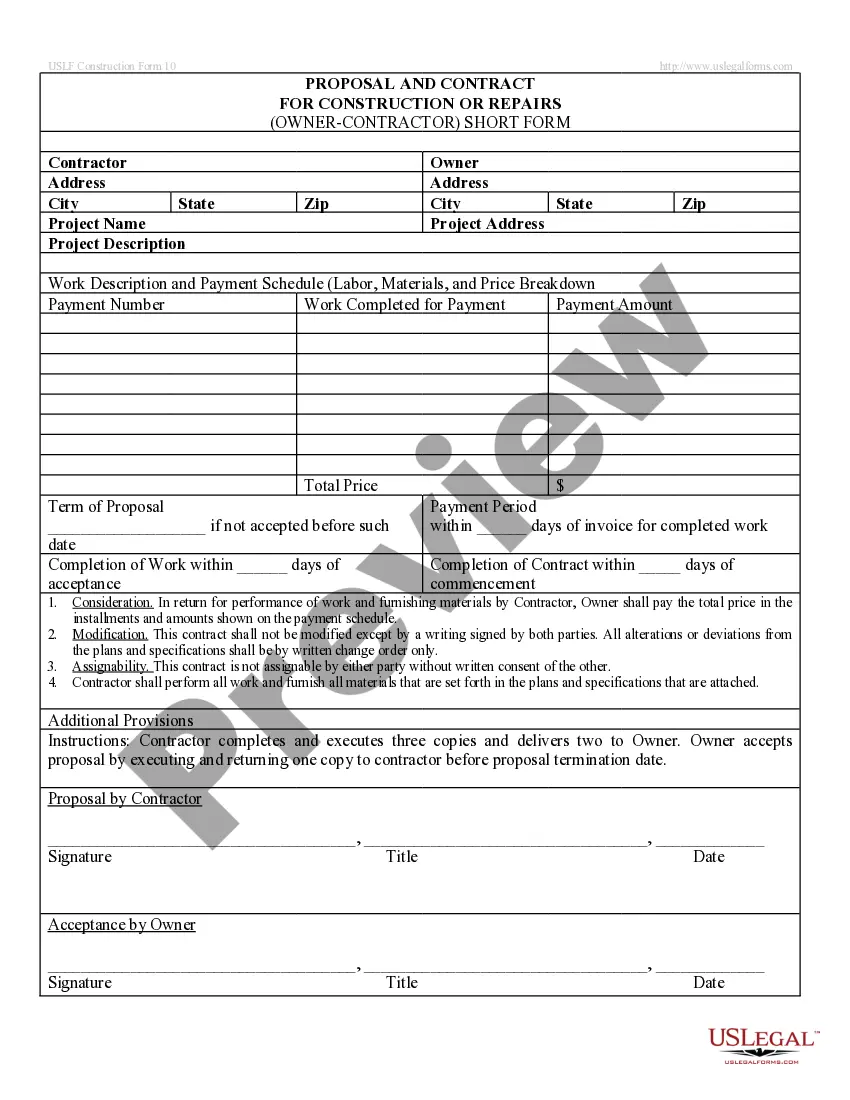

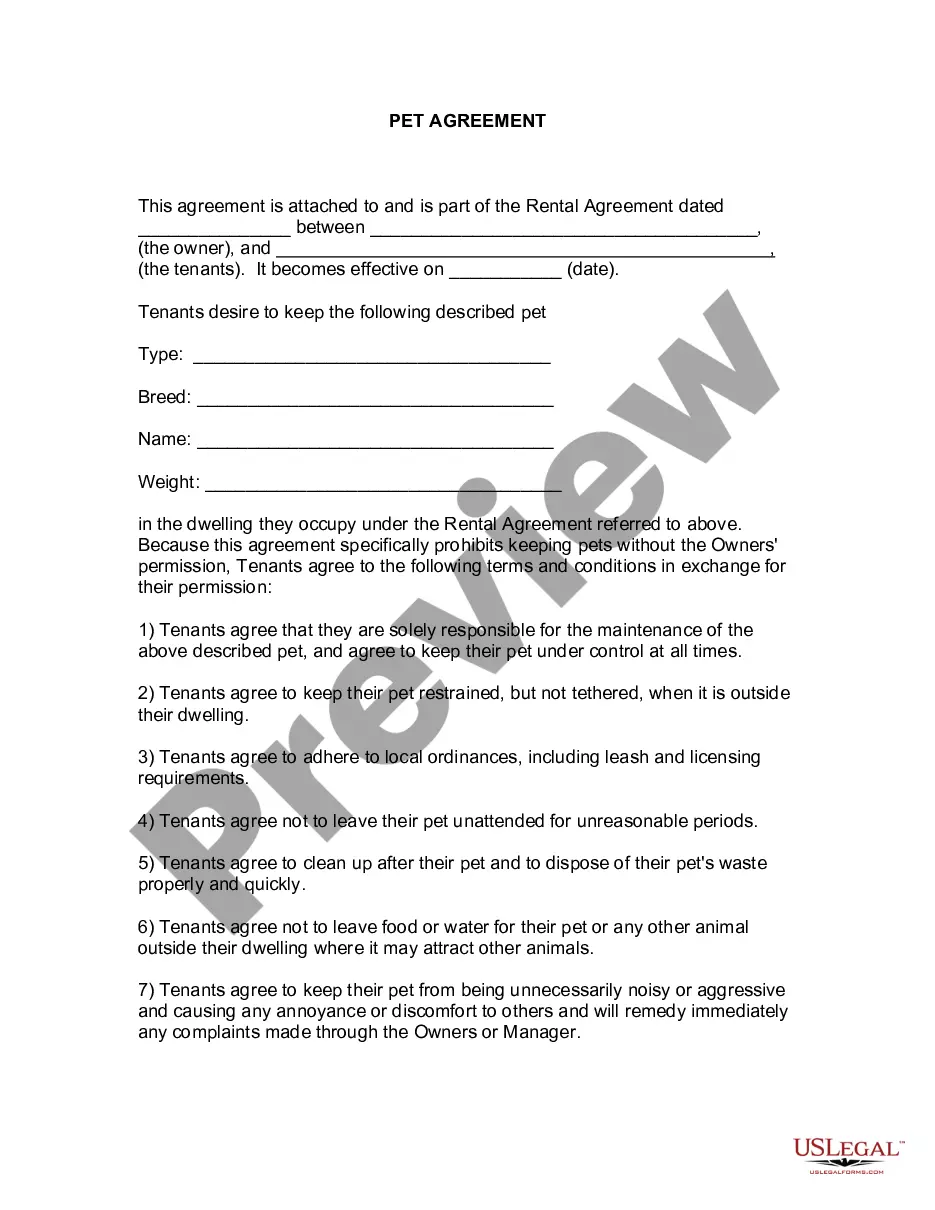

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Locating the appropriate authentic document format may prove to be a challenge.

It goes without saying that there is a multitude of templates accessible online, but how can you find the authentic form you require.

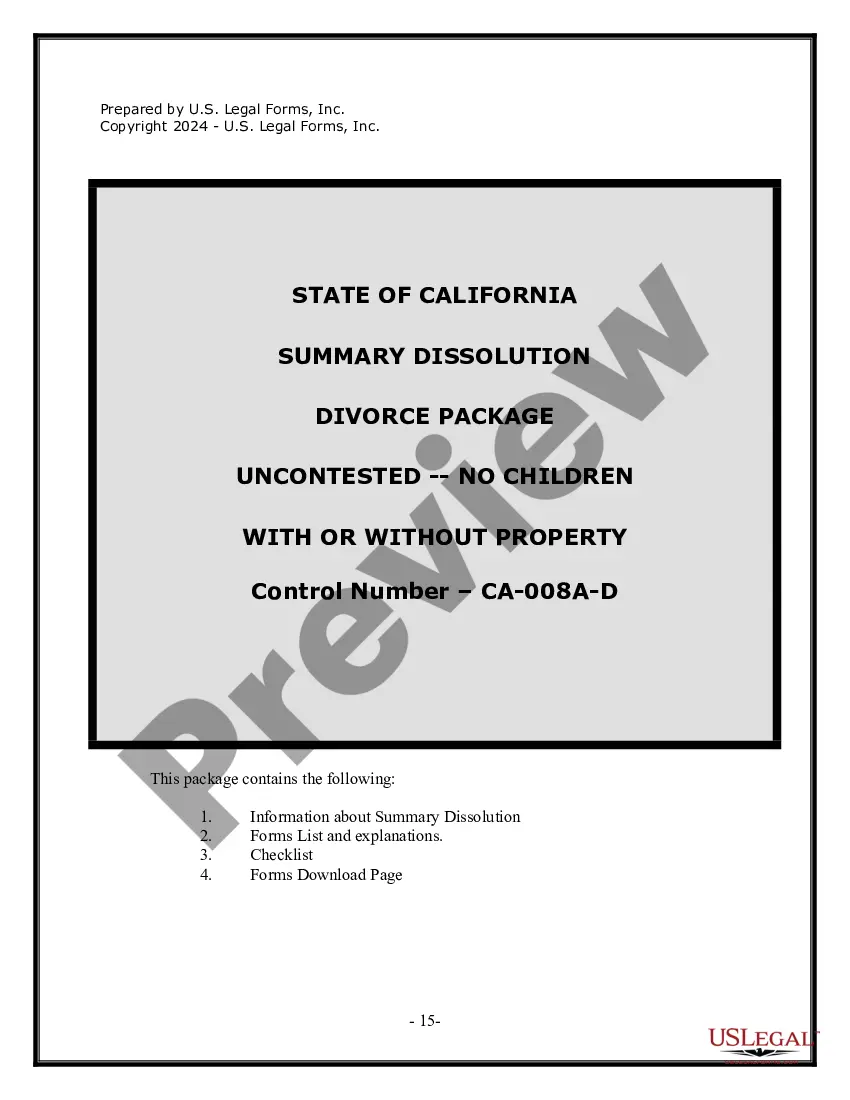

Utilize the US Legal Forms website. The service offers thousands of templates, including the Colorado Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, which you can utilize for business and personal purposes.

If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident the form is correct, click the Buy now button to purchase the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, modify, print, and sign the obtained Colorado Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that comply with state requirements.

- All of the forms are verified by professionals and comply with state and federal regulations.

- If you are already authorized, Log In to your account and click the Download button to obtain the Colorado Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

- Use your account to browse through the legal forms you have purchased previously.

- Navigate to the My documents section of your account to retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines to follow.

- First, ensure you have selected the correct form for your city/region. You may review the form using the Review button and read the form details to verify it is suitable for you.

Form popularity

FAQ

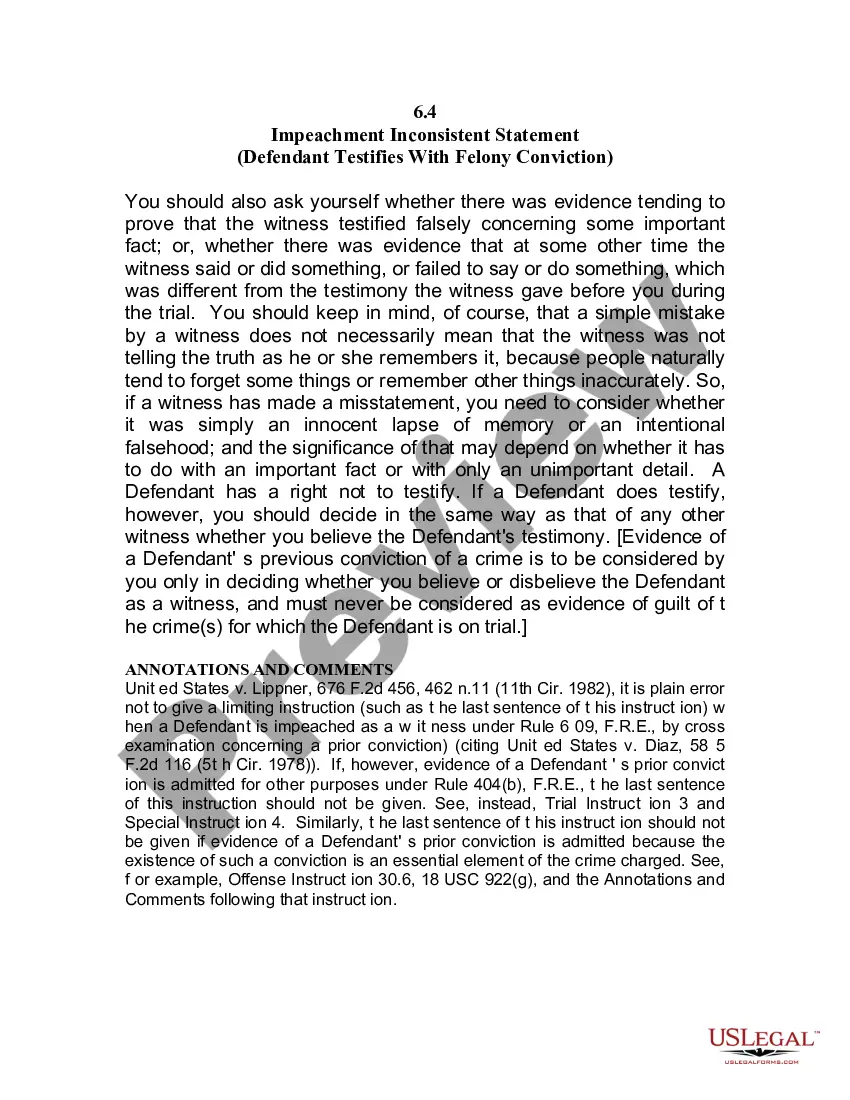

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

Collection accounts can remain on your report for seven years and 180 days from the original delinquency. Depending on the type of account and your location, this can be more than or less than the statute of limitations.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

In Colorado, a judgment in County Court lasts for 6 years, a judgment in District Court lasts for 20 years. Either can be renewed at the end of that period, but eventually, a judgment becomes unenforceable.

Colorado puts a limit on how long creditors can seek to collect on old debts. These statutes of limitations range from Three Years for certain contracts to 20 years for District Court judgments.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Also, under Colorado law, from June 29, 2020, through June 1, 2021, up to $4,000 cumulative in a depository account or accounts in a debtor's name is exempt from levy and sale under a writ of attachment or execution. If you live in Colorado, several laws protect you from abusive or overreaching debt collection tactics.