Colorado Sample Letter for Withheld Delivery

Description

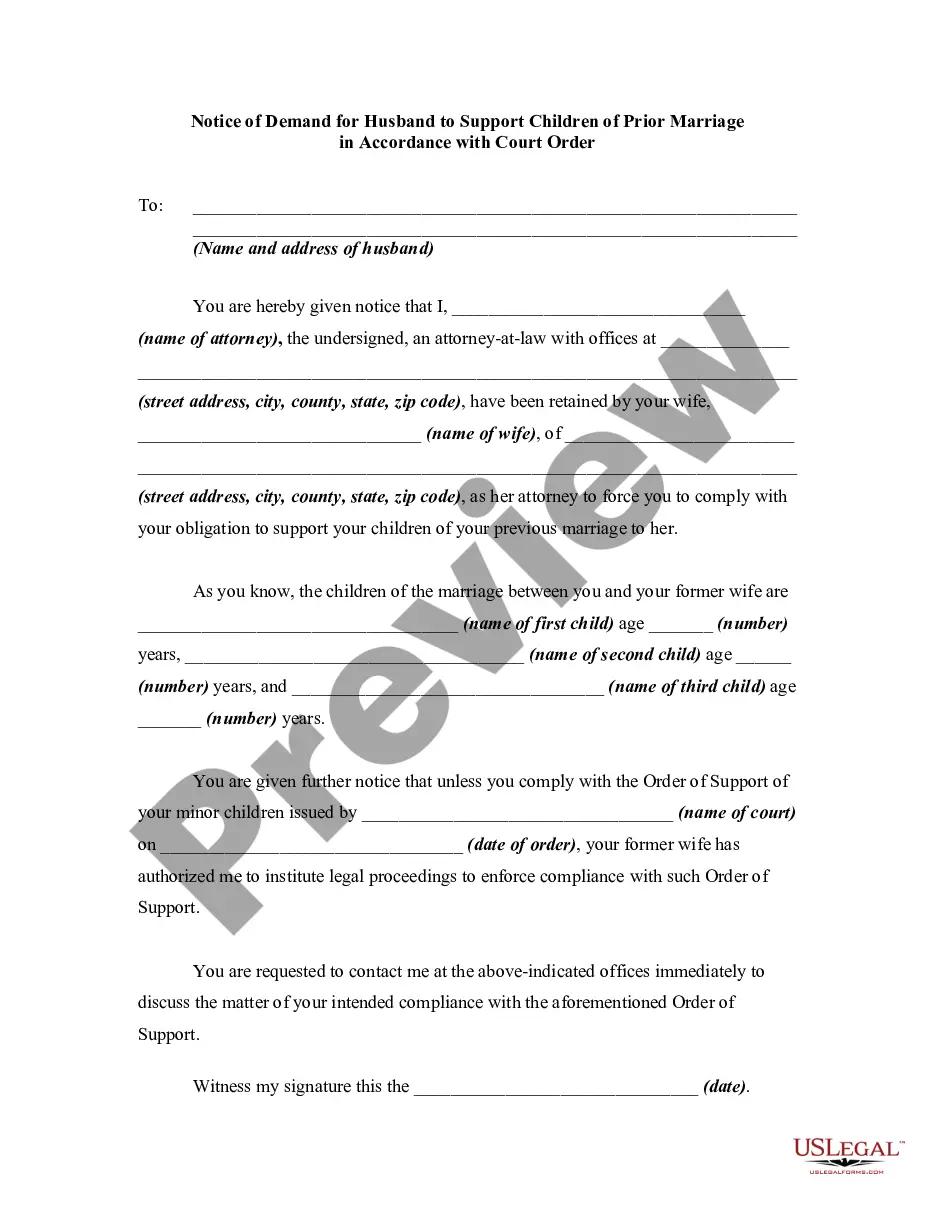

How to fill out Sample Letter For Withheld Delivery?

It is feasible to spend numerous hours online trying to locate the legal document template that fulfills the state and federal requirements you will need.

US Legal Forms offers thousands of legal forms that are vetted by experts.

It is easy to download or print the Colorado Sample Letter for Withheld Delivery from your service.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Next, you can complete, modify, print, or sign the Colorado Sample Letter for Withheld Delivery.

- Every legal document template you receive is yours forever.

- To obtain another version of any form you have acquired, navigate to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for your chosen state/region.

- Review the form outline to confirm you have selected the appropriate document.

Form popularity

FAQ

A withholding reconciliation return is an essential form that aggregates and compares the amounts withheld from employee paychecks with the reported totals to tax authorities. It serves as a checkpoint, ensuring compliance with tax regulations. Understanding this return helps you manage your payroll and tax obligations effectively. In situations requiring clarification, a Colorado Sample Letter for Withheld Delivery can streamline communication with the appropriate parties.

A tax reconciliation is the process of comparing your financial records to ensure that your reported income and taxes match what has been withheld. This helps identify any discrepancies so that you can address them before filing. Completing tax reconciliation effectively can help prevent errors on your tax return and possible audits. If needed, a Colorado Sample Letter for Withheld Delivery can assist you in pinpointing any issues and providing clarity in your records.

You are required to file a Colorado return if you meet certain income thresholds set by the state. Income earned from job wages, rentals, or business operations may necessitate a return. It’s crucial to determine your filing obligations to avoid potential penalties. If you're unsure, a Colorado Sample Letter for Withheld Delivery can help address any specific queries about your situation before you file.

The timeframe for receiving a Colorado state refund can vary, but typically it takes around six to eight weeks for processing after your return is filed. However, e-filed returns usually receive quicker processing times. To track your refund status, you can use the Colorado Department of Revenue’s online tools for a more straightforward experience. Using a Colorado Sample Letter for Withheld Delivery can help set the stage for any inquiries or clarifications you may need regarding your refund.

You should consider using a Colorado withholding certificate if you want to adjust your withholding based on specific circumstances, such as changes in your deductions or personal situation. This certificate helps ensure that you withhold the correct amount of taxes throughout the year. Furthermore, employing a Colorado Sample Letter for Withheld Delivery can provide a straightforward way to communicate with payroll about withholding levels. It’s a wise move to be proactive about your tax planning.

A Colorado withholding reconciliation return is a document that reconciles your withheld income taxes to ensure proper reporting. It allows you to verify that the amounts withheld from your employees’ wages match what you should have reported. By using this return, you can avoid confusion and ensure accurate handling of your tax obligations. Utilizing a Colorado Sample Letter for Withheld Delivery can help clarify any discrepancies you may encounter.

In Colorado, the law clearly protects employees regarding unpaid wages, requiring prompt payment for work completed. Employers that fail to meet these obligations may face penalties and legal repercussions. Utilizing a Colorado Sample Letter for Withheld Delivery can help communicate with your employer regarding outstanding payments effectively. Knowing and asserting your rights helps ensure fair treatment in the workplace.

Rule 39 22 604 pertains to the regulations surrounding income tax withholding in Colorado for employees and employers. It outlines the requirements for withholding state income tax from employee wages. Using a Colorado Sample Letter for Withheld Delivery can help you ensure that your employer complies with these tax withholding obligations. Staying informed about tax withholding is important for your financial planning.

The amount to withhold for Colorado taxes typically depends on the employee’s wages and the allowances claimed on the AW-4 form. It's important to calculate this correctly to avoid under or over-withholding. Using the Colorado Sample Letter for Withheld Delivery can assist you in determining the correct amounts to withhold.

To file Colorado withholding tax, employers must complete the appropriate tax forms and submit them to the Colorado Department of Revenue. This process can be done electronically or via mail, depending on your preference. Utilizing resources like the Colorado Sample Letter for Withheld Delivery can make this step much more manageable.