This office lease clause should be used in a base year lease. This form states that when the building is not at least 95% occupied during all or a portion of any lease year the landlord shall make an appropriate adjustment in accordance with industry standards of the building operating costs. This amount shall be deemed to be the amount of building operating costs for the year.

California Gross up Clause that Should be Used in a Base Year Lease

Description

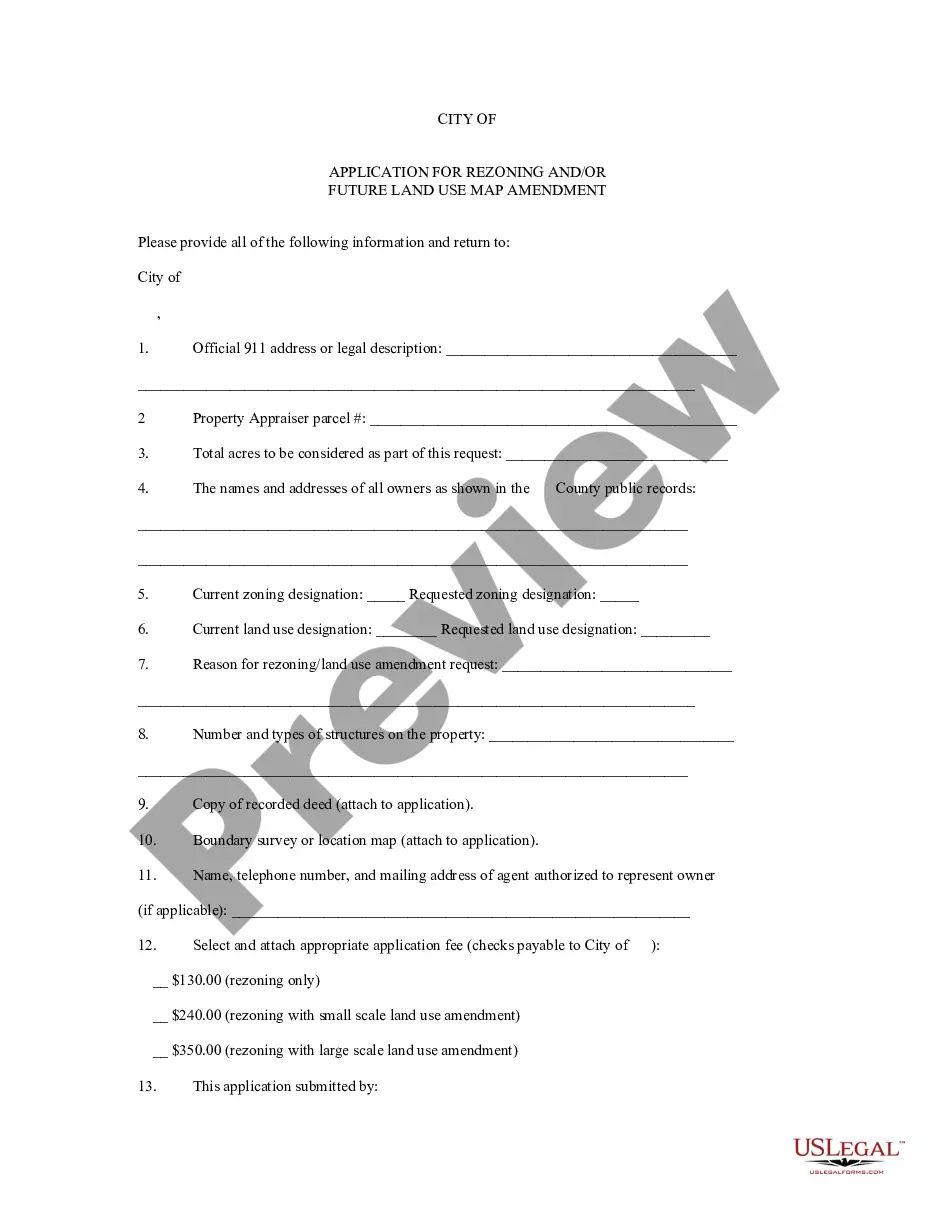

How to fill out Gross Up Clause That Should Be Used In A Base Year Lease?

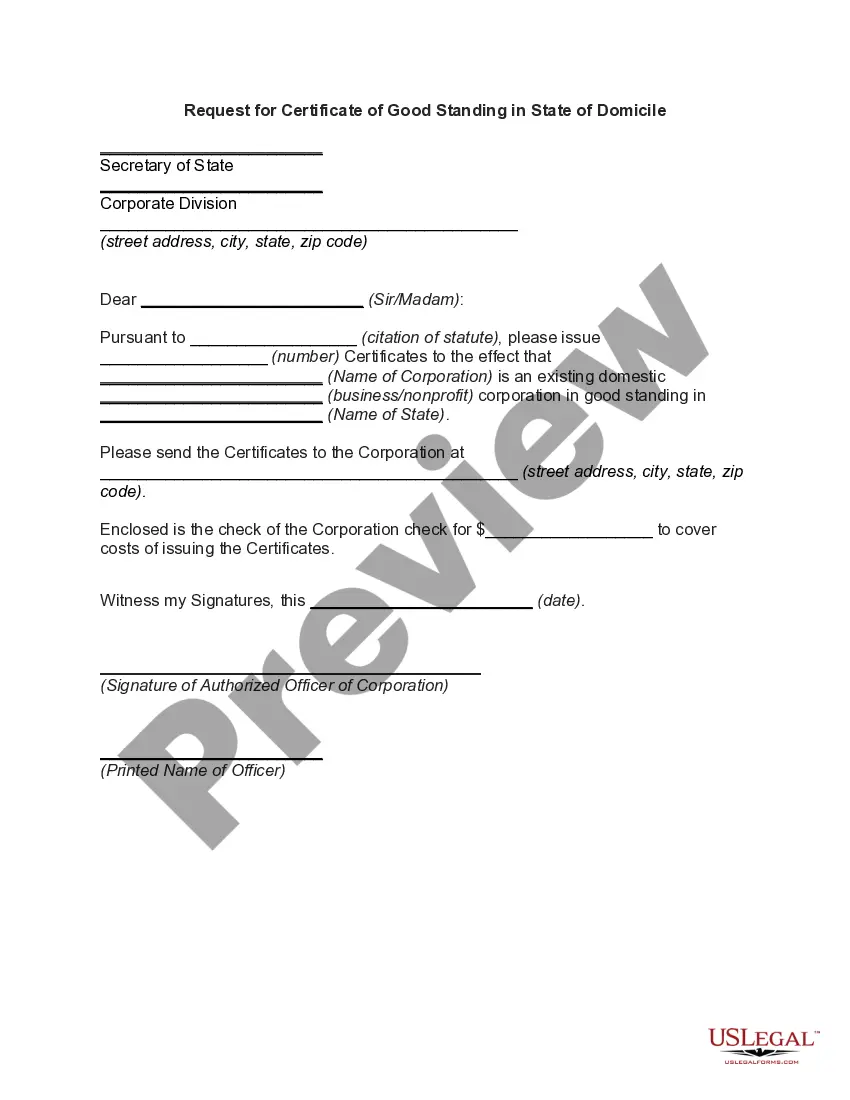

Have you been in a situation in which you will need papers for either company or specific reasons just about every working day? There are plenty of legitimate document themes available online, but discovering versions you can depend on isn`t effortless. US Legal Forms offers thousands of type themes, such as the California Gross up Clause that Should be Used in a Base Year Lease, that are composed to meet state and federal requirements.

If you are already knowledgeable about US Legal Forms site and possess your account, just log in. Following that, you may obtain the California Gross up Clause that Should be Used in a Base Year Lease format.

Should you not come with an bank account and need to begin to use US Legal Forms, follow these steps:

- Get the type you need and make sure it is for your correct area/state.

- Utilize the Review switch to examine the form.

- Browse the explanation to ensure that you have selected the correct type.

- When the type isn`t what you`re looking for, use the Look for discipline to obtain the type that meets your requirements and requirements.

- When you obtain the correct type, click Acquire now.

- Pick the pricing plan you would like, submit the required info to make your money, and purchase your order making use of your PayPal or charge card.

- Choose a convenient data file format and obtain your version.

Discover every one of the document themes you possess purchased in the My Forms food selection. You can get a more version of California Gross up Clause that Should be Used in a Base Year Lease at any time, if necessary. Just click the essential type to obtain or printing the document format.

Use US Legal Forms, by far the most extensive assortment of legitimate varieties, to save lots of time and avoid faults. The service offers expertly made legitimate document themes which can be used for a selection of reasons. Generate your account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

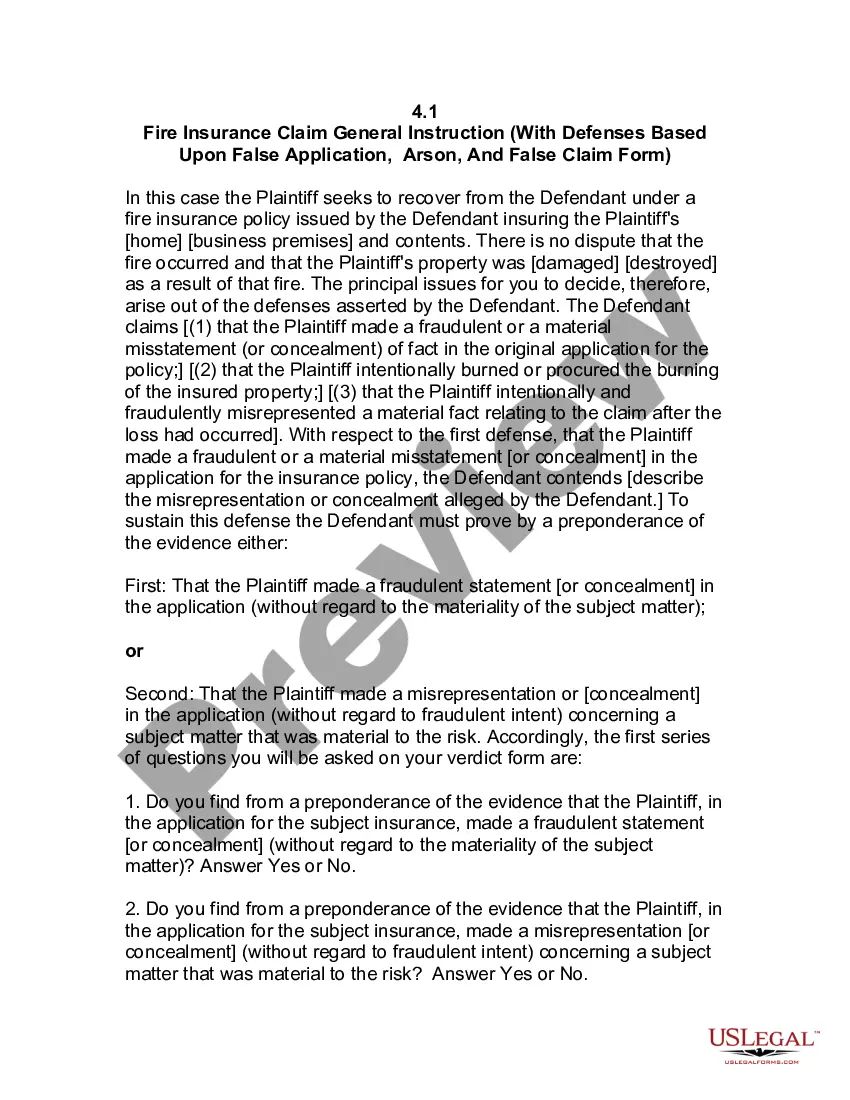

A Base Year clause is found in many Full-Service and Gross Leases. It is not found in triple net leases. The Base Year clause is a year that is tied to the actual amount of expenses for property taxes, insurance and operating expenses (sometimes called CAM) to run the property in a specified year.

Suppose that a tenant signs a lease in an office building for 5,000 square feet of space. The base rental amount is $10 per square foot. In year one of the lease, the landlord pays for all of the building operating expenses and the total comes out to $10,000. This is the base year expense stop amount.

In a base year lease, a base year is selected (usually the first year of the lease). The landlord agrees to pay the property's expenses for the base year. The landlord continues to pay the property expenses at the base year level and the tenant agrees to pay its pro rata share of any increases in property expenses.

Gross-ups are also practical for tenants. A prime example is a lease with a base year or expense stop. If a tenant negotiates a base year, then, in most cases, the tenant will pay its share each year of the operating expenses which exceed the base year's expenses.

In a modified gross or full-service lease, the landlord has you covered and will pay the operating expenses incurred for the first calendar year?or base year?of the lease. Then, your business starts paying its pro-rata share the next year.

So, what is a gross-up provision? Simply stated, the concept of ?gross up provision? stipulates that if a building has significant vacancy, the landlord can estimate what the variable operating expense would have been had the building been fully occupied, and charge the tenants their pro-rata share of that cost.

'Base year' is the first calendar year of a tenant's commercial rental period. It is especially important as all future rent payments are calculated using base year. It's additionally important to note that base year is crafted to favor landlords.