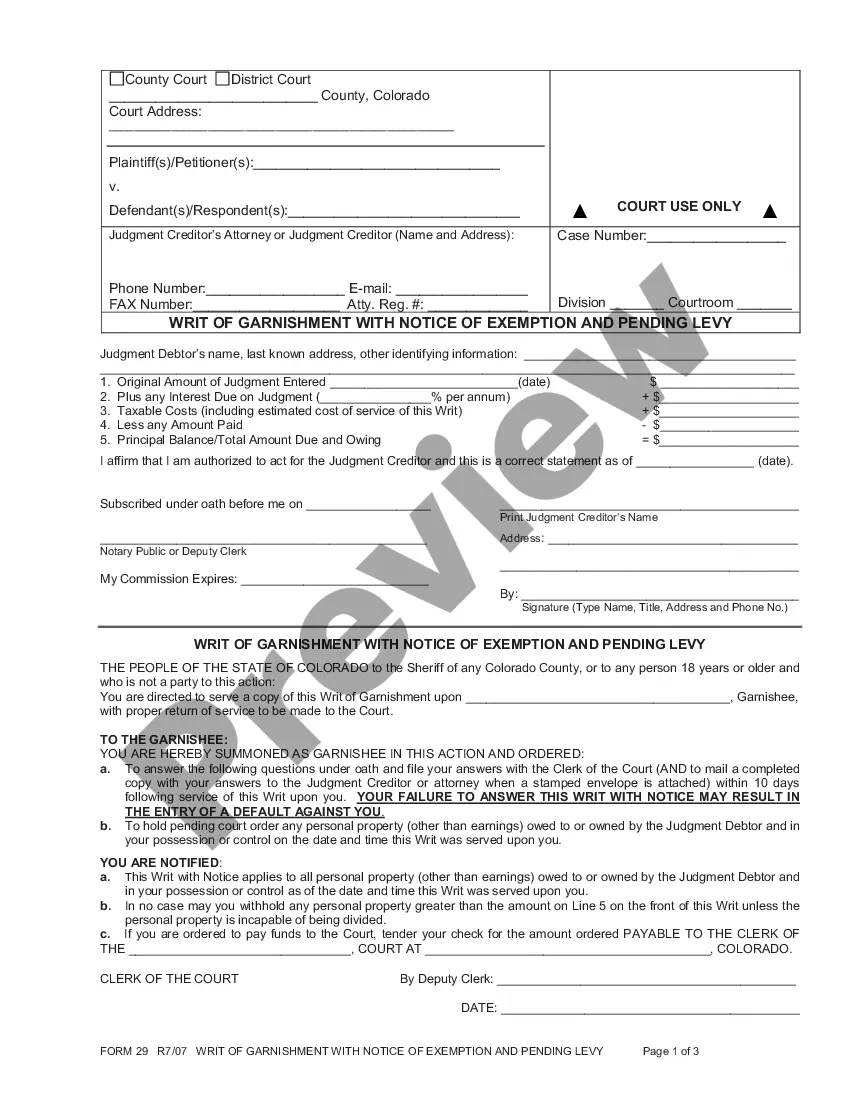

Writ of Garnishment with Notice of Exemption & Pending Levy: This is an official form from the Colorado County Court, which complies with all applicable laws and statutes. USLF amends and updates the Colorado County Court forms as is required by Colorado statutes and law.

Colorado Writ of Garnishment With Notice Of Exemption And Pending Levy

Description

How to fill out Colorado Writ Of Garnishment With Notice Of Exemption And Pending Levy?

The larger quantity of documents you ought to prepare - the more anxious you become.

You can discover numerous Colorado Writ of Garnishment with Notification of Exemption and Pending Levy models online, yet you are unsure which ones to rely on.

Eliminate the difficulty of making sample identification simpler by utilizing US Legal Forms.

Do more for less with US Legal Forms!

- Obtain expertly crafted documents that are created to comply with state specifications.

- If you already have a US Legal Forms account, Log In to your account, and you will see the Download button on the Colorado Writ of Garnishment with Notification of Exemption and Pending Levy’s page.

- If you’ve never used our platform before, complete the registration process by following these steps.

- Ensure that the Colorado Writ of Garnishment with Notification of Exemption and Pending Levy is valid in your region.

- Verify your selection by reading the description or by utilizing the Preview option if available for the selected document.

Form popularity

FAQ

In Colorado, the amount that can be garnished from your paycheck typically depends on your disposable income. Generally, creditors can garnish up to 25% of your disposable earnings or the amount by which your weekly earnings exceed 40 times the federal minimum wage, whichever is lower. Understanding the Colorado Writ of Garnishment With Notice Of Exemption And Pending Levy can help you determine your rights and obligations. For personalized assistance, US Legal Forms offers resources and guidance to navigate this complex situation.

Garnishment and levy are both methods for collecting debt but serve different purposes. A garnishment involves directly taking funds from a debtor's wage or bank account, while a levy entails seizing physical property or assets to satisfy a debt. Understanding these distinctions can help creditors and debtors navigate financial matters effectively. For those dealing with garnishments or levies, US Legal Forms offers tools and documents to assist in the navigation of these legal processes.

In Colorado, exemptions for wage garnishment allow debtors to retain a portion of their earnings, safeguarding their financial stability. Typically, a percentage of the debtor's income is exempt, making it vital for individuals to understand their rights. Claiming these exemptions requires specific forms and timely action, ensuring that individuals can protect necessary funds from being garnished. Utilizing resources like US Legal Forms can simplify this process and provide necessary guidance.

A writ of garnishment with notice of exemption and pending levy in Colorado is a legal document that allows a creditor to collect debts from a debtor's wages or bank accounts. This writ informs the debtor that their earnings or funds may be garnished unless they claim an exemption. The notice provides essential information about possible exemptions the debtor may have, ensuring that they are aware of their rights. Understanding this process is crucial for both creditors and debtors to navigate financial obligations properly.

To stop wage garnishment in Colorado, you have a few options. You can file a motion with the court that issued the Colorado Writ of Garnishment With Notice Of Exemption And Pending Levy, contesting the garnishment. Additionally, you might consider negotiating a payment plan with your creditor or claiming an exemption if applicable. Utilizing platforms like US Legal Forms can provide you with the necessary documents and guidance to navigate this process effectively.

Colorado has updated its laws surrounding garnishment to better protect individuals from excessive financial strain. The new garnishment law, effective from January 2022, incorporates limits on how much of your earnings can be garnished and enhances notice requirements for both debtors and creditors. With the Colorado Writ of Garnishment With Notice Of Exemption And Pending Levy, these changes aim to provide a fair balance between satisfying debts and ensuring individuals retain sufficient income.

In Colorado, the maximum amount that can be garnished from your paycheck depends on several factors, including your disposable income and the type of debt. Generally, the law permits creditors to garnish up to 25% of your disposable earnings or the amount by which your weekly disposable earnings exceed 30 times the federal minimum wage, whichever is less. This ensures that you still have some income to meet your living expenses even while dealing with garnishment.

Yes, your bank account can be garnished in Colorado. When a creditor obtains a Colorado Writ of Garnishment With Notice Of Exemption And Pending Levy, they can instruct your bank to freeze funds in your account. However, you may have the opportunity to claim exemptions that protect certain amounts or types of income, which is why understanding your rights is vital.

The duration for obtaining a Colorado writ of garnishment can vary. Typically, once you file the necessary documents, including the Colorado Writ of Garnishment With Notice Of Exemption And Pending Levy, it may take a week or more for the court to process your request. After the court issues the writ, it can be served on the debtor's employer or bank, further extending the timeline. It's important to stay informed through each step of the process.

After a writ of garnishment is filed, the court sends it to the employer or bank. They are required to withhold the specified funds and inform the debtor. For those facing this situation, the Colorado Writ of Garnishment With Notice Of Exemption And Pending Levy provides important information about potential exemptions that could protect your wages. We recommend using uslegalforms platform to navigate this process and ensure compliance with legal requirements.