Colorado Assignment of Assets

Description

How to fill out Assignment Of Assets?

It is feasible to spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that have been evaluated by professionals.

You can easily download or create the Colorado Assignment of Assets from this service.

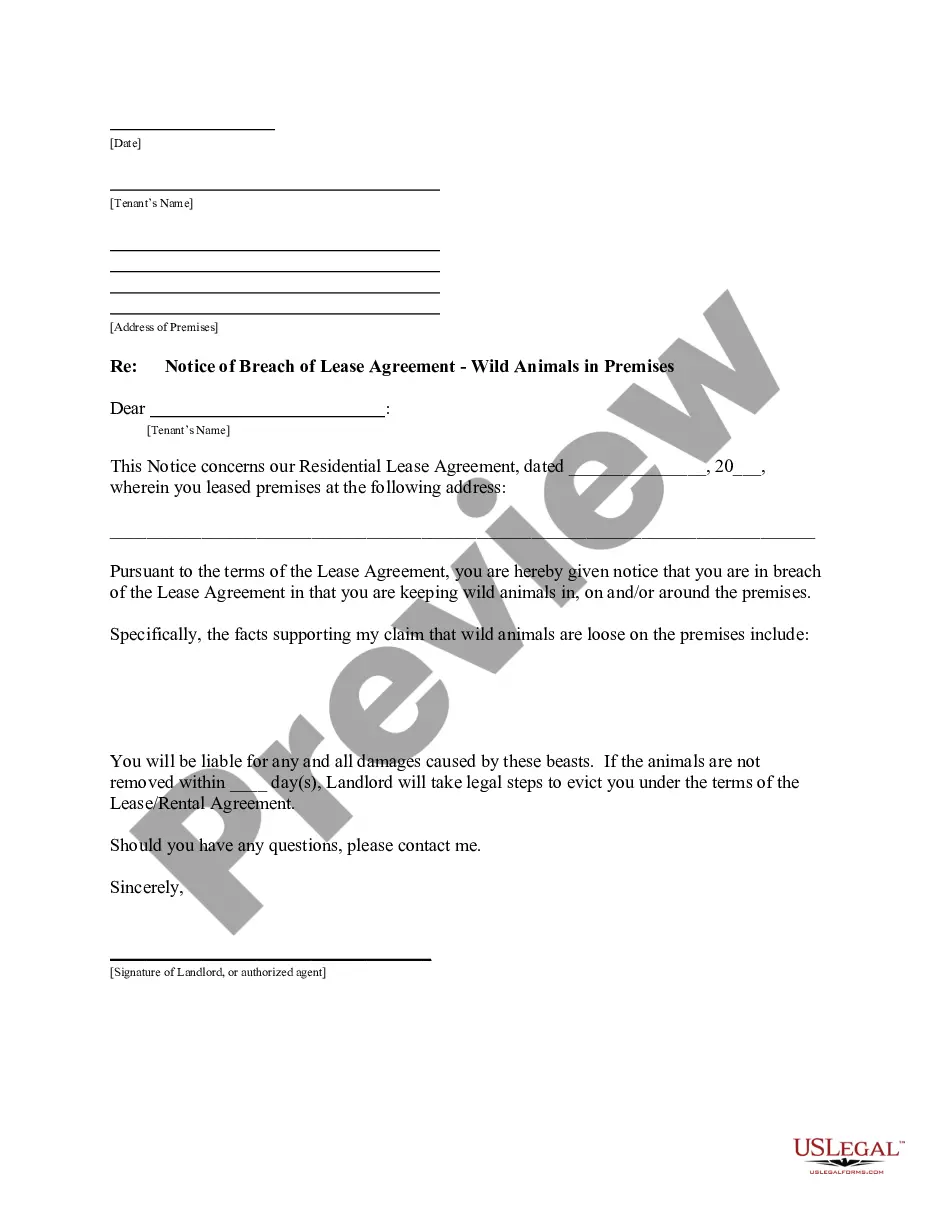

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Colorado Assignment of Assets.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these basic instructions.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Read the form description to confirm you have chosen the correct form.

Form popularity

FAQ

In Colorado, certain exemptions apply to the real property transfer tax, which can significantly affect your Colorado Assignment of Assets. For instance, transfers between spouses, transfers related to divorce settlements, and transfers of property for public purposes are commonly exempt. Additionally, when the property is transferred as part of a sale for less than market value, it may also qualify for an exemption. Understanding these exemptions can help you navigate your asset transfers more efficiently and potentially save on costs.

General assignment means transferring all or part of an individual's rights, properties, or interests to another entity, usually for specific legal or financial purposes. This concept is commonly used to resolve financial obligations and can affect how assets are categorized during estate planning. Understanding general assignment is essential for anyone considering a Colorado Assignment of Assets, as it provides clarity on the management and distribution of your estate.

In estate planning, a general assignment refers to the transfer of assets to an executor or trustee to manage according to the deceased’s wishes. This process ensures that your estate is handled properly, reducing confusion for heirs and minimizing potential disputes. A well-documented general assignment is vital, especially when organizing a Colorado Assignment of Assets, as it clarifies responsibilities and intentions.

A general assignment of assets is a legal document where an individual transfers their assets to another party, often to settle debts or manage affairs. This transfer can include property, financial accounts, and personal belongings. It plays a crucial role in estate planning and can significantly impact a Colorado Assignment of Assets when aligning with your overall financial goals.

To fill out a Colorado quit claim deed, start by obtaining the correct form from a reliable source or legal platform. You need to provide details like the names of the grantor and grantee, a clear legal description of the property, and any necessary signatures. Using a service such as US Legal Forms can simplify this process, especially when dealing with a Colorado Assignment of Assets.

People often place assets in a trust for various reasons, including protection from creditors, avoiding probate, and ensuring that their wishes are followed after their passing. A trust can help manage and distribute your assets efficiently, making it easier for your beneficiaries. It also provides flexibility in how assets are handled, which is essential when considering a Colorado Assignment of Assets.

The 2% withholding in Colorado refers to a tax requirement for certain real estate transactions. Specifically, sellers may be required to withhold 2% of the sale proceeds to ensure that taxes are collected on capital gains. This process is particularly relevant within the scope of Colorado Assignment of Assets, as it ensures compliance with tax regulations. For more detailed guidance, UsLegalForms can assist you with understanding these requirements.

A TD 1000 form Colorado is a critical document used during real estate transactions to declare the transfer of property. This form contains vital information that assists local assessors in determining property taxes. Filling out the TD 1000 correctly is an important step for those involved in the Colorado Assignment of Assets. UsLegalForms can provide the necessary tools to simplify this task.

The TD 1000 form in Colorado is a Transfer Declaration form that supports the transfer of real property ownership. This document helps assessors evaluate property value for tax assessments. For individuals engaging in the Colorado Assignment of Assets, understanding and completing the TD 1000 is essential to ensure compliance with state regulations. UsLegalForms offers templates and guidance to make this process easy for you.

Colorado Form DR 1083 is known as the Real Property Transfer Declaration. It helps document details about real estate transactions in Colorado, facilitating the assessment process for property taxes. Completing this form accurately is crucial for anyone involved in the Colorado Assignment of Assets process. If you need assistance, UsLegalForms provides resources to help you navigate this requirement seamlessly.