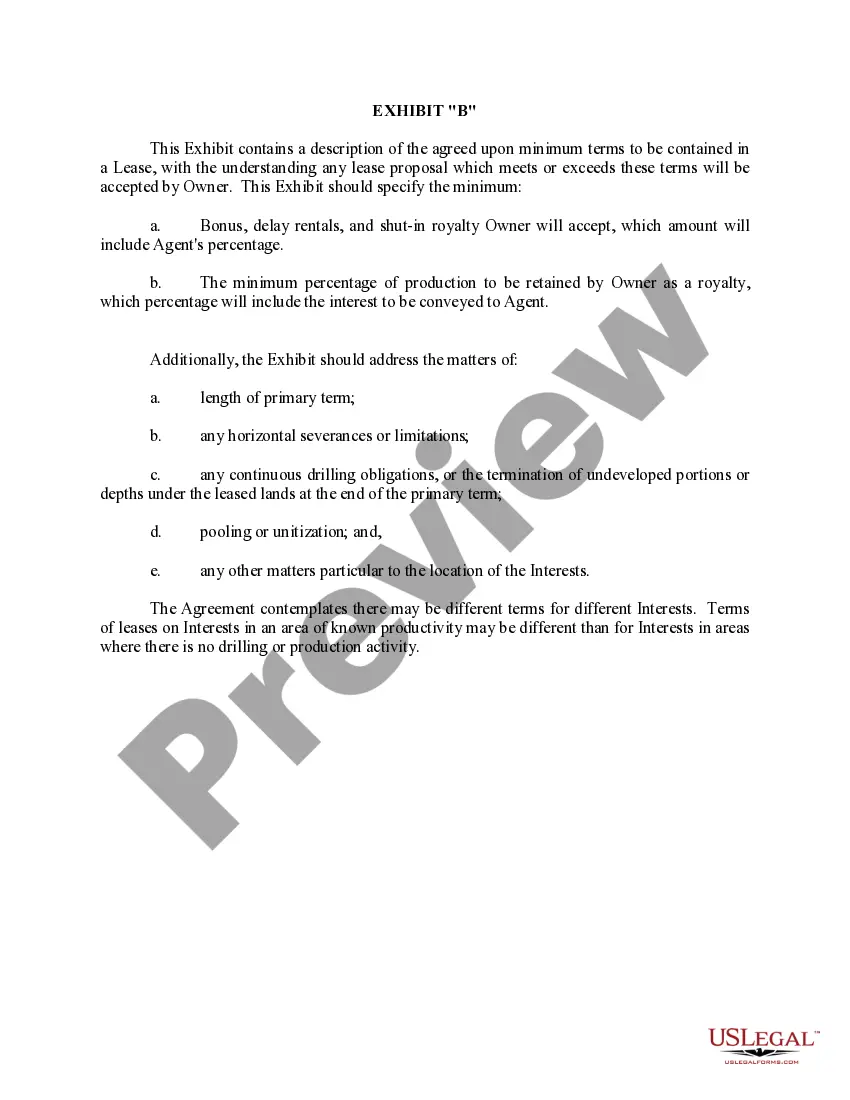

California Agreement Designating Agent to Lease Mineral Interests

Description

How to fill out Agreement Designating Agent To Lease Mineral Interests?

You can spend hrs on-line trying to find the lawful record template which fits the state and federal demands you require. US Legal Forms gives a huge number of lawful kinds which can be examined by pros. It is possible to down load or printing the California Agreement Designating Agent to Lease Mineral Interests from my support.

If you currently have a US Legal Forms bank account, you can log in and click the Down load option. After that, you can total, edit, printing, or signal the California Agreement Designating Agent to Lease Mineral Interests. Every lawful record template you acquire is your own for a long time. To get yet another duplicate for any acquired type, proceed to the My Forms tab and click the related option.

If you work with the US Legal Forms web site for the first time, follow the easy recommendations below:

- Initially, be sure that you have chosen the correct record template to the area/town that you pick. Browse the type explanation to ensure you have selected the correct type. If readily available, make use of the Preview option to search throughout the record template at the same time.

- If you would like discover yet another version in the type, make use of the Look for industry to discover the template that fits your needs and demands.

- Upon having found the template you desire, simply click Buy now to carry on.

- Find the pricing prepare you desire, type in your accreditations, and sign up for an account on US Legal Forms.

- Full the financial transaction. You should use your bank card or PayPal bank account to fund the lawful type.

- Find the structure in the record and down load it to your system.

- Make adjustments to your record if required. You can total, edit and signal and printing California Agreement Designating Agent to Lease Mineral Interests.

Down load and printing a huge number of record templates using the US Legal Forms Internet site, which provides the biggest selection of lawful kinds. Use specialist and condition-particular templates to take on your business or personal needs.

Form popularity

FAQ

California Mineral Rights Law: The California Mineral Rights owners then have full control over the subsurface minerals, surface minerals, land, and air on their property. They may extract any of it, lease it, gift it, or sell it.

To find out if you own the mineral rights to your land you can go to the county clerk's office in your town and they can help you find the historical land ownership records. You'll need to locate the deed for your property.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Receive Payment Royalties are a form of payment made to the owner of the mineral rights, in exchange for the right to extract and sell the resource. In the context of mineral rights, royalties are typically a percentage of the revenue generated from the sale of minerals extracted from the property.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.