Colorado Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

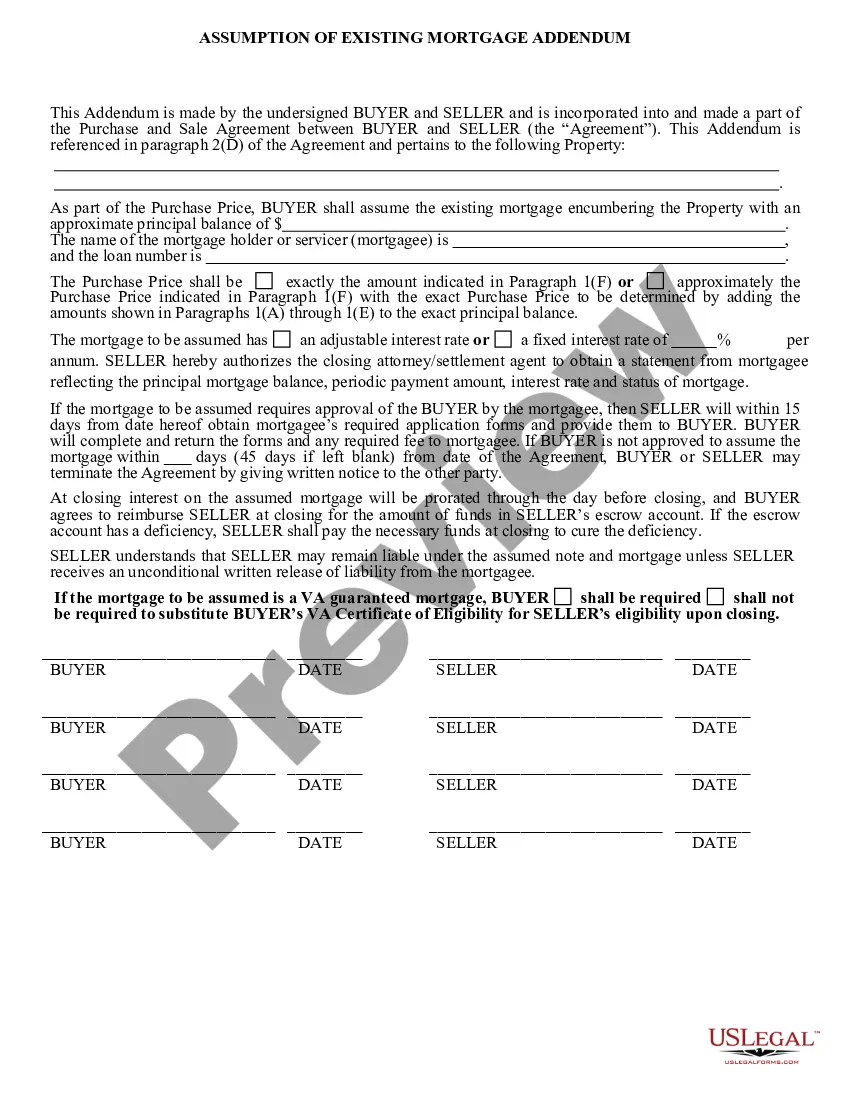

How to fill out Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

Have you been inside a placement that you need to have paperwork for either organization or individual purposes almost every day time? There are a lot of lawful record templates available on the Internet, but getting kinds you can rely on is not effortless. US Legal Forms gives 1000s of kind templates, just like the Colorado Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, that are written to satisfy state and federal demands.

In case you are already informed about US Legal Forms website and have your account, merely log in. Following that, you may down load the Colorado Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage template.

If you do not come with an bank account and would like to begin to use US Legal Forms, follow these steps:

- Discover the kind you will need and ensure it is to the appropriate metropolis/state.

- Utilize the Preview key to analyze the form.

- Look at the outline to actually have selected the right kind.

- In the event the kind is not what you are trying to find, use the Lookup industry to discover the kind that suits you and demands.

- If you obtain the appropriate kind, click Get now.

- Choose the costs prepare you want, submit the desired information and facts to create your account, and pay for the transaction using your PayPal or bank card.

- Choose a practical paper structure and down load your backup.

Get every one of the record templates you possess bought in the My Forms menu. You can get a further backup of Colorado Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage any time, if possible. Just click the essential kind to down load or printing the record template.

Use US Legal Forms, probably the most comprehensive assortment of lawful forms, to conserve time as well as prevent mistakes. The service gives professionally created lawful record templates which can be used for a selection of purposes. Generate your account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

When you take a second mortgage, you borrow from the equity you've built up in your home ? in other words, the difference between the value of your home and the remaining balance on your first mortgage. Homeowners typically access equity by taking a home equity loan or a home equity line of credit (HELOC).

Mortgage consolidation gives you the option of merging multiple loans into one. It's a good way for some people to save money or get a little more breathing room in their monthly payments. Learn more about the mortgage consolidation process and see if it's right for you.

Porting a mortgage ? transferring an existing loan to a different property ? is relatively common in Canada and the United Kingdom but rare in the United States. In any jurisdiction, porting can only happen if the lender allows it and, especially in America, few lenders will approve porting.

One benefit of consolidating your mortgages is that it can result in lower monthly payments and even reduce your loan rate. Plus, many people find that refinancing their first and second mortgage together adds more structure and organization to their financial life.

Quick Reference. The right of a mortgagee who has taken mortgages on two or more properties from the same mortagor to require the mortgagor to redeem all of the mortgages or none, provided that the contractual date of redemption (see power of sale) for all of them has passed.

Legally, there isn't a limit on how many times you can refinance your home loan. However, mortgage lenders do have a few mortgage refinance requirements you'll need to meet each time you apply for a loan, and some special considerations are important to note if you want a cash-out refinance.