An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Colorado Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

If you want to full, download, or produce legal file themes, use US Legal Forms, the largest selection of legal kinds, that can be found on the Internet. Make use of the site`s easy and hassle-free look for to find the documents you want. Numerous themes for enterprise and individual reasons are categorized by categories and claims, or key phrases. Use US Legal Forms to find the Colorado Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage with a few clicks.

When you are previously a US Legal Forms customer, log in to the profile and then click the Obtain option to get the Colorado Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage. You can even gain access to kinds you previously delivered electronically in the My Forms tab of your profile.

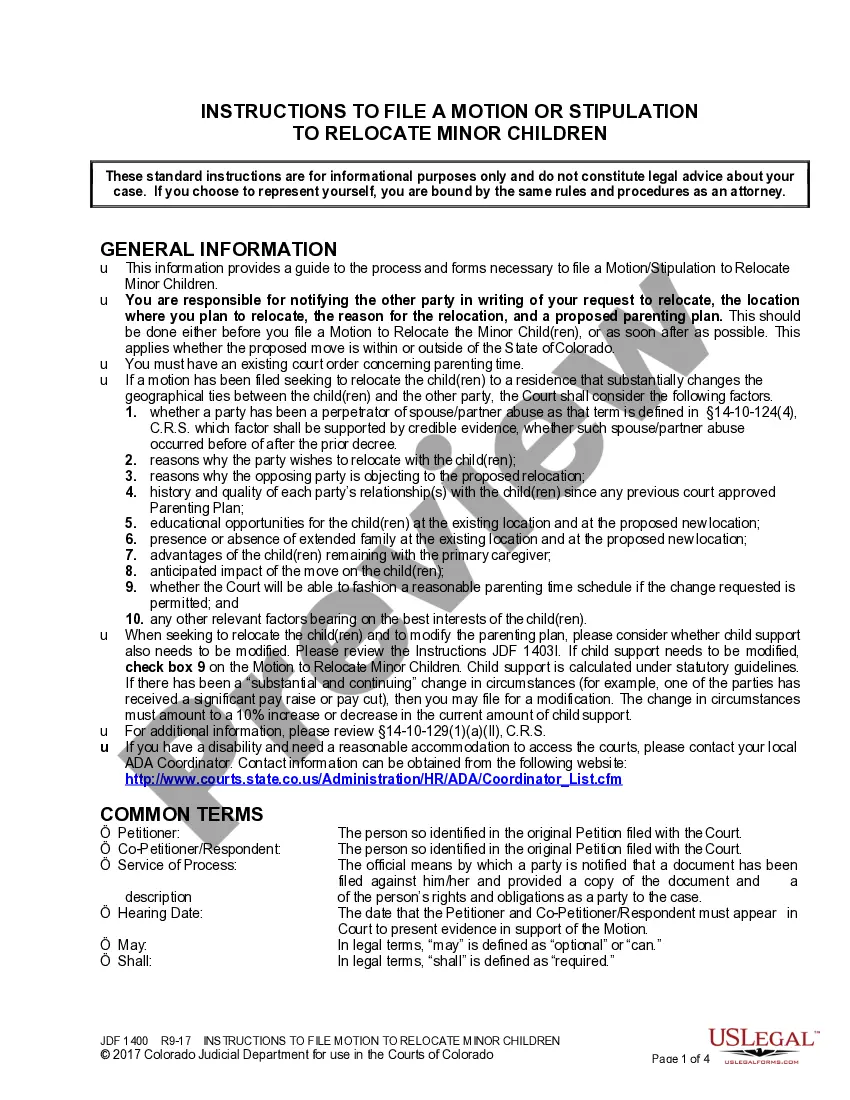

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that right area/nation.

- Step 2. Utilize the Preview option to look through the form`s content. Don`t overlook to learn the explanation.

- Step 3. When you are unsatisfied with the kind, make use of the Look for discipline towards the top of the display to discover other versions from the legal kind web template.

- Step 4. When you have discovered the shape you want, click the Get now option. Select the prices plan you like and add your references to register for an profile.

- Step 5. Approach the deal. You should use your bank card or PayPal profile to complete the deal.

- Step 6. Choose the formatting from the legal kind and download it on the device.

- Step 7. Full, edit and produce or indication the Colorado Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage.

Every legal file web template you purchase is your own permanently. You have acces to every kind you delivered electronically with your acccount. Go through the My Forms segment and select a kind to produce or download yet again.

Remain competitive and download, and produce the Colorado Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage with US Legal Forms. There are many professional and express-distinct kinds you may use to your enterprise or individual requires.

Form popularity

FAQ

By signing a promissory note, a borrower promises to pay back a set amount of money, including interest and fees, to a bank, a person or another lender.

If the promissory note is unconditional and readily saleable, it is called a negotiable instrument. Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days' notice before the payment is due.

The promissory note form should include: The names and addresses of the lender and borrower. The amount of money being borrowed and what, if any, collateral is being used. How often payments will be made in and in what amount. Signatures of both parties, in order for the note to be enforceable.

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

Colorado's Consumer Protection Laws do not allow you to charge more than 45 percent interest. If the promissory note does not specify an interest rate, Colorado law sets the annual rate at 8 percent.

A promissory note is a written and signed promise to repay a sum of money in exchange for a loan or other financing. A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.