Colorado Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

You can invest hours online searching for the legal document template that meets the federal and state requirements you desire. US Legal Forms offers an extensive collection of legal forms that can be reviewed by experts.

You can download or print the Colorado Resolution of Meeting of LLC Members to Dissolve the Company from the service.

If you already possess a US Legal Forms account, you can Log In and click the Acquire button. Afterwards, you can fill out, modify, print, or sign the Colorado Resolution of Meeting of LLC Members to Dissolve the Company. Every legal document template you purchase is yours permanently. To access another version of a purchased template, navigate to the My documents tab and click the appropriate button.

Obtain and print numerous document templates using the US Legal Forms website, which provides the largest collection of legal forms. Use professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

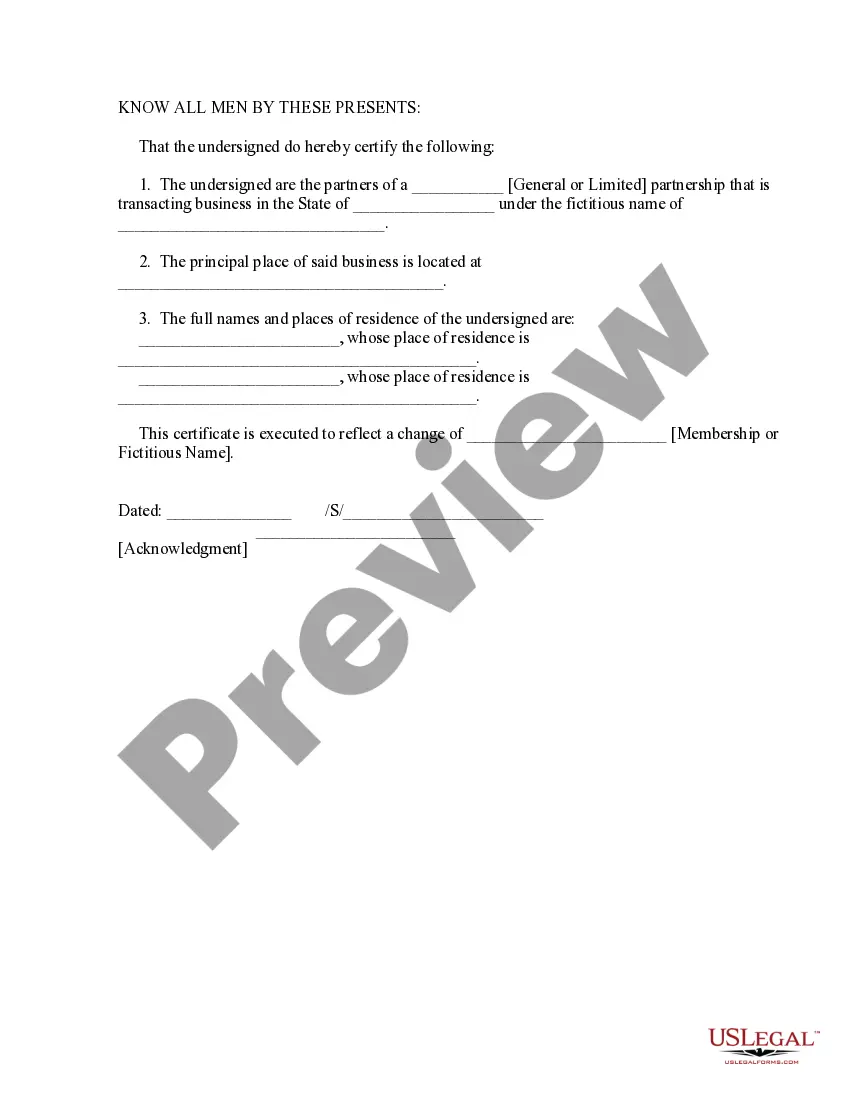

- First, make sure you have selected the correct document template for the region/city of your choice. Review the template description to ensure you have chosen the appropriate template. If available, use the Preview button to view the document template as well.

- To find another version of the template, utilize the Search field to locate the template that fits your needs and specifications.

- Once you have identified the template you want, click on Acquire now to proceed.

- Select the pricing plan you prefer, enter your information, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of the document and download it to your device.

- Make modifications to the document if necessary. You can complete, edit, sign, and print the Colorado Resolution of Meeting of LLC Members to Dissolve the Company.

Form popularity

FAQ

Once you're on your business's listing on the website go to file a form and then select statement curing delinquency (as shown in the image below). You'll need to include the registered agent name, office address, and mailing address.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

If a registered entity fails to submit its annual report and pay the filing fee timely, eventually DFI will place the entity in 200bDelinquent Status. When in Delinquent Status, the entity will not be able to fb01le any other documents with the Department until the entity is brought back to good standing by fb01ling all past

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

The Colorado Secretary of State no longer administratively or involuntarily dissolves LLCs, but it will give your LLC delinquent status if it fails to: file periodic reports. appoint and maintain a registered agent.

A dissolution/withdrawal must be filed electronically through our website. On the Summary page of the entity, scroll down and select File a form. Once the form is ready for filing, the system will proceed to the first of three payment pages. Your filing is complete once you see a Confirmation page.

Colorado requires you to file the statement online through the Secretary of State website and pay a $25 fee. The online dissolution filing is typically processed immediately. You should note that following your LLC's dissolution, others can legally use the business name.

You can get some idea of what a statement of dissolution contains by downloading the sample form from the SOS website. However, Colorado requires that all statements of dissolution be filed online using the state's online filing system. There is a $25 fee to file the statement.