Colorado Worksheet - Contingent Worker

Description

How to fill out Worksheet - Contingent Worker?

US Legal Forms - among the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or create.

Through the website, you can discover thousands of forms for commercial and personal use, categorized by types, states, or keywords. You can access the latest editions of documents like the Colorado Worksheet - Contingent Worker in moments.

If you are a member, Log In and download the Colorado Worksheet - Contingent Worker from the US Legal Forms database. The Download button will appear on every document you view. You can access all previously downloaded documents in the My documents section of your account.

Complete the purchase using a credit card or PayPal account.

Choose the format and download the document onto your device.

- Ensure you have selected the appropriate document for the city/state.

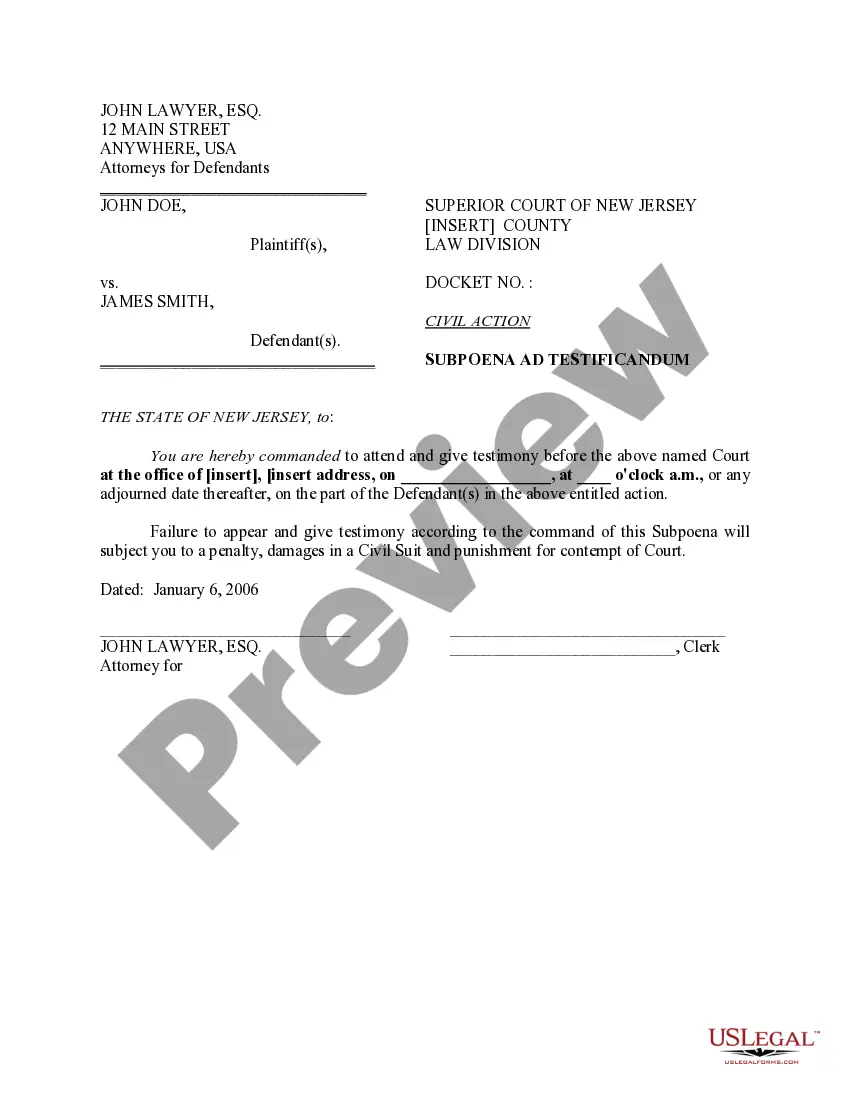

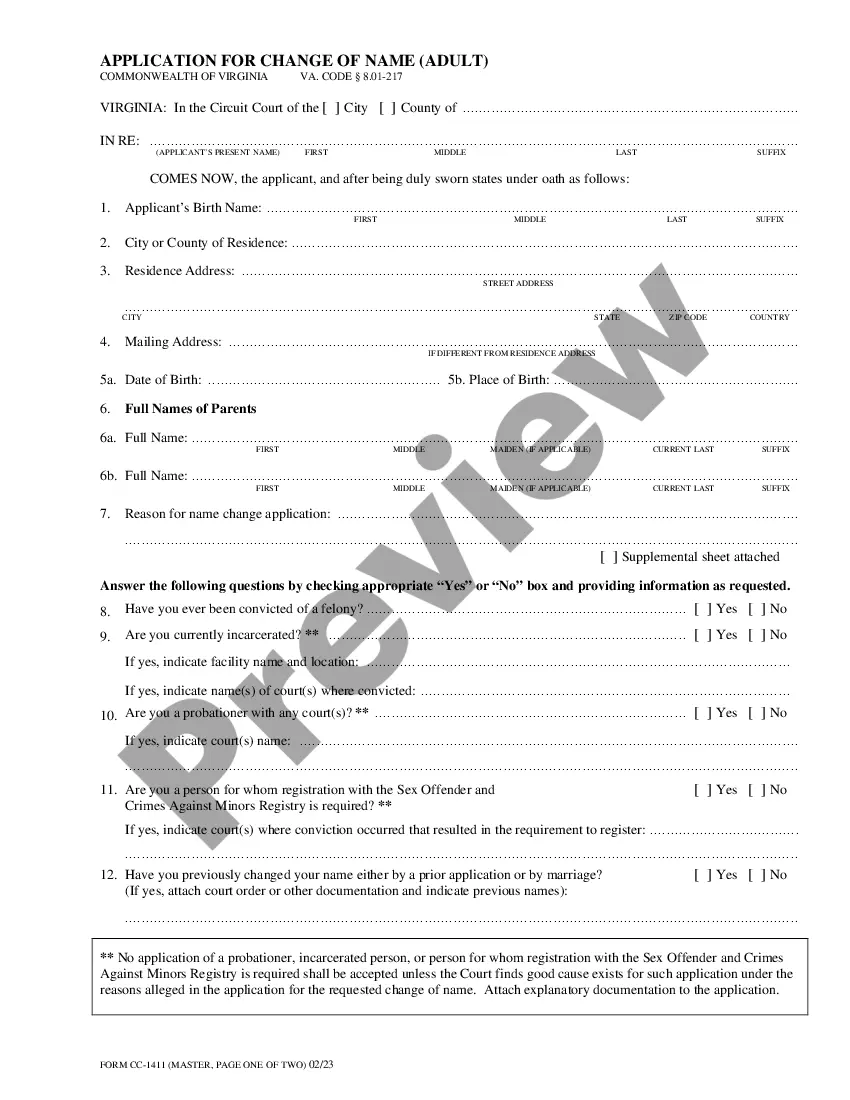

- Click the Preview button to review the content of the document.

- Read the description of the document to confirm that you have chosen the right one.

- If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your selection by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Contingent workers include independent contractors, freelancers, consultants, advisors or other outsourced workers hired on a per-job and non-permanent basis.

Unlike regular employees, contingent workers are required to work at least 40 hours a week. A. Unlike regular employees, contingent workers work through an employment agency or operate as independent contractors.

Contingent workers are hired on-demand for a defined period of time. Unlike your permanent full-time or part-time employees, you hire contingent workers on-demand and often for a limited duration or project. There's no commitment to retain your contingent hires beyond the scope of the project or contract.

Work environment Both contingent and contract employees may have more flexibility in their schedule and may choose when they want to work. They're not full-time employees, but they work on a project-to-project basis. Companies hire them because of their skills and expertise for a specific project.

A contingent worker is someone who works for an organization without being hired as their employee. Contingent workers may provide their services under a contract, temporarily, or on an as-needed basis.

Contingent workers often have the same access to company resources and sensitive information as their permanent coworkers. Gaps in screening processes can be risky since they can lead to employee theft, fraud, data security breaches, lack of compliance, legal costs and damaged reputation.

If your client wants to hire a contingent worker, they generally do not need to handle employment taxes. Contingent workers who are independent contractors are responsible for paying their own taxes because they are self employed. Contract workers are on the Employer of Record's payroll, not your client's.

A contingent worker is someone who is hired for a fixed period of time, often on a project basis. Examples of contingent workers are freelancers, consultants, part-timers, on-call workers, independent contractors, and people in other types of alternative work arrangements.

Employees: Workers are employed directly by the company for which work is performed. Contingent workers: Workers are provided by a staffing firm to the company for which work is performed and are employees of the staffing firm.

A contingent worker is someone who works for an organization without being hired as their employee. Contingent workers may provide their services under a contract, temporarily, or on an as-needed basis.