Colorado Specific Guaranty

Description

How to fill out Specific Guaranty?

It is feasible to invest time online searching for the suitable legal document template that meets the federal and state requirements you are looking for.

US Legal Forms provides a vast array of legal forms that have been reviewed by specialists.

You can acquire or print the Colorado Specific Guaranty from our service.

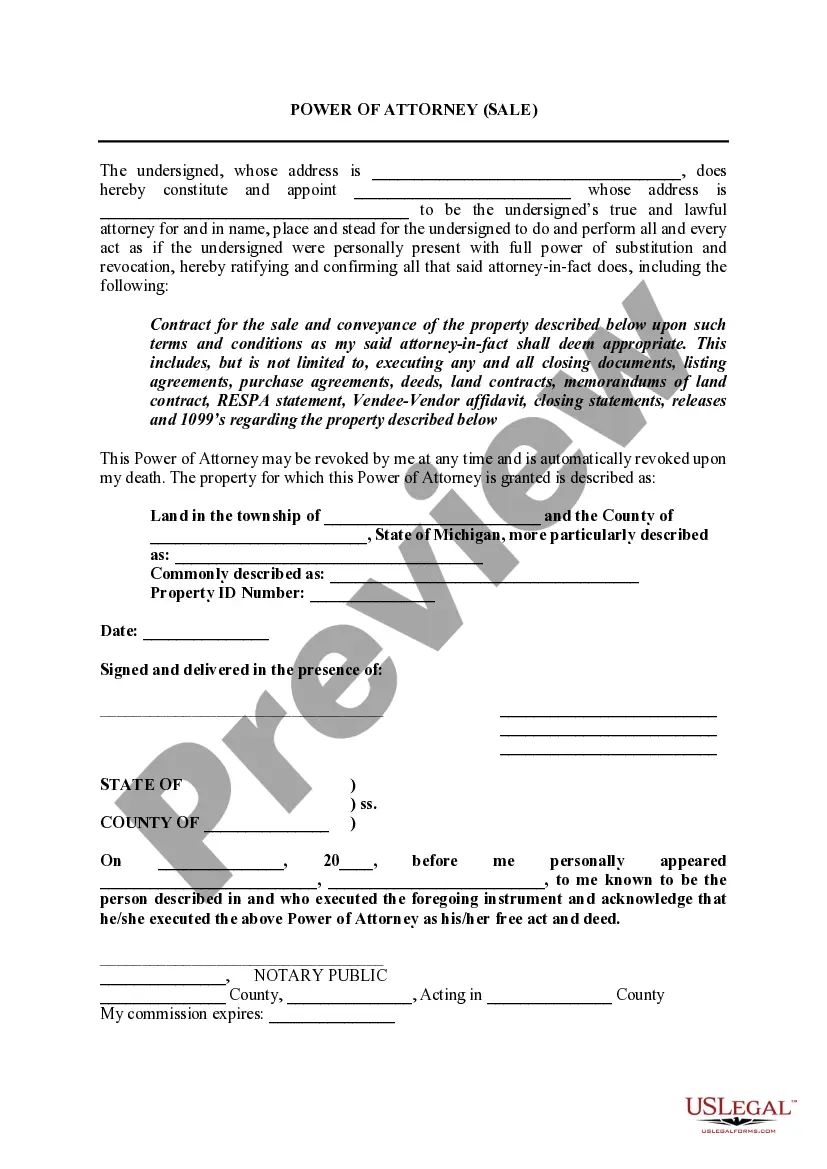

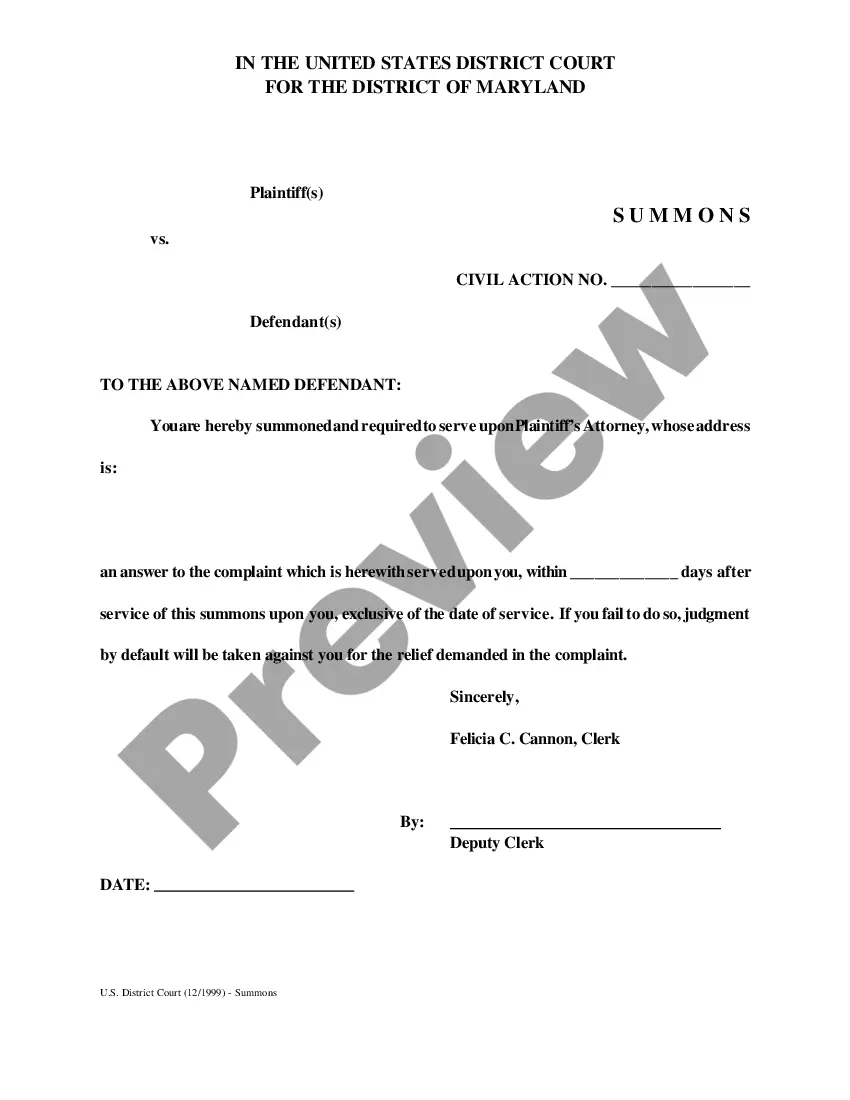

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Colorado Specific Guaranty.

- Each legal document template you obtain is yours permanently.

- To retrieve another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have chosen the correct document template for your state/city of preference.

- Refer to the form description to confirm you have selected the right form.

Form popularity

FAQ

Getting Colorado state tax forms is easy and can be done through several channels. You can visit the Colorado Department of Revenue’s website to find and download the forms you need. Additionally, the Colorado Specific Guaranty assures you that these resources are accurate and reliable. For more comprehensive assistance, consider using services like USLegalForms, which guides you through the process and provides you with the correct documentation.

To get a copy of your Colorado tax return, you can log in to your account on the Colorado Department of Revenue’s website. The Colorado Specific Guaranty works to secure your records and ensure the request process is straightforward. If you need further assistance, platforms like USLegalForms offer easy solutions for accessing and managing your tax documents. This way, you have peace of mind knowing your records are in good hands.

Absolutely, you can request tax forms online to save time and hassle. The Colorado Specific Guaranty enables you to access necessary forms quickly via the state’s website or by using online services such as USLegalForms. This convenience streamlines your tax preparation process, allowing you to focus on other important matters. Just ensure you have the correct information ready to make the request.

Yes, Colorado requires a state tax form for filing your taxes. The Colorado Specific Guaranty ensures that you comply with state regulations by submitting the correct documentation. It's important to use the appropriate tax forms to avoid any issues with your returns. You can find these forms directly on the Colorado Department of Revenue website or through platforms like USLegalForms.

Establishing nexus in Colorado requires conducting business activities that the state recognizes, such as maintaining a physical presence or making significant sales. If your business engages with the Colorado Specific Guaranty, you should ensure that you meet the state's criteria for establishing nexus. Regular reviews of your business activities can help you maintain compliance and avoid unexpected tax liabilities. Keeping detailed records is highly recommended.

Colorado form 106 must be filed by business entities operating in the state that meet specific income thresholds. This form is crucial for reporting corporate income, particularly for companies involved with the Colorado Specific Guaranty. Failing to file properly can lead to penalties, so ensure your business complies with state requirements. Consulting with tax professionals can provide additional support.

G form in Colorado reports certain government payments, such as refunds, credits, or offsets on state income taxes. This form is essential for individuals and businesses to accurately report these payments on their tax returns. If you are affected by the Colorado Specific Guaranty, understanding how this form works is vital for your taxation. Ensure you keep detailed records for accurate reporting.

Nexus requirements generally depend on the level of business activity within a state, including sales volume, physical presence, and employee engagement. In Colorado, businesses must comply with specific regulations when they meet certain thresholds. If your business deals with the Colorado Specific Guaranty, it’s vital to consult state guidelines to fully understand these requirements. Compliance will help you avoid potential legal issues.

Yes, a remote employee can establish nexus in Colorado, depending on the nature of their work. If the employee conducts substantial business activities within the state, your business may be subject to Colorado taxes. Understanding the implications of remote work on your nexus status is essential, especially when dealing with the Colorado Specific Guaranty. Regular assessments can help you manage your tax obligations effectively.

Colorado form DR 0108 is the state's tax form used to document specific tax credits and deductions, including those related to the Colorado Specific Guaranty. This form helps individuals and businesses claim various tax benefits that can affect their overall tax liability. Utilizing this form accurately is crucial for compliance and optimizing your tax position. Ensure you understand how to properly fill it out for maximum benefit.