Colorado Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

If you aim to compile, obtain, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's simple and convenient search feature to find the documents you need.

A variety of templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. After finding the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Colorado Exchange Addendum to Contract - Tax-Free Exchange Section 1031 with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to get the Colorado Exchange Addendum to Contract - Tax-Free Exchange Section 1031.

- You can also retrieve forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Review option to examine the form's details. Be sure to read the explanation.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In a 1031 exchange, certain expenses related to the transaction may be deductible. This includes costs for title insurance, closing fees, and other transaction-related expenses. However, it is essential to consult a tax professional for guidance on the deductibility of specific items to ensure compliance with regulations.

Tom: The short answer is yes. Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

The 1031 exchange process is very straightforward, with three main steps: simply sell your relinquished property, identify a replacement property within 45 days, and purchase your replacement property within 180 days.

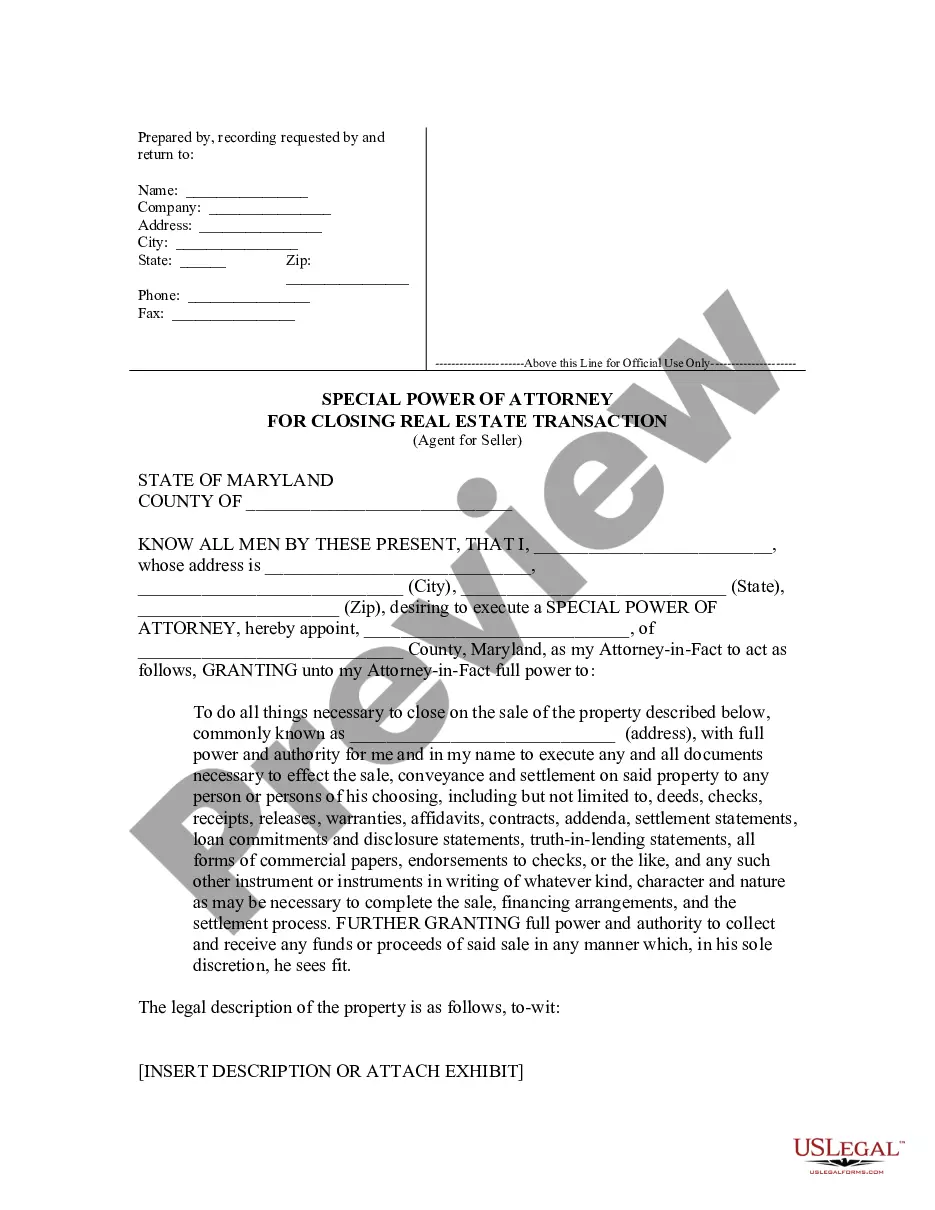

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

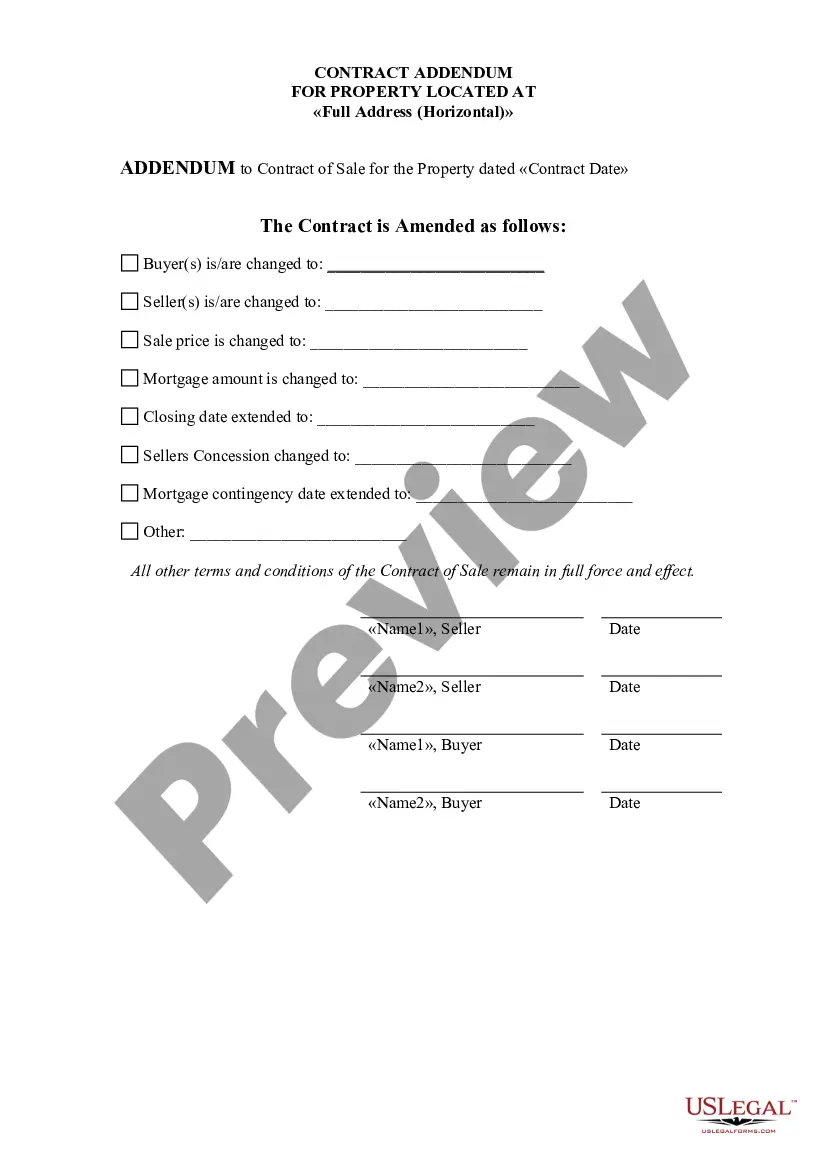

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

But one question that comes up frequently is, can you do a 1031 exchange between states? The short answer to this is yes. Because Section 1031 is a federal tax code, it is technically recognized in all states.

Under Internal Revenue Code Section 1031, real estate located in one U.S. state is like kind to real estate located in any other state, and you can trade from one state to another. In most cases you are able to defer both federal and state tax, assuming the state has an income tax.

1. Don't try to exchange a piece of personal property. 1031 exchanges can only be done between investment properties that you own, which means REITs, funds or an LLC that owns shares in another LLC don't qualify.

Did you know that there is a legal way to defer capital gain taxes on your investment properties? It's called a 1031 Exchange, or a Like-Kind Exchange, and it's a federal tax code recognized by all states, including Colorado.

Did you know that there is a legal way to defer capital gain taxes on your investment properties? It's called a 1031 Exchange, or a Like-Kind Exchange, and it's a federal tax code recognized by all states, including Colorado.