If you have to total, down load, or print legitimate document web templates, use US Legal Forms, the most important assortment of legitimate forms, that can be found on the web. Take advantage of the site`s easy and practical lookup to obtain the documents you need. Various web templates for enterprise and individual reasons are categorized by categories and states, or keywords. Use US Legal Forms to obtain the Colorado Agreement Between Widow and Heirs as to Division of Estate with a handful of click throughs.

In case you are presently a US Legal Forms customer, log in for your profile and then click the Down load button to have the Colorado Agreement Between Widow and Heirs as to Division of Estate. Also you can gain access to forms you earlier saved from the My Forms tab of the profile.

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape to the appropriate city/land.

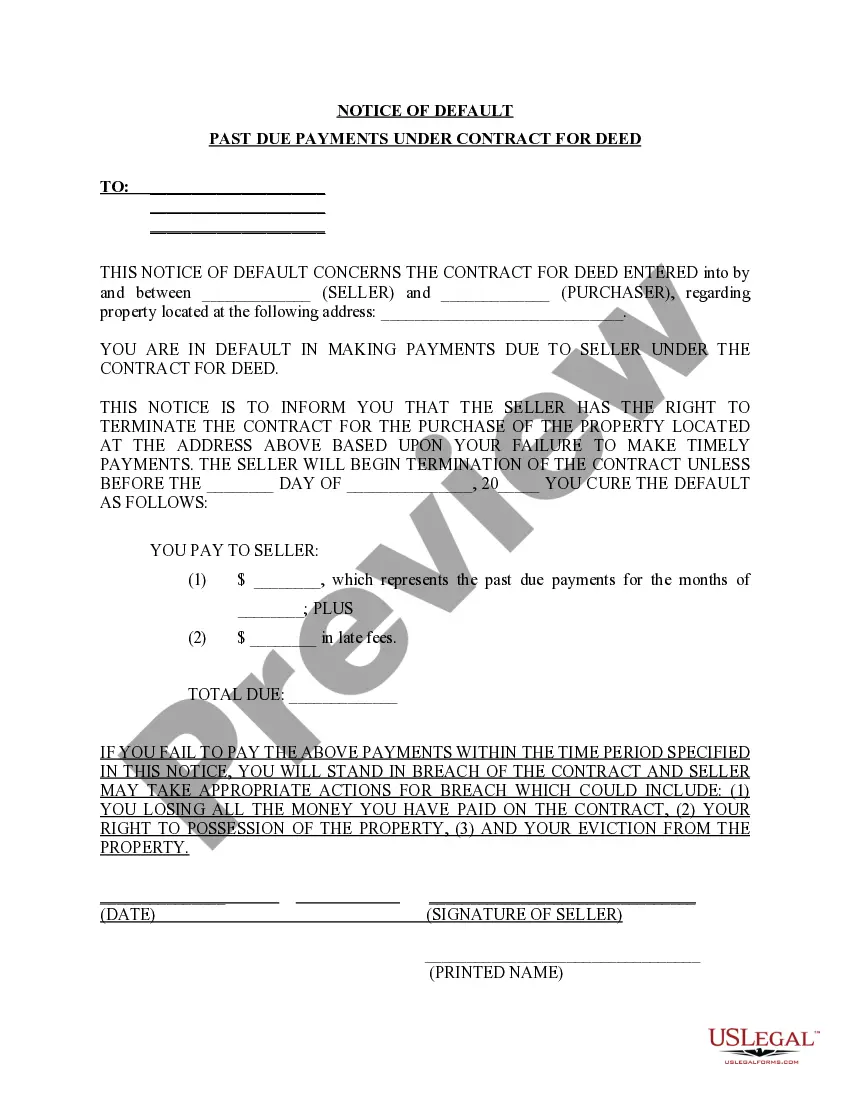

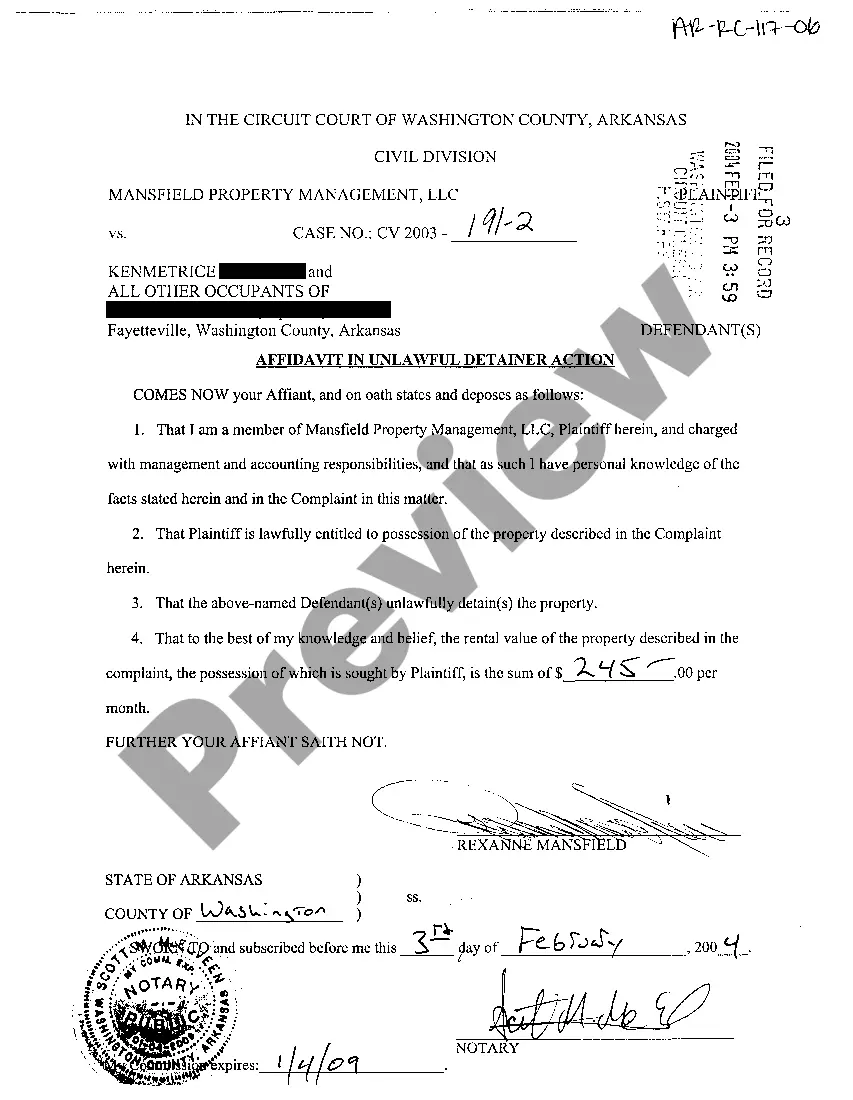

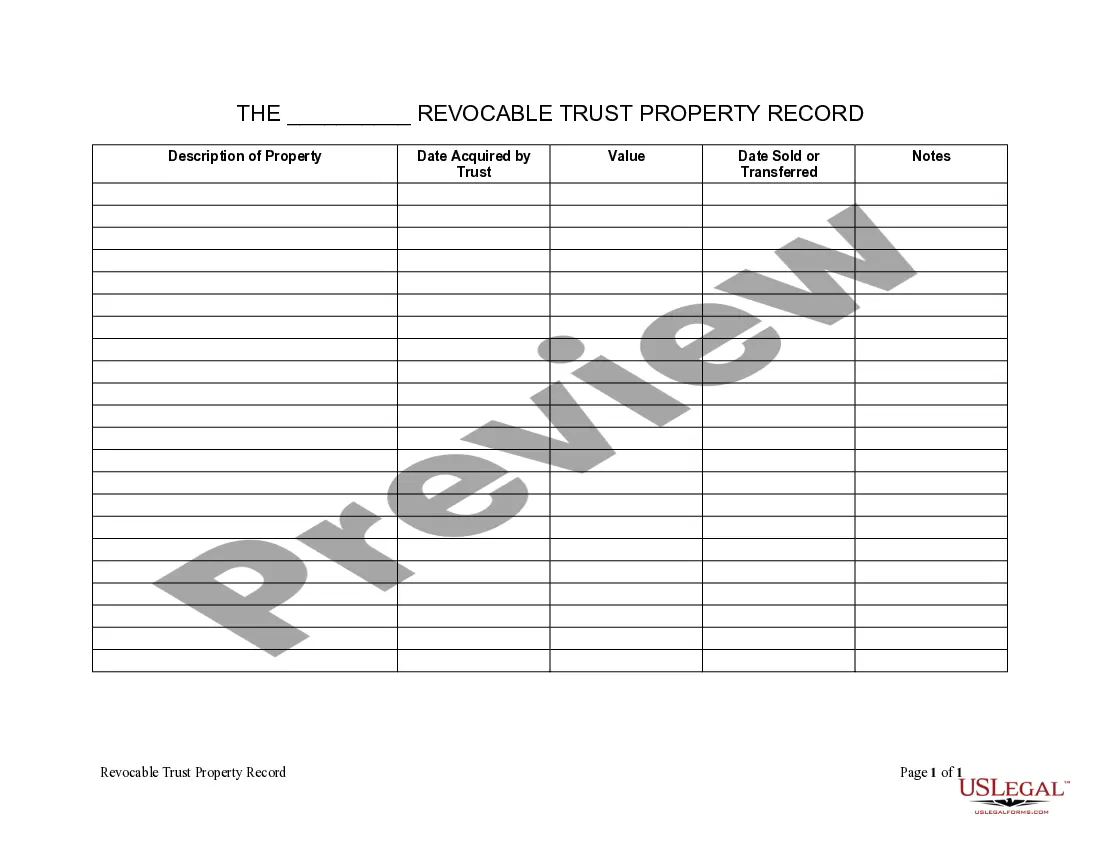

- Step 2. Make use of the Review option to check out the form`s content material. Don`t forget about to read through the outline.

- Step 3. In case you are not happy together with the kind, use the Lookup industry at the top of the display screen to find other types of your legitimate kind web template.

- Step 4. When you have located the shape you need, click on the Acquire now button. Choose the costs strategy you prefer and include your credentials to register for the profile.

- Step 5. Process the financial transaction. You can use your bank card or PayPal profile to perform the financial transaction.

- Step 6. Choose the file format of your legitimate kind and down load it in your gadget.

- Step 7. Total, edit and print or signal the Colorado Agreement Between Widow and Heirs as to Division of Estate.

Each and every legitimate document web template you purchase is your own eternally. You might have acces to each and every kind you saved inside your acccount. Click on the My Forms segment and decide on a kind to print or down load again.

Be competitive and down load, and print the Colorado Agreement Between Widow and Heirs as to Division of Estate with US Legal Forms. There are millions of skilled and status-certain forms you can use for your enterprise or individual requires.