Colorado Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

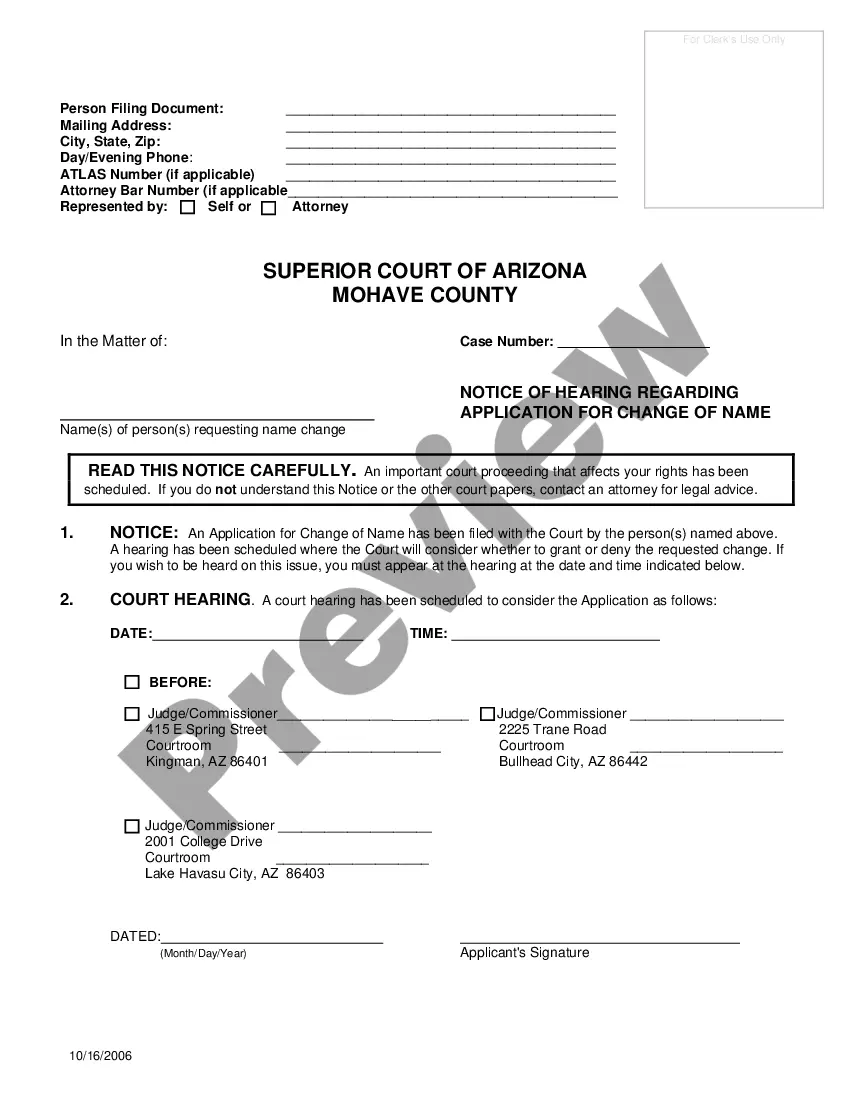

How to fill out Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

If you seek to compile, download, or create valid document formats, utilize US Legal Forms, the largest selection of legal templates available online.

Employ the site’s straightforward and convenient search to acquire the documents you require.

A range of templates for business and personal applications are organized by categories and regions, or keywords.

Step 4. Once you identify the form you need, click the Purchase now button. Select your preferred pricing plan and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Colorado Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and press the Acquire button to retrieve the Colorado Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Utilize the Review option to examine the form’s details. Remember to read the instructions.

- Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

Since a GRAT represents an incomplete gift, it is not a suitable vehicle to use in a generation-skipping transfer (GST), as the value of the skipped gift is not determined until the end of the trust term.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

In other words, if the grantor (or a non-adverse party) has the power to revoke any part of a trust and reclaim the trust assets, then the grantor will be taxed on the trust income.

Grantor Retained Income Trust, Definition A grantor retained income trust allows the person who creates the trust to transfer assets to it while still being able to receive net income from trust assets. The grantor maintains this right for a fixed number of years.

The creator of the trust (the Grantor) transfers assets to the GRAT while retaining the right to receive fixed annuity payments, payable at least annually, for a specified term of years. After the expiration of the term, the Grantor will no longer receive any further benefits from the GRAT.

Upon the death of the grantor, grantor trust status terminates, and all pre-death trust activity must be reported on the grantor's final income tax return. As mentioned earlier, the once-revocable grantor trust will now be considered a separate taxpayer, with its own income tax reporting responsibility.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

At the end of the initial term retained by the Grantor, if the Grantor is still living, the remainder beneficiaries (or a trust to be administered for the benefit of the remainder beneficiaries) receive $100,0000 plus all capital growth (which is the amount over and above the net income that was paid to the Grantor).